Regarding the legitimacy of Morgan International (Hong Kong) Limited forex brokers, it provides ASIC and WikiBit, .

Is Morgan International (Hong Kong) Limited safe?

Business

License

Is Morgan International (Hong Kong) Limited markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

GO MARKETS PTY LTD

Effective Date: Change Record

2004-03-10Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

L 7 447 COLLINS ST MELBOURNE VIC 3000 AUSTRALIAPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Morgan International Hong Kong Limited Safe or a Scam?

Introduction

Morgan International Hong Kong Limited is a forex broker that positions itself within the competitive landscape of online trading. As the forex market continues to expand, traders are increasingly drawn to various brokers promising lucrative opportunities. However, the proliferation of forex scams necessitates a cautious approach when selecting a trading partner. Traders must evaluate the legitimacy of brokers like Morgan International Hong Kong Limited to avoid potential financial pitfalls. This article aims to provide an objective analysis of whether Morgan International Hong Kong Limited is safe or a scam, utilizing various sources and a structured evaluation framework.

Regulation and Legitimacy

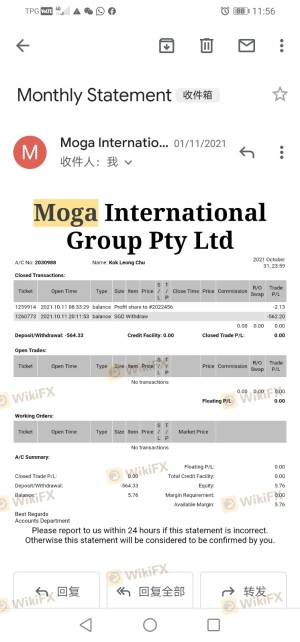

The regulatory status of a forex broker is a critical factor that traders should consider. A well-regulated broker is generally more trustworthy, as they are held accountable to financial authorities that enforce compliance with industry standards. In the case of Morgan International Hong Kong Limited, the broker has been flagged as a "suspicious clone" by various regulatory bodies, raising concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | N/A | Australia | Suspicious Clone |

| SFC | N/A | Hong Kong | Unregulated |

The lack of a valid license from a reputable regulatory authority like the Australian Securities and Investments Commission (ASIC) or the Securities and Futures Commission (SFC) is a significant red flag. The term "suspicious clone" indicates that Morgan International may not be a legitimate broker but rather an entity attempting to mimic a reputable firm. This raises serious questions about the broker's compliance history and operational transparency, leading to concerns about the safety of traders' funds.

Company Background Investigation

Morgan International Hong Kong Limited has a relatively opaque history, with limited information available about its ownership structure and management team. The absence of comprehensive disclosures is troubling, as transparency is a hallmark of a reputable broker. A broker's management team should ideally have a solid background in finance and trading, contributing to the firm's credibility.

The company's lack of clear information regarding its operational history and regulatory compliance further complicates the assessment of its legitimacy. Traders should be wary of engaging with a broker that does not provide adequate insight into its management and operational practices. The opacity surrounding Morgan International Hong Kong Limited raises questions about its accountability and commitment to ethical trading practices.

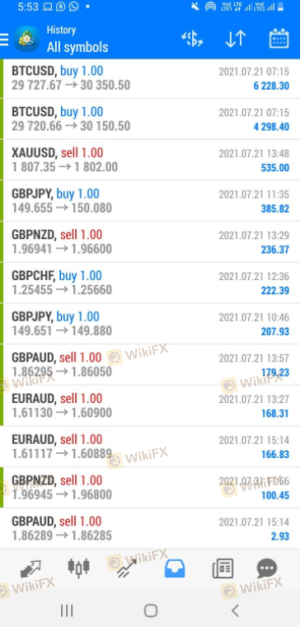

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall cost structure and potential profitability. Morgan International Hong Kong Limited has been reported to have a fee structure that may not align with industry standards.

| Fee Type | Morgan International Hong Kong Limited | Industry Average |

|---|---|---|

| Spread for Major Pairs | High | Low |

| Commission Structure | Unclear | Clear |

| Overnight Interest Range | Variable | Fixed |

The broker's spreads for major currency pairs are reported to be higher than the industry average, which could significantly impact trading profitability. Additionally, the lack of clarity regarding commission structures and overnight interest rates could indicate hidden fees or unfavorable trading conditions. Such practices are often associated with less reputable brokers, making it essential for traders to scrutinize these conditions carefully.

Client Fund Security

The safety of client funds is paramount when selecting a forex broker. Morgan International Hong Kong Limited's policies regarding fund security are unclear, raising concerns about the protection measures in place. A reputable broker typically segregates client funds from operational funds, ensuring that traders' money is protected even in the event of financial difficulties.

Furthermore, the absence of investor protection mechanisms or negative balance protection policies is alarming. Traders should be cautious when dealing with a broker that does not offer these safeguards, as it increases the risk of losing their investments. Historical issues related to fund security or unresolved disputes can further exacerbate these concerns, making it vital for traders to gather as much information as possible before proceeding with this broker.

Customer Experience and Complaints

Analyzing customer feedback and experiences can provide valuable insights into a broker's reliability. Reviews of Morgan International Hong Kong Limited reveal a pattern of complaints related to fund withdrawal issues and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Customer Support | Medium | Inconsistent |

Many users have reported difficulties in withdrawing their funds, with some claiming that their requests were ignored or delayed indefinitely. This pattern of complaints is concerning, as it suggests a lack of responsiveness and accountability from the broker. The severity of these complaints indicates that potential clients should exercise extreme caution when considering Morgan International Hong Kong Limited as their trading partner.

Platform and Execution

The trading platform's performance is crucial for a positive trading experience. Morgan International Hong Kong Limited's platform has received mixed reviews, with some users reporting issues related to stability and execution quality.

Traders have expressed concerns about slippage during high volatility periods, which can adversely affect trading outcomes. Additionally, reports of order rejections or manipulative practices raise further doubts about the broker's integrity. A reliable trading platform should provide seamless execution and transparent operations, and any signs of manipulation can be indicative of deeper issues within the brokerage.

Risk Assessment

Using Morgan International Hong Kong Limited comes with inherent risks that traders should be aware of.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns. |

| Financial Risk | High | High spreads and unclear fees can lead to losses. |

| Withdrawal Risk | High | Reports of withdrawal issues are prevalent. |

Given the various risks associated with this broker, traders are advised to approach Morgan International Hong Kong Limited with caution. Conducting thorough due diligence and considering alternative brokers with better reputations may help mitigate these risks.

Conclusion and Recommendations

Based on the comprehensive analysis presented, it is evident that Morgan International Hong Kong Limited raises several red flags that suggest it may not be a safe broker. The lack of regulatory oversight, opaque company information, high trading costs, and a pattern of customer complaints all contribute to a concerning profile. Traders should exercise caution and consider alternative, well-regulated brokers to safeguard their investments.

For those seeking reliable options in the forex market, brokers regulated by reputable authorities such as ASIC, FCA, or SFC should be prioritized. These brokers typically offer better transparency, customer support, and overall trading conditions, ensuring a more secure trading environment.

In summary, while Morgan International Hong Kong Limited may present itself as a legitimate trading option, the evidence suggests that it is prudent to approach with skepticism and consider safer alternatives.

Is Morgan International (Hong Kong) Limited a scam, or is it legit?

The latest exposure and evaluation content of Morgan International (Hong Kong) Limited brokers.

Morgan International (Hong Kong) Limited Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Morgan International (Hong Kong) Limited latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.