Regarding the legitimacy of OPTIONCC forex brokers, it provides VFSC and WikiBit, .

Is OPTIONCC safe?

Business

License

Is OPTIONCC markets regulated?

The regulatory license is the strongest proof.

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

UnverifiedLicense Type:

Forex Trading License (EP)

Licensed Entity:

OPTIONCC LIMITED

Effective Date:

2018-05-30Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

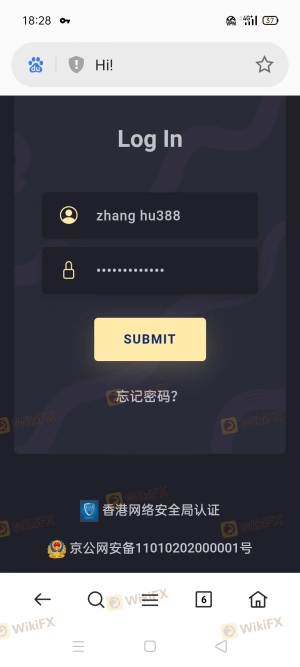

Is OptionCC Safe or Scam?

Introduction

OptionCC is a binary options trading platform that has been active since its establishment in 2016. Headquartered in Beijing, it positions itself as a provider of trading services across various assets, including currencies, commodities, stocks, and indices. With the growing popularity of online trading, it has become increasingly important for traders to thoroughly evaluate their brokers to ensure their safety and reliability. The foreign exchange market is rife with potential pitfalls, including scams and fraudulent activities, making due diligence essential for traders looking to protect their investments.

In this article, we will assess the safety and legitimacy of OptionCC by analyzing its regulatory status, company background, trading conditions, customer fund security, customer experiences, platform performance, and overall risk profile. Our investigation is based on a review of multiple credible sources, including user reviews, regulatory information, and industry reports, to provide a comprehensive overview of whether OptionCC is a safe trading option or a potential scam.

Regulation and Legitimacy

The regulatory environment in which a broker operates is a critical factor in determining its legitimacy. OptionCC claims to be regulated by the Vanuatu Financial Services Commission (VFSC) and is registered as a financial service provider in New Zealand. However, it is important to note that the VFSC is often considered a low-tier regulator, which may not enforce stringent compliance measures compared to top-tier regulators like the FCA (UK) or ASIC (Australia).

Here is a summary of OptionCC's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Vanuatu Financial Services Commission | Not disclosed | Vanuatu | Active but low-tier |

The quality of regulation is paramount as it directly impacts the level of investor protection. Low-tier regulators may provide minimal oversight, leading to increased risks for traders. Additionally, OptionCC's compliance history is questionable, as there are reports of user complaints regarding withdrawal issues and alleged fraud. This raises concerns about the effectiveness of the regulatory framework that oversees OptionCC's operations.

Company Background Investigation

OptionCC was founded in 2016 and has since positioned itself as a player in the binary options market. While the company claims to offer a range of trading services, the details surrounding its ownership structure and management team are somewhat opaque. The lack of transparency can be a red flag for potential investors, as it makes it difficult to assess the credibility of the individuals behind the platform.

The management team's background and expertise are crucial in evaluating the company's operational integrity. Unfortunately, there is limited publicly available information regarding the qualifications and experience of OptionCC's leadership. This lack of clarity can lead to skepticism about the company's commitment to ethical trading practices. Moreover, the overall transparency of the company, including its financial disclosures and operational practices, is inadequate, which can further exacerbate concerns among potential traders.

Trading Conditions Analysis

When assessing a broker's trading conditions, it is essential to consider the overall fee structure and any potential hidden costs that could impact a trader's profitability. OptionCC advertises competitive trading conditions, including a maximum return rate of up to 85% on certain trades. However, the specifics of its fee structure are not clearly laid out, which can lead to confusion among traders.

To provide a clearer understanding, here is a comparison of OptionCC's trading costs against the industry average:

| Fee Type | OptionCC | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not disclosed | 1.0 - 2.0 pips |

| Commission Model | Not disclosed | Varies by broker |

| Overnight Interest Range | Not disclosed | 0.5% - 2.0% |

The absence of detailed information regarding spreads, commissions, and overnight interest rates is concerning. Traders may find themselves facing unexpected costs that can significantly affect their trading outcomes. Moreover, the lack of clarity in fee structures can indicate a potential attempt to obfuscate the true cost of trading on the platform.

Customer Fund Security

The safety of client funds is a paramount concern for any trader. OptionCC claims to implement various security measures to protect client funds, including segregated accounts and secure payment methods. However, the specifics of these measures remain unclear, leaving traders to wonder about the actual safety of their investments.

An analysis of the broker's fund security practices reveals the following:

- Segregated Accounts: While OptionCC states that it uses segregated accounts to protect client funds, the lack of independent verification raises questions about the effectiveness of this measure.

- Investor Protection: There is no clear indication that OptionCC offers any investor protection schemes, such as compensation funds, which could reimburse clients in the event of broker insolvency.

- Negative Balance Protection: The absence of a policy guaranteeing negative balance protection could expose traders to significant financial risks, especially in volatile market conditions.

The historical record of any fund security issues or disputes involving OptionCC is also a cause for concern. Reports of withdrawal difficulties and allegations of fraud have surfaced, suggesting that the broker may not have a solid track record in safeguarding client assets.

Customer Experience and Complaints

The experiences of existing and former customers provide valuable insights into the reliability of a trading platform. Feedback for OptionCC has been mixed, with several users reporting positive experiences, while others have voiced significant complaints. Common issues include withdrawal delays, unresponsive customer support, and accusations of fraudulent practices.

Here is a summary of the primary complaint types and their severity assessments:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Support Responsiveness | Medium | Average |

| Allegations of Fraud | High | Inconsistent |

One notable case involved a user who reported being unable to withdraw funds from their account despite multiple requests. This situation highlights the potential risks associated with trading on platforms like OptionCC, where customer support may not adequately address issues faced by traders.

Platform and Trade Execution

The performance of a trading platform is crucial for a seamless trading experience. OptionCC claims to provide a user-friendly interface and quick execution times. However, reports of slippage and order rejections have raised concerns about the platform's reliability.

The quality of trade execution and the prevalence of slippage can significantly impact a trader's profitability. If traders frequently encounter issues with order execution, it could indicate underlying problems with the platform's infrastructure. Additionally, any signs of platform manipulation could further erode trust among users.

Risk Assessment

Using OptionCC comes with inherent risks that potential traders must consider. The lack of transparency in regulatory compliance, customer fund security, and trading conditions raises red flags.

Here is a risk scorecard summarizing the key risk areas associated with OptionCC:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Low-tier regulation raises concerns |

| Fund Security | High | Lack of clear protection measures |

| Customer Support | Medium | Mixed reviews indicate potential issues |

| Trading Conditions | High | Unclear fees may lead to unexpected costs |

To mitigate these risks, traders should conduct thorough research before committing funds to OptionCC. It may also be wise to consider alternative brokers with stronger regulatory oversight and better customer feedback.

Conclusion and Recommendations

Based on the comprehensive analysis presented, it is evident that OptionCC exhibits several warning signs that warrant caution. The combination of low-tier regulation, unclear trading conditions, and mixed customer experiences suggests that traders should approach this platform with skepticism.

For those considering trading with OptionCC, it is advisable to start with a minimal investment and closely monitor the trading conditions and customer support responsiveness. Additionally, traders should explore alternative brokers that offer stronger regulatory protections and more transparent trading conditions, such as those regulated by top-tier authorities like the FCA or ASIC.

In conclusion, while OptionCC may present itself as a viable trading option, the potential risks and concerns outlined in this article indicate that it may not be the safest choice for traders. Caution is advised, and thorough due diligence is essential to ensure the safety of investments in the volatile world of forex trading.

Is OPTIONCC a scam, or is it legit?

The latest exposure and evaluation content of OPTIONCC brokers.

OPTIONCC Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

OPTIONCC latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.