JP Review 1

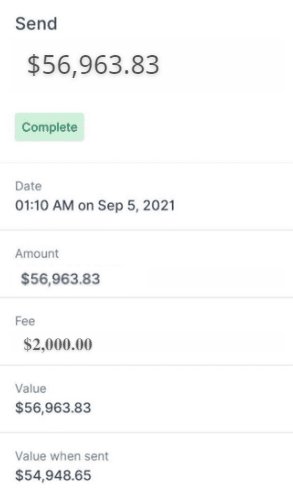

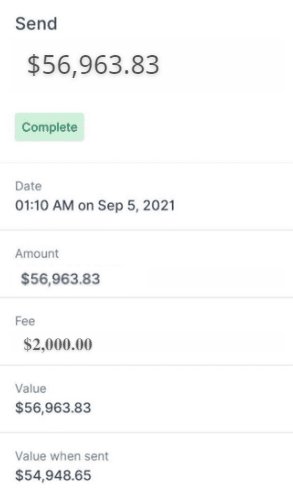

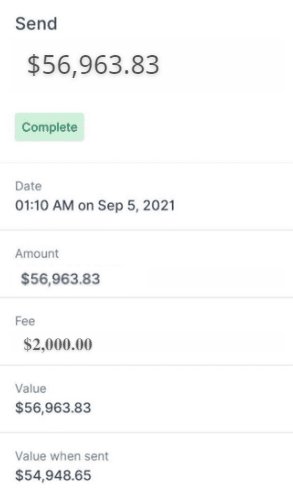

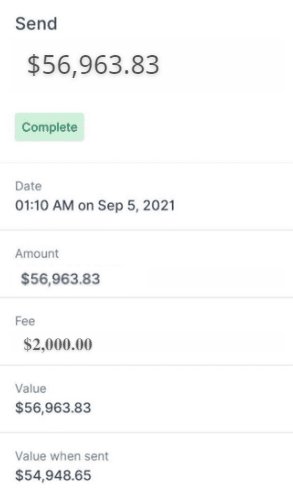

I lost USD 60,000 to JP Market .you put your money an you do a copy trader the three week later their systems go down and boom you money is gone.

JP Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

I lost USD 60,000 to JP Market .you put your money an you do a copy trader the three week later their systems go down and boom you money is gone.

This jp review gives you a complete analysis of JP-branded financial services. It covers multiple companies that operate under the JP name. JP represents a collection of different financial service providers rather than just one single brokerage, based on the information we found.

The landscape includes JPMorgan Chase's investment and brokerage services, which offer traditional investment products and securities trading. It also includes Japan Review publications that focus on academic and research content about Japanese studies. The main user base for JP-branded services includes institutional investors who want comprehensive investment solutions and academic researchers who need scholarly publications.

JPMorgan Securities LLC operates as a registered broker-dealer that provides investment services. It maintains clear distinctions from FDIC-insured banking products. However, the scattered nature of available information limits our ability to give a definitive positive or negative assessment of these services.

Key characteristics include JPMorgan's established presence in investment services with clear regulatory disclosures. Japan Review focuses on academic publishing. The main limitation in this evaluation comes from the diverse nature of entities sharing the JP designation and insufficient consolidated information about their unified service offerings.

This evaluation covers multiple entities that operate under the JP designation. These include JPMorgan Securities LLC, Japan Review publications, and related financial services. Readers should note that these represent separate organizations with distinct service offerings rather than a single integrated platform.

The assessment methodology relies on publicly available information from official sources, regulatory filings, and institutional documentation. Due to the varied nature of JP-branded entities, this review focuses primarily on the most substantial and clearly documented services, particularly those offered by JPMorgan Securities LLC.

Information gaps exist regarding specific trading conditions, detailed fee structures, and comprehensive service comparisons across all JP-designated entities.

| Dimension | Score | Justification |

|---|---|---|

| Account Conditions | 6/10 | Limited specific information available about account types and requirements |

| Tools and Resources | 7/10 | JPMorgan's established infrastructure suggests comprehensive tools |

| Customer Service and Support | 6/10 | Institutional presence implies support structure, but details unavailable |

| Trading Experience | 6/10 | Established brokerage operations suggest functional trading environment |

| Trust and Reliability | 8/10 | JPMorgan's regulatory status and institutional reputation |

| User Experience | 5/10 | Insufficient information to assess user interface and experience quality |

The JP designation includes several distinct financial entities. JPMorgan Securities LLC represents the most prominent brokerage operation. JPMorgan Securities LLC functions as a registered broker-dealer that offers investment and brokerage products to clients, according to available regulatory documentation.

The organization operates under clear regulatory frameworks. It explicitly states that investment and insurance products are not FDIC insured and carry inherent market risks. JPMorgan Chase Bank, N.A. provides the banking infrastructure supporting these investment services, though the entities maintain operational separation.

The business model centers on providing comprehensive investment solutions while maintaining regulatory compliance and transparency about product risks. This jp review identifies that the organization emphasizes client education about the distinction between insured banking products and investment securities. The service framework includes access to current documentation through the jpmorganinvestment platform, indicating a commitment to transparency and regulatory compliance.

The organization's structure includes both advisory account services and traditional brokerage account options. This suggests multiple service tiers for different client needs. However, specific details about account minimums, fee structures, and available trading instruments require additional research beyond the currently available information.

Regulatory Status: JPMorgan Securities LLC operates as a registered broker-dealer under U.S. financial regulations. Specific regulatory numbers and oversight details are not provided in available materials.

Deposit and Withdrawal Methods: Current documentation does not specify available funding methods or withdrawal procedures for brokerage accounts.

Minimum Deposit Requirements: Specific minimum deposit amounts for account opening are not detailed in accessible information.

Promotions and Bonuses: No promotional offers or bonus structures are mentioned in the available regulatory and service documentation.

Tradeable Assets: Investment and insurance products are referenced. Specific asset classes, currency pairs, or trading instruments are not listed in current materials.

Cost Structure: The documentation references both brokerage account fees and advisory account fees. This indicates multiple fee structures, but specific amounts and calculation methods require additional investigation.

Leverage Ratios: No information about available leverage or margin requirements is provided in current documentation.

Platform Options: Access through jpmorganinvestment platform is mentioned. Detailed platform specifications and alternatives are not described.

Geographic Restrictions: Service availability by region is not specified in available materials.

Customer Service Languages: Language support options are not detailed in current documentation. Given the institutional nature, multiple language support would be expected though.

This jp review notes that many specific operational details require direct contact with the service provider for comprehensive information.

The account conditions for JP-branded services appear to follow institutional standards for registered broker-dealers, particularly through JPMorgan Securities LLC. Available documentation indicates the existence of both brokerage accounts and advisory accounts. This suggests multiple service tiers designed to accommodate different client needs and investment approaches.

The organization maintains clear distinctions between investment products and traditional banking services, which reflects professional account management practices. However, this jp review identifies significant information gaps regarding specific account types, minimum balance requirements, and account opening procedures. The regulatory documentation emphasizes that investment products carry market risks and lack FDIC insurance protection.

This indicates that account holders must meet suitability requirements for investment activities. The reference to advisory accounts suggests the availability of managed investment services, though specific qualifications and fee structures for these services are not detailed in accessible materials. The institutional nature of JPMorgan's operations implies robust account infrastructure and established procedures for client onboarding and account maintenance.

However, without specific information about account features, Islamic account options, or specialized trading accounts, a complete assessment of account conditions remains limited. The organization's emphasis on regulatory compliance suggests thorough account documentation and verification processes.

JPMorgan's institutional presence in financial services suggests access to comprehensive trading tools and research resources. Specific details about platform capabilities are not provided in current documentation though. The reference to the jpmorganinvestment platform indicates a digital infrastructure for account access and investment management.

This would typically include portfolio monitoring, transaction capabilities, and account reporting functions. The organization's scale and market position imply access to institutional-grade research and analysis resources, including market commentary, economic analysis, and investment research. However, without specific information about trading platforms, charting tools, or analytical resources, this evaluation cannot definitively assess the quality and comprehensiveness of available tools.

The distinction between brokerage and advisory services suggests different levels of tool access and research support depending on account type. Educational resources and client support materials are not specifically detailed in available information, though institutional service providers typically offer comprehensive client education and market analysis. The regulatory emphasis on risk disclosure suggests that client education about investment risks and market conditions forms part of the service framework.

However, specific details about webinars, educational content, or training materials require additional investigation.

The institutional nature of JPMorgan Securities LLC suggests established customer service infrastructure. Specific details about support channels, availability, and service quality are not provided in accessible documentation though. Registered broker-dealers typically maintain comprehensive client support systems to meet regulatory requirements and client service standards.

This includes phone support, online assistance, and dedicated account management for qualifying clients. The organization's emphasis on regulatory compliance and risk disclosure indicates systematic approaches to client communication and support. The availability of current documentation through online platforms suggests digital support channels and self-service capabilities for account holders.

However, specific information about response times, multilingual support, or 24/7 availability is not detailed in current materials. Advisory account services imply personalized client support and consultation, though the scope and availability of these services depend on account type and client qualifications. The institutional framework suggests professional client service standards, but without specific performance metrics or client feedback, a comprehensive assessment of service quality remains limited.

The regulatory environment requires responsive client support for compliance and dispute resolution purposes.

The trading experience through JP-branded services likely centers on JPMorgan Securities LLC's brokerage platform. Specific details about execution quality, platform stability, and trading features are not provided in available documentation though. The organization's status as a registered broker-dealer implies compliance with execution quality standards and regulatory requirements for order handling and trade reporting.

Platform access through the jpmorganinvestment system suggests digital trading capabilities. Specific features such as mobile applications, advanced order types, or real-time market data are not detailed in current materials though. The institutional nature of the service provider implies professional-grade trading infrastructure designed to handle various investment transactions and portfolio management activities.

This jp review notes that execution quality, spread competitiveness, and platform reliability require assessment through direct platform experience or additional performance data. The regulatory framework governing broker-dealer operations provides baseline standards for trade execution and client protection, but specific performance metrics and user experience details are not available in current documentation. The distinction between brokerage and advisory services suggests different trading experiences depending on account type and service level.

JPMorgan Securities LLC's regulatory status as a registered broker-dealer provides a foundation for trust and reliability assessment. The organization operates under U.S. financial regulations, which require compliance with capital requirements, client protection rules, and operational standards. The clear disclosure that investment products are not FDIC insured demonstrates transparency about product risks and regulatory distinctions.

The institutional reputation of JPMorgan Chase provides additional credibility. Specific regulatory ratings, compliance history, or third-party assessments are not detailed in available materials though. The organization's emphasis on regulatory documentation and risk disclosure suggests systematic approaches to compliance and client protection.

However, specific information about client fund segregation, insurance coverage, or dispute resolution procedures requires additional investigation. The scale and established presence of JPMorgan in financial services implies institutional stability and operational continuity, though specific financial strength ratings or regulatory examination results are not provided. The regulatory environment requires ongoing compliance monitoring and reporting, which provides systematic oversight of operations and client protection measures.

User experience assessment for JP-branded services faces limitations due to insufficient information about platform interfaces, account management procedures, and client interaction systems. The availability of online platform access through jpmorganinvestment suggests digital account management capabilities. Specific details about user interface design, navigation, and functionality are not provided in current documentation though.

The institutional focus of JPMorgan Securities LLC implies professional-grade user interfaces designed for serious investors rather than casual traders. However, without specific information about platform usability, mobile applications, or client onboarding experiences, a comprehensive user experience evaluation remains incomplete. The distinction between brokerage and advisory services suggests different user experiences depending on service level and account type.

Client satisfaction metrics, user feedback, or platform performance reviews are not available in current materials. This limits the ability to assess actual user experiences. The regulatory framework requires clear communication and accessible account information, which provides baseline user experience standards, but specific satisfaction levels and common user concerns require additional research and client feedback analysis.

This jp review presents a neutral assessment of JP-branded financial services, primarily represented by JPMorgan Securities LLC's brokerage operations. The evaluation is constrained by limited specific information about trading conditions, platform features, and detailed service offerings. The institutional nature and regulatory compliance of JPMorgan Securities provide credibility, but comprehensive service assessment requires additional detailed information about operational specifics.

The services appear most suitable for investors seeking established institutional brokerage services with regulatory oversight and professional infrastructure. However, traders requiring detailed platform specifications, competitive fee structures, or comprehensive service comparisons should conduct additional research and direct consultation with service providers. The fragmented nature of JP-designated entities necessitates careful identification of specific service providers and their distinct offerings.

FX Broker Capital Trading Markets Review