Is IPO FOREX safe?

Business

License

Is IPO Forex A Scam?

Introduction

IPO Forex positions itself as an online trading platform within the forex market, catering to a diverse audience of traders looking to engage in currency trading and other financial instruments. However, the growing number of unregulated brokers in the forex industry necessitates a cautious approach when selecting a trading partner. Traders must be vigilant in assessing the legitimacy and reliability of brokers, as the risk of scams remains prevalent. This article utilizes a comprehensive investigative framework, drawing on multiple sources, to evaluate the safety and legitimacy of IPO Forex, focusing on its regulatory status, company background, trading conditions, and customer experiences.

Regulation and Legitimacy

The regulatory environment is a critical factor in determining the safety of any forex broker. A regulated broker is subject to oversight by a financial authority, which enforces compliance with strict standards designed to protect investors. Unfortunately, IPO Forex is not regulated by any recognized financial authority, raising significant concerns about its legitimacy and operational practices.

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulation means that IPO Forex does not adhere to the rigorous compliance measures that regulated brokers must follow. This lack of oversight can lead to potential risks, including unfair trading practices, withdrawal issues, and the absence of investor protection mechanisms. Historical data indicates that unregulated brokers often engage in dubious activities, which can jeopardize client funds. Thus, is IPO Forex safe? The answer leans towards caution, as the lack of regulatory oversight is a significant red flag.

Company Background Investigation

Understanding a broker's history and ownership structure is vital in assessing its credibility. IPO Forex claims to be operated by XPO Solutions Ltd., yet detailed information about the company's founding and operational history is scarce. The lack of transparency regarding its ownership raises questions about accountability.

The management team behind IPO Forex appears to lack substantial credentials in financial services, which could impact their operational effectiveness. A well-experienced management team is crucial for navigating the complexities of the forex market. Furthermore, the absence of publicly available information about the company's financial health and operational history only adds to the skepticism surrounding its legitimacy. Without a clear understanding of its background, potential clients may be left vulnerable to risks associated with trading through IPO Forex.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly influence a trader's experience. IPO Forex presents a variety of trading instruments, including forex pairs, but the details regarding its fee structure are not clearly outlined. An opaque fee structure can often be indicative of hidden costs that may affect profitability.

| Fee Type | IPO Forex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Varies | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of a clear commission model and spread information raises questions about the transparency of IPO Forex's trading conditions. Traders should be wary of any broker that does not provide detailed information about costs, as this could lead to unexpected losses. Moreover, the potential for unusual fees may indicate that the broker is not acting in the best interests of its clients. Therefore, it is essential to ask the question: is IPO Forex safe? Given the unclear trading conditions, traders should proceed with caution.

Client Fund Safety

The safety of client funds is paramount when evaluating a forex broker. Measures such as fund segregation, investor protection, and negative balance protection are critical indicators of a broker's commitment to safeguarding client assets. Unfortunately, IPO Forex does not provide sufficient information regarding its fund security measures.

Without regulatory oversight, there is no assurance that client funds are held in segregated accounts, which is a standard practice among reputable brokers. Furthermore, the absence of investor protection mechanisms leaves clients vulnerable in the event of financial disputes or broker insolvency. Historical reports of fund safety issues with unregulated brokers serve as a warning to potential clients. Thus, it is reasonable to conclude that is IPO Forex safe? The lack of transparency in fund safety measures is a significant concern.

Customer Experience and Complaints

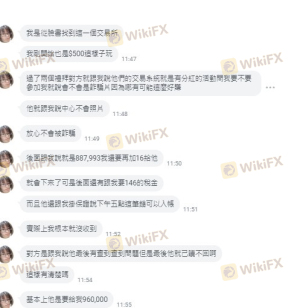

Analyzing customer feedback is essential for understanding the overall experience with a broker. Reviews of IPO Forex reveal a mix of experiences, with many users expressing frustration over withdrawal issues and unresponsive customer service. Common complaints include delayed withdrawals, unhelpful support, and difficulties in accessing funds.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Support Issues | Medium | Poor |

| Misleading Marketing | High | Unclear |

Typical cases highlight severe issues where clients have reported being unable to withdraw their funds for extended periods. These complaints suggest a systemic problem within the company's operational practices. As a result, potential traders must consider whether is IPO Forex safe given the alarming patterns in customer feedback.

Platform and Execution

The trading platform's performance is another critical aspect of a broker's reliability. IPO Forex claims to offer a user-friendly trading environment, but reviews indicate that users have experienced technical difficulties, including slow execution and high slippage rates. Such issues can significantly impact trading outcomes and profitability.

Moreover, any signs of potential platform manipulation should be taken seriously. Traders should be vigilant in monitoring their trades and execution quality to ensure that they are not being subjected to unfair practices. Given the concerns regarding execution quality, it leads to further questioning: is IPO Forex safe? The evidence suggests that traders may face challenges when using this platform.

Risk Assessment

Engaging with IPO Forex presents several risks that traders should be aware of. The lack of regulation, unclear fee structures, and negative customer feedback all contribute to a higher risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker |

| Financial Risk | High | Lack of transparency |

| Operational Risk | Medium | Technical issues |

To mitigate these risks, traders should conduct thorough due diligence before engaging with IPO Forex. It may also be wise to start with a small investment, if any, and to consider using regulated alternatives to minimize exposure to potential losses.

Conclusion and Recommendations

In summary, the investigation into IPO Forex raises several red flags regarding its legitimacy and safety. The lack of regulation, opaque trading conditions, and negative customer feedback suggest that potential traders should exercise extreme caution. While some may still consider engaging with IPO Forex, it is essential to weigh the risks against the potential rewards.

For those seeking a more secure trading environment, it is advisable to explore brokers that are regulated by reputable financial authorities, ensuring better protection for your investments. Ultimately, the question remains: is IPO Forex safe? The evidence suggests that it may not be the best choice for traders who value security and transparency in their trading activities.

Is IPO FOREX a scam, or is it legit?

The latest exposure and evaluation content of IPO FOREX brokers.

IPO FOREX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

IPO FOREX latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.