Regarding the legitimacy of GeGold forex brokers, it provides HKGX, FSA and WikiBit, (also has a graphic survey regarding security).

Is GeGold safe?

Software Index

Risk Control

Is GeGold markets regulated?

The regulatory license is the strongest proof.

HKGX Precious Metals Trading (AGN)

Hong Kong Gold Exchange

Hong Kong Gold Exchange

Current Status:

RegulatedLicense Type:

Precious Metals Trading (AGN)

Licensed Entity:

巨象金業有限公司

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://www.gegoldhk.comExpiration Time:

--Address of Licensed Institution:

九龍尖沙咀河內道5號普基商業中心10樓1004室Phone Number of Licensed Institution:

37515814Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Gold Elephant Markets Limited

Effective Date:

--Email Address of Licensed Institution:

info@geprofit.comSharing Status:

No SharingWebsite of Licensed Institution:

www.geprofit.comExpiration Time:

--Address of Licensed Institution:

Suite 4, Global Village, Jivan’s Complex, Mont Fleuri, Mahe, SeychellesPhone Number of Licensed Institution:

+248 4327225Licensed Institution Certified Documents:

Is Gold Elephant Limited A Scam?

Introduction

Gold Elephant Limited is a forex brokerage that positions itself as a provider of trading services primarily focused on precious metals, including gold and silver. This broker operates with a regulatory license from the Chinese Gold and Silver Exchange Society (CGSE), which is a significant point of interest for potential traders. As the forex market continues to grow, traders must exercise caution and perform thorough due diligence when selecting a broker. The landscape is rife with firms that may not prioritize client interests, leading to potential financial losses.

This article aims to provide an objective assessment of Gold Elephant Limited, examining its regulatory status, company background, trading conditions, client experiences, and overall safety. Our investigation is based on a comprehensive review of various online resources, including regulatory databases, customer reviews, and expert analyses.

Regulation and Legitimacy

Understanding the regulatory framework in which a broker operates is crucial for assessing its legitimacy. Gold Elephant Limited claims to be regulated by the Chinese Gold and Silver Exchange Society (CGSE), holding a Type AA license. This regulatory body has a long-standing reputation in the industry, and its oversight is intended to ensure that its members adhere to strict trading standards.

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| Chinese Gold and Silver Exchange Society (CGSE) | 117 | Hong Kong | Verified |

The CGSE is recognized for its rigorous compliance protocols, which are designed to protect investors and maintain market integrity. Gold Elephant Limited's affiliation with this regulatory body suggests a level of oversight that may offer some assurance to traders. However, it is essential to delve deeper into the regulatory quality and historical compliance of the broker.

While the CGSE is reputable, it is not considered a top-tier regulator compared to entities like the FCA or ASIC. As such, traders should remain vigilant and not solely rely on the regulatory status as a guarantee of safety. A history of compliance issues, if any, would further raise concerns about the brokers reliability.

Company Background Investigation

Gold Elephant Limited was founded with the aim of becoming a leading fintech broker in Asia, specializing in precious metals trading. The company is headquartered in Hong Kong and claims to leverage advanced financial technologies to provide real-time trading solutions. However, detailed information about its ownership structure and management team is somewhat limited, which raises questions about transparency.

The management teams background and professional experience can significantly impact a broker's operations. A well-qualified team with extensive industry experience can enhance a broker's credibility. Unfortunately, the available data does not provide comprehensive insights into the specific qualifications of Gold Elephant Limited's leadership.

In terms of transparency, the broker's website offers basic information about its services but lacks detailed disclosures about its financial health, ownership, or operational history. This opacity can be a red flag for potential clients, as a trustworthy broker should be willing to provide detailed information about its operations and management.

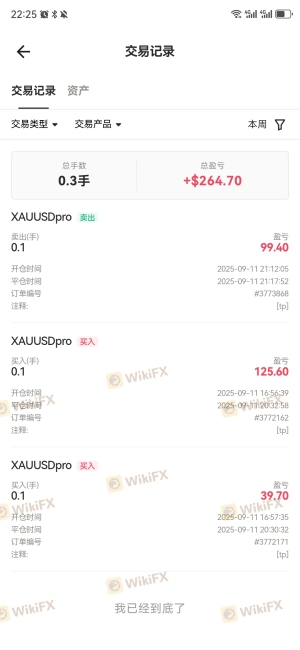

Trading Conditions Analysis

The trading conditions offered by Gold Elephant Limited are a critical aspect of its overall appeal. The broker provides access to a range of trading instruments, primarily focusing on gold and silver. However, understanding the cost structure is essential for evaluating the competitiveness of its offerings.

| Fee Type | Gold Elephant Limited | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | TBD |

| Commission Structure | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

While specific figures were not readily available, potential traders should be aware of any unusual fees or commissions that could affect profitability. High spreads or hidden fees can significantly diminish trading returns, making it essential to scrutinize the fee structure before opening an account.

Moreover, the broker's lack of clarity regarding trading costs can be concerning. Traders should always seek brokers that provide transparent information about their pricing models to avoid unexpected expenses.

Client Fund Security

Client fund security is paramount in the forex trading environment. Gold Elephant Limited claims to implement various measures to protect client funds, including segregated accounts, which ensure that client money is kept separate from the broker's operational funds. Additionally, the broker offers negative balance protection, which is a vital feature that prevents clients from losing more than their initial deposits.

However, the effectiveness of these measures can only be assessed through historical performance and any past incidents involving fund security. If there have been any disputes or issues related to fund withdrawals or mismanagement, it would significantly impact the broker's reputation and trustworthiness.

As of now, there are no widely reported incidents regarding fund security issues at Gold Elephant Limited, but potential clients should remain cautious and conduct their research.

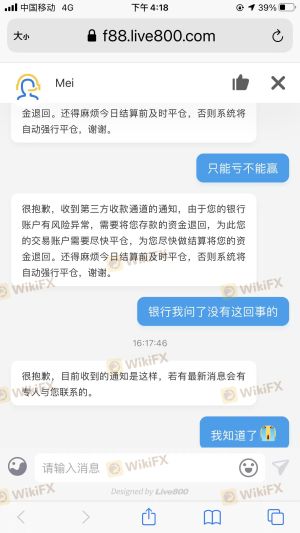

Customer Experience and Complaints

Customer feedback offers valuable insights into the reliability of a brokerage. Reviews of Gold Elephant Limited reveal a mixed bag of experiences. While some users report satisfactory trading experiences, others have raised concerns about withdrawal delays and customer service responsiveness.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Mixed |

| Customer Service | Medium | Slow |

A common theme among complaints is the difficulty in withdrawing funds, which can be a significant concern for traders. Delayed withdrawals can indicate potential liquidity issues or operational inefficiencies. Moreover, the quality of customer service is crucial for resolving issues promptly, and any shortcomings in this area can lead to trader dissatisfaction.

A couple of notable cases highlight these issues. One user reported being unable to access their account for several days, leading to frustration and lost trading opportunities. Another individual mentioned slow responses from customer support when addressing withdrawal concerns. These experiences underscore the importance of reliable customer service in maintaining trader trust.

Platform and Trade Execution

The trading platform provided by Gold Elephant Limited is a critical component of the trading experience. The broker utilizes the widely recognized MetaTrader 4 (MT4) platform, known for its user-friendly interface and robust trading features. However, the performance and stability of the platform can significantly affect order execution quality.

Traders have reported mixed experiences regarding order execution, with some indicating issues with slippage and delays during high volatility periods. Such problems can hinder trading effectiveness, leading to potential losses.

Additionally, any signs of platform manipulation or unfair practices should be closely monitored. A broker should provide a fair trading environment, and any evidence to the contrary would warrant serious concern.

Risk Assessment

Engaging with Gold Elephant Limited presents several risks that traders should consider. While the broker is regulated, the quality of that regulation is not on par with top-tier authorities. This factor alone contributes to a higher risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Medium | Regulated by CGSE but not a top-tier authority. |

| Fund Security | Medium | Segregated accounts and negative balance protection in place, but no historical issues reported. |

| Customer Service | High | Complaints about slow response times and withdrawal issues. |

To mitigate these risks, traders should consider implementing strict risk management strategies, such as setting stop-loss orders and diversifying their trading portfolio. Additionally, conducting regular reviews of the broker's performance and staying informed about any regulatory changes can help traders make more informed decisions.

Conclusion and Recommendations

In conclusion, Gold Elephant Limited presents a mixed picture regarding its safety and reliability as a forex broker. While it operates under the oversight of a regulatory body, the CGSE's status does not equate to the stringent protections offered by top-tier regulators.

Traders should be cautious, especially given the reported issues with customer service and withdrawal processes. Those considering trading with Gold Elephant Limited should ensure they are comfortable with the risks involved and may want to explore alternative brokers with stronger regulatory frameworks and better customer feedback.

For traders seeking reliable options, consider brokers regulated by top-tier authorities such as the FCA or ASIC, which offer greater transparency and investor protection. Always prioritize your financial security and conduct thorough research before making any commitments.

Is GeGold a scam, or is it legit?

The latest exposure and evaluation content of GeGold brokers.

GeGold Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GeGold latest industry rating score is 6.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.