CRM Trade Review 1

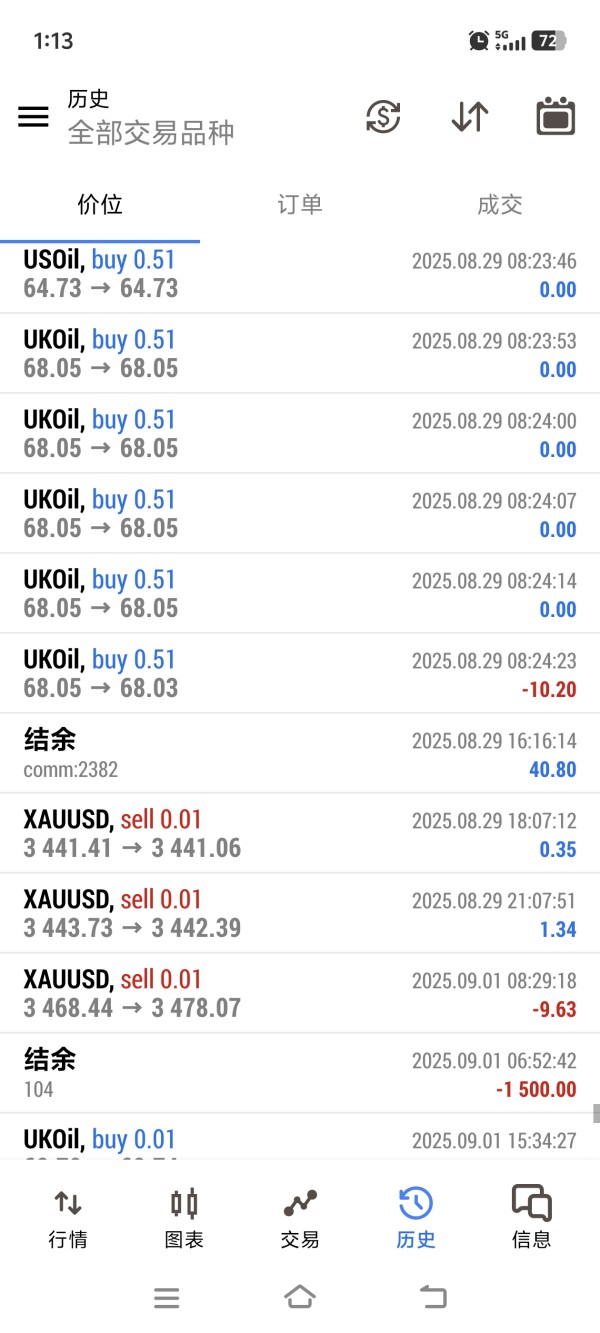

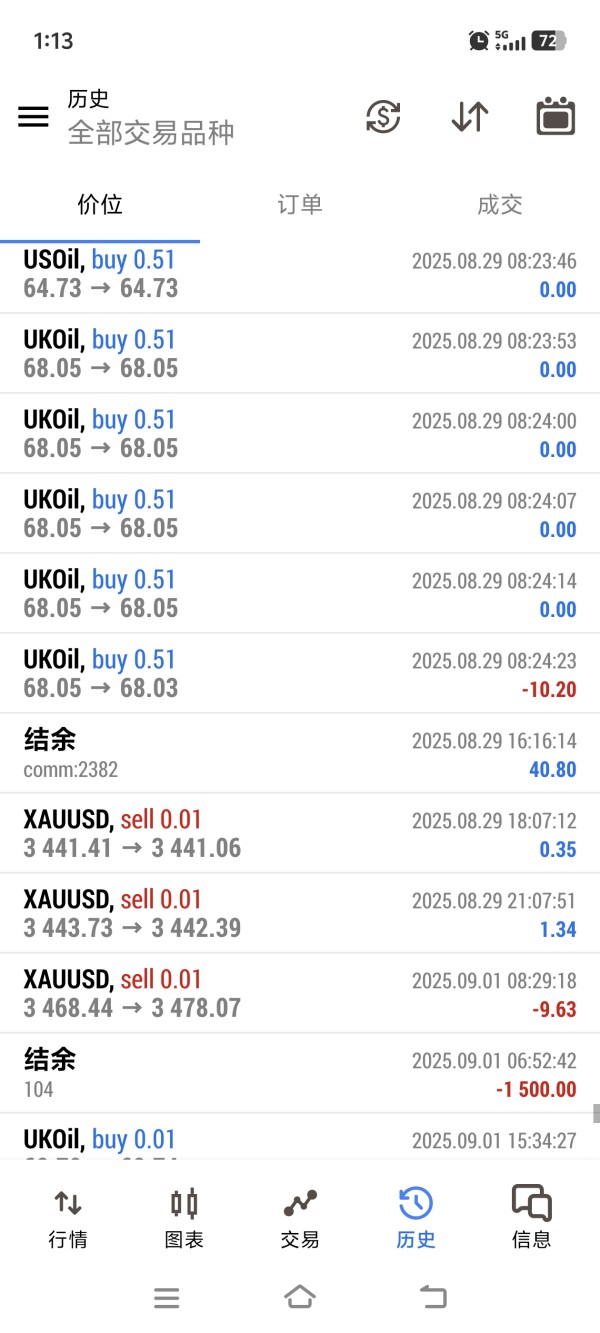

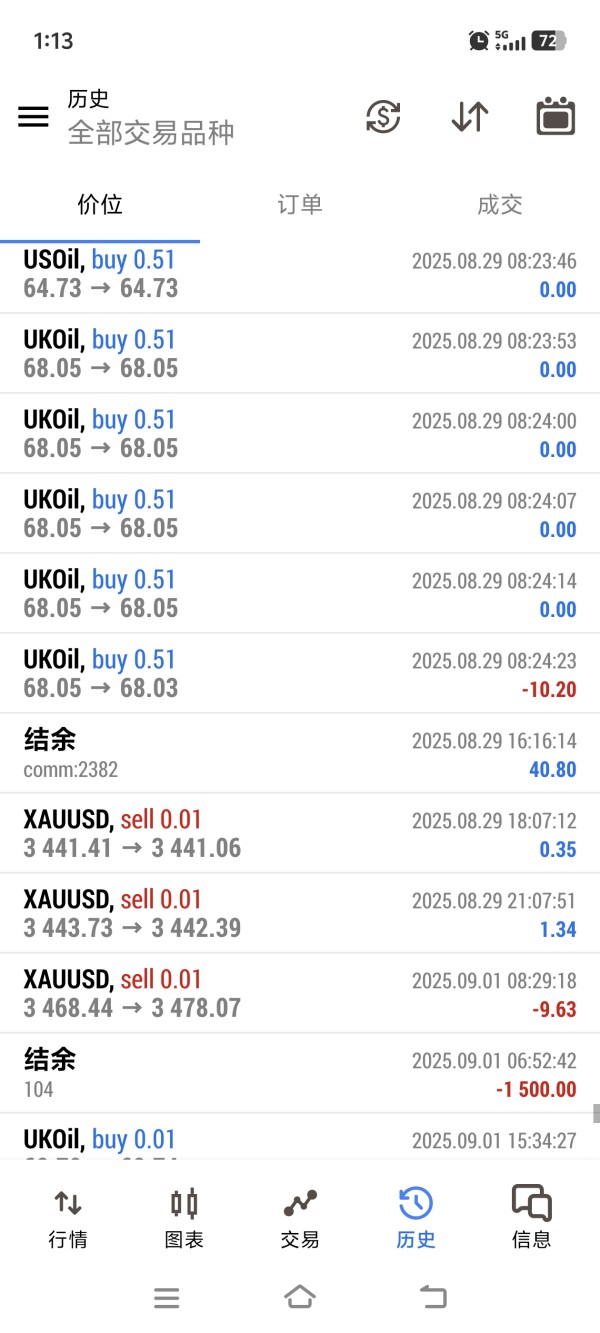

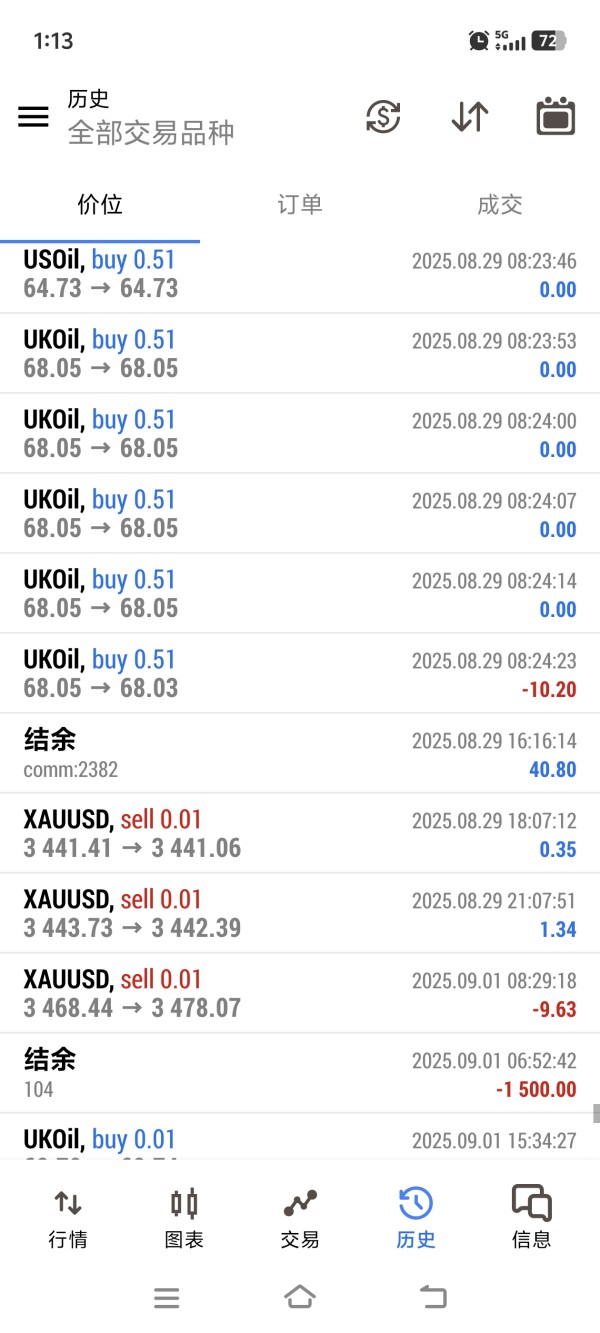

Money earned within the platform's rules cannot be withdrawn, and the platform has misappropriated client funds, with $1,500 in the account being seized by the platform.

CRM Trade Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Business

License

Money earned within the platform's rules cannot be withdrawn, and the platform has misappropriated client funds, with $1,500 in the account being seized by the platform.

This comprehensive crm trade review examines a trading service provider that caters to forex traders and small brokerage operations. Based on available information, CRM Trade positions itself as a solution for traders seeking customer relationship management tools integrated with trading capabilities, which helps streamline their business operations. The platform reportedly supports popular trading platforms including MT4 and MT5. It also offers advanced risk management tools designed to help traders manage the psychological pressures and operational complexities of forex trading.

The service appears particularly focused on addressing the mental and organizational challenges that traders face. It recognizes that with so much stress, figures, overwhelming losses, and exhilarating gains throughout a day, it's easy to feel drained and mentally exhausted from just the moral pressure. This positioning suggests CRM Trade targets both individual traders looking to systematize their approach and smaller brokerage firms requiring client management solutions, making it a versatile platform for different user types.

However, our analysis reveals significant information gaps regarding regulatory status, detailed account conditions, and comprehensive user feedback. This limits our ability to provide a definitive assessment of the platform's overall reliability and performance.

This review is compiled based on publicly available information and industry reports. Specific details regarding regulatory compliance, regional entity differences, and operational variations across jurisdictions were not detailed in available sources, so readers should exercise caution when making decisions. Readers should conduct independent due diligence and verify all information directly with the service provider before making any trading or business decisions.

The trading industry involves substantial risk. CRM solutions for trading should be evaluated within the context of your specific regulatory environment and business requirements.

| Evaluation Criteria | Score | Justification |

|---|---|---|

| Account Conditions | N/A | Insufficient information available in source materials |

| Tools and Resources | 8/10 | Strong platform support and advanced risk management tools |

| Customer Service | N/A | No specific information available regarding support services |

| Trading Experience | N/A | Limited details on actual trading execution and platform performance |

| Trust and Reliability | N/A | Regulatory information not specified in available sources |

| User Experience | N/A | Insufficient user feedback data in source materials |

CRM Trade operates within the intersection of customer relationship management and trading services. Specific details about its founding year and corporate background were not detailed in available source materials, but the company appears to focus on providing technological solutions that address both the operational and psychological challenges inherent in forex trading environments.

The service model seems designed around the recognition that trading involves significant mental pressure and organizational complexity. As noted in industry discussions, traders often experience substantial stress from overwhelming losses, and exhilarating gains throughout a day, making systematic approaches to trade management increasingly valuable for long-term success.

The platform's emphasis on supporting MT4 and MT5 trading platforms suggests compatibility with industry-standard trading infrastructure. Their focus on risk management tools indicates an understanding of the critical importance of risk control in trading operations, which is essential for trader survival. The target market appears to include both individual forex traders seeking better organization and smaller brokerage operations requiring client management capabilities. Specific market positioning details were not comprehensively outlined in available materials.

Regulatory Status: Specific regulatory information was not detailed in available source materials. This represents a significant information gap for potential users evaluating compliance and oversight.

Account Types and Requirements: Detailed account structure information was not specified in available sources. This includes minimum deposit requirements and account tier distinctions.

Deposit and Withdrawal Methods: Specific information regarding funding methods and withdrawal processes was not detailed in source materials. Users will need to contact the provider directly for these details.

Trading Assets: Based on available information, the platform appears to support forex trading and potentially CFD instruments. Comprehensive asset listings were not provided in the source materials.

Platform Options: The service reportedly supports MT4 and MT5 platforms. This indicates compatibility with widely-used trading infrastructure that most traders are familiar with.

Cost Structure: Detailed fee schedules, spread information, and commission structures were not specified in available materials. This makes cost comparison challenging for potential users.

Leverage Options: Specific leverage ratios and margin requirements were not detailed in source documentation. Traders should inquire directly about these important trading conditions.

This crm trade review highlights the significant information gaps that potential users should address through direct inquiry with the service provider.

The evaluation of account conditions for CRM Trade faces substantial limitations due to insufficient information in available source materials. Traditional account assessment criteria including minimum deposit requirements, account type varieties, verification processes, and special account features could not be adequately analyzed based on current documentation, which creates challenges for potential users trying to make informed decisions.

For forex traders and brokerage operations considering CRM solutions, account structure typically represents a critical decision factor. Standard industry considerations include scalability of account options, integration capabilities with existing trading infrastructure, and flexibility in customization for specific business models, all of which are important for operational success.

The absence of detailed account information in this crm trade review necessitates direct engagement with the service provider to understand available options, pricing structures, and setup requirements. Potential users should specifically inquire about account scalability, data migration capabilities, and integration requirements with existing trading systems to ensure compatibility.

Without comprehensive account details, traders and firms should approach evaluation cautiously. They should ensure all operational requirements are clearly understood before implementation decisions.

CRM Trade demonstrates strength in its technological infrastructure, particularly through its reported support for MT4 and MT5 trading platforms. This compatibility suggests robust integration capabilities with established trading workflows, which represents a significant advantage for traders already familiar with these industry-standard platforms and reduces the learning curve for new users.

The platform's emphasis on advanced risk management tools addresses a critical need in forex trading environments. According to industry observations, traders frequently struggle with the psychological pressures of trading, where stress, figures, overwhelming losses, and exhilarating gains throughout a day can lead to mental exhaustion and poor decision-making that affects their trading performance.

The risk management focus appears designed to help traders systematize their approach to position sizing, loss limitation, and emotional control. These are all crucial elements for sustainable trading performance that can make the difference between success and failure. However, specific details about the nature and functionality of these tools were not comprehensively outlined in available materials.

For CRM functionality specifically, the platform appears positioned to help traders organize client relationships and trading activities. Detailed feature specifications require direct inquiry with the provider.

Customer service evaluation for CRM Trade faces significant limitations due to absence of specific support information in available source materials. Critical service elements including support channel availability, response time standards, multilingual capabilities, and service hour coverage could not be assessed based on current documentation, which makes it difficult to evaluate this important aspect of the service.

For trading-related services, customer support quality often proves crucial during market volatility when technical issues or account problems require immediate resolution. The absence of detailed support information represents a notable gap in this evaluation that potential users should address.

Industry standards typically include 24/5 support during market hours, multiple communication channels, and technical expertise specific to trading platform integration. Without specific information about CRM Trade's support infrastructure, potential users cannot adequately assess service reliability or determine if the support meets their needs.

The lack of user feedback regarding support experiences further limits assessment capabilities. Traders and firms evaluating CRM solutions should prioritize direct testing of support responsiveness and technical competency before committing to implementation.

Assessment of actual trading experience through CRM Trade faces substantial information limitations. Critical performance factors including platform stability, execution speed, order processing reliability, and mobile accessibility could not be evaluated based on available source materials, which makes it challenging to assess the quality of the trading experience.

The platform's reported MT4/MT5 integration suggests potential for familiar trading experiences for users already comfortable with these platforms. However, the specific implementation quality, customization options, and performance optimization features remain unclear without detailed technical specifications that would help users understand what to expect.

Trading experience evaluation typically encompasses execution quality, platform uptime, feature accessibility, and integration smoothness with existing workflows. The absence of user testimonials or performance data in available materials prevents comprehensive assessment of these crucial factors that directly impact trading success.

This crm trade review emphasizes the need for potential users to conduct thorough testing, preferably through demo accounts or trial periods. They should evaluate actual trading experience quality before full implementation.

Trust assessment for CRM Trade encounters significant challenges due to limited regulatory and transparency information in available source materials. Key trust indicators including regulatory oversight, financial safeguards, operational transparency, and industry reputation could not be adequately evaluated, which creates uncertainty about the platform's credibility and safety.

Regulatory compliance represents a fundamental trust factor for any trading-related service. Yet specific regulatory status, licensing information, and oversight details were not provided in available documentation, leaving potential users without crucial information about consumer protections and operational standards.

Industry reputation analysis also faces limitations due to insufficient third-party evaluations, user feedback, and independent assessments in available materials. Without comprehensive trust indicators, potential users must conduct extensive independent due diligence to verify the platform's legitimacy and track record.

The lack of detailed financial safeguards information, including fund segregation practices, insurance coverage, and operational security measures, further complicates trust assessment. Users should prioritize verification of these elements directly with the service provider.

User experience evaluation for CRM Trade remains limited due to insufficient user feedback and interface information in available source materials. Critical UX elements including interface design quality, navigation efficiency, setup complexity, and user satisfaction metrics could not be comprehensively assessed, making it difficult to determine how user-friendly the platform actually is.

The platform's positioning for both individual traders and small brokerage operations suggests a need for scalable user experience design that accommodates different user types and technical sophistication levels. However, specific interface design approaches and usability optimization features were not detailed in available materials, leaving questions about how well the platform serves different user groups.

User onboarding experience, which often determines initial adoption success, could not be evaluated due to lack of process descriptions or user testimonials. Similarly, ongoing user satisfaction and common user challenges remain unclear without comprehensive feedback data that would provide insights into real-world usage.

The absence of user experience information in available materials necessitates direct evaluation through platform demonstrations or trial access. This allows potential users to assess interface quality, feature accessibility, and overall usability before implementation decisions.

This crm trade review reveals a service positioned at the intersection of trading technology and customer relationship management, with apparent strengths in platform integration and risk management focus. However, significant information gaps regarding regulatory status, detailed operational features, and user experiences limit comprehensive evaluation and make it difficult to provide a definitive recommendation.

The platform appears most suitable for forex traders and small brokerage operations seeking CRM integration with established trading infrastructure. This is particularly true for those already utilizing MT4/MT5 platforms who want to enhance their operational efficiency. The emphasis on risk management tools addresses genuine industry needs for systematic trading approaches that can help traders maintain discipline and consistency.

Primary advantages include reported platform compatibility and risk management focus, while key limitations center on insufficient transparency regarding regulatory compliance, detailed features, and user experiences. Potential users should prioritize direct evaluation and verification of all operational aspects before implementation to ensure the platform meets their specific needs and requirements.

FX Broker Capital Trading Markets Review