Is GDI safe?

Business

License

Is GDI Safe or Scam?

Introduction

GDI, or GDI Holdings Limited, is a forex broker that has positioned itself in the competitive landscape of online trading. Operating primarily out of China, GDI claims to offer a range of trading services to clients worldwide. However, the forex market is notorious for its volatility and the presence of unregulated brokers, which necessitates a cautious approach for traders evaluating their options. It is crucial for traders to thoroughly assess the legitimacy and safety of any forex broker before committing their funds. This article aims to provide a comprehensive evaluation of GDI's safety, regulatory status, and overall reliability based on extensive research, including reviews, regulatory filings, and user experiences.

Regulation and Legitimacy

One of the most significant factors in determining whether GDI is safe involves its regulatory status. Regulatory oversight is essential in the forex industry as it ensures that brokers adhere to specific standards, thereby protecting traders from potential fraud and malpractice. GDI currently lacks any valid regulatory licenses from recognized financial authorities, which raises serious concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Regulated |

The absence of regulatory oversight means that GDI does not have to comply with the stringent requirements typically imposed on regulated brokers, such as maintaining segregated accounts for client funds and providing transparent reporting. Furthermore, user reviews indicate a history of complaints regarding difficulties with withdrawals and lack of customer support, which are common red flags for unregulated brokers.

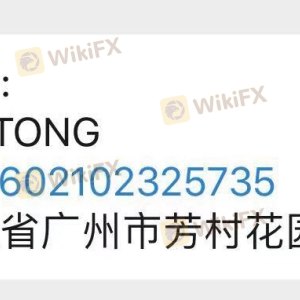

Company Background Investigation

GDI Holdings Limited has been operating for approximately 5 to 10 years, but its corporate history is shrouded in ambiguity. The company's ownership structure is not publicly disclosed, which adds to the opacity surrounding its operations. A lack of transparency regarding ownership can be a significant concern for traders, as it raises questions about accountability and the companys financial stability.

The management teams background also plays a critical role in assessing the broker's credibility. Unfortunately, there is little available information about the qualifications and experience of GDI's management team. This lack of information can be a deterrent for potential clients, as a knowledgeable and experienced management team is often indicative of a reliable broker.

Trading Conditions Analysis

When evaluating whether GDI is safe, it is essential to analyze the trading conditions it offers. The overall fee structure and trading costs can significantly impact a trader's profitability. GDI's pricing model is reportedly competitive; however, the lack of clarity regarding hidden fees is concerning.

| Fee Type | GDI | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | None | $5 - $10 per lot |

| Overnight Interest Range | High | 1.5% - 3.0% |

Traders have reported that GDI employs a variable spread model, which can lead to higher costs during volatile market conditions. Additionally, the absence of a clear commission structure may lead to unexpected charges, making it difficult for traders to budget their trading expenses effectively.

Client Fund Security

The security of client funds is paramount when assessing whether GDI is safe. A reputable broker typically offers measures such as segregated accounts, investor protection schemes, and negative balance protection. Unfortunately, GDI does not provide clear information on these critical safety features.

The lack of segregated accounts means that client funds may not be protected in the event of the broker's insolvency. Furthermore, without investor protection, traders risk losing their entire investment if GDI were to cease operations. Historical complaints about withdrawal issues further exacerbate concerns about the safety of funds held with GDI.

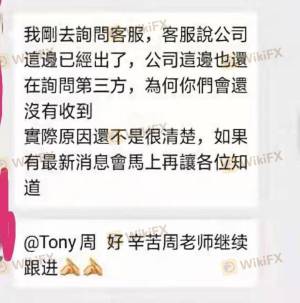

Customer Experience and Complaints

Analyzing customer feedback is vital in determining the overall reputation of GDI. Many user reviews highlight significant issues with the trading platform, customer service, and withdrawal processes.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Availability | Medium | Slow |

| Platform Stability | High | Unresponsive |

Common complaints include difficulties in withdrawing funds, slow customer service responses, and platform instability. These issues suggest that GDI may not prioritize customer satisfaction, raising further doubts about its reliability. For instance, one user reported being unable to withdraw their funds for several months, highlighting a serious concern for potential investors.

Platform and Execution

The performance and reliability of the trading platform are crucial for any forex broker. GDI claims to offer a user-friendly trading environment; however, reviews indicate that the platform often experiences downtime and slow execution speeds. This can lead to missed trading opportunities and increased frustration among users.

Additionally, there are reports of slippage and order rejections, which can significantly impact trading outcomes. These issues may suggest a lack of robust infrastructure or potential manipulation, further questioning whether GDI is safe for traders.

Risk Assessment

Using GDI poses several risks that traders should be aware of. The absence of regulatory oversight, combined with poor customer feedback and unresolved complaints, indicates a higher risk level for potential clients.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulation or oversight |

| Financial Risk | High | Lack of fund protection |

| Operational Risk | Medium | Platform instability and performance |

To mitigate these risks, traders should consider using regulated brokers with a proven track record and transparent operations. Conducting thorough research and reading user reviews can also help in making informed decisions.

Conclusion and Recommendations

In conclusion, the evidence suggests that GDI is not a safe trading option for forex traders. The lack of regulatory oversight, combined with numerous complaints regarding customer service and fund security, raises significant red flags. While GDI may offer some attractive trading conditions, the overall risks associated with trading through this broker outweigh the potential benefits.

For traders seeking reliable and secure options, it is advisable to consider regulated brokers that prioritize investor protection and have a strong reputation in the industry. Some recommended alternatives include brokers with solid regulatory backgrounds and positive user feedback, ensuring a safer trading environment.

In summary, is GDI safe? The answer leans toward a cautious "no," and potential traders should tread carefully before engaging with this broker.

Is GDI a scam, or is it legit?

The latest exposure and evaluation content of GDI brokers.

GDI Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GDI latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.