Is FDX CAPITAL safe?

Business

License

Is FDX Capital Safe or Scam?

Introduction

FDX Capital is a relatively new player in the forex market, claiming to offer investment management services to traders and investors. Established in December 2019, it positions itself as a reliable platform for forex trading and investment. However, the rapid growth of online trading has led to an influx of both legitimate and fraudulent brokers, making it imperative for traders to exercise caution when evaluating forex brokers. This article aims to investigate whether FDX Capital is a safe trading option or a potential scam by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

To conduct this analysis, we have sourced information from various online reviews, regulatory bodies, and user testimonials. The evaluation framework includes regulatory compliance, company history, trading conditions, customer feedback, and risk assessment. By synthesizing this information, we will provide a comprehensive overview of FDX Capital's trustworthiness.

Regulation and Legitimacy

Regulation is a critical factor in determining the safety of a forex broker. A regulated broker is subject to oversight by financial authorities, which helps ensure the protection of client funds and adherence to ethical trading practices. Unfortunately, FDX Capital appears to be operating without proper regulation.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of a regulatory license raises significant red flags. The lack of oversight means that there are no legal protections for clients, making it easier for the broker to engage in unethical practices without fear of repercussions. Moreover, FDX Capital has been associated with other questionable brokers, further complicating its legitimacy. The combination of being unregulated and having ties to dubious entities suggests that FDX Capital may not be a safe option for traders.

Company Background Investigation

FDX Capital's company history is relatively short, having been established in December 2019. The website claims to have a team of five fund managers operating from various countries, including Malaysia, Indonesia, Thailand, and Russia. However, the identities of these managers remain anonymous, which is concerning for potential investors. A lack of transparency regarding the management team and their qualifications undermines the credibility of the broker.

In terms of ownership structure, FDX Capital does not provide detailed information about its parent company or its financial backing. This opacity raises questions about the firm's operational stability and long-term viability. A trustworthy broker typically discloses information about its founders and management team, allowing potential clients to assess their expertise and experience. In this case, the lack of such information further contributes to the perception that FDX Capital may not be a safe trading platform.

Trading Conditions Analysis

FDX Capital advertises attractive trading conditions, including low minimum deposits and competitive leverage. However, the overall fee structure lacks transparency.

| Fee Type | FDX Capital | Industry Average |

|---|---|---|

| Spread on Major Pairs | N/A | 1.0 - 2.0 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of specific fee details raises concerns about potential hidden charges. Traders often report unexpected fees when attempting to withdraw funds or during the trading process, which can significantly impact their profitability. The lack of clarity in FDX Capital's fee structure is a warning sign that should not be overlooked. Traders need to be cautious, as brokers with unclear fee policies may exploit this ambiguity to their advantage.

Client Funds Safety

The safety of client funds is paramount when selecting a forex broker. FDX Capital claims to implement various security measures, but the lack of regulatory oversight raises doubts about the effectiveness of these measures.

The broker does not provide information about segregated accounts, which are essential for protecting client funds from operational risks. Additionally, there is no mention of investor protection mechanisms or negative balance protection policies. This lack of assurance regarding fund safety heightens the risk for potential investors.

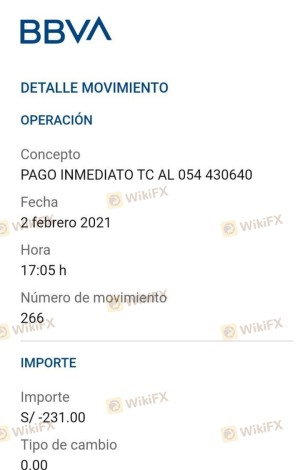

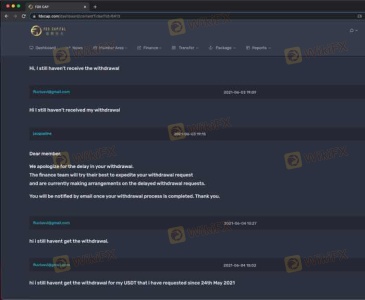

Moreover, numerous complaints have emerged from clients who reported difficulties in withdrawing their funds. Such issues indicate a troubling pattern that could suggest that FDX Capital may not be a safe trading environment for investors looking to secure their capital.

Customer Experience and Complaints

Customer feedback is a crucial aspect of evaluating a forex broker's reliability. A review of user experiences with FDX Capital reveals a concerning trend of negative feedback and complaints.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Customer Support | Medium | Fair |

| Misleading Promotions | High | Poor |

Many users have reported significant delays in processing withdrawal requests, with some claiming that their requests were ignored altogether. Such experiences indicate a lack of responsiveness from the broker, which is a significant red flag. Additionally, clients have expressed frustration over misleading promotional offers that were not honored, further eroding trust in the platform.

Two notable cases involve clients who deposited funds with the expectation of receiving bonuses or promotional offers, only to find that these offers were not legitimate. The lack of effective communication from FDX Capital's support team exacerbated their frustrations, leading to a loss of confidence in the broker's integrity.

Platform and Trade Execution

The trading platform is another critical element of a broker's offering. While FDX Capital claims to provide a user-friendly trading environment, reviews indicate that the platform may suffer from performance issues. Users have reported instances of slippage, delayed order execution, and even outright rejections of trading orders.

These issues raise concerns about the overall reliability and integrity of the trading platform. A broker that manipulates trade execution can significantly impact a trader's ability to make informed decisions and realize profits. The lack of transparency regarding platform performance and execution quality suggests that FDX Capital may not be a safe choice for traders seeking a stable trading environment.

Risk Assessment

Using FDX Capital presents several risks that potential investors should consider carefully.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight or protection |

| Fund Safety Risk | High | Lack of transparency regarding fund security |

| Customer Service Risk | Medium | Poor response to customer complaints |

| Execution Risk | High | Issues with order execution and slippage |

Traders should be particularly wary of the high regulatory risk associated with FDX Capital, as the absence of oversight leaves them vulnerable to potential fraud. Additionally, the lack of transparency regarding fund safety measures further compounds these risks. To mitigate these concerns, it is advisable to conduct thorough research and consider alternative brokers with established regulatory frameworks and positive user reviews.

Conclusion and Recommendations

In conclusion, the evidence suggests that FDX Capital may not be a safe trading option for forex investors. The absence of regulation, combined with a lack of transparency regarding company operations and customer feedback, raises significant concerns about the broker's legitimacy.

Traders should exercise extreme caution when considering FDX Capital as their trading partner. For those seeking safer alternatives, it is recommended to explore regulated brokers with proven track records and positive user experiences. By prioritizing safety and transparency, traders can better protect their investments and achieve their financial goals. Always remember to thoroughly research any broker before committing your funds to ensure that you are trading in a secure environment.

Is FDX CAPITAL a scam, or is it legit?

The latest exposure and evaluation content of FDX CAPITAL brokers.

FDX CAPITAL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FDX CAPITAL latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.