Is XCOQ safe?

Business

License

Is XCOQ A Scam?

Introduction

XCOQ is a forex broker that has emerged in the trading landscape, primarily targeting retail traders with its offerings. Established in 2017, XCOQ claims to provide a comprehensive trading platform for various financial instruments, including forex, CFDs, and commodities. However, as the forex market continues to grow, so does the prevalence of scams and unregulated brokers. Traders must exercise caution and conduct thorough due diligence before entrusting their funds to any broker. This article aims to provide an objective analysis of XCOQ, evaluating its regulatory status, company background, trading conditions, customer experiences, and overall safety. Our investigation is based on a review of user feedback, regulatory information, and expert analyses from reputable financial sources.

Regulation and Legitimacy

The regulatory status of a broker is paramount in determining its legitimacy and safety for traders. XCOQ claims to be regulated by the Australian Securities and Investments Commission (ASIC). However, the broker has been flagged as a "suspicious clone" by ASIC, raising significant concerns regarding its legitimacy. Below is a summary of the core regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 328866 | Australia | Suspicious Clone |

ASIC is known for its stringent regulatory standards, which are designed to protect investors and ensure fair trading practices. However, the designation of XCOQ as a "suspicious clone" indicates that it may not comply with these regulations, potentially exposing traders to risks such as fund misappropriation and fraudulent practices. Furthermore, the official website of XCOQ is currently inaccessible, which raises additional red flags about its operational legitimacy. The lack of transparency regarding its regulatory compliance and the numerous complaints from users about withdrawal issues further complicate the broker's standing.

Company Background Investigation

XCOQ was established in 2017 and claims to operate out of Australia. However, the details surrounding its ownership structure and management team are vague, making it difficult to ascertain the company's credibility. A thorough examination of the broker's history reveals a lack of significant achievements or milestones that would typically bolster a broker's reputation in the industry.

The management team's background and professional experience are also unclear, which is concerning for potential investors. A transparent and experienced management team is crucial for building trust in a brokerage firm. The absence of clear information regarding the company's ownership and operational practices raises questions about its transparency and accountability. Furthermore, the inability to access its official website limits potential clients' ability to gather necessary information about the broker, which is essential for making informed decisions. Overall, the lack of transparency and information disclosure surrounding XCOQ casts doubt on its reliability and raises concerns about whether XCOQ is safe for trading.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall value to traders. XCOQ's fee structure and trading conditions appear to be competitive, but certain aspects warrant scrutiny. The broker claims to offer a range of financial instruments with varying spreads and commissions. However, user feedback indicates that there may be hidden fees or unfavorable conditions that could impact trading profitability.

Heres a comparison of core trading costs:

| Fee Type | XCOQ | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not specified | 1.0 - 2.0 pips |

| Commission Model | Not specified | $5 - $10 per lot |

| Overnight Interest Range | Not specified | Varies widely |

The absence of clear information regarding spreads and commissions raises concerns about the broker's transparency. Traders should be cautious of brokers that do not provide detailed information about their fee structures, as this can lead to unexpected costs that diminish trading profits. Moreover, the lack of clarity surrounding overnight interest rates and commission models can create confusion for traders attempting to calculate their overall trading costs effectively. Therefore, it is crucial for prospective clients to thoroughly investigate XCOQ's trading conditions and ensure they align with their trading strategies and risk management practices.

Client Fund Safety

The safety of client funds is a critical aspect of evaluating any forex broker. XCOQ claims to implement various security measures to protect client funds, but the specifics of these measures are not well-documented. The broker should ideally segregate client funds from its operating capital and provide investor protection mechanisms to ensure that traders' funds are secure.

In light of the reported issues regarding withdrawal problems, it is essential to assess the broker's policies on fund segregation, investor protection, and negative balance protection. A lack of such measures can lead to significant risks for traders, especially in the event of the broker facing financial difficulties or engaging in fraudulent practices. Historical issues with fund security and withdrawal complaints from users further exacerbate concerns about whether XCOQ is safe for trading.

Customer Experience and Complaints

Customer feedback is a valuable source of information when assessing a broker's reliability and service quality. Reviews of XCOQ reveal a troubling pattern of complaints, particularly regarding withdrawal issues. Many users have reported being unable to withdraw their funds for extended periods, leading to frustration and distrust. The following table summarizes the primary complaint types and their severity assessments:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Unable to withdraw funds | High | Poor |

| Delayed responses from support | Medium | Poor |

| Lack of transparency | High | Poor |

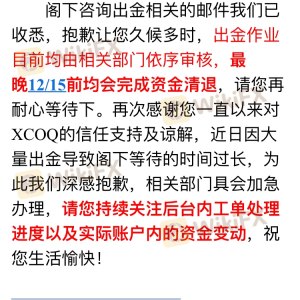

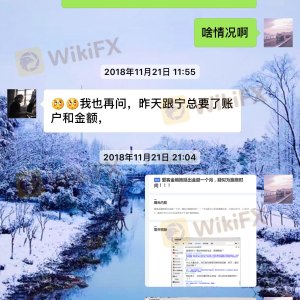

For instance, one user reported being unable to withdraw funds for over two months, despite assurances from customer service that the withdrawal would be processed. Such complaints indicate a concerning trend that could suggest deeper issues within the broker's operations. The overall quality of customer service has also been criticized, with many users expressing dissatisfaction with the responsiveness and helpfulness of support staff. These patterns of complaints raise significant concerns about the reliability of XCOQ and whether it is safe for trading.

Platform and Execution

The performance and stability of a broker's trading platform are crucial for ensuring a positive trading experience. XCOQ utilizes the MetaTrader 4 (MT4) platform, which is widely regarded for its user-friendly interface and robust functionality. However, users have reported issues related to order execution quality, including slippage and rejections.

A thorough assessment of the platform's performance reveals the following concerns:

- Order Execution Quality: Reports of slippage and order rejections raise questions about the broker's ability to execute trades efficiently. Traders rely on timely execution to capitalize on market opportunities, and any delays can impact profitability.

- Platform Manipulation: There are allegations of potential platform manipulation, although concrete evidence is lacking. Traders should remain vigilant and monitor their trading activity closely to detect any irregularities.

Overall, while the MT4 platform offers solid features, the reported issues with execution quality and potential manipulation risks raise concerns about whether XCOQ is safe for trading.

Risk Assessment

Engaging with XCOQ entails several risks that traders should be aware of. The following risk assessment summarizes key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Flagged as a suspicious clone by ASIC |

| Withdrawal Issues | High | Numerous complaints regarding withdrawals |

| Transparency | High | Lack of information about fees and operations |

| Customer Service Quality | Medium | Poor response times and support quality |

Traders should consider these risks when deciding whether to engage with XCOQ. To mitigate these risks, it is advisable to conduct thorough research and consider alternative brokers with better regulatory standing and customer service records.

Conclusion and Recommendations

In conclusion, the evidence suggests that XCOQ may pose significant risks to traders. The broker's classification as a "suspicious clone" by ASIC, coupled with numerous complaints about withdrawal issues and poor customer service, raises serious concerns about its legitimacy and operational practices. Given these factors, it is prudent for traders to exercise caution when considering XCOQ as a trading partner.

For traders seeking a reliable and secure trading environment, it is advisable to explore alternative brokers that are well-regulated and have a proven track record of positive customer experiences. Brokers regulated by top-tier authorities such as the FCA or ASIC, with transparent fee structures and strong customer support, are typically safer options for traders. Ultimately, ensuring the safety of your investments should be a top priority, and selecting a trustworthy broker is a critical step in achieving that goal.

Is XCOQ a scam, or is it legit?

The latest exposure and evaluation content of XCOQ brokers.

XCOQ Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

XCOQ latest industry rating score is 1.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.