Is CCASIA CORSTAL CAPITAL safe?

Business

License

Is CCASIA CORSTAL CAPITAL A Scam?

Introduction

CCASIA CORSTAL CAPITAL is a Hong Kong-based forex broker that claims to offer a wide range of financial instruments, including forex, indices, and commodities. In the rapidly evolving and often volatile forex market, the importance of selecting a reliable broker cannot be overstated. Traders must be vigilant and conduct thorough evaluations of brokers to avoid potential scams and ensure their investments are secure. This article aims to provide a comprehensive analysis of CCASIA CORSTAL CAPITAL, utilizing various sources and assessment frameworks to determine whether it is a safe trading platform or a scam.

Regulation and Legitimacy

The regulatory status of a forex broker is critical in assessing its legitimacy. Unfortunately, CCASIA CORSTAL CAPITAL operates without any regulatory oversight from recognized financial authorities. This lack of regulation raises significant red flags, as regulated brokers are required to adhere to strict compliance standards designed to protect investors.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulation means that CCASIA CORSTAL CAPITAL is not subject to any external audits or oversight, which can lead to concerns about the safety of client funds and the overall integrity of the trading environment. Furthermore, there have been reports of forced liquidations and complaints regarding the broker's practices, suggesting a troubling history of compliance issues. The high potential risk associated with trading on unregulated platforms cannot be overlooked, making it imperative for traders to exercise caution when considering CCASIA CORSTAL CAPITAL.

Company Background Investigation

CCASIA CORSTAL CAPITAL was established with the intention of providing a diverse range of trading options to clients. However, details regarding the company's history, ownership structure, and management team remain vague. The lack of transparency in these areas is concerning, as it is essential for traders to understand who they are dealing with and the experience of the individuals managing their investments.

The management teams background is particularly important in assessing the broker's credibility. Unfortunately, there is limited information available regarding the qualifications and professional experiences of the team behind CCASIA CORSTAL CAPITAL. This opacity can lead to further skepticism about the firm's operations and the level of service that clients can expect. A broker's transparency in disclosing such information is a significant factor in establishing trust with potential clients.

Trading Conditions Analysis

When evaluating a broker, the overall fee structure and trading conditions are crucial components. CCASIA CORSTAL CAPITAL requires a minimum deposit of $100, which may seem reasonable. However, the broker does not clearly outline its spreads and commissions, a common tactic among unregulated brokers that often leads to hidden costs.

| Fee Type | CCASIA CORSTAL CAPITAL | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-3 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of clarity surrounding these costs suggests that traders may encounter unexpected fees, which can significantly impact their profitability. This ambiguity in the trading conditions raises concerns about the broker's intentions and whether it prioritizes the interests of its clients.

Client Fund Safety

The safety of client funds is a paramount concern when trading with any broker. CCASIA CORSTAL CAPITAL has not provided sufficient information regarding its fund security measures. There is no indication of segregated accounts or investor protection policies, which are standard practices among reputable brokers.

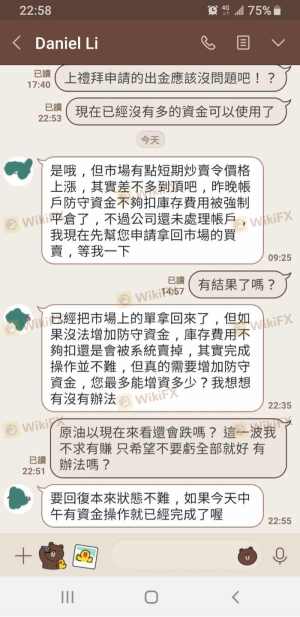

The absence of such safeguards places traders at risk of losing their investments without any recourse. Furthermore, historical complaints about forced liquidations and requests for additional funding to unfreeze accounts indicate a troubling pattern that undermines confidence in the broker's commitment to protecting client assets.

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's reliability. Reviews of CCASIA CORSTAL CAPITAL reveal a pattern of negative experiences, with many users reporting issues related to withdrawals and forced liquidations.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Forced Liquidation | High | Poor |

| Customer Support Issues | Medium | Slow |

Several users have shared experiences of being pressured to add funds to their accounts to prevent liquidation, raising serious concerns about the broker's practices. One user reported a significant profit only to have their account liquidated after refusing to participate in a promotional activity. Such complaints highlight potential manipulative tactics employed by the broker, further questioning whether CCASIA CORSTAL CAPITAL is a scam.

Platform and Execution

The performance and reliability of a trading platform are critical for successful trading. CCASIA CORSTAL CAPITAL offers a proprietary platform rather than well-known options like MT4 or MT5. Without access to established platforms, traders may face challenges in terms of usability, execution speed, and reliability.

Concerns about order execution quality, slippage, and potential manipulation are heightened when using an unregulated broker's proprietary platform. Reports of forced liquidations and issues with order execution may indicate a lack of proper infrastructure to support traders effectively.

Risk Assessment

Using CCASIA CORSTAL CAPITAL for trading carries inherent risks that potential clients should carefully consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulation or oversight. |

| Financial Risk | High | Lack of fund security measures. |

| Execution Risk | Medium | Proprietary platform concerns. |

| Customer Service Risk | High | Poor response to complaints. |

To mitigate these risks, traders are advised to conduct thorough research before engaging with CCASIA CORSTAL CAPITAL. Seeking alternative brokers with robust regulatory oversight and transparent practices is highly recommended.

Conclusion and Recommendations

In conclusion, the evidence presented raises significant concerns about whether CCASIA CORSTAL CAPITAL is a safe trading platform or a potential scam. The absence of regulation, coupled with troubling customer complaints and a lack of transparency, suggests that traders should exercise extreme caution.

For those considering forex trading, it is advisable to explore reputable alternatives that are regulated by top-tier authorities. Brokers such as IG, OANDA, and Forex.com offer robust regulatory protections, transparent pricing, and a commitment to customer service. By choosing a well-regulated broker, traders can ensure a safer trading environment and better protect their investments.

Ultimately, the key question remains: Is CCASIA CORSTAL CAPITAL safe? Based on the available evidence, it is prudent to approach this broker with skepticism and consider other options for trading.

Is CCASIA CORSTAL CAPITAL a scam, or is it legit?

The latest exposure and evaluation content of CCASIA CORSTAL CAPITAL brokers.

CCASIA CORSTAL CAPITAL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CCASIA CORSTAL CAPITAL latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.