Is FxTrader safe?

Business

License

Is Fxtrader Safe or Scam?

Introduction

Fxtrader positions itself as an online forex and CFD broker, claiming to provide a platform for trading various financial instruments, including forex pairs, commodities, and cryptocurrencies. As the forex market continues to grow, traders must exercise caution when selecting brokers to ensure their investments are secure. The prevalence of scams in the financial industry makes it imperative for traders to conduct thorough research before committing their funds. This article aims to evaluate the legitimacy of Fxtrader by examining its regulatory status, company background, trading conditions, client fund safety, customer experiences, platform performance, and associated risks. Our investigation is based on a review of multiple sources, including user feedback and regulatory databases, to provide a comprehensive overview of whether Fxtrader is safe or a potential scam.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in assessing its legitimacy. A regulated broker is subject to oversight by financial authorities, which helps ensure compliance with industry standards and protects client funds. In the case of Fxtrader, it has been reported that the broker operates without any regulation from recognized financial authorities.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of regulation raises significant concerns regarding the safety of funds and the broker's accountability. Unregulated brokers like Fxtrader are not required to adhere to strict operational guidelines, which can lead to unethical practices and a lack of transparency. Furthermore, without regulatory oversight, clients have limited recourse in the event of disputes or fund mismanagement.

Historically, brokers without proper licenses have been associated with various compliance issues, including fraudulent activities and the inability to honor withdrawal requests. Consequently, the lack of regulatory oversight for Fxtrader suggests that it may not be a safe option for traders looking to invest their money.

Company Background Investigation

Understanding the company behind a trading platform is essential for evaluating its reliability. Fxtrader claims to be based in New Zealand, yet there is minimal information available regarding its ownership structure or management team. The anonymity surrounding the company's leadership raises red flags about its transparency and accountability.

The lack of a clear corporate history or detailed information about the company's founders and executives can be alarming for potential investors. A reputable broker typically provides information about its management team, including their professional backgrounds and relevant experience in the financial markets. However, in the case of Fxtrader, such details are conspicuously absent.

The opacity of Fxtrader's corporate structure and its failure to disclose essential information about its operations contribute to the perception that it may not be a trustworthy entity. For traders seeking a reliable broker, it is crucial to partner with firms that demonstrate transparency and a proven track record in the industry.

Trading Conditions Analysis

Evaluating the trading conditions offered by a broker is vital for understanding its cost structure and overall value proposition. Fxtrader presents a range of trading instruments, but the specifics of its fees and spreads remain unclear.

| Fee Type | Fxtrader | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | TBD | TBD |

| Commission Model | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

The absence of detailed information on trading costs can be a significant concern for traders. Brokers that employ hidden fees or unusual cost structures can significantly impact a trader's profitability. Moreover, the lack of clarity regarding commissions and spreads may indicate that Fxtrader does not prioritize transparency in its operations.

Traders should be wary of any broker that does not provide clear and accessible information about its fee structure. In an industry where every pip counts, understanding the costs associated with trading is essential for making informed decisions.

Client Fund Safety

The safety of client funds is perhaps the most critical aspect of any trading platform. Fxtrader has been reported to lack essential safety measures, such as segregated accounts and investor protection schemes. Without these safeguards, client funds may be at risk in the event of the broker's insolvency or fraudulent activities.

Segregated accounts are crucial as they ensure that client funds are kept separate from the broker's operational funds, providing an additional layer of security. Furthermore, participation in investor compensation schemes can offer some degree of protection for clients in the event of a broker's failure. However, there is no indication that Fxtrader adheres to these best practices.

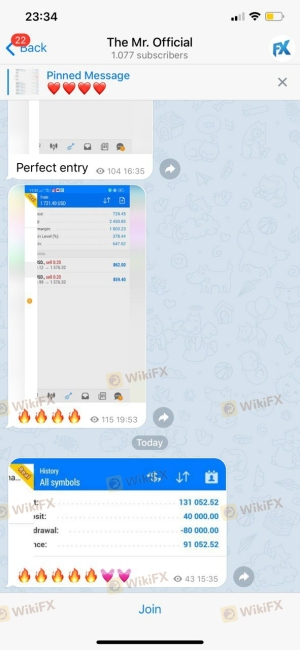

Historical issues related to fund safety, such as withdrawal delays and unresponsive customer service, have been reported by users of Fxtrader. These concerns highlight the potential risks associated with entrusting funds to an unregulated broker.

Customer Experience and Complaints

Analyzing customer feedback is essential for gauging the overall reliability of a broker. Reviews and testimonials for Fxtrader reveal a concerning pattern of complaints regarding withdrawal issues and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Customer Support | High | Poor |

Common complaints include difficulties in processing withdrawals, with users reporting extended delays and unresponsive support teams. Such issues can significantly impact a trader's experience and raise questions about the broker's operational integrity.

One notable case involved a trader who was unable to access their funds after multiple requests for withdrawal. The lack of timely responses from Fxtrader's support team exacerbated the situation, leading to frustration and distrust among clients.

Platform and Trade Execution

The performance of a trading platform is crucial for ensuring a smooth trading experience. Fxtrader claims to offer a variety of trading platforms, including MT4 and MT5, but user reviews indicate mixed experiences regarding platform stability and order execution quality.

Traders have reported instances of slippage and order rejections, which can hinder trading performance and result in financial losses. The presence of such issues raises concerns about the broker's reliability and the overall user experience on the platform.

Risk Assessment

Using Fxtrader presents several risks that traders should consider before opening an account.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Fund Safety Risk | High | Lack of segregated accounts and investor protection. |

| Customer Service Risk | Medium | Poor response times and unresolved complaints. |

Traders should be aware of these risks and consider implementing strategies to mitigate them. For example, opting for smaller initial deposits or using risk management tools can help protect against potential losses.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that Fxtrader is not a safe option for traders. The lack of regulation, transparency, and a history of customer complaints raises significant concerns about its legitimacy. Traders should exercise caution and consider alternative options that offer regulatory oversight and a proven track record of reliability.

For those looking for safer alternatives, it is advisable to explore brokers that are regulated by reputable authorities such as the FCA, ASIC, or CySEC. These brokers typically provide a higher level of security and transparency, ensuring a safer trading environment.

In summary, is Fxtrader safe? The answer appears to be no, and traders would be wise to seek out more trustworthy options in the forex market.

Is FxTrader a scam, or is it legit?

The latest exposure and evaluation content of FxTrader brokers.

FxTrader Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FxTrader latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.