Is GainfxMarkets safe?

Business

License

Is GainFXMarkets Safe or Scam?

Introduction

GainFXMarkets positions itself as a forex broker catering to traders seeking diverse financial instruments and trading opportunities. However, in an industry where trust and transparency are paramount, potential clients must exercise caution when evaluating brokers. The forex market is rife with both legitimate opportunities and potential scams, making it crucial for traders to conduct thorough due diligence before committing their funds. This article aims to provide an objective analysis of GainFXMarkets, utilizing available information from various sources to assess its regulatory status, company background, trading conditions, and overall safety.

Regulation and Legitimacy

Understanding the regulatory framework surrounding a broker is vital in determining its credibility. GainFXMarkets claims to operate under regulatory oversight; however, the specifics of its licensing remain ambiguous. The following table summarizes the core regulatory information available:

| Regulatory Authority | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| Unknown | N/A | N/A | Not Verified |

The absence of clear regulatory information raises significant concerns. A reputable broker typically operates under the supervision of a recognized financial authority, which ensures compliance with industry standards and provides a safety net for client funds. GainFXMarkets does not appear to be regulated by any top-tier authority such as the FCA (UK) or ASIC (Australia), which is a red flag for potential investors. Without such oversight, clients may face challenges in recouping losses in case of disputes or fraud.

Furthermore, the lack of historical compliance records for GainFXMarkets adds to the uncertainty surrounding its legitimacy. Regulatory compliance is not merely a formality; it reflects a broker's commitment to ethical practices and client protection. Consequently, traders should approach GainFXMarkets with caution, as its regulatory status does not inspire confidence in its operational integrity.

Company Background Investigation

A thorough investigation into GainFXMarkets reveals limited information regarding its history, ownership structure, and operational transparency. The broker's website is often inaccessible, which further complicates efforts to gather essential details. This lack of transparency is concerning, as it prevents potential clients from understanding who they are dealing with and the broker's track record in the industry.

Details about the management team and their professional experience are also scarce. A reputable broker typically provides information about its leadership, including their qualifications and prior experience in the financial sector. This information is crucial for assessing the competence and reliability of the broker's management. Unfortunately, GainFXMarkets does not offer such insights, which may indicate a lack of accountability.

Additionally, the broker's information disclosure practices are questionable. Trustworthy brokers prioritize transparency, providing clients with comprehensive information about their services, fees, and risk factors. In contrast, GainFXMarkets' limited disclosures create an environment of uncertainty, making it difficult for traders to make informed decisions about their investments.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions and fee structure is paramount. GainFXMarkets claims to offer various account types, each with distinct features and minimum deposit requirements. However, the specific details regarding spreads, commissions, and overnight interest rates remain elusive.

Heres a comparison of core trading costs:

| Fee Type | GainFXMarkets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies (0 - 10) |

| Overnight Interest Range | N/A | 0.5 - 2.5% |

The absence of transparent information on trading costs is concerning. Traders should expect clarity regarding spreads and commissions, as these can significantly impact overall profitability. Moreover, if GainFXMarkets employs unusual or hidden fees, this could be detrimental to clients' trading experiences.

Additionally, the broker's leverage offerings and margin requirements are crucial factors to consider. While high leverage can amplify profits, it also increases risk. GainFXMarkets' lack of clear information regarding these parameters further complicates the decision-making process for potential clients.

Client Funds Safety

The safety of client funds is a critical aspect of any broker's operations. GainFXMarkets has not provided sufficient information regarding its measures for safeguarding client capital. Key considerations include fund segregation, investor protection schemes, and negative balance protection policies.

In a regulated environment, brokers are typically required to maintain client funds in segregated accounts, ensuring that they are not used for operational expenses. Additionally, reputable brokers often participate in investor compensation schemes, which provide a safety net for clients in case of insolvency. GainFXMarkets' lack of clarity on these aspects raises red flags regarding the safety of client funds.

Moreover, there have been no reported incidents of fund security breaches or disputes involving GainFXMarkets, but the absence of regulatory oversight increases the risk of potential issues arising in the future. Traders must remain vigilant and consider the implications of entrusting their capital to a broker with unclear safety protocols.

Customer Experience and Complaints

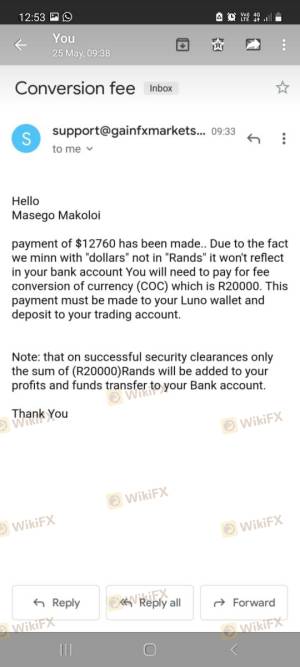

Analyzing customer feedback and experiences is essential for assessing a broker's reliability. Reviews of GainFXMarkets reveal a mixed bag of opinions, with some users expressing dissatisfaction with the broker's services. Common complaints include difficulties in withdrawing funds, lack of responsive customer support, and unclear fee structures.

Heres a summary of the primary complaint types and their severity assessment:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Support Availability | Medium | Limited |

| Fee Transparency | High | No Response |

One notable case involved a trader who reported challenges in withdrawing their funds after several unsuccessful attempts to contact customer support. This type of experience can significantly impact a trader's confidence in a broker and highlights the importance of responsive customer service.

Platform and Trade Execution

The performance and reliability of a broker's trading platform are pivotal for traders. GainFXMarkets claims to offer a user-friendly platform; however, detailed evaluations of its stability, execution quality, and potential issues remain scant.

Traders should expect fast order execution and minimal slippage, particularly in volatile market conditions. If GainFXMarkets experiences frequent downtime or has a high rate of rejected orders, this could hinder trading performance and lead to substantial financial losses. The lack of information regarding these metrics makes it challenging for potential clients to assess the broker's operational integrity.

Risk Assessment

Using GainFXMarkets comes with inherent risks that potential clients should carefully consider. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of oversight raises concerns about fund safety. |

| Transparency Risk | Medium | Limited information about fees and company structure. |

| Customer Support Risk | High | Reports of slow responses and withdrawal issues. |

To mitigate these risks, traders are advised to conduct thorough due diligence before engaging with GainFXMarkets. Seeking out well-regulated alternatives with a proven track record can provide greater security and peace of mind.

Conclusion and Recommendations

In conclusion, the analysis of GainFXMarkets raises several concerns regarding its safety and reliability. The absence of regulatory oversight, limited transparency, and mixed customer feedback suggest that potential clients should approach this broker with caution. While there may be opportunities for trading, the risks associated with GainFXMarkets outweigh the potential benefits.

For traders seeking a safer alternative, it is advisable to consider well-established brokers regulated by reputable authorities. Brokers such as IG, OANDA, and Forex.com offer robust regulatory frameworks, transparent fee structures, and reliable customer support, making them more trustworthy options for forex trading. Always prioritize safety and due diligence when selecting a broker to ensure a secure trading experience.

In summary, is GainFXMarkets safe? The evidence suggests that it is prudent to exercise caution and consider alternative options for trading in the forex market.

Is GainfxMarkets a scam, or is it legit?

The latest exposure and evaluation content of GainfxMarkets brokers.

GainfxMarkets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GainfxMarkets latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.