Is BreeTrade safe?

Business

License

Is BreeTrade Safe or Scam?

Introduction

BreeTrade is a forex broker that has emerged in the trading landscape since its establishment in 2021. Positioned as a platform for both novice and experienced traders, BreeTrade claims to offer a range of trading instruments, including forex, cryptocurrencies, and commodities. However, as with any trading platform, it is crucial for traders to exercise caution and conduct thorough evaluations before engaging with a broker. The forex market, while offering lucrative opportunities, is also fraught with risks, including potential scams and unregulated entities. This article aims to provide an objective assessment of BreeTrade, investigating its regulatory status, company background, trading conditions, and customer experiences. Our evaluation is based on a comprehensive analysis of multiple sources, including user reviews, regulatory databases, and financial analysis platforms.

Regulation and Legitimacy

One of the primary factors to consider when evaluating whether "BreeTrade is safe" is its regulatory status. Regulation serves as a critical framework for safeguarding traders' interests, ensuring that brokers adhere to stringent operational standards. Unfortunately, BreeTrade has been flagged for lacking valid regulation. Below is a summary of its regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| National Futures Association (NFA) | 0541392 | United States | Unauthorized |

Despite claiming to be registered in the United Kingdom, BreeTrade's association with the NFA appears questionable, as it exceeds the scope of business regulated by this authority. The absence of credible regulatory oversight raises significant concerns about investor protection and financial transparency. Moreover, the low score of 1.30 out of 10 on WikiFX indicates a high level of risk associated with this broker. Therefore, it is imperative for traders to approach BreeTrade with caution and consider the potential risks of engaging with an unregulated entity.

Company Background Investigation

BreeTrade operates under the name Bree Limited and was established in 2021. The broker claims to provide a comprehensive suite of trading services, yet its transparency and credibility are questionable. The company's ownership structure remains vague, with limited information available regarding its management team. A thorough examination of the management's professional backgrounds reveals a lack of substantial experience in the financial services industry, which raises additional red flags.

Furthermore, BreeTrade's website does not provide adequate information regarding its operational history or the qualifications of its team. Transparency in a broker's operations is essential for building trust with clients. The lack of detailed disclosures regarding company ownership, management, and operational history further complicates the assessment of whether "BreeTrade is safe."

Trading Conditions Analysis

When evaluating whether "BreeTrade is a scam," it is essential to analyze its trading conditions, including fees, spreads, and commissions. BreeTrade presents itself as a competitive broker, claiming to offer average spreads as low as 0.0 pips and leverage up to 1:400. However, the fee structure warrants scrutiny due to its potential lack of transparency.

| Fee Type | BreeTrade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.1 pips | 0.5 pips |

| Commission Model | Variable | Fixed |

| Overnight Interest Range | High | Moderate |

The absence of a clear commission structure can lead to unexpected costs for traders, which is a common issue with brokers lacking robust regulatory oversight. Additionally, the high overnight interest rates can significantly impact trading profitability, particularly for those engaging in longer-term positions. Therefore, while BreeTrade may appear competitive on the surface, the underlying fee structure raises concerns about the broker's overall integrity and transparency.

Client Fund Security

An essential aspect of evaluating whether "BreeTrade is safe" involves assessing the security of client funds. BreeTrade claims to implement various security measures; however, the lack of regulation raises serious questions about the effectiveness of these measures.

The broker does not appear to offer segregated accounts for client funds, which is a standard practice among regulated brokers to ensure that clients' money is protected in the event of insolvency. Furthermore, there is no indication of investor protection schemes or negative balance protection policies in place. These factors contribute to a heightened risk profile for traders using BreeTrade, as the absence of such safeguards can lead to significant financial losses.

Customer Experience and Complaints

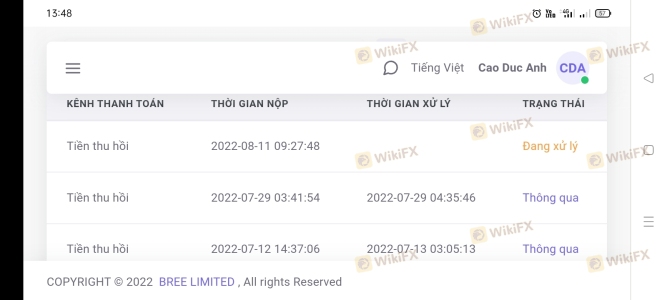

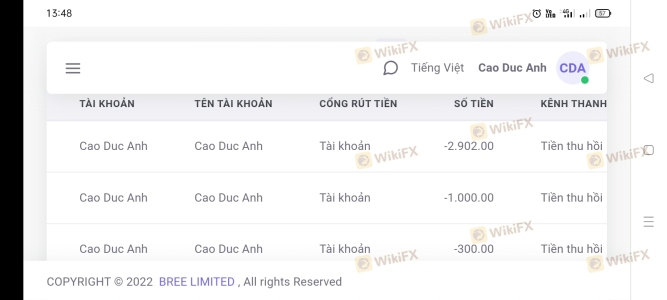

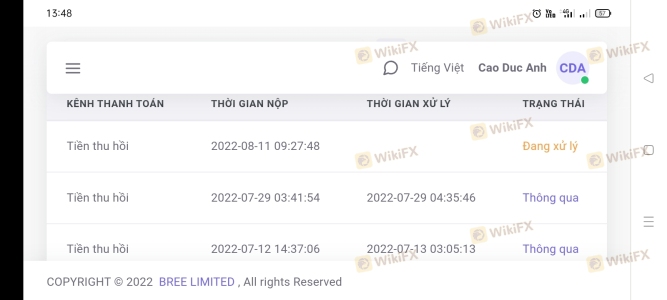

Customer feedback is a crucial indicator of a broker's reliability. An analysis of user reviews reveals a concerning trend of complaints regarding withdrawal issues and poor customer service. Many users have reported difficulties in processing withdrawal requests, which is a significant red flag when determining if "BreeTrade is a scam."

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Service Complaints | Medium | Inadequate Support |

For instance, a typical complaint involved users stating they could not cancel withdrawal orders, with some waiting weeks for their requests to be processed. Such complaints not only highlight the operational inefficiencies of BreeTrade but also suggest potential risks associated with the broker's practices.

Platform and Trade Execution

The trading platform is another critical component in assessing whether "BreeTrade is safe." BreeTrade utilizes the MetaTrader 5 platform, which is widely recognized for its robust features and user-friendly interface. However, user experiences indicate that the platform suffers from performance issues, including slow execution speeds and frequent downtimes.

Moreover, reports of slippage and order rejections have emerged, raising concerns about the overall quality of trade execution. These issues can adversely affect trading outcomes, particularly for those employing high-frequency trading strategies.

Risk Assessment

In conclusion, evaluating the comprehensive risk profile of BreeTrade is essential for traders contemplating engagement with this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of valid regulation raises significant concerns. |

| Financial Risk | High | Absence of investor protection and segregated accounts. |

| Operational Risk | Medium | Reports of withdrawal issues and platform performance concerns. |

To mitigate these risks, traders are advised to conduct thorough due diligence, consider using regulated alternatives, and start with a demo account to gauge the broker's reliability before committing significant capital.

Conclusion and Recommendations

In summary, the evidence suggests that traders should approach BreeTrade with caution. The lack of regulation, questionable compliance history, and numerous customer complaints indicate potential risks associated with this broker. Therefore, it is advisable for traders to explore regulated alternatives that offer a higher level of security and investor protection. For those seeking reliable trading platforms, brokers regulated by reputable authorities such as the FCA or ASIC are recommended. Ultimately, the key takeaway is to prioritize safety and transparency when choosing a forex broker, ensuring a secure trading environment.

Is BreeTrade a scam, or is it legit?

The latest exposure and evaluation content of BreeTrade brokers.

BreeTrade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BreeTrade latest industry rating score is 1.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.