Is BITCOIN TRADE MERGE safe?

Business

License

Is Bitcoin Trade Merge A Scam?

Introduction

Bitcoin Trade Merge is a forex broker that has emerged in the competitive landscape of online trading platforms. Specializing in cryptocurrency and forex trading, it claims to offer an extensive range of trading options and tools to both novice and experienced traders. However, with the proliferation of online trading platforms, traders must exercise caution and thoroughly evaluate the credibility of brokers before committing their funds. This article aims to investigate the legitimacy and safety of Bitcoin Trade Merge by examining its regulatory status, company background, trading conditions, customer safety measures, client experiences, and overall risk profile. The analysis is based on various online reviews, regulatory databases, and user feedback to provide a comprehensive overview.

Regulation and Legitimacy

The regulatory status of a trading platform is a critical factor in determining its legitimacy and safety. A regulated broker is typically subject to stringent oversight, which helps protect traders from fraud and ensures fair trading practices. In the case of Bitcoin Trade Merge, it appears to operate without any recognized regulatory oversight, raising concerns about its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

The absence of a regulatory license from a reputable authority is a significant red flag. Top-tier regulators, such as the FCA in the UK or ASIC in Australia, enforce strict compliance standards to ensure brokers operate transparently and fairly. Without such oversight, Bitcoin Trade Merge may not adhere to the best practices expected in the trading industry. This lack of regulation could expose traders to potential risks, including unfair trading practices and difficulties in fund recovery in case of disputes. Therefore, it is essential to approach Bitcoin Trade Merge with caution, as the lack of regulatory oversight can often indicate a higher risk of fraudulent activities.

Company Background Investigation

Understanding the company behind a trading platform is crucial for assessing its reliability. Bitcoin Trade Merge's history, ownership structure, and management team can offer insights into its operational integrity. Unfortunately, detailed information about the company's background appears to be scarce. The absence of transparency regarding its ownership and management raises questions about its credibility.

A reliable broker typically provides clear information about its founders, management team, and operational history. In the case of Bitcoin Trade Merge, potential traders may find it challenging to ascertain the qualifications and expertise of the individuals running the platform. This lack of transparency can be concerning, as it may indicate a reluctance to disclose vital information that could impact traders' trust.

Furthermore, the company's operational practices and history of compliance (or lack thereof) are essential in evaluating its reliability. If Bitcoin Trade Merge has faced any legal disputes or regulatory actions in the past, this could further undermine its credibility. As such, traders should be wary of engaging with a broker that lacks a well-documented and transparent history, as this could be indicative of underlying issues.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions it offers is vital. Bitcoin Trade Merge promotes competitive trading conditions, but a closer examination reveals some potential concerns regarding its fee structure and trading costs.

| Fee Type | Bitcoin Trade Merge | Industry Average |

|---|---|---|

| Major Currency Pair Spread | High | Low to Medium |

| Commission Model | N/A | Varies |

| Overnight Interest Range | Unclear | Varies |

The spread on major currency pairs is reported to be on the higher side compared to industry standards, which could significantly impact trading profitability. High spreads can eat into traders' profits, especially for those engaging in frequent trading. Furthermore, the absence of a clear commission model raises additional questions about hidden fees that may not be disclosed upfront.

Traders should be cautious about any unusual or opaque fees, as these can often be a tactic used by less reputable brokers to generate revenue at the expense of their clients. The lack of clarity regarding the overnight interest range further complicates the assessment of trading costs. Transparency in fee structures is essential for building trust with clients, and Bitcoin Trade Merge's vagueness in this area may warrant further scrutiny.

Customer Funds Security

The security of client funds is paramount when choosing a trading platform. A reputable broker implements robust measures to ensure the safety of traders' deposits. Unfortunately, there is limited information available regarding Bitcoin Trade Merge's fund security protocols.

Traders should inquire about the broker's policies on fund segregation, investor protection, and negative balance protection. A trustworthy broker typically keeps client funds in segregated accounts, ensuring that traders' money is protected in the event of the broker's insolvency. Additionally, negative balance protection is a critical feature that prevents traders from losing more than their initial deposit, offering an extra layer of security.

Given the lack of information regarding Bitcoin Trade Merge's security measures, potential traders should approach with caution. Any historical issues related to fund safety or disputes could further exacerbate concerns about the broker's reliability. It is advisable for traders to seek platforms with established security protocols and a history of safeguarding client funds.

Customer Experience and Complaints

Customer feedback is a valuable resource when evaluating the credibility of a trading platform. Reviews and testimonials from actual users can provide insights into the broker's performance, reliability, and customer service quality. In the case of Bitcoin Trade Merge, there are mixed reviews, with several users expressing dissatisfaction.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Unresponsive Support | Medium | Poor |

| Hidden Fees | High | Unclear |

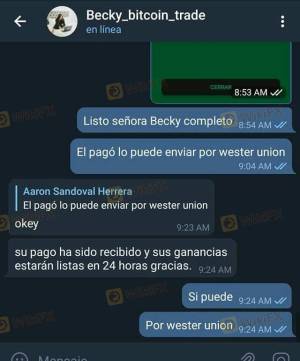

Common complaints include difficulties in withdrawing funds, unresponsive customer support, and concerns about hidden fees. Withdrawal issues are particularly alarming, as they can indicate potential fraud or mismanagement of client funds. A broker that fails to respond adequately to customer inquiries or complaints may not be acting in good faith, further raising concerns about its integrity.

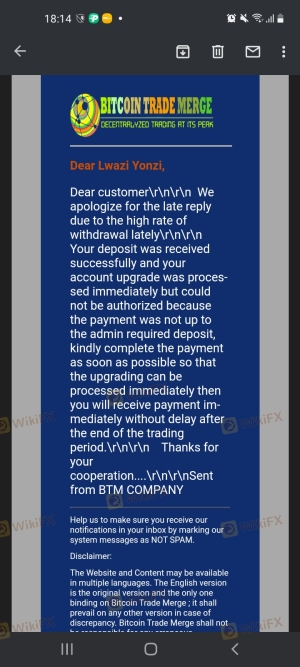

One notable case involved a trader who reported that after achieving some profits, they were informed that they needed to upgrade their account to access their funds. This type of tactic is often associated with scams, where brokers create barriers to withdrawing funds. Such practices should raise red flags for potential clients, signaling that they may want to reconsider engaging with Bitcoin Trade Merge.

Platform and Trade Execution

The performance of a trading platform is crucial for a seamless trading experience. Traders expect a reliable and user-friendly interface, as well as efficient order execution. In the case of Bitcoin Trade Merge, there are concerns regarding platform stability and execution quality.

Traders have reported instances of slippage during high volatility periods, which can significantly impact trading outcomes. Additionally, any signs of order rejections or manipulation can further undermine confidence in the platform. A broker that consistently fails to provide a stable trading environment may not be suitable for traders looking for a reliable trading experience.

Risk Assessment

Engaging with a trading platform like Bitcoin Trade Merge carries inherent risks. Understanding these risks is essential for making informed decisions about whether to proceed with trading.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of oversight can lead to fraud. |

| Fund Security Risk | High | Insufficient measures may jeopardize client funds. |

| Customer Service Risk | Medium | Unresponsive support can lead to unresolved issues. |

The absence of regulation and unclear security measures significantly heightens the risk associated with trading on this platform. Traders should be aware of these risks and consider implementing strategies to mitigate them, such as limiting their exposure and ensuring they do not invest more than they can afford to lose.

Conclusion and Recommendations

In conclusion, the investigation into Bitcoin Trade Merge raises several concerns about its legitimacy and safety. The lack of regulatory oversight, transparency issues, and mixed customer feedback suggest that traders should approach this broker with caution. There are indications of potential fraud, particularly regarding withdrawal issues and hidden fees.

For traders seeking reliable alternatives, it is advisable to consider brokers that are regulated by reputable authorities and have a proven track record of customer satisfaction. Platforms such as eToro, IG, or OANDA offer robust security measures, transparent fee structures, and responsive customer support, making them more trustworthy options for traders looking to navigate the forex market safely.

Ultimately, traders must prioritize their safety and due diligence when selecting a broker, and it is crucial to remain vigilant against potential scams in the ever-evolving landscape of online trading.

Is BITCOIN TRADE MERGE a scam, or is it legit?

The latest exposure and evaluation content of BITCOIN TRADE MERGE brokers.

BITCOIN TRADE MERGE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BITCOIN TRADE MERGE latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.