Regarding the legitimacy of Globe Pro forex brokers, it provides VFSC and WikiBit, .

Is Globe Pro safe?

Business

License

Is Globe Pro markets regulated?

The regulatory license is the strongest proof.

VFSC Derivatives Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

FS International Limited

Effective Date: Change Record

2023-07-04Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Globe Pro A Scam?

Introduction

Globe Pro is a forex broker that positions itself as a trading platform for both novice and experienced traders. Established in Vanuatu, it claims to offer a wide range of trading instruments and competitive trading conditions. However, the forex market is fraught with risks, and traders must exercise caution when selecting a broker. The potential for scams and unreliable trading platforms necessitates thorough due diligence. In this article, we will evaluate whether Globe Pro is a safe trading option or a potential scam by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment.

Regulation and Legitimacy

When assessing the safety of a forex broker, regulatory oversight is a crucial factor. Globe Pro is regulated by the Vanuatu Financial Services Commission (VFSC), which is known for its relatively lax regulatory framework compared to more stringent authorities like the UKs Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC). Below is a table summarizing Globe Pro's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Vanuatu Financial Services Commission (VFSC) | 700227 | Vanuatu | Suspicious Clone |

While Globe Pro is technically licensed, the VFSCs oversight is often criticized for being insufficient to ensure client safety. Notably, Globe Pro has been flagged by several regulatory bodies, including the Spanish regulator CNMV, which issued warnings regarding its operations. Such warnings raise significant concerns about the broker's legitimacy and adherence to regulatory standards. The lack of robust regulatory protection implies that traders may not have adequate recourse in the event of disputes or financial mishaps, leading to the conclusion that is Globe Pro safe? remains an open question.

Company Background Investigation

Globe Pro Limited, the entity behind the broker, has a somewhat obscure history. Founded in 2018, it operates from Vanuatu, a jurisdiction often associated with offshore companies and lax regulatory requirements. The ownership structure is not transparently disclosed, which raises red flags regarding accountability and governance.

The management teams background is also unclear, with limited information available on their professional qualifications and experience in the financial industry. This lack of transparency can lead to concerns about the broker's reliability and trustworthiness. A reputable broker typically provides detailed information about its management team and their qualifications, which is crucial for building trust with clients. In summary, the opacity surrounding Globe Pro's corporate structure and management raises questions about its legitimacy and the safety of trading with them.

Trading Conditions Analysis

Globe Pro advertises competitive trading conditions, but a closer inspection reveals a complex fee structure that may not be as favorable as it seems. Traders are often attracted by the promise of low spreads and high leverage, but it is essential to scrutinize the hidden costs associated with trading. Below is a comparison of core trading costs:

| Fee Type | Globe Pro | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.7 pips | 1.0 - 1.5 pips |

| Commission Model | None (for standard account) | Varies (often around $5 per lot) |

| Overnight Interest Range | Not specified | Typically 1-3% |

While the advertised spread of 1.7 pips may seem attractive, it is higher than the industry average for major currency pairs, which typically ranges from 1.0 to 1.5 pips. Additionally, the absence of clear information on overnight interest rates and other potential fees suggests a lack of transparency, which could lead to unexpected costs for traders. This ambiguity raises further concerns about whether is Globe Pro safe for traders looking to maintain a clear understanding of their trading expenses.

Customer Funds Security

The security of customer funds is a critical aspect of any forex broker's operations. Globe Pro claims to implement various safety measures to protect client funds, including segregated accounts. However, the lack of detailed information regarding these measures raises concerns about their effectiveness.

Moreover, Globe Pro does not provide negative balance protection, which means that traders could potentially lose more than their initial deposit. This absence of a safety net is particularly alarming for retail traders, who may not have the experience or resources to manage such risks effectively. Historical complaints regarding withdrawal issues further exacerbate concerns about the safety of funds held with Globe Pro. In light of these factors, it is essential to question whether is Globe Pro safe for individual traders.

Customer Experience and Complaints

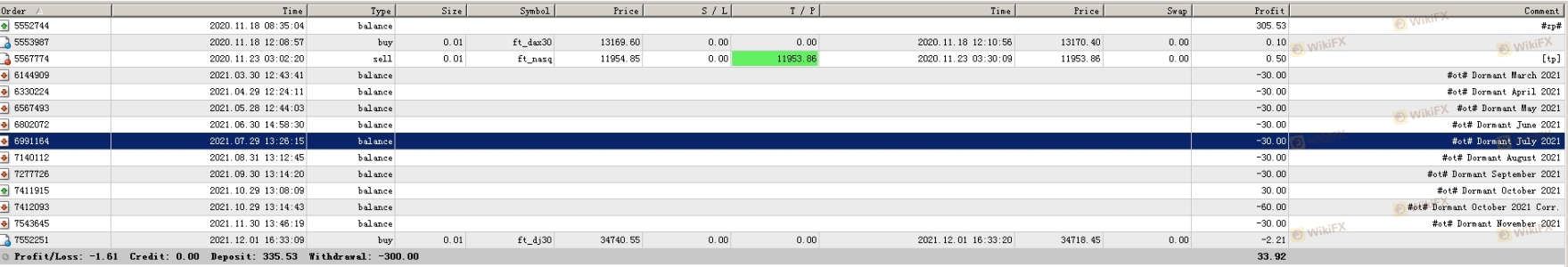

Analyzing customer feedback is vital in assessing the reliability of a broker. Reviews of Globe Pro reveal a pattern of complaints, particularly regarding withdrawal difficulties. Many users have reported being unable to withdraw their funds, with some claiming that their accounts were charged unexplained fees even during periods of inactivity. Below is a summary of common complaint types:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow or no response |

| Unexplained Fees | Medium | No clear explanation provided |

One notable case involved a trader who reported waiting over a month for a withdrawal request to be processed, raising serious doubts about the broker's operational integrity. Another user claimed that $30 was deducted from their account monthly without any activity. These complaints suggest a troubling pattern of customer dissatisfaction and point towards potential operational issues within Globe Pro. Therefore, the question remains: is Globe Pro safe for traders who value timely access to their funds?

Platform and Trade Execution

The trading platform offered by Globe Pro is the widely used MetaTrader 4 (MT4), known for its robust features and user-friendly interface. However, user experiences indicate that the platform may suffer from performance issues, including slippage and order rejections. Traders have reported instances where their orders were not executed as expected, leading to frustration and potential financial losses.

While MT4 is generally regarded as a reliable platform, the quality of execution can vary significantly between brokers. If Globe Pro is unable to provide consistent and reliable execution, it could lead to adverse trading experiences for its users. This raises concerns about the overall trading environment and whether traders can trust that their orders will be handled efficiently. Thus, the inquiry into whether is Globe Pro safe extends to its platform performance and execution reliability.

Risk Assessment

Trading with any forex broker carries inherent risks, and Globe Pro is no exception. Below is a summary of key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Weak regulation and warnings from authorities. |

| Withdrawal Risk | High | Frequent complaints about withdrawal issues. |

| Transparency Risk | Medium | Lack of clear information on fees and management. |

The combination of high regulatory risk and withdrawal issues significantly raises the overall risk profile of trading with Globe Pro. Traders should remain vigilant and consider these factors carefully before deciding to engage with this broker. To mitigate risks, it is advisable to maintain a diversified portfolio and avoid investing significant capital in a single broker, especially one with a questionable reputation.

Conclusion and Recommendations

In conclusion, the evidence suggests that Globe Pro exhibits several characteristics commonly associated with unreliable brokers. The lack of stringent regulatory oversight, coupled with numerous customer complaints about withdrawals and transparency issues, raises significant concerns about the safety of trading with this platform. Therefore, the question is Globe Pro safe can be answered with caution: it is advisable to approach this broker with skepticism.

For traders seeking a more reliable trading environment, it is recommended to consider brokers regulated by reputable authorities such as the FCA or ASIC. These brokers typically offer better protections for customer funds and more transparent trading conditions. Ultimately, whether you are a novice or an experienced trader, prioritizing safety and reliability in your choice of broker is crucial for long-term success in the forex market.

Is Globe Pro a scam, or is it legit?

The latest exposure and evaluation content of Globe Pro brokers.

Globe Pro Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Globe Pro latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.