Is DCMEFX safe?

Business

License

Is DCMEFX Safe or a Scam?

Introduction

DCMEFX is a relatively new player in the forex market, having emerged as a broker that promises to provide a comprehensive trading experience for both novice and experienced traders. With its headquarters reportedly located in Hong Kong, DCMEFX offers a range of trading products, including currencies, commodities, and cryptocurrencies. Given the volatile nature of the forex market, it is crucial for traders to conduct thorough due diligence before engaging with any broker. The potential for scams in the forex industry is high, making it imperative for traders to assess the legitimacy and safety of brokers like DCMEFX. This article aims to objectively evaluate the safety of DCMEFX by analyzing its regulatory status, company background, trading conditions, customer security measures, and client experiences.

Regulation and Legitimacy

The regulatory environment is one of the most critical factors in determining the safety of a forex broker. A well-regulated broker is usually subject to stringent oversight, which can protect traders' interests. Unfortunately, DCMEFX lacks clear regulatory oversight. According to multiple sources, it appears that DCMEFX operates without valid regulatory licenses, raising significant concerns about its legitimacy.

| Regulatory Agency | License Number | Jurisdiction | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulation means that traders have limited recourse in the event of disputes or fraudulent activity. Regulatory bodies like the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the US enforce strict guidelines that help ensure the safety of clients' funds. Without such oversight, the risks associated with trading through DCMEFX are considerably heightened. Moreover, past complaints regarding the broker's operations suggest a lack of transparency and accountability, which further supports the notion that DCMEFX may not be a safe option for traders.

Company Background Investigation

A thorough investigation into the companys history and ownership structure is essential to understanding its credibility. DCMEFX has been operating for a relatively short period, and information about its management team and ownership is scarce. This lack of transparency can be alarming, as it often indicates that a broker may not have the stability or experience necessary to provide reliable trading services.

The management teams background and professional experience are critical indicators of a broker's reliability. In the case of DCMEFX, there is limited information available about its executives, which raises questions about their qualifications and ability to manage client funds effectively. Transparency in operations and clear communication from management are vital for building trust with clients. Unfortunately, DCMEFX's failure to provide this information may deter potential traders from engaging with the platform.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is crucial for evaluating its overall appeal. DCMEFX promotes itself as a broker with competitive trading conditions, but scrutiny reveals that its fee structure may not be as favorable as advertised. Traders should be aware of all costs associated with trading, including spreads, commissions, and overnight fees.

| Fee Type | DCMEFX | Industry Average |

|---|---|---|

| Spread (Major Currency Pairs) | 1.0 - 3.0 pips | 1.0 - 2.0 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | High | Moderate |

The spreads offered by DCMEFX can be higher than the industry average, potentially eating into traders' profits. Furthermore, the commission model lacks clarity, which can lead to unexpected costs during trading. Such discrepancies are red flags that traders should consider before opening an account. The overall trading costs can significantly impact the profitability of trades, making it essential to evaluate whether DCMEFX's conditions are genuinely competitive or if they conceal hidden fees.

Client Funds Safety

The safety of client funds is paramount when assessing a broker's reliability. DCMEFX's lack of regulation raises concerns about its client fund protection measures. A reputable broker typically employs strict protocols to ensure that client funds are kept secure, including segregating client accounts from company funds and offering negative balance protection.

Unfortunately, there is little information available about DCMEFX's policies regarding fund safety. Traders should be cautious if a broker does not clearly outline its security measures. The absence of investor protection schemes can lead to significant financial losses, especially in the event of a broker's insolvency or fraudulent activity. Historical data on fund safety issues related to DCMEFX further complicates its standing as a trustworthy broker.

Customer Experience and Complaints

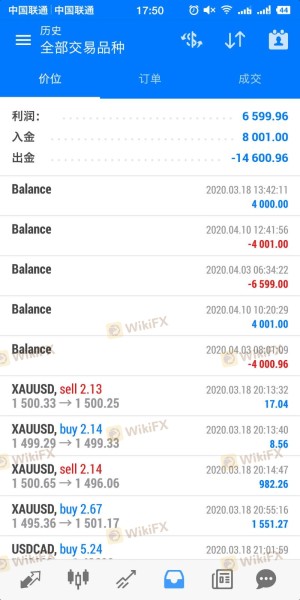

Customer feedback is invaluable when assessing a broker's reputation. Reviews and testimonials can provide insights into real user experiences, highlighting both strengths and weaknesses. In the case of DCMEFX, numerous complaints have surfaced regarding withdrawal issues and unresponsive customer service.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Support | Medium | Poor |

| Account Blocking | High | Very Poor |

The most common complaints involve difficulties withdrawing funds, with some users reporting that they were unable to access their money for extended periods. Such issues are significant red flags, indicating that DCMEFX may not prioritize customer service or the timely processing of transactions. The lack of a robust support system can leave traders feeling vulnerable and frustrated, further questioning the safety of trading with DCMEFX.

Platform and Execution

Evaluating the trading platform's performance is essential for understanding a broker's overall user experience. DCMEFX claims to offer a user-friendly trading platform, but reports of execution delays, slippage, and rejections of orders raise concerns about its reliability.

The quality of order execution is critical for traders, as delays can lead to missed opportunities and increased costs. If a broker consistently fails to execute orders promptly or accurately, it can significantly impact a trader's profitability. Signs of potential platform manipulation, such as frequent slippage or rejected orders, should prompt traders to consider whether DCMEFX is a safe choice for their trading activities.

Risk Assessment

Engaging with any broker involves inherent risks, and DCMEFX is no exception. The lack of regulation, combined with negative customer experiences, contributes to a higher overall risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Customer Service Risk | High | Poor responsiveness and complaints |

| Fund Safety Risk | High | Lack of transparency regarding fund protection |

To mitigate these risks, traders should thoroughly research and consider alternative brokers with established reputations and regulatory oversight. Diversifying trading accounts across multiple platforms can also help spread risk and protect against potential losses.

Conclusion and Recommendations

In conclusion, the evidence suggests that DCMEFX presents several red flags that indicate it may not be a safe broker for forex trading. The lack of regulatory oversight, combined with numerous complaints regarding customer service and fund withdrawals, raises serious concerns about its legitimacy. Traders should exercise caution and consider alternative options that offer more robust regulatory protections and transparent operations.

For those seeking reliable forex brokers, consider established firms with strong regulatory backgrounds, such as IG, OANDA, or Forex.com. These brokers provide a safer trading environment, ensuring that traders interests are protected while offering competitive trading conditions. Ultimately, ensuring safety in trading is paramount, and traders should always prioritize working with reputable and regulated brokers to safeguard their investments.

Is DCMEFX a scam, or is it legit?

The latest exposure and evaluation content of DCMEFX brokers.

DCMEFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

DCMEFX latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.