Is Morgenfx safe?

Business

License

Is Morgenfx A Scam?

Introduction

Morgenfx is a forex broker that has positioned itself in the competitive landscape of the foreign exchange market. Established in 2017, this broker claims to offer various trading services primarily targeting clients in China and the broader Asian market. However, the influx of online trading platforms has made it imperative for traders to exercise caution when selecting a broker. The foreign exchange market is rife with scams and unregulated entities, making it essential for traders to perform thorough due diligence before committing their funds.

This article aims to assess the safety and legitimacy of Morgenfx by examining its regulatory status, company background, trading conditions, client fund security, customer experience, platform performance, and associated risks. The findings are based on a comprehensive review of available online resources, including user feedback, regulatory reports, and expert analyses.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors in determining its legitimacy. Morgenfx claims to be regulated by the Financial Conduct Authority (FCA) in the UK; however, various sources indicate that it may operate as a suspicious clone of a legitimate entity. This situation raises significant concerns regarding the broker's compliance with industry standards and investor protection protocols.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 600331 | United Kingdom | Suspicious Clone |

The lack of a clear regulatory framework and the presence of multiple complaints against Morgenfx suggest that traders should exercise extreme caution. A broker with a low regulatory score, such as Morgenfx's WikiFX score of 1.59, signals potential risks that could jeopardize investor funds. The absence of a robust regulatory environment could lead to issues related to fund safety and withdrawal difficulties.

Company Background Investigation

Morgenfx was founded in 2017 and has established a presence primarily in the Asian market. However, information about its ownership structure and management team is scarce, leading to questions about the broker's transparency. The lack of publicly available details regarding the company's history and operational stability raises red flags for potential investors.

The management teams background is crucial in assessing the broker's credibility. Unfortunately, the absence of detailed profiles or professional histories for key personnel makes it challenging to gauge their expertise and commitment to regulatory compliance. This lack of transparency further complicates the assessment of whether Morgenfx is safe for trading.

Trading Conditions Analysis

Morgenfx offers various trading conditions, but the overall fee structure is ambiguous and raises concerns. Traders are often attracted to brokers with competitive spreads and low fees; however, Morgenfx's fee policies may include hidden charges that could significantly impact profitability.

| Fee Type | Morgenfx | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | 1.5 pips | 1.0 pips |

| Commission Model | None specified | Varies |

| Overnight Interest Range | High | Moderate |

The higher-than-average spreads and unclear commission structure suggest that traders may not receive the best value. Additionally, any unusual fees could indicate underlying issues within the broker's operational model, further questioning its legitimacy.

Client Fund Security

The safety of client funds is paramount when evaluating a forex broker. Morgenfx claims to implement measures to secure client funds, including segregated accounts. However, the effectiveness of these measures remains unverified due to the broker's suspicious regulatory status.

The absence of investor protection mechanisms, such as negative balance protection, raises concerns about the potential risks traders may face. Furthermore, historical complaints regarding withdrawal issues and fund accessibility suggest a pattern of behavior that could jeopardize client investments.

Customer Experience and Complaints

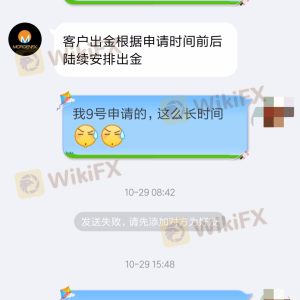

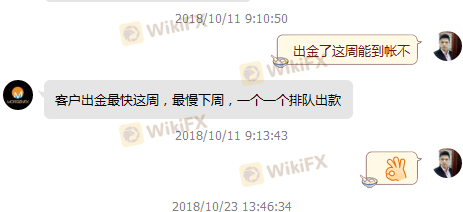

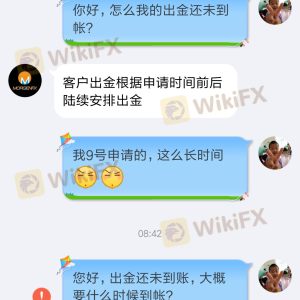

Customer feedback is a vital indicator of a broker's reliability and service quality. Reviews of Morgenfx reveal a mixed bag of experiences, with several users reporting difficulties in withdrawing funds and unresponsive customer service.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Unresponsive Customer Service | Medium | Poor |

Specific cases highlight the broker's failure to address critical issues, such as delayed withdrawals and account closures. These complaints underscore the importance of assessing whether Morgenfx is safe for trading, as unresolved issues can lead to significant financial losses for clients.

Platform and Execution

The performance and reliability of a trading platform are crucial for traders. Morgenfx utilizes the MetaTrader 4 and 5 platforms, which are generally well-regarded in the industry. However, the execution quality, including slippage and order rejections, is an area of concern.

Traders have reported instances of slippage during volatile market conditions, which can adversely affect trading outcomes. Furthermore, any signs of platform manipulation could indicate deeper issues with the broker's operational integrity.

Risk Assessment

Engaging with Morgenfx carries several risks that traders should consider. The lack of regulatory oversight, combined with a history of customer complaints, raises the overall risk profile associated with this broker.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unverified status |

| Financial Risk | High | Withdrawal issues |

| Operational Risk | Medium | Platform stability |

To mitigate these risks, traders should consider using smaller amounts for initial investments while closely monitoring their trading activities. Researching alternative brokers with better regulatory standings may also provide safer trading environments.

Conclusion and Recommendations

In summary, the evidence suggests that Morgenfx exhibits several characteristics typical of potentially fraudulent brokers. The lack of adequate regulation, coupled with numerous customer complaints and a questionable operational history, raises significant concerns about its trustworthiness.

For traders considering engaging with Morgenfx, it is advisable to proceed with caution. Those seeking a more secure trading environment should explore alternative brokers known for their regulatory compliance and positive customer feedback. Reliable options include brokers with strong regulatory frameworks and transparent operational practices, ensuring that your investments are safer and more secure.

In conclusion, the question of "Is Morgenfx safe?" leans towards a cautious response, urging traders to be vigilant and informed when navigating the forex landscape.

Is Morgenfx a scam, or is it legit?

The latest exposure and evaluation content of Morgenfx brokers.

Morgenfx Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Morgenfx latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.