Is DuxMarket safe?

Business

License

Is DuxMarket A Scam?

Introduction

DuxMarket is a forex broker that claims to offer a wide range of trading instruments, including forex, precious metals, and indices. Established in 2019, it positions itself as a global trading platform targeting various markets. However, the question of whether DuxMarket is a legitimate broker or a scam has become increasingly pertinent among traders. Evaluating the credibility of a forex broker is crucial, as the wrong choice can lead to significant financial losses. Traders must be cautious and conduct thorough research before engaging with any broker, particularly those that are unregulated or have a questionable reputation.

This article aims to provide an objective analysis of DuxMarket's legitimacy through a comprehensive investigation. We will assess its regulatory status, company background, trading conditions, client fund safety, customer experiences, platform performance, and overall risk profile. By synthesizing data from various credible sources, this evaluation will help traders determine if DuxMarket is a safe option for their trading needs.

Regulation and Legitimacy

One of the most critical aspects of evaluating a forex broker is its regulatory status. Regulatory oversight ensures that brokers adhere to specific standards designed to protect investors. DuxMarket claims to be regulated by the National Futures Association (NFA) in the United States, citing license number 0524124. However, investigations reveal that while this license number exists, DuxMarket is not an approved member of the NFA, raising serious concerns about its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0524124 | United States | Not Approved |

The absence of proper regulatory oversight means that DuxMarket operates without the necessary checks and balances typically associated with legitimate brokers. This lack of regulation increases the risk of fraudulent activities, such as market manipulation and misappropriation of funds. Additionally, reports indicate that the broker's website has faced periods of suspension, a common red flag for potential scams.

Company Background Investigation

DuxMarket is operated by Dux Holding Group Limited, a company registered in the United Kingdom. However, information regarding the company's ownership structure and management team is sparse, contributing to a lack of transparency. The absence of publicly available details about the management team and their professional backgrounds raises concerns about the broker's credibility.

The company's operational history is relatively short, having been established in 2019. While the age of a broker does not necessarily dictate its reliability, the lack of a proven track record can be a cause for concern. Furthermore, the limited information available about DuxMarket's operations and management suggests that traders may not be able to hold the broker accountable in the event of disputes or issues.

Trading Conditions Analysis

DuxMarket offers various trading conditions, including a minimum deposit requirement of $500 and leverage of up to 1:400. While high leverage can be attractive to traders seeking to amplify their potential returns, it also increases the risk of significant losses. The broker claims to provide competitive spreads starting from 1.6 pips, but there is limited transparency regarding any additional fees or commissions that may apply.

| Fee Type | DuxMarket | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.6 pips | 0.5 - 1.2 pips |

| Commission Model | Not Specified | Varies |

| Overnight Interest Range | Not Specified | Varies |

The lack of clarity regarding the commission structure and overnight interest rates may indicate potential hidden costs that could impact traders' profitability. Additionally, the minimum deposit requirement is relatively high compared to industry standards, which typically range from $100 to $200. This could deter novice traders from engaging with DuxMarket.

Client Fund Safety

When assessing a broker's safety, it is essential to consider the measures in place to protect client funds. DuxMarket claims to implement various safety protocols, but detailed information regarding fund segregation, investor protection, and negative balance protection is lacking. The absence of these crucial safety measures raises concerns about the security of traders' funds.

Reports from users indicate that DuxMarket has faced issues related to fund withdrawals, with many clients unable to access their money. Such incidents are alarming and suggest that the broker may not prioritize the safety and accessibility of client funds.

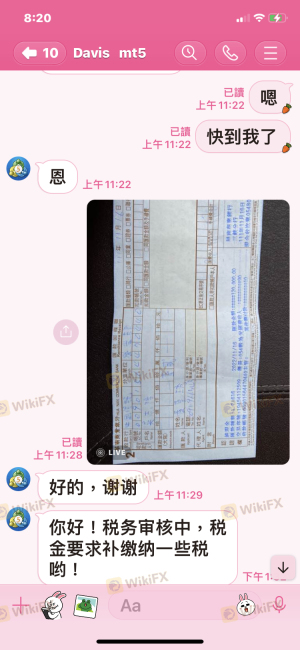

Customer Experience and Complaints

Customer feedback is a vital component in evaluating the reliability of a broker. Unfortunately, reviews about DuxMarket are predominantly negative. Many traders have reported losing their investments and experiencing difficulties with withdrawals. These complaints indicate a pattern of issues that could suggest the broker is involved in questionable practices.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Transparency | Medium | Poor |

| Unresponsive Support | High | Poor |

In one notable case, a trader reported that after depositing funds, their account was unexpectedly restricted, preventing them from making any withdrawals. This experience highlights the potential risks associated with trading through DuxMarket.

Platform and Trade Execution

DuxMarket offers the popular MetaTrader 4 (MT4) trading platform, known for its user-friendly interface and robust features. However, user reviews indicate concerns regarding platform stability and order execution quality. Reports of slippage and rejected orders have surfaced, which can significantly impact trading performance.

The lack of transparency about the broker's execution policies raises questions about potential manipulation. Traders should be wary of brokers that do not provide clear information regarding their order execution processes.

Risk Assessment

Using DuxMarket comes with several risks that traders should carefully consider. The absence of regulatory oversight, combined with negative user experiences and reports of fund withdrawal issues, contributes to a high-risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Fund Safety Risk | High | Reports of withdrawal issues. |

| Execution Risk | Medium | Concerns about slippage and rejections. |

To mitigate these risks, traders should conduct thorough research before engaging with DuxMarket and consider using regulated brokers that offer better protections and transparency.

Conclusion and Recommendations

In conclusion, the evidence suggests that DuxMarket operates as an unregulated broker with multiple red flags. The lack of regulatory oversight, combined with negative customer feedback and withdrawal issues, raises serious concerns about its legitimacy. Therefore, it is advisable for traders to exercise caution when considering DuxMarket for their trading activities.

If you are a novice trader or someone seeking a reliable trading environment, it may be prudent to explore alternative brokers that are regulated and have a proven track record of transparency and client satisfaction. Some recommended alternatives include Admiral Markets and TD Ameritrade, both of which offer robust regulatory protections and positive user experiences.

Ultimately, the decision to engage with DuxMarket should be made with careful consideration of the risks involved. Remember, the safety of your investments should always be a top priority.

Is DuxMarket a scam, or is it legit?

The latest exposure and evaluation content of DuxMarket brokers.

DuxMarket Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

DuxMarket latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.