Is Axi safe?

Business

License

Is Axi Safe or Scam?

Introduction

Axi, formerly known as Axitrader, is a well-established broker that has made its mark in the forex and CFD trading landscape since its inception in 2007. With its headquarters in Sydney, Australia, Axi has grown to serve a diverse clientele across over 100 countries. As the forex market continues to expand, traders must exercise caution and thoroughly evaluate brokers before committing their funds. This article aims to assess whether Axi is a safe trading option or if there are potential red flags that traders should be aware of. Our evaluation framework is based on a comprehensive review of regulatory status, customer feedback, trading conditions, and overall company transparency.

Regulation and Legitimacy

The legitimacy of a broker often hinges on its regulatory status. Axi is regulated by several reputable authorities, which adds a layer of security for traders. The following table summarizes Axi's core regulatory information:

| Regulatory Authority | License Number | Jurisdiction | Verification Status |

|---|---|---|---|

| ASIC | 318232 | Australia | Verified |

| FCA | 509746 | United Kingdom | Verified |

| DFSA | F003742 | Dubai | Verified |

| SVG FSA | 25417 | St. Vincent and the Grenadines | Not Verified |

Axi's regulation by the Australian Securities and Investments Commission (ASIC) and the Financial Conduct Authority (FCA) in the UK indicates a commitment to maintaining high industry standards. These regulators enforce strict compliance measures, including the segregation of client funds and the provision of negative balance protection. However, Axi has faced regulatory scrutiny in the past, particularly regarding compliance issues that led to temporary suspensions by ASIC. While these concerns have been addressed, traders should remain vigilant and aware of the potential risks associated with trading under less stringent jurisdictions, such as the SVG FSA.

Company Background Investigation

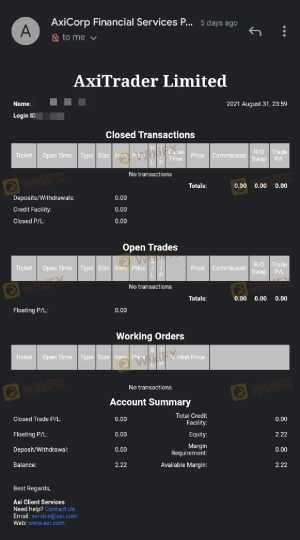

Founded in 2007, Axi has evolved from a small startup to a globally recognized broker. The company was established by a team of traders who aimed to create a trading platform that prioritized client needs. Over the years, Axi has expanded its operations, establishing offices in regions such as the UK, Dubai, and Asia. The ownership structure of Axi is transparent, with Axicorp Financial Services Pty Ltd as the parent company, incorporated in Australia.

The management team at Axi comprises experienced professionals with extensive backgrounds in finance and trading. This expertise contributes to the broker's reputation for reliability and customer service. Axi has consistently received accolades for its commitment to transparency and has been recognized with multiple awards for its services and customer satisfaction. In terms of information disclosure, Axi maintains a user-friendly website that provides essential details about its services, trading conditions, and regulatory status. However, some users have reported that the level of detail regarding fees and commissions could be improved.

Trading Conditions Analysis

Axi offers a variety of trading conditions that cater to different trader profiles. The broker provides three types of accounts: Standard, Pro, and Elite. The Standard account has no minimum deposit requirement, while the Pro account is designed for more experienced traders and charges a commission per trade. The Elite account is aimed at high-volume traders and requires a minimum deposit of $25,000.

The following table compares Axi's core trading costs with industry averages:

| Fee Type | Axi | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | 1.0 pips (Standard) | 0.7 pips |

| Commission Model | $7 per round trip (Pro) | $6 per round trip |

| Overnight Interest Range | Varies | Varies |

Axi's fee structure is competitive, particularly for high-volume traders using the Pro and Elite accounts. However, some traders have expressed concerns about the lack of transparency regarding specific fees, especially for overnight financing and inactivity charges. While Axi claims to charge no deposit or withdrawal fees, it is essential for traders to read the fine print and understand any potential hidden costs associated with their trading activity.

Client Fund Safety

The safety of client funds is paramount when evaluating a broker. Axi implements several measures to ensure the security of its clients' funds, including the segregation of client accounts from operational funds. This practice is crucial in the event of financial difficulties, as it helps protect traders' investments. Axi also provides negative balance protection, meaning that clients cannot lose more than their initial investment. This feature is particularly important in the volatile forex market, where price fluctuations can lead to significant losses.

Despite these safety measures, there have been historical concerns regarding Axi's handling of client funds, particularly during periods of regulatory scrutiny. Traders should remain aware of these past issues while evaluating Axi's current practices. Overall, the broker's commitment to fund safety, combined with its regulatory oversight, suggests a relatively secure trading environment for clients.

Customer Experience and Complaints

Customer feedback plays a vital role in assessing a broker's reliability. Axi has received mixed reviews from clients, with some praising its customer service and trading conditions, while others have reported issues related to withdrawals and account management. The following table summarizes common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response times |

| Account Verification Issues | Medium | Lengthy process |

| Customer Support Responsiveness | Medium | Generally positive |

Common complaints include delays in processing withdrawals and difficulties in account verification. Some users have expressed frustration with the responsiveness of Axi's customer support team, particularly during peak trading times. However, many clients have also reported positive experiences with support staff, highlighting their professionalism and willingness to assist. One notable case involved a trader who faced delays in withdrawing funds after a profitable trading period. While Axi eventually resolved the issue, the trader expressed dissatisfaction with the time taken to process the request.

Platform and Trade Execution

Axi exclusively uses the MetaTrader 4 (MT4) platform, which is a popular choice among traders for its user-friendly interface and robust features. The platform supports automated trading through Expert Advisors (EAs) and offers a range of technical analysis tools. Overall, users have reported a positive experience with MT4, citing its stability and ease of use.

In terms of order execution, Axi claims to provide fast and reliable trade execution. However, some traders have reported instances of slippage and rejected orders during high volatility periods. While these issues are not uncommon in the forex market, they can impact trading performance and raise concerns about the broker's execution quality.

Risk Assessment

Trading with Axi involves several risks that traders should consider before opening an account. The primary risks include regulatory scrutiny, potential withdrawal delays, and the inherent volatility of the forex market. The following table summarizes the key risk areas:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Medium | Potential for issues in less regulated jurisdictions |

| Withdrawal Processing Delays | High | Complaints about delays in fund withdrawals |

| Market Volatility | High | Forex trading involves significant risks due to price fluctuations |

To mitigate these risks, traders should conduct thorough research before opening an account with Axi. It is advisable to start with a demo account to familiarize oneself with the platform and trading conditions. Additionally, maintaining a well-defined risk management strategy can help protect against significant losses.

Conclusion and Recommendations

In conclusion, Axi presents itself as a regulated and credible broker with a solid reputation in the forex market. While there are some concerns regarding its operations under lower-tier regulators and historical compliance issues, the overall regulatory framework provided by ASIC and FCA offers a level of safety for traders. However, potential clients should be cautious and aware of the mixed customer feedback regarding withdrawal processes and account management.

For traders seeking a reliable broker, Axi can be a suitable option, especially for those familiar with the MT4 platform and looking for competitive trading conditions. However, it is essential to stay vigilant and consider alternative brokers if you prioritize a wider range of trading instruments or advanced platform features. If you are looking for alternatives, consider brokers like Pepperstone or IC Markets, which also offer robust regulatory oversight and a diverse range of trading options. Ultimately, ensuring the safety of your investments should be the top priority when selecting a forex broker.

Is Axi safe? While it has strong regulatory backing and sound trading conditions, traders should keep an eye on customer feedback and be prepared for potential challenges in the withdrawal process.

Is Axi a scam, or is it legit?

The latest exposure and evaluation content of Axi brokers.

Axi Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Axi latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.