FazoFX 2025 Review: Everything You Need to Know

Executive Summary

This fazofx review looks at a forex broker that works as an offshore trading service provider registered in Saint Vincent and the Grenadines. FazoFX offers three types of trading accounts. The broker also gives access to multiple financial markets including forex, cryptocurrencies, precious metals, commodities, and stock CFDs through the MetaTrader 5 platform. The broker requires a minimum deposit of $100. This makes it easy for new traders to start.

However, our analysis shows big gaps in available information, especially about regulatory oversight and user feedback. The lack of specific regulatory details creates concerns for potential clients. Limited transparency about trading conditions also presents problems. According to available sources, FazoFX targets users seeking diversified trading opportunities through the MT5 platform. But the absence of comprehensive regulatory information may limit its appeal to risk-averse traders. This review maintains a neutral stance due to insufficient data about actual user experiences and regulatory compliance.

Important Notice

Regional Entity Differences: FazoFX is registered in Saint Vincent and the Grenadines. This jurisdiction is known for lighter regulatory oversight compared to major financial centers like the UK, Australia, or Cyprus. Traders should be aware that offshore registration may offer less investor protection than brokers regulated by tier-1 authorities.

Review Methodology: This evaluation is based on publicly available information and market data. Comprehensive user feedback was not extensively collected. This happened due to limited available testimonials and reviews across major broker review platforms.

Rating Framework

Broker Overview

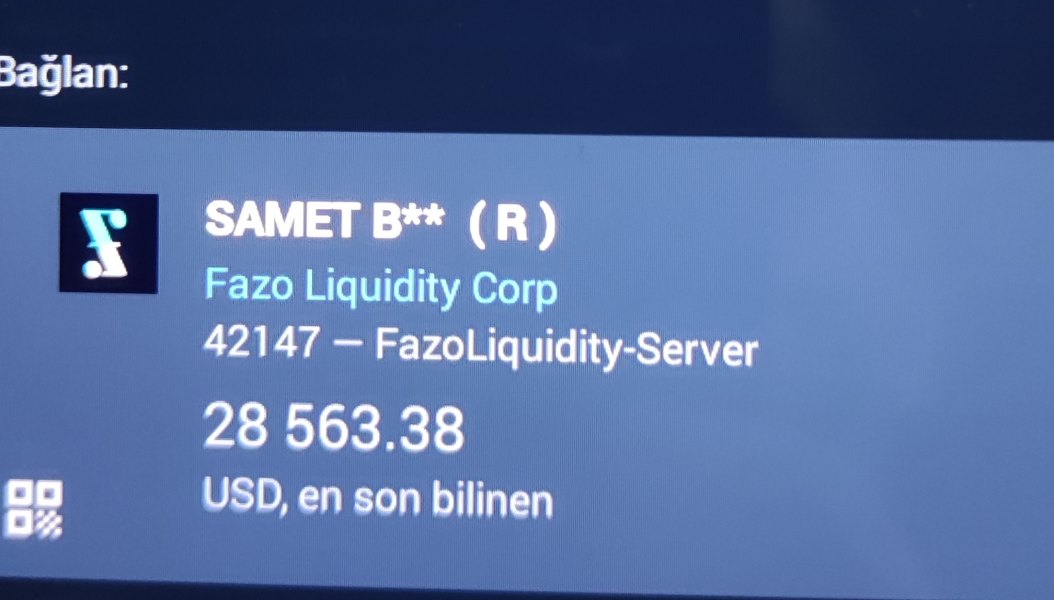

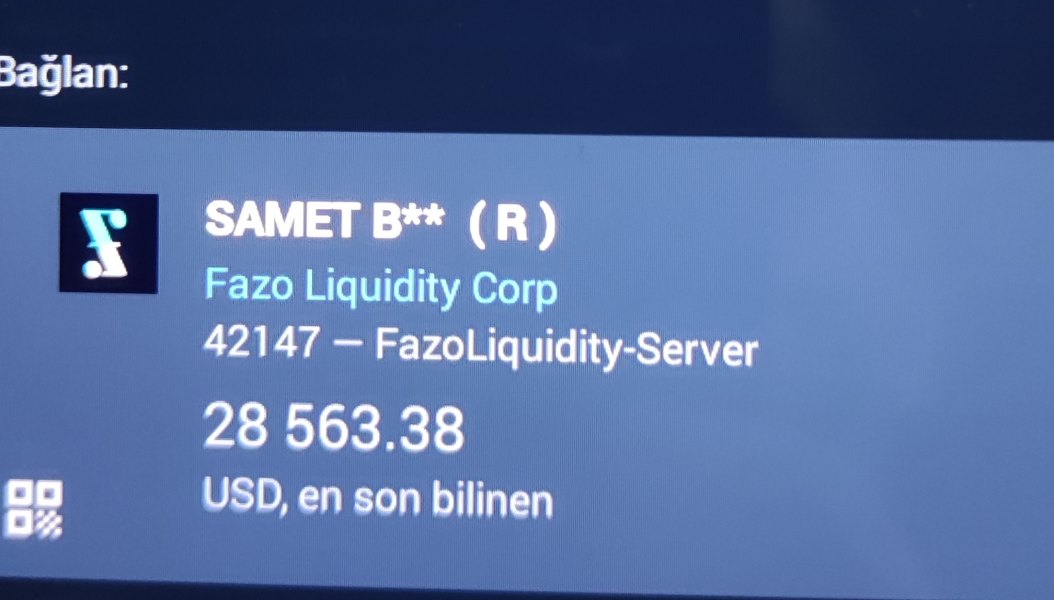

FazoFX operates as an offshore forex broker providing trading services through its registration in Saint Vincent and the Grenadines. The company positions itself as a provider of multi-asset trading opportunities. However, specific information about its founding year and detailed company background remains limited in available documentation. As an offshore entity, FazoFX operates outside the strict regulatory frameworks that govern brokers in major financial jurisdictions. This may appeal to certain trader segments but raises questions about oversight and investor protection.

The broker's primary business model centers around providing access to global financial markets through the MetaTrader 5 platform. FazoFX offers trading across multiple asset classes including foreign exchange pairs, cryptocurrency CFDs, precious metals, commodities, and stock indices. The platform supports three distinct account types. However, detailed specifications for each account tier were not comprehensively detailed in available materials. This fazofx review notes that while the broker provides market access, the lack of detailed regulatory information and limited transparency about trading conditions may concern potential clients seeking fully regulated trading environments.

Regulatory Region: FazoFX is registered in Saint Vincent and the Grenadines. However, specific regulatory authority details and license numbers were not mentioned in available documentation.

Deposit and Withdrawal Methods: Specific payment methods and withdrawal processes were not detailed in available information sources.

Minimum Deposit Requirements: The broker requires a minimum deposit of $100. This positions it as accessible to retail traders with limited initial capital.

Bonus and Promotions: Information about promotional offers, welcome bonuses, or ongoing incentive programs was not mentioned in available materials.

Tradeable Assets: FazoFX provides access to forex currency pairs, cryptocurrency CFDs, precious metals trading, commodity markets, and stock CFDs across multiple global markets.

Cost Structure: Detailed information about spreads, commissions, overnight financing charges, and other trading costs was not comprehensively available. This limits cost comparison capabilities.

Leverage Ratios: Maximum leverage offerings and leverage restrictions were not specified in available documentation.

Platform Options: The primary trading platform is MetaTrader 5. MT5 provides users with advanced charting tools and automated trading capabilities.

Regional Restrictions: Specific countries or regions where services are restricted were not mentioned in available materials.

Customer Service Languages: Supported languages for customer support services were not detailed in available information.

This fazofx review acknowledges that many crucial details remain unclear due to limited publicly available information about the broker's operations and policies.

Detailed Rating Analysis

Account Conditions Analysis (Score: 5/10)

FazoFX offers three different trading account types. However, specific features and benefits of each account tier were not comprehensively detailed in available materials. The $100 minimum deposit requirement positions the broker as accessible to new traders and those with limited initial capital. This represents a positive aspect of their account structure. However, the lack of detailed information about account-specific features, trading conditions, and tier-based benefits significantly impacts the evaluation.

The absence of clear information about leverage options, spread structures, and commission rates across different account types makes it difficult for potential clients to make informed decisions. Account opening procedures and verification requirements were not detailed in available sources. This raises questions about the onboarding process efficiency. Additionally, no information was found regarding specialized account options such as Islamic accounts for Muslim traders or demo account availability for testing purposes.

The limited transparency about account conditions represents a significant weakness in FazoFX's offering. Professional traders typically require detailed information about trading conditions, execution policies, and account features before committing funds. This fazofx review notes that the lack of comprehensive account information may deter serious traders seeking transparent and well-documented trading conditions.

FazoFX provides access to the MetaTrader 5 platform. This is considered an industry-standard trading environment offering advanced charting capabilities, technical analysis tools, and automated trading support through Expert Advisors. The MT5 platform includes features such as multiple timeframe analysis, comprehensive indicator libraries, and sophisticated order management systems. These features can meet most traders' technical requirements.

The broker supports trading across multiple asset classes including forex, cryptocurrencies, precious metals, commodities, and stock CFDs. This provides portfolio diversification opportunities. This multi-asset approach allows traders to capitalize on various market opportunities and implement cross-asset trading strategies. However, detailed information about research resources, market analysis, educational materials, and proprietary trading tools was not available in source materials.

The absence of information about educational resources, market research, economic calendars, and trading guides represents a significant gap in the broker's offering. Modern traders expect comprehensive educational support. This is especially true for newer market participants who require guidance and learning resources. While the MT5 platform provides robust technical capabilities, the lack of additional analytical resources and educational content limits the overall value proposition for traders seeking comprehensive support services.

Customer Service and Support Analysis (Score: 4/10)

Information about FazoFX's customer service infrastructure, support channels, and service availability was not detailed in available materials. This makes it impossible to assess the quality and accessibility of client support services. The absence of clear information about contact methods, response times, and support hours represents a significant concern for potential clients. These clients may require assistance with account management, technical issues, or trading inquiries.

Professional forex brokers typically provide multiple support channels including live chat, email support, telephone assistance, and comprehensive FAQ sections. The lack of visible customer service information suggests either limited support infrastructure or poor communication about available services. This gap is particularly concerning given the offshore regulatory status. Strong customer support becomes even more critical for building client confidence in such cases.

User feedback and testimonials about customer service experiences were not found in available sources. This further limits the ability to assess actual service quality. Without clear information about support availability, response times, and problem resolution effectiveness, potential clients cannot evaluate whether FazoFX provides adequate assistance when needed. This lack of transparency about customer support represents a significant weakness in the broker's overall offering.

Trading Experience Analysis (Score: 5/10)

The trading experience evaluation focuses on the MetaTrader 5 platform. This platform provides a robust foundation for forex and CFD trading activities. MT5 offers advanced order types, sophisticated charting capabilities, and support for automated trading strategies through Expert Advisors. The platform's technical capabilities should meet most traders' requirements for market analysis and trade execution. It provides a familiar environment for users experienced with MetaTrader platforms.

However, critical information about execution quality, order processing speeds, slippage rates, and platform stability was not available in source materials. These factors significantly impact actual trading experiences and can affect profitability. This is especially true for active traders and scalping strategies. The absence of user feedback about platform performance, execution quality, and overall trading conditions makes it difficult to assess real-world trading experiences.

Mobile trading capabilities, platform customization options, and integration with third-party tools were not detailed in available information. Modern traders increasingly rely on mobile platforms and expect seamless connectivity across devices. This fazofx review notes that while the MT5 foundation provides solid technical capabilities, the lack of detailed information about execution quality and user experiences limits confidence in the overall trading environment.

Trust Factor Analysis (Score: 3/10)

The trust factor evaluation reveals significant concerns about FazoFX's regulatory status and transparency. Registration in Saint Vincent and the Grenadines without specific regulatory authority details raises questions about oversight and investor protection. Offshore registration in jurisdictions with limited regulatory frameworks typically provides less security for client funds. This is compared to brokers regulated by established authorities like the FCA, ASIC, or CySEC.

The absence of detailed information about client fund segregation, deposit protection schemes, and regulatory compliance measures further impacts trust assessment. Professional traders typically seek brokers with clear regulatory status, segregated client accounts, and transparent operational procedures. The lack of comprehensive regulatory information makes it difficult for potential clients to assess the safety of their funds and the broker's operational legitimacy.

No information was found about third-party audits, financial reporting, or industry certifications that could enhance credibility. Additionally, the limited availability of user reviews and testimonials prevents assessment of actual client experiences and satisfaction levels. The combination of unclear regulatory status and limited transparency about operational procedures results in a low trust factor score. This may concern risk-averse traders seeking secure trading environments.

User Experience Analysis (Score: 4/10)

Evaluating user experience proves challenging due to the limited availability of client feedback and detailed information about FazoFX's services. The lack of comprehensive user testimonials, reviews on major broker comparison platforms, and detailed service descriptions makes it difficult to assess actual client satisfaction and experience quality. This absence of user feedback represents a significant gap in understanding how the broker performs in real-world trading scenarios.

Interface design, website navigation, account management systems, and overall user journey information were not comprehensively available in source materials. Modern traders expect intuitive interfaces, efficient account management tools, and streamlined processes for deposits, withdrawals, and account maintenance. Without detailed information about these aspects, potential clients cannot assess whether FazoFX provides user-friendly services that meet contemporary expectations.

The registration and verification processes, fund management procedures, and common user concerns were not detailed in available materials. Additionally, no information was found about user support resources, account management tools, or client portal features that could enhance the overall experience. The limited transparency about user-facing services and the absence of client feedback significantly impact the ability to recommend FazoFX based on proven user satisfaction.

Conclusion

This comprehensive fazofx review reveals a broker with limited transparency and insufficient information for thorough evaluation. While FazoFX offers access to multiple asset classes through the established MT5 platform with a reasonable $100 minimum deposit, significant concerns arise from the lack of regulatory clarity and limited user feedback. The offshore registration in Saint Vincent and the Grenadines, combined with minimal available information about trading conditions, customer service, and operational procedures, results in below-average ratings across most evaluation criteria.

FazoFX may appeal to traders willing to accept higher risks in exchange for multi-asset trading opportunities and potentially flexible trading conditions. However, the lack of comprehensive regulatory oversight and limited transparency about services makes it unsuitable for risk-averse traders seeking fully regulated and well-documented trading environments. Potential clients should carefully consider the implications of trading with an offshore broker that provides limited information about its operations and regulatory compliance.