Zee Capitals Review 1

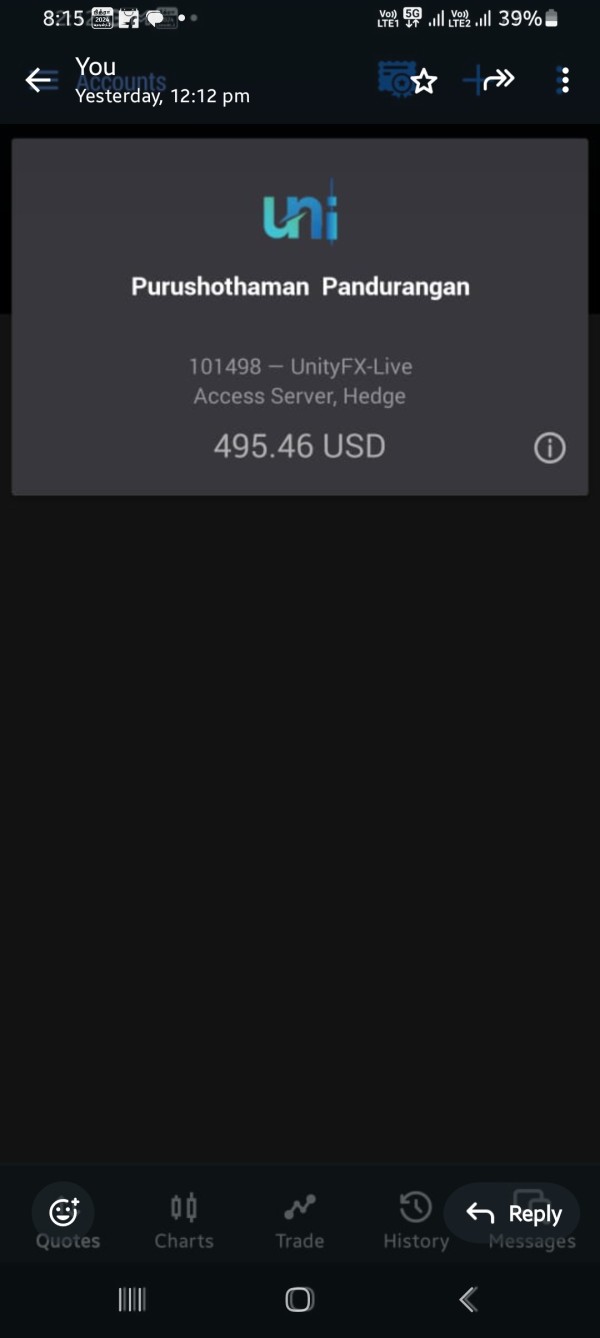

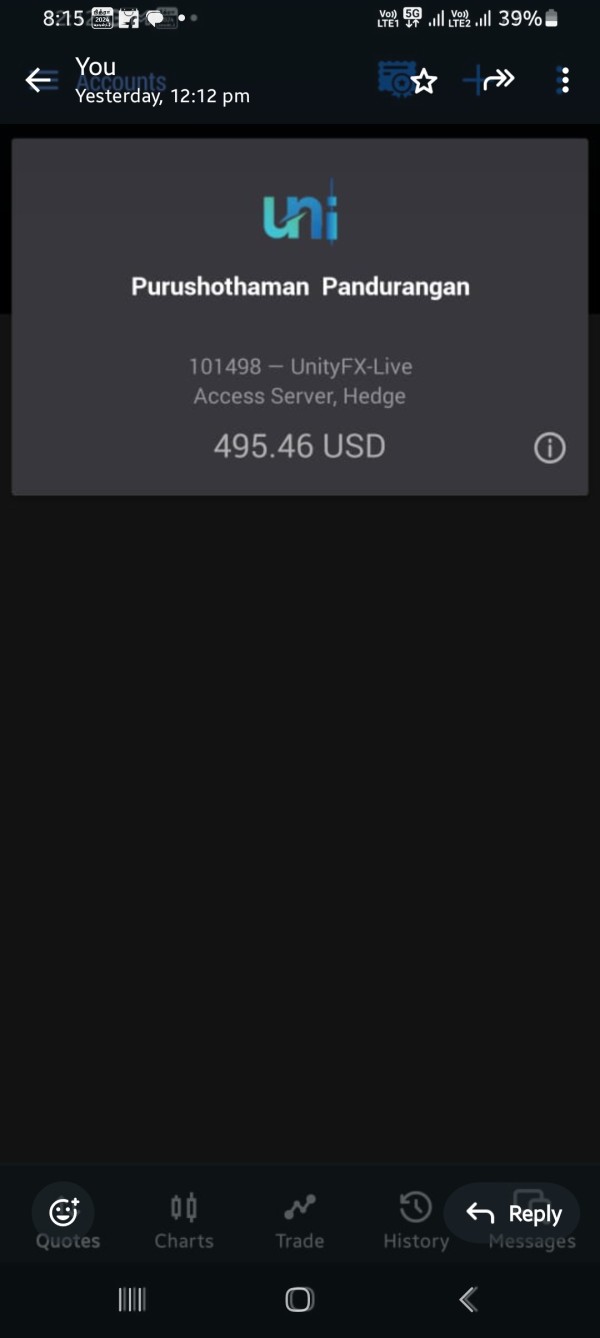

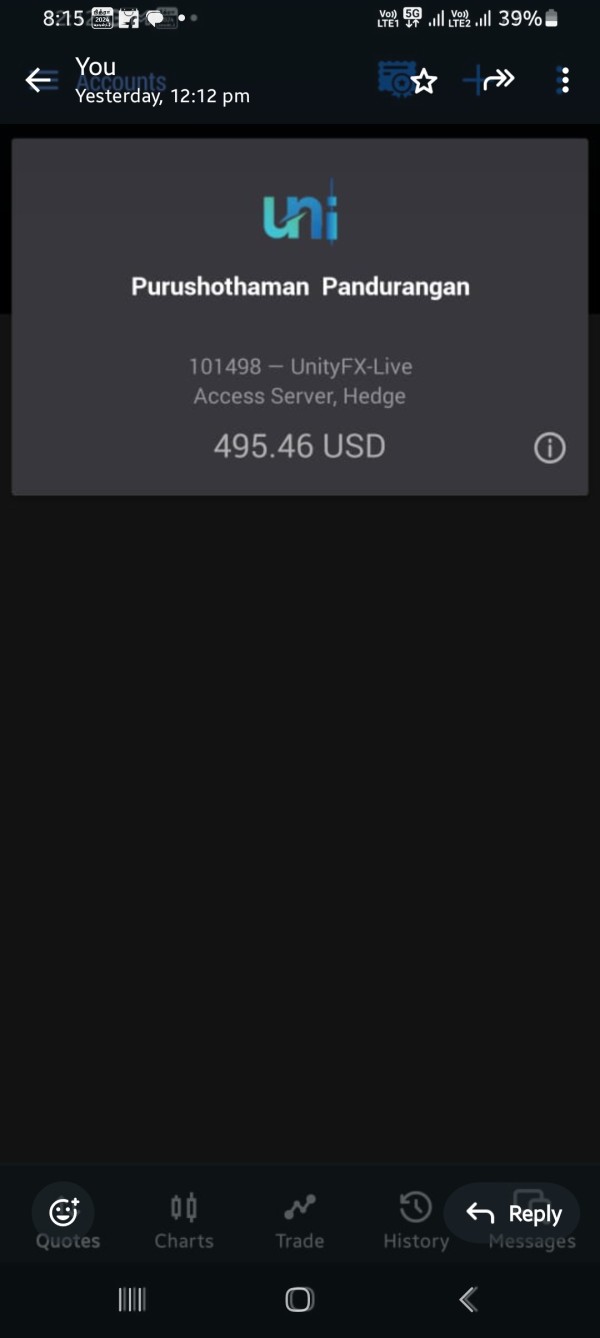

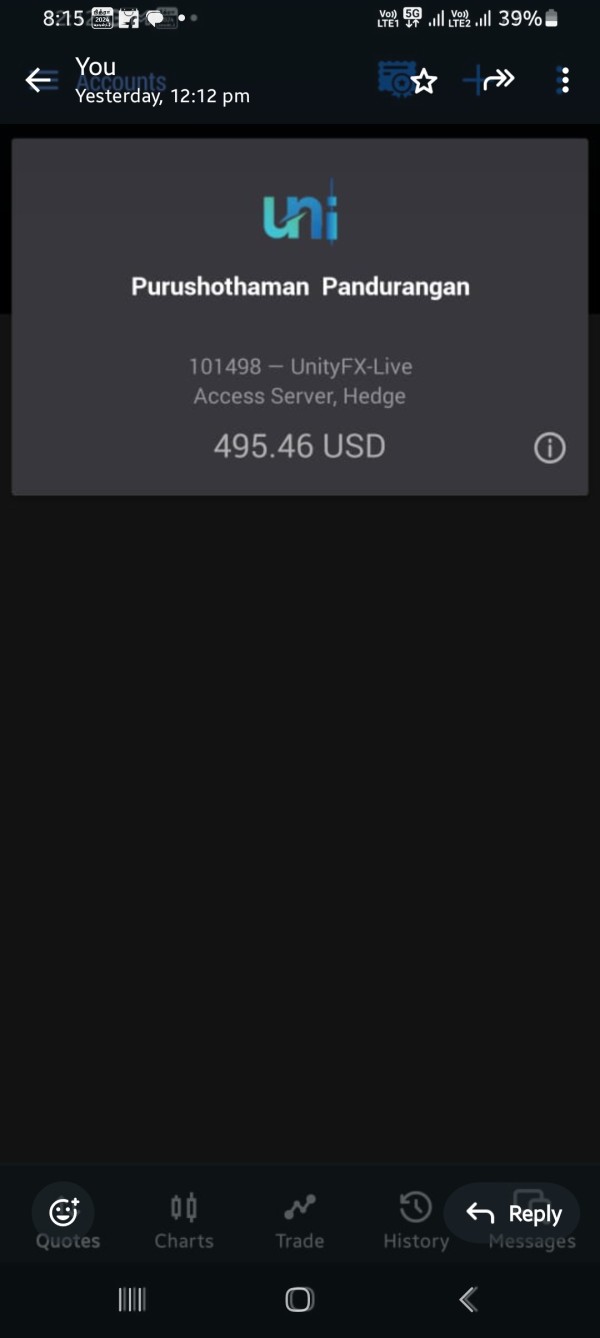

They asked 100 $ deposit They also guide for trade But once get the profit .. They won't give Withdrawal I lost 500 $ . They used trading platform mt5 in the unity fx .. They totally cheated me..

Zee Capitals Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Business

License

They asked 100 $ deposit They also guide for trade But once get the profit .. They won't give Withdrawal I lost 500 $ . They used trading platform mt5 in the unity fx .. They totally cheated me..

Zee Capitals is widely recognized as an unregulated broker that poses significant risks to traders. This broker has mostly negative user reviews and gets poor ratings overall. This zee capitals review shows that the platform claims to offer trading across multiple asset classes including cryptocurrencies, commodities, indices, stocks, and forex, but serious regulatory warnings overshadow these offerings completely. The Malta Financial Services Authority has specifically warned against Zee Capitals as an unregulated broker. This warning raises serious concerns about trader protection and fund security for anyone considering this platform.

The platform targets users seeking diversified asset trading opportunities. However, potential clients must have very high risk tolerance given the regulatory uncertainties surrounding this broker. User feedback consistently highlights poor service quality, questionable business practices, and concerning withdrawal issues that affect many traders. Based on available public information and user testimonials, Zee Capitals fails to meet industry standards for safety, transparency, and regulatory compliance in multiple important areas. Traders considering this platform should exercise extreme caution and thoroughly understand the risks associated with unregulated brokers before making any financial commitments.

Due to the absence of proper regulatory oversight, Zee Capitals may encounter varying legal risks and compliance requirements across different jurisdictions. The regulatory landscape for unregulated brokers differs significantly between regions. This difference potentially exposes traders to additional legal and financial uncertainties that could affect their investments. This evaluation is based exclusively on publicly available information and user feedback, as no direct testing or verification of the platform's services has been conducted by our team. The Malta Financial Services Authority has issued explicit warnings identifying Zee Capitals as an unregulated entity. This warning serves as a primary consideration in this assessment and should concern potential users. Potential users should consult with financial advisors and verify current regulatory status before engaging with this platform.

| Dimension | Score | Rating |

|---|---|---|

| Account Conditions | 2/10 | Poor |

| Tools and Resources | 4/10 | Below Average |

| Customer Service and Support | 3/10 | Poor |

| Trading Experience | 3/10 | Poor |

| Trust and Reliability | 1/10 | Very Poor |

| User Experience | 2/10 | Poor |

Overall Rating: 2.5/10

The scoring reflects serious problems across all evaluated dimensions. Trust and reliability received the lowest possible rating due to regulatory warnings and negative user feedback patterns that appear consistently across multiple sources.

Zee Capitals operates as an online trading platform claiming to provide access to various financial instruments across multiple markets. The company's establishment date and detailed corporate background information remain unclear in available documentation. This lack of clarity raises transparency concerns typical of unregulated entities that operate without proper oversight. The platform's business model centers on facilitating online trading without proper regulatory authorization. This approach fundamentally compromises trader protection and industry compliance standards that legitimate brokers must follow.

The broker's operational structure lacks the oversight mechanisms required by legitimate financial services providers. According to available information, Zee Capitals offers trading services across forex, commodities, cryptocurrencies, stocks, and indices. However, the actual quality and reliability of these services remain questionable given the regulatory warnings from authorities. The Malta Financial Services Authority serves as the primary regulatory reference point, having issued clear warnings about the company's unregulated status that potential users should take seriously. This zee capitals review emphasizes that potential users should prioritize regulated alternatives that provide proper investor protection and regulatory compliance.

Regulatory Status: Zee Capitals claims association with Malta's financial services sector but has been explicitly warned against by the Malta Financial Services Authority as an unregulated entity. This warning creates significant legal and financial risks for users who choose to trade with this platform.

Deposit and Withdrawal Methods: Specific information regarding payment processing methods, supported currencies, and transaction procedures is not detailed in available documentation. This lack of information indicates potential transparency issues that could affect user experience.

Minimum Deposit Requirements: The platform's minimum deposit thresholds and account funding requirements are not clearly specified in accessible materials. This absence suggests inadequate disclosure practices that legitimate brokers typically avoid.

Promotional Offers: Details regarding bonus structures, promotional campaigns, or incentive programs are not mentioned in available information sources. Most legitimate brokers clearly outline their promotional offerings for potential clients.

Tradeable Assets: The platform advertises access to forex pairs, cryptocurrency markets, commodity trading, stock instruments, and market indices. However, the actual availability and trading conditions remain unverified by independent sources.

Cost Structure: Comprehensive information about spreads, commission rates, overnight fees, and other trading costs is notably absent from available documentation. This absence prevents accurate cost assessment for potential traders.

Leverage Ratios: Specific leverage offerings and margin requirements are not detailed in accessible information sources. Most regulated brokers provide clear leverage information to help traders understand their risk exposure.

Platform Options: The trading platform technology, software providers, and interface specifications are not clearly outlined in available materials. This lack of technical information makes it difficult to assess platform capabilities.

Geographic Restrictions: Regional availability and jurisdiction-specific limitations are not specified in current documentation. Understanding geographic restrictions is important for international traders.

Customer Support Languages: Multi-language support availability and communication options are not detailed in accessible information sources. This zee capitals review highlights the concerning lack of transparency across multiple operational aspects that affect user experience.

The account conditions offered by Zee Capitals demonstrate significant deficiencies in transparency and user protection. Available information fails to specify account type varieties, features, or differentiation between service levels. This represents a fundamental shortcoming for any legitimate brokerage operation that serves diverse client needs. The absence of clear minimum deposit requirements prevents potential users from making informed decisions about account accessibility and financial commitments.

Account opening procedures and verification processes are not adequately documented. This lack of documentation raises concerns about compliance with anti-money laundering regulations and know-your-customer requirements that legitimate brokers must follow. The lack of specialized account options, such as Islamic accounts for religious compliance or professional trader accounts with enhanced features, indicates limited service customization for different user needs. User feedback suggests difficulties with account management and unclear terms of service. These issues contribute to overall dissatisfaction with account-related services among existing users.

The regulatory warning from MFSA further undermines confidence in account safety and legal protection. Without proper regulatory oversight, account holders lack access to compensation schemes and dispute resolution mechanisms typically available through regulated brokers. This zee capitals review emphasizes that the poor account conditions score reflects fundamental deficiencies in user protection and service transparency that affect all account holders.

Zee Capitals' trading tools and educational resources demonstrate limited depth and questionable quality compared to industry standards. While the platform claims to support multiple asset classes, specific information about trading tools, analytical software, and research capabilities remains largely undisclosed to potential users. The absence of detailed tool specifications prevents accurate assessment of platform functionality and trader support systems.

Research and market analysis resources are not comprehensively documented. This suggests potential limitations in fundamental and technical analysis support that traders typically expect from legitimate brokers. Educational materials, tutorials, and trader development resources appear insufficient based on available information. This particularly impacts novice traders requiring guidance and skill development opportunities to improve their trading performance. The lack of automated trading support details, including expert advisor compatibility and algorithmic trading features, represents another significant limitation for advanced traders.

User feedback does not provide substantial positive commentary regarding tool effectiveness or resource quality. This indicates potential deficiencies in platform capabilities that could affect trading success. Professional trading tools such as advanced charting packages, market scanners, and risk management systems are not adequately described in available materials. This suggests possible limitations in professional trader support that could drive experienced users to seek alternatives. The moderate scoring reflects the platform's claims of multi-asset support while acknowledging the lack of detailed tool verification and user satisfaction data.

Customer service quality at Zee Capitals receives consistently negative feedback from users. This indicates systemic issues with support responsiveness and problem resolution that affect many clients. Available information does not specify customer service channels, availability hours, or response time commitments. This represents poor service transparency that legitimate brokers typically avoid. The absence of detailed support structure information suggests potential limitations in user assistance capabilities.

User reviews consistently highlight poor service experiences. These include delayed responses, unhelpful support interactions, and difficulties resolving account-related issues that frustrate many clients. The lack of multi-language support documentation raises concerns about international user accommodation and communication effectiveness for diverse client bases. Customer service accessibility through various channels such as live chat, telephone support, or email assistance is not clearly outlined in available materials. This makes it difficult for potential users to understand how they can get help when needed.

Problem resolution effectiveness appears limited based on user feedback patterns. There are particular concerns about withdrawal processing and account management support that affect user satisfaction significantly. The unregulated status compounds customer service issues by removing regulatory recourse options typically available for dispute resolution through official channels. Training and expertise levels of support staff remain questionable given the negative user experiences reported across multiple feedback sources.

The trading experience provided by Zee Capitals shows significant deficiencies based on available user feedback and platform assessment. Users report poor trading conditions, including concerns about order execution quality, platform stability, and overall trading environment reliability that affect their daily trading activities. The absence of detailed platform specifications prevents thorough evaluation of technical performance and trading infrastructure quality.

Platform stability and execution speed appear problematic according to user reports. There are concerns about slippage, requotes, and order processing delays that can significantly impact trading results. Mobile trading capabilities and cross-device synchronization are not adequately documented in available materials. This potentially limits trading flexibility for active users who need to trade on different devices. The lack of advanced order types and trading features may restrict sophisticated trading strategies and risk management approaches that experienced traders require.

User feedback indicates frustration with trading conditions. This includes spread competitiveness and execution transparency issues that affect overall satisfaction. The absence of detailed trading statistics and performance metrics prevents objective assessment of platform capabilities for potential users. Market access reliability and data feed quality concerns further compound trading experience issues that users face regularly. This zee capitals review emphasizes that the poor trading experience score reflects fundamental platform limitations and user dissatisfaction patterns across multiple areas.

Trust and reliability represent the most concerning aspects of Zee Capitals' operations. These areas earn the lowest possible rating due to severe regulatory and credibility issues that cannot be overlooked. The Malta Financial Services Authority has explicitly warned against Zee Capitals as an unregulated broker. This indicates serious compliance failures and potential legal violations that pose significant risks to users. This regulatory warning fundamentally undermines any claims of legitimacy or trustworthiness that the platform might make.

The absence of proper regulatory authorization eliminates essential investor protections. These include deposit insurance, segregated client funds, and regulatory oversight mechanisms that protect traders at legitimate brokers. Company transparency remains severely limited, with insufficient disclosure about corporate structure, ownership details, and operational procedures that users should know. The lack of regulatory compliance creates significant risks for fund security and legal recourse options that could leave users without protection.

User reviews consistently express concerns about platform reliability. These include withdrawal processing issues and business practice transparency problems that affect user confidence significantly. The absence of third-party audits, regulatory reporting, or industry certifications further compounds trust issues for potential users. Negative industry reputation and warning flags from regulatory authorities create substantial credibility concerns. These concerns cannot be overlooked by potential users seeking safe trading environments for their investments.

Overall user satisfaction with Zee Capitals demonstrates consistently negative patterns across multiple experience dimensions. User reviews indicate widespread dissatisfaction with platform functionality, customer service interactions, and overall service quality that affects most clients. The absence of positive user testimonials or satisfaction metrics suggests systemic issues with user experience delivery across the platform.

Interface design and platform usability are not adequately documented in available materials. This prevents assessment of user-friendly features and navigation efficiency that could improve the trading experience. Registration and account verification processes appear problematic based on user feedback from existing clients. There are reports of complicated procedures and unclear requirements that frustrate new users trying to get started. Fund management experiences, including deposit and withdrawal processes, receive particularly negative feedback from users who have attempted these transactions.

Common user complaints include difficulties with platform access and poor customer service responsiveness. Users also express concerns about fund security that affect their confidence in the platform. The lack of user-centric features such as educational resources, trading tools, and account management capabilities contributes to overall dissatisfaction among clients. User retention and satisfaction metrics are not available from the platform. However, negative feedback patterns suggest poor user experience delivery across multiple touchpoints that users encounter regularly.

This comprehensive zee capitals review reveals that Zee Capitals operates as an unregulated broker with substantial risks and predominantly negative user feedback. This makes it unsuitable for traders prioritizing safety, transparency, and regulatory protection in their trading activities. The platform's lack of proper oversight from the Malta Financial Services Authority, combined with consistently poor user experiences, creates an environment unsuitable for serious trading activities that require reliability and security.

While Zee Capitals claims to offer diversified asset trading opportunities across forex, cryptocurrencies, commodities, stocks, and indices, these potential advantages are completely overshadowed by fundamental regulatory and operational deficiencies. The absence of investor protections, transparent business practices, and reliable customer support makes this platform particularly risky for all trader categories. This applies regardless of experience level or risk tolerance that individual traders might have.

Based on this analysis, Zee Capitals cannot be recommended to any trader seeking legitimate, safe, and regulated trading services. Potential users should prioritize properly regulated alternatives that provide comprehensive investor protection, transparent operations, and positive user satisfaction records that demonstrate reliability and trustworthiness.

FX Broker Capital Trading Markets Review