OTTMarkets 2025 Review: Everything You Need to Know

Executive Summary

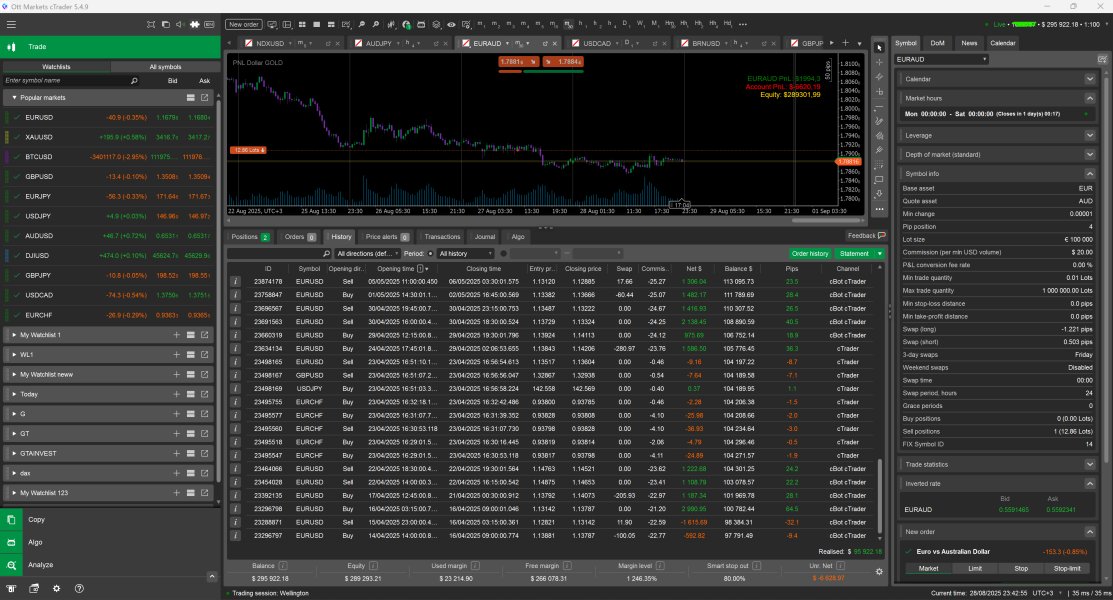

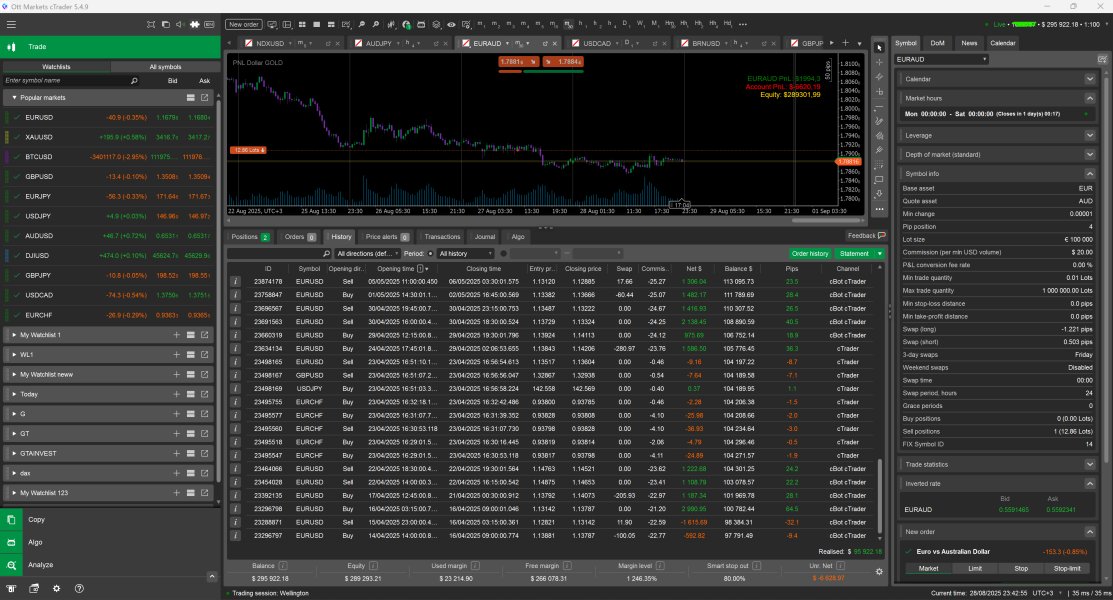

This ottmarkets review gives you a complete look at OTT Markets, a CFD broker that has created mixed reactions among traders in 2025. OTT Markets says it is a trading platform that gives access to over 25 forex currency pairs and multiple asset classes through the cTrader platform. Our review shows serious concerns that potential clients should think about carefully.

The broker says it works with core values of integrity, professionalism, and continuous growth. It targets traders who want forex and CFD trading. Some users on review platforms have called it an ideal trading platform, but several warning signals have come from various sources, including scam alerts from multiple website analysis platforms.

The company offers trading across different asset classes including precious metals, energy commodities, stocks, indices, ETFs, and cryptocurrencies like Bitcoin. Despite these offerings, the lack of clear regulatory information and mixed user feedback puts this broker in a warning category for potential traders.

Important Disclaimers

This review uses publicly available information, user feedback, and industry analysis standards as of 2025. Traders should know that regulatory information for OTT Markets was not clearly specified in available sources, which raises important concerns for potential clients.

The evaluation method uses user testimonials, platform features, asset offerings, and industry standard comparisons to provide a balanced assessment. Due to limited transparency about regulatory oversight, traders should do additional research before working with this broker.

The information presented shows the current state of available data and may not capture all aspects of the broker's operations or recent developments.

Rating Framework

Broker Overview

OTT Markets works as a CFD broker in the financial services sector. Specific establishment details and founding year information were not clearly specified in available sources.

The company presents itself with stated core values of integrity, professionalism, and continuous growth. It positions itself as a service provider for traders seeking access to global financial markets through CFD instruments.

The broker's business model centers on providing CFD trading services across multiple asset categories. This enables clients to speculate on price movements without owning underlying assets.

According to available information, the company emphasizes its commitment to providing trading opportunities while maintaining professional standards in client service delivery. The platform infrastructure is built around the cTrader trading system, available in PC, web-based, and mobile versions.

This technological foundation supports trading across an extensive range of financial instruments. These include over 25 forex currency pairs, precious metals such as gold and silver, energy commodities like oil, stock indices, individual equities, ETFs, and cryptocurrency options including Bitcoin.

However, specific regulatory oversight details were not clearly established in the available sources. This represents a significant consideration for potential clients evaluating this ottmarkets review.

Regulatory Jurisdiction: Specific regulatory information was not clearly detailed in available sources, which raises important transparency concerns for potential traders considering this broker.

Deposit and Withdrawal Methods: Payment processing options and withdrawal procedures were not specifically outlined in the available source materials.

Minimum Deposit Requirements: Minimum account funding requirements were not specified in the accessible information.

Promotional Offers: Details regarding bonus structures or promotional campaigns were not mentioned in the available sources.

Tradeable Assets: The broker provides access to over 25 forex currency pairs, oil and energy commodities, precious metals including gold and silver, additional metal commodities, stock instruments, market indices, ETF products, and cryptocurrency trading options including Bitcoin.

Cost Structure: According to available information, EUR/USD trading shows an average spread of 0 pips. However, comprehensive commission details and fee structures for other instruments were not fully specified in the sources.

Leverage Options: Specific leverage ratios and margin requirements were not detailed in the available information.

Platform Selection: The broker utilizes cTrader as its primary trading platform. It offers PC desktop, web-based, and mobile application versions for client access.

Geographic Restrictions: Specific regional limitations or restricted territories were not outlined in the available sources.

Customer Support Languages: Available customer service language options were not specified in the accessible materials.

This ottmarkets review highlights the limited transparency in several key operational areas that traders typically require for informed decision-making.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of OTT Markets' account conditions faces significant limitations due to insufficient publicly available information. Standard account features such as account type variations, minimum deposit requirements, and specific account opening procedures were not detailed in accessible sources.

This lack of transparency represents a notable concern for potential clients who require clear understanding of account terms before committing funds. Industry standard practice typically includes multiple account tiers with varying features, minimum funding requirements, and specific benefits for different trader categories.

However, without comprehensive account condition details, it becomes challenging for traders to assess whether OTT Markets' offerings align with their trading needs and financial capabilities. The absence of information regarding Islamic account options, professional trading accounts, or institutional account features further limits the assessment.

Additionally, account opening verification processes, required documentation, and timeline expectations remain unclear. This information gap in our ottmarkets review suggests that potential clients would need to contact the broker directly for essential account details, which may not align with industry transparency standards.

OTT Markets demonstrates strength in its trading infrastructure and asset diversity. The broker provides access to over 25 forex currency pairs, covering major, minor, and exotic currency combinations that cater to various trading strategies.

The asset selection extends beyond forex to include commodities like oil, precious metals including gold and silver, stock instruments, market indices, ETF products, and cryptocurrency options such as Bitcoin. The cTrader platform serves as the primary trading infrastructure, offering professional-grade charting capabilities, advanced order management, and algorithmic trading support.

This platform choice indicates a focus on providing sophisticated trading tools that appeal to both retail and professional traders. The availability of PC desktop, web-based, and mobile versions ensures trading accessibility across different devices and operating systems.

However, the evaluation is limited by the absence of information regarding research tools, market analysis resources, educational materials, or trading signal services. Industry-leading brokers typically provide comprehensive market research, economic calendars, and educational content to support trader development.

The lack of detailed information about these supplementary resources represents a gap in the overall service offering assessment.

Customer Service and Support Analysis

The assessment of OTT Markets' customer service capabilities is significantly hampered by the absence of detailed information in available sources. Critical customer support elements such as available communication channels, response time commitments, service quality standards, and operational hours were not specified in accessible materials.

Modern forex brokers typically offer multiple contact methods including live chat, email support, telephone assistance, and sometimes social media engagement. The availability of 24/5 or 24/7 support during market hours has become an industry standard expectation.

However, without specific information about OTT Markets' customer service infrastructure, potential clients cannot assess whether the broker meets contemporary support standards. Multilingual support capabilities, which are essential for international brokers serving diverse client bases, were also not detailed in available sources.

Additionally, the absence of information regarding dedicated account management, technical support specialization, or escalation procedures for complex issues represents a significant transparency gap. This limitation in our evaluation suggests that customer service quality remains an unknown factor for potential clients considering this broker.

Trading Experience Analysis

The trading experience evaluation for OTT Markets focuses primarily on the cTrader platform infrastructure and reported pricing conditions. The platform choice suggests a commitment to providing professional-grade trading technology with advanced charting capabilities, sophisticated order types, and algorithmic trading support that appeals to experienced traders.

According to available information, EUR/USD trading shows an average spread of 0 pips, which would be competitive if consistently maintained and if commission structures are reasonable. However, comprehensive execution quality data, including order fill rates, slippage statistics, and execution speed metrics, were not available in the sources reviewed.

The platform's availability across PC, web, and mobile formats provides flexibility for traders who require access across different devices and locations. However, specific user feedback regarding platform stability, order execution reliability, or mobile app functionality was not detailed in available sources.

This ottmarkets review cannot fully assess the practical trading experience quality due to limited user experience data and technical performance metrics.

Trust and Safety Analysis

The trust and safety evaluation of OTT Markets reveals concerning findings that potential clients should carefully consider. Multiple website analysis platforms have issued warnings about potential scam risks associated with the broker, which represents a significant red flag for trader safety and fund security.

While the company states core values of integrity, professionalism, and continuous growth, the absence of clear regulatory oversight information undermines confidence in these claims. Legitimate brokers typically provide transparent regulatory details, license numbers, and regulatory body contact information for client verification purposes.

The warnings from scam detection services suggest that independent analysis has identified risk factors that traders should investigate thoroughly before engaging with this broker. However, it's important to note that some users have reportedly described the platform positively, indicating mixed experiences among the user base.

Fund safety measures, segregated account policies, and dispute resolution procedures were not detailed in available sources, further complicating the trust assessment. The lack of regulatory transparency combined with external warnings creates a risk profile that conservative traders may find unacceptable.

User Experience Analysis

User experience assessment for OTT Markets reveals a divided landscape with contrasting feedback from different sources. According to available information, some users have described the platform as ideal for their trading needs, suggesting positive experiences with the service offering and platform functionality.

However, the overall user experience picture remains incomplete due to limited detailed feedback in accessible sources. Standard user experience factors such as account opening efficiency, platform navigation, deposit and withdrawal processes, and customer service interactions lack comprehensive documentation in available materials.

The target user demographic appears to focus on traders interested in forex and CFD trading across multiple asset classes. The cTrader platform selection suggests an orientation toward more sophisticated traders who appreciate advanced trading tools and professional-grade functionality.

The conflicting signals between positive user testimonials and external warning systems create uncertainty about the actual user experience quality. Without comprehensive user feedback data, interface design reviews, or detailed process evaluations, this aspect of our assessment remains inconclusive.

Potential clients would benefit from seeking additional user experiences and conducting thorough research before committing to this platform.

Conclusion

This ottmarkets review reveals a broker with mixed characteristics that require careful consideration by potential clients. OTT Markets offers access to diverse trading assets including over 25 forex pairs and multiple asset classes through the cTrader platform, which represents competitive infrastructure for CFD trading.

However, significant transparency concerns, including the absence of clear regulatory information and warnings from multiple scam detection platforms, create substantial risk considerations. The broker appears most suitable for traders specifically interested in forex and CFD trading who prioritize asset diversity and platform sophistication over regulatory transparency.

However, the lack of comprehensive information about account conditions, customer service, and regulatory oversight suggests that conservative traders may prefer more established alternatives with clearer regulatory credentials. The main advantages include diverse asset offerings and professional trading platform infrastructure, while primary disadvantages encompass regulatory transparency gaps and external risk warnings.

Potential clients should conduct extensive due diligence and consider these factors carefully before making trading decisions with this broker.