Is Ronghui Group Co., Ltd safe?

Business

License

Is Ronghui Group Co., Ltd A Scam?

Introduction

Ronghui Group Co., Ltd has positioned itself as a player in the forex market, claiming to offer a range of trading services, including forex and contracts for differences (CFDs). As the online trading landscape continues to grow, traders are increasingly faced with a myriad of options, making it crucial to carefully evaluate the legitimacy and reliability of any broker they consider. With the rise of scams and fraudulent practices in the financial sector, understanding the regulatory status, company background, and customer experiences of trading platforms is paramount.

In this article, we will conduct a thorough investigation into Ronghui Group Co., Ltd to determine whether it is a safe trading option or a potential scam. Our evaluation will be based on a comprehensive analysis of the broker's regulatory status, company history, trading conditions, customer feedback, and overall risk assessment.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most significant factors that traders should consider before investing their funds. Proper regulation indicates that the broker adheres to specific standards designed to protect investors, while a lack of regulation can be a red flag for potential fraud.

Regulatory Information Table

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

Ronghui Group Co., Ltd is not regulated by any recognized financial authority, which raises serious concerns about its legitimacy. The absence of a regulatory license means that traders have little to no recourse in the event of disputes or financial losses. Furthermore, the lack of transparency regarding the broker's operational jurisdiction adds to the apprehension surrounding its trustworthiness.

In contrast, reputable brokers are usually licensed by well-known regulatory bodies such as the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the USA, which enforce strict compliance measures to safeguard client funds. Given the unregulated status of Ronghui Group Co., Ltd, it is prudent for traders to exercise extreme caution when considering this broker.

Company Background Investigation

Understanding the background of a broker is essential for assessing its credibility. Ronghui Group Co., Ltd claims to be based in the UK; however, multiple reviews suggest that its actual operations may be offshore, in regions notorious for lax regulatory standards.

The broker's ownership structure remains unclear, as it does not provide substantial information about its management team or operational history. This lack of transparency is concerning, as reputable brokers typically disclose details about their leadership, including their professional experience and qualifications in the financial industry.

Moreover, the absence of any historical compliance records or regulatory scrutiny raises further doubts about the broker's reliability. Traders should be wary of companies that do not offer clear information about their operations, as this can indicate potential attempts to obscure fraudulent practices.

Trading Conditions Analysis

Ronghui Group Co., Ltd presents several trading conditions that may initially seem attractive; however, a closer inspection reveals potential pitfalls.

Core Trading Costs Comparison Table

| Cost Type | Ronghui Group Co., Ltd | Industry Average |

|---|---|---|

| Spread on Major Pairs | 1.2 pips | 0.6-1.0 pips |

| Commission Structure | Not Specified | Varies |

| Overnight Interest Range | Not Specified | Varies |

While the broker advertises spreads of 1.2 pips on major currency pairs, this is significantly higher than the industry average. Moreover, the lack of clarity regarding commission structures and overnight interest rates raises concerns about hidden fees that could impact traders' profitability.

Traders should be particularly cautious of any broker that imposes excessive fees or has vague policies surrounding costs, as these can be indicative of a scam. The high minimum deposit requirement of $1,000 compared to other brokers that allow entry with as little as $5 or $10 further suggests that Ronghui Group Co., Ltd may be prioritizing profit over accessibility for traders.

Customer Funds Safety

The safety of customer funds is a primary concern for any trader, and it is essential to evaluate the measures a broker has in place to protect client assets.

Ronghui Group Co., Ltd does not provide sufficient information regarding the segregation of client funds, investor protection schemes, or negative balance protection policies. This lack of transparency is alarming, as reputable brokers typically maintain segregated accounts to ensure that client funds are kept separate from operational funds, reducing the risk of loss in case of insolvency.

Additionally, the absence of any investor compensation schemes means that traders may have little to no recourse if the broker were to become insolvent. Historical data on Ronghui Group Co., Ltd shows no evidence of significant security issues; however, the lack of regulatory oversight and transparency raises the risk of potential financial mismanagement.

Customer Experience and Complaints

Analyzing customer feedback is crucial for understanding the overall experience of trading with a particular broker.

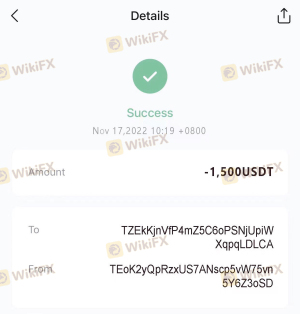

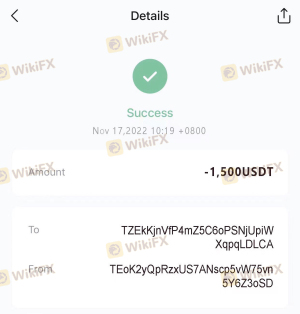

Many reviews of Ronghui Group Co., Ltd indicate a pattern of negative experiences among users, with common complaints including difficulty in withdrawing funds, poor customer service, and a lack of responsiveness to inquiries.

Complaint Severity Assessment Table

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

| Account Management | High | Poor |

For instance, some traders have reported being unable to withdraw their funds, leading to frustration and financial loss. The lack of effective communication from the broker exacerbates these issues, leaving clients feeling unsupported.

These complaints indicate a concerning trend that suggests Ronghui Group Co., Ltd may not be adequately equipped to handle customer needs or resolve issues effectively.

Platform and Trade Execution

A broker's trading platform and execution quality are vital aspects of the trading experience.

Ronghui Group Co., Ltd claims to offer access to popular trading platforms like MetaTrader 5; however, many users have reported issues with platform functionality, including difficulties in account registration and poor execution quality. There are also concerns about potential slippage and order rejections, which can significantly impact trading outcomes.

Risk Assessment

Using Ronghui Group Co., Ltd poses several risks that traders should be aware of before deciding to invest.

Risk Rating Summary Table

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Fund Safety Risk | High | Lack of transparency regarding fund safety. |

| Customer Service Risk | Medium | Poor response to customer inquiries. |

To mitigate these risks, traders should consider sticking to regulated brokers with a proven track record of customer service and fund safety. Engaging with a broker that is licensed by a reputable authority can provide an added layer of security and peace of mind.

Conclusion and Recommendations

Based on the comprehensive analysis conducted, it is evident that Ronghui Group Co., Ltd raises significant red flags regarding its legitimacy and reliability as a forex broker. The absence of regulation, coupled with a lack of transparency and negative customer feedback, strongly suggests that this broker may not be a safe option for traders.

For those considering engaging with Ronghui Group Co., Ltd, it is advisable to approach with extreme caution. It is recommended to explore alternative brokers that are well-regulated and have positive customer reviews. Some reliable options include brokers regulated by the FCA, ASIC, or CFTC, which offer a safer trading environment and better customer support.

In summary, is Ronghui Group Co., Ltd safe? The evidence points to a conclusion that traders should be wary of investing with this broker, as it exhibits many characteristics associated with scams and untrustworthy practices in the forex market.

Is Ronghui Group Co., Ltd a scam, or is it legit?

The latest exposure and evaluation content of Ronghui Group Co., Ltd brokers.

Ronghui Group Co., Ltd Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Ronghui Group Co., Ltd latest industry rating score is 1.45, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.45 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.