Is HCONVERGE safe?

Business

License

Is Hconverge Safe or Scam?

Introduction

Hconverge, a forex broker operating under the name Hconverge International Limited, has garnered attention in the forex trading community. Established within the competitive landscape of online trading, Hconverge aims to provide a platform for traders interested in various financial instruments, including forex, stocks, commodities, and bonds. However, the legitimacy and safety of Hconverge have come under scrutiny, prompting traders to approach this broker with caution. Given the volatile nature of the forex market and the potential risks involved with unregulated brokers, it is essential for traders to carefully assess the credibility of any trading platform they consider. This article will explore the safety of Hconverge by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulation and Legitimacy

The regulatory status of a forex broker is crucial in determining its safety and reliability. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards and practices. Unfortunately, Hconverge lacks proper regulatory oversight, which raises significant concerns regarding its legitimacy. According to various sources, Hconverge does not hold valid licenses from recognized regulatory bodies, indicating a high potential risk for traders.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulation implies that Hconverge operates without the necessary checks and balances that protect traders. This lack of oversight can lead to issues such as fund mismanagement, withdrawal difficulties, and potential fraudulent activities. Traders are advised to exercise extreme caution when dealing with unregulated brokers like Hconverge, as they carry inherent risks that could jeopardize their investments.

Company Background Investigation

Hconverge International Limited, the entity behind Hconverge, is relatively new to the forex market, with a history ranging between two to five years. The company claims to be based in the United Kingdom, but there are inconsistencies regarding its operational base and ownership structure. The lack of transparency surrounding the company's ownership raises further questions about its credibility.

The management teams background is also unclear, with limited information available about their qualifications and experience in the financial sector. A competent management team is vital for a broker's success and reliability, as it directly impacts operational practices and customer service. The opacity surrounding Hconverge's leadership and their expertise in the industry is concerning and contributes to the overall uncertainty about the broker's legitimacy.

Trading Conditions Analysis

When evaluating whether Hconverge is safe, it is essential to consider its trading conditions, including fees and spreads. Hconverge has been reported to offer competitive spreads; however, the absence of a clear fee structure raises concerns. Traders must be aware of hidden fees that may not be disclosed upfront, which can significantly affect their trading profitability.

| Fee Type | Hconverge | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | Variable | 1.0 - 2.0 pips |

| Commission Model | None specified | $5 - $10 per lot |

| Overnight Interest Range | Not disclosed | 0.5% - 2.5% |

The lack of transparency regarding fees is a red flag for potential traders. If Hconverge does not provide clear information about its fee structure, it may indicate a lack of integrity, making it difficult for traders to assess the true costs of trading with this broker. Traders should be wary of brokers that do not openly disclose their fees, as this can lead to unexpected charges and diminished returns on investment.

Client Fund Safety

The safety of client funds is paramount when assessing the reliability of any forex broker. Hconverge does not provide sufficient information on its fund protection measures, such as segregation of client funds and investor compensation schemes. Without these safeguards, traders' funds may be at risk in the event of broker insolvency or mismanagement.

Moreover, the absence of negative balance protection is concerning, as it leaves traders vulnerable to incurring debts greater than their initial investments. There have been reports of withdrawal difficulties and other fund-related issues associated with Hconverge, further highlighting the risks involved in trading with this broker. Traders must prioritize brokers that offer robust fund safety measures to mitigate potential financial losses.

Customer Experience and Complaints

Customer feedback plays a crucial role in evaluating a broker's reliability. Hconverge has received mixed reviews from users, with several complaints highlighting issues related to withdrawal difficulties and slow customer service responses. Common complaint patterns include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Poor Customer Service | Medium | Inconsistent |

| Transparency Concerns | High | Unaddressed |

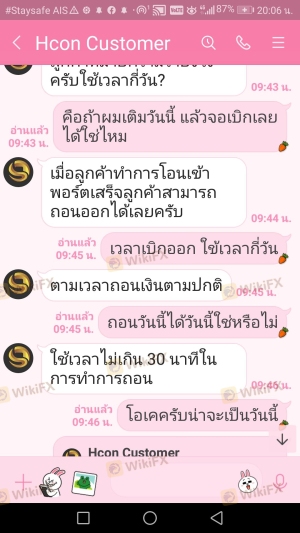

One notable case involved a trader who struggled to withdraw funds after a series of successful trades. Despite repeated attempts to contact customer support, the trader reported delays and a lack of clear communication from Hconverge. This case exemplifies the potential risks associated with using a broker that does not prioritize customer service and transparency.

Platform and Execution

The trading platform offered by Hconverge is based on the widely used MetaTrader 4 (MT4), which provides a range of features for traders. However, the performance of the platform, including execution speed and reliability, is crucial for successful trading. There have been mixed reports regarding order execution quality, with some users experiencing slippage and order rejections.

Traders have expressed concerns about potential signs of platform manipulation, which could adversely affect their trading outcomes. A broker's ability to provide a stable and efficient trading environment is essential, and any inconsistencies in this regard could indicate deeper issues with the broker's operations.

Risk Assessment

When considering whether Hconverge is safe, it is essential to evaluate the overall risk profile associated with trading through this broker. The following risk assessment summarizes key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight |

| Financial Risk | High | Lack of fund protection measures |

| Customer Service Risk | Medium | Slow response to complaints |

| Execution Risk | Medium | Reports of slippage and rejections |

To mitigate these risks, traders should consider using risk management strategies, such as setting stop-loss orders and only investing what they can afford to lose. Additionally, exploring alternative brokers with better regulatory oversight and customer service could provide a safer trading environment.

Conclusion and Recommendations

In conclusion, the analysis of Hconverge raises significant concerns regarding its safety and legitimacy. The lack of regulation, transparency issues, and negative customer feedback suggest that traders should approach this broker with caution. There are clear signs of potential fraud, particularly in the areas of fund management and customer service.

For traders seeking reliable alternatives, it is advisable to consider brokers that are well-regulated and have a proven track record of positive customer experiences. Some reputable options include brokers like IG, OANDA, and Forex.com, which offer robust regulatory oversight and transparent trading conditions. Ultimately, conducting thorough research and due diligence is essential for any trader looking to navigate the forex market safely and effectively.

Is HCONVERGE a scam, or is it legit?

The latest exposure and evaluation content of HCONVERGE brokers.

HCONVERGE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

HCONVERGE latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.