Is Engel FX safe?

Business

License

Is Engel FX A Scam?

Introduction

Engel FX is a forex broker based in the United Kingdom, established in 2018. It positions itself as a provider of various financial instruments, including forex, commodities, indices, cryptocurrencies, and stocks. However, the legitimacy of Engel FX has come into question, as potential traders need to exercise caution when evaluating forex brokers. The foreign exchange market is rife with scams and unregulated entities, making it essential for traders to conduct thorough due diligence before committing their funds. In this article, we will investigate Engel FX's regulatory status, company background, trading conditions, customer fund safety, client experiences, platform performance, and overall risk assessment to determine whether Engel FX is safe or a potential scam.

Regulation and Legitimacy

The regulatory status of a forex broker is critical in determining its legitimacy and trustworthiness. Engel FX currently operates without proper regulatory authorization, which raises significant concerns. Regulatory bodies like the National Futures Association (NFA) in the United States have flagged Engel FX as unauthorized, while the Australian Securities and Investments Commission (ASIC) has identified it as a "suspicious clone." This lack of regulation means that Engel FX does not adhere to the stringent standards that regulated brokers must follow, putting client funds at risk.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | Unauthorized | United States | Not Verified |

| ASIC | Suspicious Clone | Australia | Not Verified |

The absence of a solid regulatory framework means that Engel FX may not provide the same level of investor protection found in regulated environments. Furthermore, the broker has been linked to numerous complaints regarding withdrawal issues and potential scams. The quality of regulation is paramount for any trading platform, as it ensures compliance with legal standards that protect traders from fraud and malpractice.

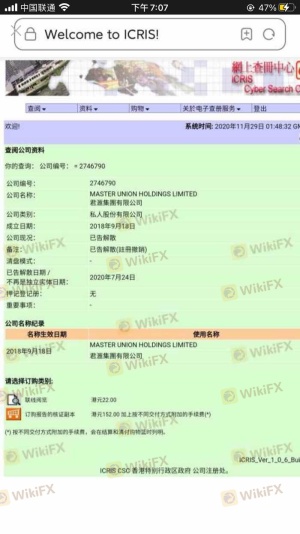

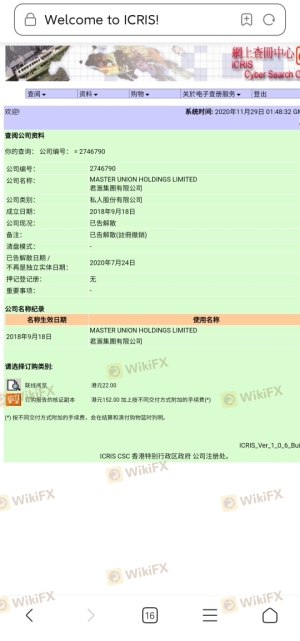

Company Background Investigation

Engel FX's company history indicates that it has been operational since 2018, but its ownership structure and management team remain opaque. A lack of transparency in these areas can lead to skepticism among potential clients. The absence of detailed information about the management team raises red flags, as experienced leaders typically contribute to a broker's credibility.

Transparency in a broker's operations is vital for building trust. Engel FX's failure to provide comprehensive information on its ownership and management team leaves potential traders in the dark, making it difficult to assess the broker's reliability. Without a clear understanding of who is behind the company, traders may find it challenging to feel secure in their investment decisions.

Trading Conditions Analysis

Engel FX offers a variety of trading conditions, including no minimum deposit for its standard account and a maximum leverage of up to 1:500. However, the overall fee structure warrants scrutiny. The broker claims to have competitive spreads starting from 0.1 pips, but traders should be cautious of any hidden fees that could affect their trading profitability.

| Fee Type | Engel FX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.1 pips | 1.0 pips |

| Commission Model | $3 per lot | $5 per lot |

| Overnight Interest Range | Varies | Varies |

While Engel FX's spreads may appear attractive, traders must ensure they fully understand the commission structure and any potential overnight fees that could impact their bottom line. A lack of clarity in fee disclosure can lead to unexpected costs, making it essential for traders to read the fine print before engaging with the broker.

Customer Fund Safety

The safety of client funds is a paramount concern for any broker. Engel FX claims to implement measures for fund security, but the absence of regulatory oversight raises questions about the effectiveness of these measures. The broker does not provide clear information on whether client funds are held in segregated accounts, which is a standard practice among regulated brokers to protect client assets.

Investor protection policies, such as negative balance protection, are also crucial in safeguarding traders against market volatility. However, Engel FX's lack of transparency in this area may leave traders vulnerable to losses that exceed their initial deposits. Historical issues regarding fund safety and withdrawal problems reported by clients further exacerbate concerns about the broker's reliability.

Customer Experience and Complaints

Client feedback plays a significant role in assessing the credibility of a broker. Reviews and testimonials reveal a pattern of complaints against Engel FX, particularly regarding withdrawal issues. Many users have reported difficulties in accessing their funds, with some claiming that the broker has absconded with their investments.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Fund Absconding | Critical | Non-responsive |

Two notable cases highlight these concerns: one trader reported being unable to withdraw funds for over three months, while another claimed that their account was frozen without explanation. Such experiences underscore the potential risks associated with trading with Engel FX, raising the question: Is Engel FX safe?

Platform and Trade Execution

The trading platform offered by Engel FX is MetaTrader 4 (MT4), a widely recognized platform known for its user-friendly interface. However, the performance and stability of the platform are critical for a positive trading experience. Users have reported issues with order execution, including slippage and rejected orders.

The quality of trade execution is vital for traders, especially in fast-moving markets. Any signs of platform manipulation or poor execution quality can significantly impact trading outcomes. If Engel FX fails to maintain high standards in this area, it could further damage its reputation and trustworthiness.

Risk Assessment

Engaging with Engel FX presents several risks that potential traders should consider carefully. The absence of regulation, coupled with numerous client complaints, indicates a high-risk environment.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No proper oversight |

| Withdrawal Risk | High | Complaints of fund access issues |

| Platform Reliability Risk | Medium | Reports of execution issues |

To mitigate these risks, potential traders should conduct thorough research, remain aware of the broker's reputation, and consider starting with a smaller investment. Additionally, seeking alternatives with robust regulatory frameworks may provide a safer trading environment.

Conclusion and Recommendations

In conclusion, Engel FX raises several red flags that suggest it may not be a safe trading option. The lack of regulatory oversight, combined with numerous complaints regarding withdrawal issues and a lack of transparency, indicates that potential traders should exercise extreme caution.

For those considering trading with Engel FX, it is crucial to weigh the risks against the potential benefits carefully. Traders may want to explore regulated alternatives such as IG, OANDA, or Forex.com, which offer more robust investor protections and a proven track record in the industry. Ultimately, ensuring the safety of your investments should be the top priority when selecting a forex broker.

Is Engel FX a scam, or is it legit?

The latest exposure and evaluation content of Engel FX brokers.

Engel FX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Engel FX latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.