Is bosslane safe?

Business

License

Is Bosslane Safe or a Scam?

Introduction

In the rapidly evolving world of forex trading, Bosslane has emerged as a platform that aims to cater to traders looking for a variety of financial instruments. Operating under the name Boss Lane Market Limited, this broker claims to provide access to various trading options, including futures, options, swaps, and CFDs. However, as with any trading platform, it is crucial for traders to conduct thorough due diligence before investing their hard-earned money. The forex market can be fraught with risks, and choosing the wrong broker can lead to significant financial losses.

This article aims to provide an objective analysis of whether Bosslane is safe or if it poses potential risks to traders. To achieve this, we will examine its regulatory status, company background, trading conditions, customer fund safety measures, user experiences, platform performance, and overall risk profile. Our investigation is based on a comprehensive review of available data, including user feedback, regulatory information, and market analysis.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors determining its legitimacy and safety. In the case of Bosslane, the broker operates without any valid regulatory oversight. It has been classified as "unauthorized" by the National Futures Association (NFA) in the United States, indicating that it does not adhere to the regulatory standards meant to protect traders.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| National Futures Association (NFA) | N/A | United States | Unauthorized |

The absence of regulation raises significant concerns about the broker's trustworthiness. Regulatory bodies like the NFA enforce strict rules to ensure that brokers operate fairly and transparently, protecting clients' interests. Without such oversight, traders using Bosslane may face higher risks, including potential fraud or mismanagement of funds. Furthermore, the lack of a regulatory framework means that traders have limited recourse in case of disputes or issues related to fund withdrawals.

Company Background Investigation

Bosslane is reportedly a relatively new player in the forex market, having been active for approximately 5 to 10 years. However, its operational history is shrouded in ambiguity, with limited information available regarding its ownership structure and management team. A thorough investigation reveals that the company is registered in the United States, but the specifics about its founders and key personnel remain unclear.

The lack of transparency regarding the management team is concerning. A competent and experienced management team is essential for the successful operation of a brokerage. Without clear information on who runs the company and their qualifications, potential clients may find it challenging to trust Bosslane. Furthermore, the absence of a detailed company history raises questions about its long-term viability and commitment to ethical trading practices.

Trading Conditions Analysis

When evaluating whether Bosslane is safe, it's essential to consider the trading conditions it offers. The broker provides various account types, including standard, premium, and business accounts, each with different transaction limits and fees. However, the overall fee structure and trading conditions have raised eyebrows among users.

| Fee Type | Bosslane | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | Starting from 1.5 pips | 1.0 - 1.5 pips |

| Commission Model | $5 to $10 per lot | $5 per lot |

| Overnight Interest Range | Variable | Variable |

The spreads offered by Bosslane start at 1.5 pips on major currency pairs, which is on par with the industry average. However, the variable commissions, which can range from $5 to $10 per lot, may be considered high by some traders, especially when compared to more competitive brokers. Additionally, the absence of a demo account limits the ability of potential clients to test the platform before committing real funds.

Customer Fund Safety

The safety of customer funds is paramount when assessing whether Bosslane is safe. Unfortunately, this broker does not provide adequate information regarding its fund safety measures. There are no clear policies on the segregation of client funds, investor protection schemes, or negative balance protection.

Without stringent measures to protect client funds, traders using Bosslane may be at risk of losing their investments in the event of financial difficulties faced by the broker. Moreover, there have been reports of difficulties in fund withdrawals, which further exacerbate concerns regarding the safety of funds. The lack of transparency in this area is a significant red flag for potential clients.

Customer Experience and Complaints

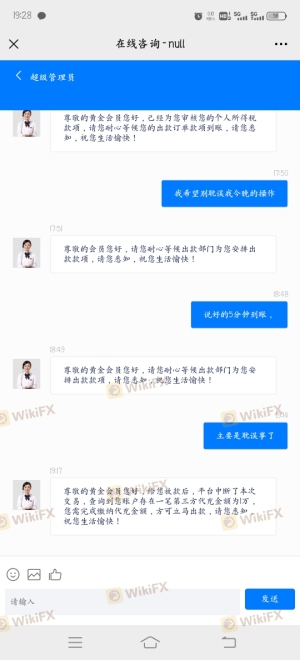

Analyzing customer feedback is crucial in determining whether Bosslane is safe. Reviews indicate a pattern of complaints related to fund withdrawals, unresponsive customer service, and reports of fraud. Many users have expressed frustration over their inability to withdraw funds, often citing delays and unclear communication from the company.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Customer Service | Medium | Slow Response |

| Fraud Allegations | High | No Clear Response |

For instance, one user reported a significant delay in processing a withdrawal request, which took weeks to resolve, while another highlighted a lack of communication from customer support. Such complaints raise serious questions about the reliability of Bosslane and suggest that potential clients should exercise caution.

Platform and Trade Execution

The performance and reliability of the trading platform are critical factors in assessing whether Bosslane is safe. The broker offers the MetaTrader 4 platform, which is widely regarded for its user-friendly interface and comprehensive features. However, users have reported issues related to order execution quality, including slippage and rejected orders.

Traders have expressed concerns about the possibility of platform manipulation, which can severely impact trading outcomes. A reliable broker should ensure that trades are executed promptly and at the expected prices. The reported issues with execution quality suggest that traders may face challenges when using Bosslane for their trading activities.

Risk Assessment

Using Bosslane comes with inherent risks, primarily due to its lack of regulation and the negative feedback from users.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Financial Risk | High | Reports of withdrawal issues |

| Operational Risk | Medium | Concerns regarding platform stability |

To mitigate these risks, potential clients should consider starting with a minimal deposit and conducting thorough research before committing significant capital. It is also advisable to explore alternative brokers with robust regulatory frameworks and positive user reviews.

Conclusion and Recommendations

In conclusion, the evidence suggests that Bosslane may not be a safe choice for traders. The lack of regulation, combined with negative user feedback regarding fund withdrawals and customer service, raises significant concerns about the broker's legitimacy and reliability. While the trading conditions may appear competitive at first glance, the underlying issues related to fund safety and operational transparency cannot be overlooked.

For traders seeking a reliable forex broker, it is advisable to consider alternatives that are regulated by reputable authorities and have a proven track record of positive customer experiences. Brokers such as OANDA, IG, and Forex.com are examples of platforms that offer robust regulatory protection and favorable trading conditions. Ultimately, it is essential to prioritize safety and transparency when choosing a trading platform to ensure a secure trading experience.

Is bosslane a scam, or is it legit?

The latest exposure and evaluation content of bosslane brokers.

bosslane Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

bosslane latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.