Is Matsui Shokai safe?

Business

License

Is Matsui Shokai Safe or a Scam?

Introduction

Matsui Shokai, also known as Matsui Securities Co., Ltd., is a prominent player in the Japanese online brokerage market, offering a variety of trading services including forex, equities, and futures. Established in 1918, the firm has evolved significantly, particularly with the rise of online trading platforms. However, as the forex market becomes increasingly competitive, traders must exercise caution when selecting a broker. Evaluating the legitimacy and reliability of a brokerage is essential to safeguard investments and ensure a positive trading experience. This article aims to provide a comprehensive analysis of Matsui Shokai's credibility, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulation and Legitimacy

The regulatory environment for forex brokers is crucial, as it ensures the protection of traders and the integrity of financial markets. Matsui Shokai operates under the oversight of the Financial Services Agency (FSA) in Japan, which is known for its stringent regulatory standards. The presence of a reputable regulatory body can significantly enhance a broker's credibility and provide a layer of security for traders.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Services Agency (FSA) | 164 | Japan | Verified |

Matsui Shokai is regulated by the FSA, which mandates compliance with financial laws and protects client funds through strict operational guidelines. The FSA's oversight includes regular audits and adherence to capital requirements, which are essential for maintaining a trustworthy brokerage. Historically, Matsui Shokai has maintained a good compliance record, reflecting its commitment to regulatory standards. However, the lack of transparency regarding specific license expiry dates and the limited information available on its website raises questions about the overall transparency of the brokerage.

Company Background Investigation

Matsui Shokai has a long-standing history in the financial services industry, tracing its roots back to 1918. Originally a conventional brokerage, the company transitioned to an online platform in 1998, becoming one of the first firms in Japan to offer internet trading services. This shift allowed Matsui Shokai to capture a significant market share, particularly among individual investors seeking low-cost trading options.

The management team, led by President Michio Matsui, possesses extensive experience in the financial sector. Under his leadership, the company has focused on innovation and customer service, adapting to changing market dynamics. Despite its achievements, some critiques highlight that Matsui Shokai's information disclosure practices could be improved. The company's website lacks comprehensive details about its services and operational policies, which may hinder potential clients from making informed decisions.

Trading Conditions Analysis

Matsui Shokai offers a variety of trading instruments, including forex, stocks, and mutual funds. Its fee structure is competitive, particularly for active traders, but potential clients should be aware of any unusual or hidden fees that could impact their trading experience.

| Fee Type | Matsui Shokai | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.5 pips | 1.0 pips |

| Commission Model | Commission-free on forex | Average 0.1% |

| Overnight Interest Range | Varies | Varies |

The trading conditions at Matsui Shokai are generally favorable, especially for forex trading, where spreads are competitive compared to industry averages. However, customers have reported occasional discrepancies in commission structures and hidden fees, which could lead to unexpected costs. It is essential for traders to thoroughly review the fee schedule and terms of service before committing to the platform.

Customer Funds Security

The safety of customer funds is a paramount concern for any trader. Matsui Shokai implements several measures to ensure the security of client assets. The brokerage adheres to strict regulations regarding fund segregation, ensuring that client funds are kept separate from the company's operational funds. This practice is crucial for protecting investors in the event of financial difficulties faced by the brokerage.

Additionally, Matsui Shokai offers negative balance protection, which prevents clients from losing more than their deposited amount. However, historical complaints regarding delayed withdrawals and unresponsive customer service have raised alarms about the broker's commitment to fund security. Such issues could potentially compromise the overall trustworthiness of Matsui Shokai.

Customer Experience and Complaints

Customer feedback is a vital indicator of a brokerage's reliability. Reviews of Matsui Shokai reveal a mixed bag of experiences. While some users praise the platform for its ease of use and competitive pricing, others express frustration over withdrawal delays and lack of effective customer support.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response times |

| Customer Service | Medium | Limited availability |

| Platform Stability | Low | Generally stable |

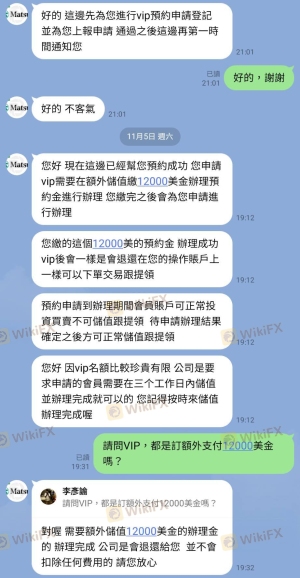

Common complaints revolve around withdrawal processes, with users reporting significant delays and inadequate responses from customer service. These issues can erode trust and deter potential clients from engaging with the platform. A few notable cases highlight the struggles faced by customers attempting to retrieve their funds, which raises concerns about the broker's operational efficiency and commitment to customer satisfaction.

Platform and Execution Quality

The trading platform offered by Matsui Shokai is designed to cater to the needs of retail investors. Users generally report a stable and user-friendly experience, with access to essential trading tools and resources. However, the execution quality has come under scrutiny, with some traders experiencing slippage and order rejections during volatile market conditions.

The platform's performance and reliability are crucial for ensuring a seamless trading experience. Traders should be aware of any potential signs of manipulation or execution issues, as these can significantly impact trading outcomes.

Risk Assessment

Using Matsui Shokai as a forex broker presents several risks that potential clients should consider. The overall risk profile of the brokerage can be summarized as follows:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Subject to regulatory oversight, but transparency issues exist. |

| Operational Risk | High | Historical complaints regarding withdrawal issues and customer service. |

| Market Risk | Medium | Exposure to market volatility inherent in forex trading. |

To mitigate these risks, traders are advised to conduct thorough research, read user reviews, and ensure they fully understand the terms and conditions of the brokerage. Additionally, keeping abreast of any regulatory updates or changes in the broker's operating practices can help in making informed decisions.

Conclusion and Recommendations

In conclusion, while Matsui Shokai has established itself as a significant player in the Japanese online brokerage market, potential clients should approach with caution. The brokerage is regulated by the FSA, which adds a layer of legitimacy; however, concerns about transparency, customer service, and withdrawal issues cannot be overlooked.

Traders should carefully evaluate their individual needs and consider alternative brokers with a stronger reputation for customer service and operational efficiency. For those seeking reliable options, brokers such as SBI Securities or Rakuten Securities may offer more robust services and better customer support.

Ultimately, assessing whether "Is Matsui Shokai Safe?" requires a balanced view of its regulatory standing, operational practices, and customer experiences. By staying informed and cautious, traders can make decisions that align with their investment goals and risk tolerance.

Is Matsui Shokai a scam, or is it legit?

The latest exposure and evaluation content of Matsui Shokai brokers.

Matsui Shokai Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Matsui Shokai latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.