Is ACM CAPITALS safe?

Business

License

Is ACM Capitals A Scam?

Introduction

ACM Capitals is an online forex broker that positions itself as a provider of specialized trading services, claiming to offer advanced trading platforms and high security for its clients. As the forex market continues to grow, traders must exercise caution when selecting brokers, as the landscape is rife with both legitimate firms and potential scams. The importance of evaluating a brokers credibility cannot be overstated, as it directly impacts the safety of your funds and the overall trading experience.

In this article, we will conduct a thorough investigation into ACM Capitals, assessing its regulatory status, company background, trading conditions, customer fund safety, user experiences, platform performance, and associated risks. Our analysis is based on a review of multiple credible sources and user feedback, ensuring a well-rounded perspective on whether ACM Capitals is safe or a potential scam.

Regulation and Legitimacy

The regulatory environment surrounding ACM Capitals raises significant concerns. The broker claims to operate from the Marshall Islands, a jurisdiction known for its lenient regulatory framework. This lack of stringent oversight is a red flag for potential investors, as it can lead to a lack of accountability and transparency in the broker's operations.

Heres a summary of the regulatory status of ACM Capitals:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Marshall Islands | Not Verified |

The absence of regulation means that ACM Capitals does not adhere to any recognized financial standards, which could jeopardize the safety of client funds. Regulatory bodies like the FCA in the UK or CySEC in Cyprus enforce strict guidelines to protect investors, and the lack of such oversight for ACM Capitals indicates a high-risk trading environment. This brings into question the broker's legitimacy and raises the possibility that it could engage in unscrupulous practices without fear of repercussions.

Company Background Investigation

ACM Capitals presents itself as a company built by industry professionals with years of experience, yet details about its history and ownership structure are alarmingly scarce. The brokers website lacks transparency, failing to provide crucial information such as the names of its founders, management team, or any verifiable business history. This anonymity is concerning, as it complicates any potential recourse for traders should issues arise.

The management team‘s background is particularly important in assessing whether ACM Capitals is safe. Without identifiable leaders with proven track records in the financial industry, traders are left in the dark regarding the broker's operational integrity. Moreover, the lack of information about the company’s financial backing or operational practices raises further doubts about its commitment to ethical trading.

In summary, the opaque nature of ACM Capitals company information and its failure to disclose essential operational details contribute to a perception of untrustworthiness. The absence of transparency is a significant indicator that potential clients should consider when evaluating whether ACM Capitals is safe.

Trading Conditions Analysis

When it comes to trading conditions, ACM Capitals advertises a low minimum deposit requirement of just $10, which may seem attractive to novice traders. However, this low barrier to entry is often a tactic used by unscrupulous brokers to lure in unsuspecting clients. The trading fees and conditions associated with ACM Capitals are not clearly outlined, which is another red flag.

Below is a comparison of core trading costs associated with ACM Capitals versus the industry average:

| Fee Type | ACM Capitals | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | Not Disclosed | 1-2 pips |

| Commission Structure | Not Disclosed | Varies (0-10 USD) |

| Overnight Interest Range | Not Disclosed | 2-5% |

The lack of transparency regarding spreads and commissions is concerning. Traders often rely on this information to make informed decisions, and ACM Capitals' failure to disclose these details could indicate hidden fees or unfavorable trading conditions. Moreover, the absence of a clear commission structure raises questions about how the broker generates revenue, which is essential for assessing whether ACM Capitals is safe.

Customer Fund Safety

One of the most critical aspects of evaluating a broker is the safety of customer funds. ACM Capitals does not provide adequate information regarding its fund security measures. There are no indications of segregated accounts, which are essential for ensuring that client funds are kept separate from the broker's operational funds. This lack of segregation raises concerns about the potential misuse of client deposits.

Furthermore, there is no mention of investor protection schemes, which are crucial for safeguarding client funds in the event of broker insolvency. Without these protections, traders face the risk of losing their entire investment without any recourse for recovery.

Historically, brokers operating under similar circumstances have faced numerous complaints regarding fund withdrawal issues, leading to significant financial losses for traders. The absence of a clear safety net for funds raises serious doubts about whether ACM Capitals is a safe option for traders.

Customer Experience and Complaints

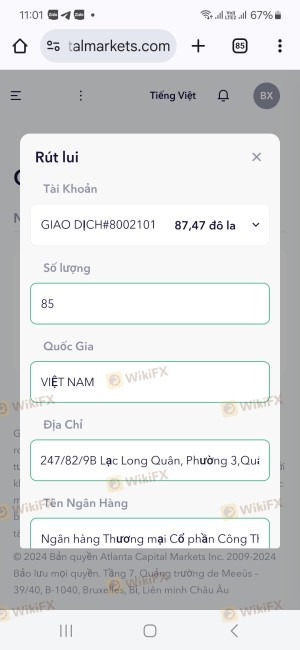

User feedback regarding ACM Capitals has been overwhelmingly negative, with many traders reporting severe issues related to fund withdrawals and customer service. Common complaints include the inability to withdraw funds after making profitable trades, which is a significant concern for anyone considering investing with this broker.

Heres a summary of the main complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Customer Support | Medium | Poor |

| Transparency Concerns | High | None |

Several users have shared their experiences, highlighting the brokers unresponsiveness to queries and complaints. For instance, one trader reported being unable to withdraw funds despite numerous attempts to contact customer support. This lack of responsiveness is indicative of a broader issue within the company, suggesting that ACM Capitals may not prioritize customer satisfaction.

Platform and Trade Execution

The trading platform offered by ACM Capitals is web-based and reportedly lacks the advanced features and stability found in more reputable platforms like MetaTrader 4 or 5. Users have raised concerns about the platform's performance, including slow execution times and a high incidence of slippage, which can significantly impact trading outcomes.

Additionally, there are allegations of price manipulation and other unethical practices, which could further erode trust in the broker. Traders have reported instances where they experienced unexpected price changes that led to significant losses, raising alarms about the integrity of the platform.

Risk Assessment

Using ACM Capitals presents several risks that potential traders should be aware of. The combination of unregulated status, lack of transparency, and negative user feedback creates a high-risk trading environment.

Heres a risk scorecard summarizing key risk areas:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight. |

| Fund Safety Risk | High | No segregation of funds. |

| Customer Service Risk | Medium | Poor response to complaints. |

| Platform Integrity Risk | High | Reports of manipulation and slippage. |

To mitigate these risks, potential traders should consider using regulated brokers with robust customer support and transparent trading conditions.

Conclusion and Recommendations

In conclusion, the evidence suggests that ACM Capitals exhibits several characteristics commonly associated with untrustworthy brokers. The absence of regulation, lack of transparency regarding trading conditions, and numerous complaints from users raise significant concerns about whether ACM Capitals is safe.

Traders are advised to exercise extreme caution when dealing with ACM Capitals, as the potential for financial loss is high. For those seeking reliable alternatives, consider brokers that are regulated by reputable authorities and offer transparent trading conditions. Always conduct thorough research before committing funds to any trading platform to safeguard your investments.

Is ACM CAPITALS a scam, or is it legit?

The latest exposure and evaluation content of ACM CAPITALS brokers.

ACM CAPITALS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ACM CAPITALS latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.