Is WISEFXTRADE safe?

Business

License

Is Wisefxtrade Safe or a Scam?

Introduction

In the ever-evolving world of online trading, Wisefxtrade has emerged as a contender in the forex market, claiming to provide access to a wide range of trading instruments and promising lucrative returns. However, the influx of scam brokers in this sector necessitates that traders exercise caution and conduct thorough evaluations before committing their funds. This article aims to investigate whether Wisefxtrade is a legitimate broker or a potential scam. Our analysis is based on a comprehensive review of user feedback, regulatory information, company background, trading conditions, and overall market reputation.

Regulatory and Legitimacy

A broker's regulatory status is crucial in determining its credibility and the safety of traders' funds. Wisefxtrade claims to operate under the auspices of various regulatory bodies, but upon closer examination, it appears that there is a lack of verifiable licenses.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Regulated |

The absence of a regulatory license raises significant concerns about Wisefxtrade's legitimacy. Regulatory bodies such as the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the US impose strict rules to protect investors. Unregulated brokers like Wisefxtrade are not subject to these regulations, which means they can operate without oversight, putting clients funds at risk. Furthermore, the lack of transparency regarding their regulatory claims adds to the suspicion surrounding their operations.

Company Background Investigation

Wisefxtrade presents itself as a reputable trading platform; however, its background raises several red flags. The company lacks detailed information on its ownership structure and management team, which is often a sign of a dubious operation. Legitimate brokers typically provide information about their founders and key personnel, including their qualifications and experience in the financial sector.

The absence of such information can lead to questions about the broker's transparency and accountability. Furthermore, Wisefxtrade has been reported to have a vague history, with many users unable to trace its origins or corporate structure. This lack of clarity makes it difficult for potential investors to trust their funds to this broker.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is essential. Wisefxtrade claims to provide competitive trading fees, but many users have reported hidden charges and unfavorable conditions.

| Fee Type | Wisefxtrade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | N/A | Competitive |

| Overnight Interest Range | High | Low |

The trading conditions at Wisefxtrade appear to be less favorable than those offered by more established brokers. Reports of high spreads and hidden fees suggest that traders may not receive the value they expect. Additionally, the lack of transparency regarding commissions and fees raises concerns about the overall cost of trading with this broker.

Client Fund Safety

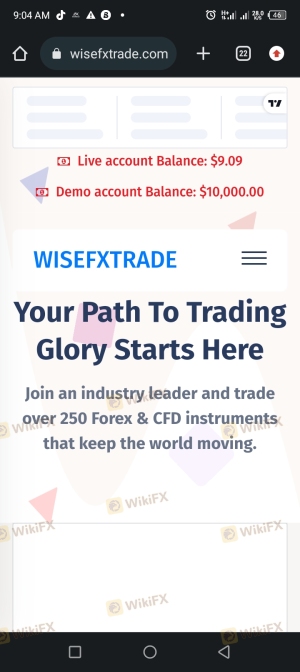

The safety of client funds is paramount when selecting a broker. Wisefxtrade has been scrutinized for its lack of fund protection measures. They do not appear to offer segregated accounts, which would typically ensure that client funds are kept separate from the broker's operational funds.

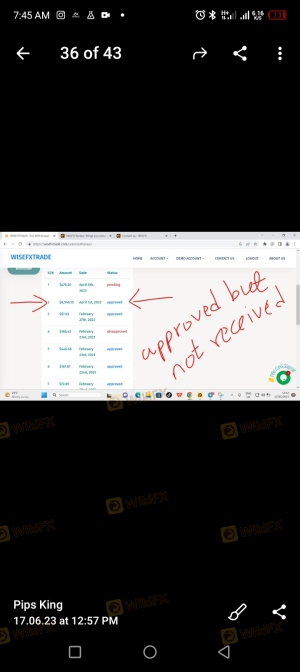

Furthermore, there are no indications of investor protection schemes in place, such as those provided by regulated brokers, which can offer compensation in the event of broker insolvency. The absence of negative balance protection also poses a significant risk, as it leaves traders vulnerable to losing more than their initial investment. Historical complaints regarding withdrawal issues further highlight the potential risks associated with this broker.

Customer Experience and Complaints

User feedback is a valuable resource for assessing a broker's reliability. Wisefxtrade has received a mixed bag of reviews, with many users expressing dissatisfaction with their trading experience.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delays | Medium | Inconsistent |

| Misleading Promotions | High | No Response |

Common complaints include difficulties in withdrawing funds, poor customer support, and misleading promotional offers. Users have reported that once they attempt to withdraw their funds, they encounter delays or outright refusals, a common tactic employed by scam brokers to retain clients' money. These issues contribute to the growing concern that Wisefxtrade may not be a trustworthy broker.

Platform and Trade Execution

The trading platform is another critical aspect of any broker's offering. Wisefxtrade claims to provide a user-friendly trading interface, but reviews suggest that the platform may not perform as advertised. Users have reported issues with order execution, including slippage and rejected orders, which can significantly impact trading outcomes.

Moreover, there are indications that the platform may manipulate trades to create the illusion of profitability. Such practices are common among unregulated brokers and serve to further erode trust in their operations. Traders should be wary of any broker that does not provide a reliable and transparent trading experience.

Risk Assessment

Engaging with Wisefxtrade presents several risks that potential traders should consider.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Safety Risk | High | Lack of segregation and protection |

| Withdrawal Risk | High | History of withdrawal issues |

| Transparency Risk | High | Limited information on ownership |

Given these risks, it is essential for traders to approach Wisefxtrade with caution. If one chooses to engage with this broker, it is advisable to only invest what one can afford to lose and to consider using risk management strategies.

Conclusion and Recommendations

After a thorough investigation, it is evident that Wisefxtrade exhibits several characteristics commonly associated with scam brokers. The lack of regulation, transparency, and poor customer feedback raises significant red flags. Potential traders should be cautious and consider alternative options that offer more robust regulatory protections and a better overall trading experience.

For those seeking reliable trading platforms, it is advisable to look for brokers regulated by recognized authorities such as the FCA, ASIC, or the NFA. These brokers typically provide better security for client funds and adhere to stringent operational standards. In conclusion, Wisefxtrade does not appear to be a safe trading option, and traders should exercise extreme caution if considering this broker.

Is WISEFXTRADE a scam, or is it legit?

The latest exposure and evaluation content of WISEFXTRADE brokers.

WISEFXTRADE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

WISEFXTRADE latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.