Is BVB TRADE safe?

Business

License

Is BVB Trade Safe or a Scam?

Introduction

BVB Trade is a forex broker that has positioned itself in the competitive landscape of online trading. Founded in 2015 and operating out of Saint Vincent and the Grenadines, BVB Trade claims to offer a variety of trading products including forex, commodities, indices, and cryptocurrencies. However, the lack of regulation and the high minimum deposit requirement of $10,000 raise significant red flags for potential traders. In the volatile world of forex trading, it is crucial for traders to thoroughly evaluate the legitimacy and safety of the brokers they choose. This article aims to provide an in-depth analysis of BVB Trade's regulatory status, company background, trading conditions, customer experiences, and overall safety. The findings are based on a review of various sources, including regulatory databases, user reviews, and expert analyses.

Regulation and Legitimacy

One of the most critical aspects of evaluating any forex broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to certain standards and practices. Unfortunately, BVB Trade operates as an unregulated entity, which significantly diminishes its credibility.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Saint Vincent and the Grenadines | Unverified |

The absence of a regulatory framework means that BVB Trade is not subject to oversight by any financial authority, leaving clients with limited protections. This unregulated status raises concerns about the broker's transparency, security, and adherence to industry norms. Moreover, there have been numerous reports indicating that BVB Trade has been involved in fraudulent activities, including manipulating client accounts and restricting withdrawals. This lack of regulatory oversight is a significant factor that potential clients should consider when asking, "Is BVB Trade safe?"

Company Background Investigation

BVB Trade was established in 2015 and is headquartered in Saint Vincent and the Grenadines, a location often associated with unregulated brokers due to its lenient financial laws. The company's ownership structure is not publicly disclosed, which raises further concerns about transparency.

The management team behind BVB Trade lacks significant experience in the financial services industry, which can be detrimental to a broker's reliability. A well-versed management team can often provide assurance to clients regarding the broker's operational integrity. Furthermore, the lack of information regarding the company's ownership and operational history makes it difficult for potential clients to assess the broker's credibility.

Overall, the company's opacity is alarming and contributes to the question of whether "Is BVB Trade safe?" The absence of clear ownership and management information makes it challenging for traders to have confidence in the broker's operations.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions is essential. BVB Trade has a notably high minimum deposit requirement of $10,000, which can be a significant barrier for many retail traders. The broker claims to offer no commissions on trades, which sounds appealing; however, this could be offset by wider spreads that are not immediately apparent.

| Fee Type | BVB Trade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Varies | 1.0 - 2.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Varies | Varies |

The lack of transparency regarding spreads and overnight interest rates raises concerns about the overall cost of trading with BVB Trade. Traders may find themselves facing hidden fees that could significantly impact their profitability. The high minimum deposit combined with potentially unfavorable trading conditions leads to the question, "Is BVB Trade safe for new or small-scale traders?"

Client Funds Security

The security of client funds is paramount in the trading industry. Unfortunately, BVB Trade's unregulated status means that there are no investor protection mechanisms in place. Reports indicate that BVB Trade may not segregate client funds, which poses a significant risk. In the event of the broker's insolvency, clients may find it challenging to recover their investments.

Additionally, there are no clear policies regarding negative balance protection, leaving traders vulnerable to losing more than their initial investment. Historical complaints have surfaced regarding clients being unable to withdraw funds, which further emphasizes the risks involved. When considering the safety of trading with BVB Trade, potential clients must weigh these significant risks against their investment goals.

Customer Experience and Complaints

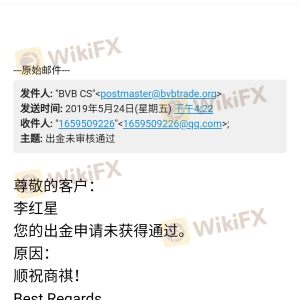

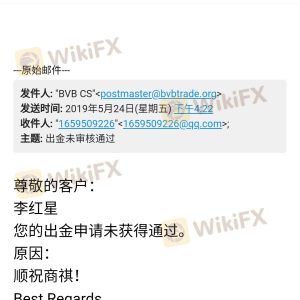

Customer feedback is often a telling indicator of a broker's reliability and service quality. Reviews of BVB Trade reveal a pattern of negative experiences, primarily concerning withdrawal issues and poor customer service.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/No Response |

| Account Manipulation | High | Ignored Complaints |

| Customer Support Quality | Medium | Limited Availability |

Many users have reported being unable to withdraw their funds after making substantial deposits, leading to allegations of fraud. The companys response to these complaints has been inadequate, often leaving clients frustrated and without recourse. Such patterns of behavior raise serious questions about the legitimacy of BVB Trade and whether "Is BVB Trade safe?" is a question worth pursuing.

Platform and Execution

The trading platform offered by BVB Trade is MetaTrader 4 (MT4), a widely recognized platform in the forex industry. While MT4 is known for its reliability, the overall execution quality at BVB Trade has been called into question. Reports of slippage and order rejections have surfaced, which can severely impact trading outcomes.

Furthermore, there are indications that the broker may engage in practices that manipulate client orders, further eroding trust. Traders must be cautious and consider whether the trading environment at BVB Trade aligns with their expectations and needs.

Risk Assessment

The overall risk of trading with BVB Trade appears to be high, given the various concerns outlined in this analysis.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight or investor protection. |

| Financial Risk | High | Lack of fund segregation and withdrawal issues. |

| Operational Risk | Medium | Potential for order manipulation and slippage. |

| Transparency Risk | High | Limited information on ownership and management. |

To mitigate these risks, potential traders are advised to conduct thorough research, utilize demo accounts where available, and avoid depositing large sums until they are confident in the broker's legitimacy.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that BVB Trade poses significant risks for potential traders. The lack of regulation, high minimum deposit requirements, and numerous reports of withdrawal issues contribute to the conclusion that BVB Trade may not be a safe option for most traders.

For those considering forex trading, it may be prudent to explore alternative brokers that are regulated by reputable authorities and offer transparent trading conditions. Brokers like IG, OANDA, and Forex.com are examples of more reliable options.

Ultimately, the question "Is BVB Trade safe?" leans towards a resounding "no" for many traders, particularly those who are new to the forex market. Caution is advised, and it is essential to prioritize safety and regulatory compliance when selecting a trading platform.

Is BVB TRADE a scam, or is it legit?

The latest exposure and evaluation content of BVB TRADE brokers.

BVB TRADE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BVB TRADE latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.