ORJIN CAPITAL Review 1

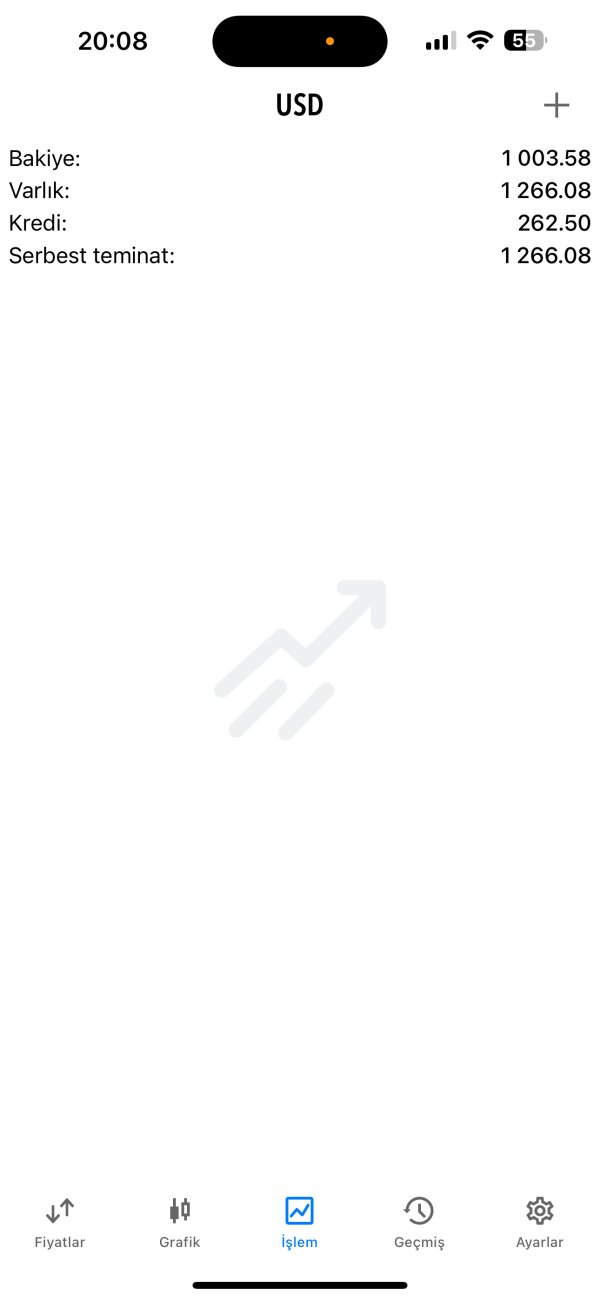

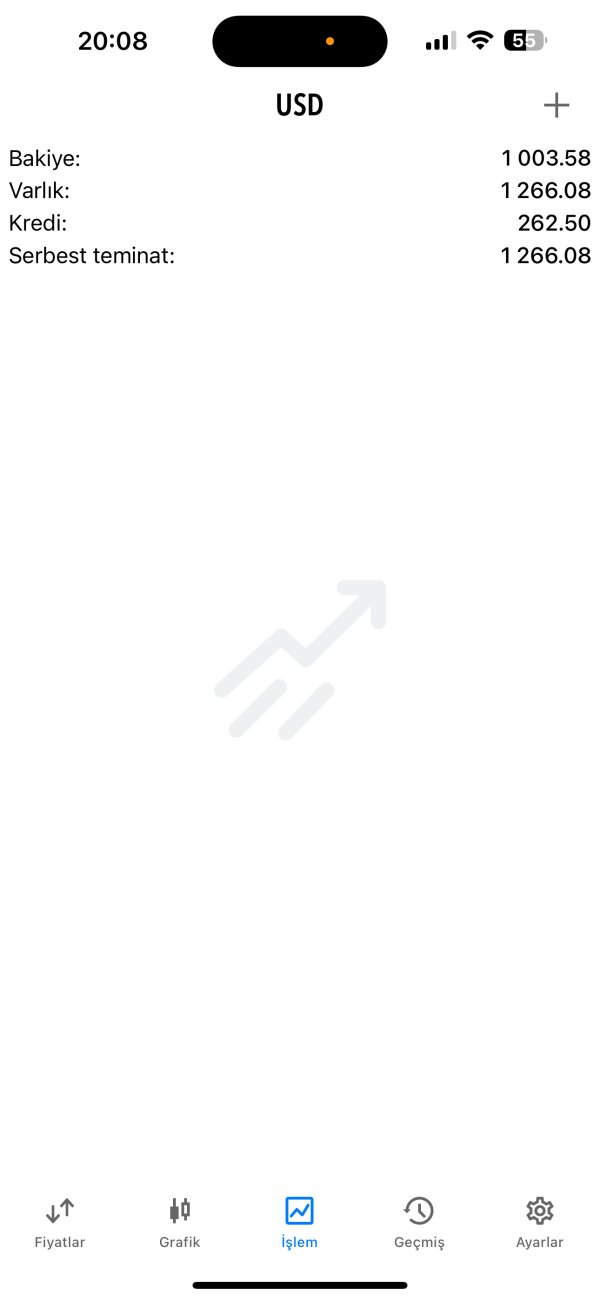

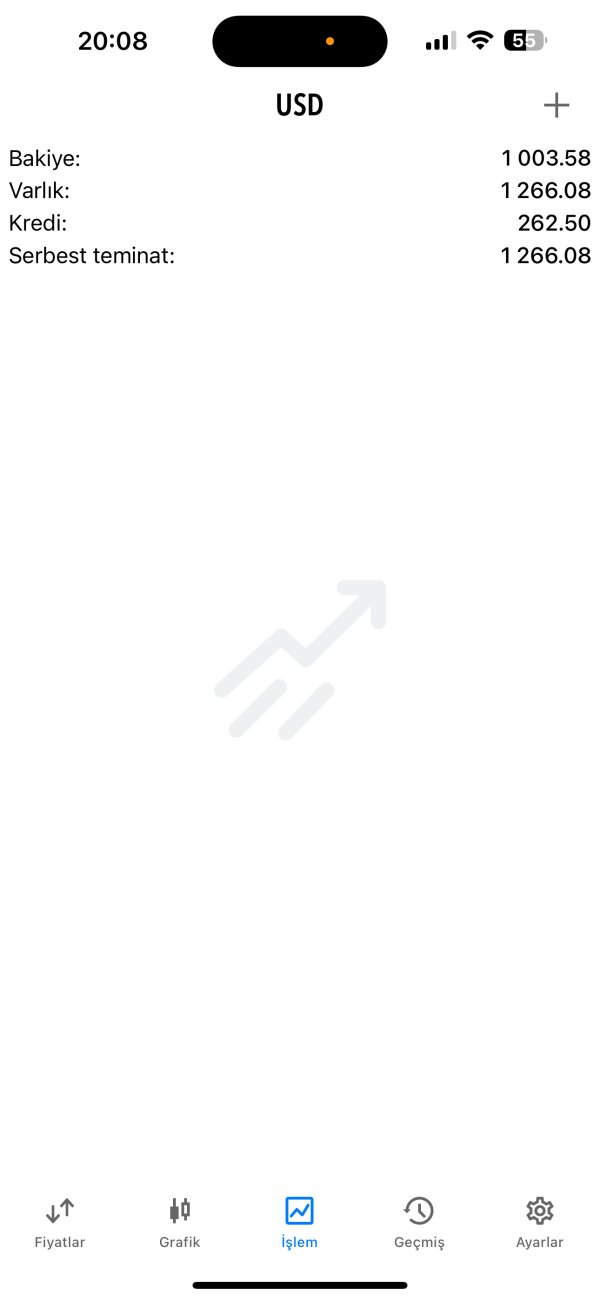

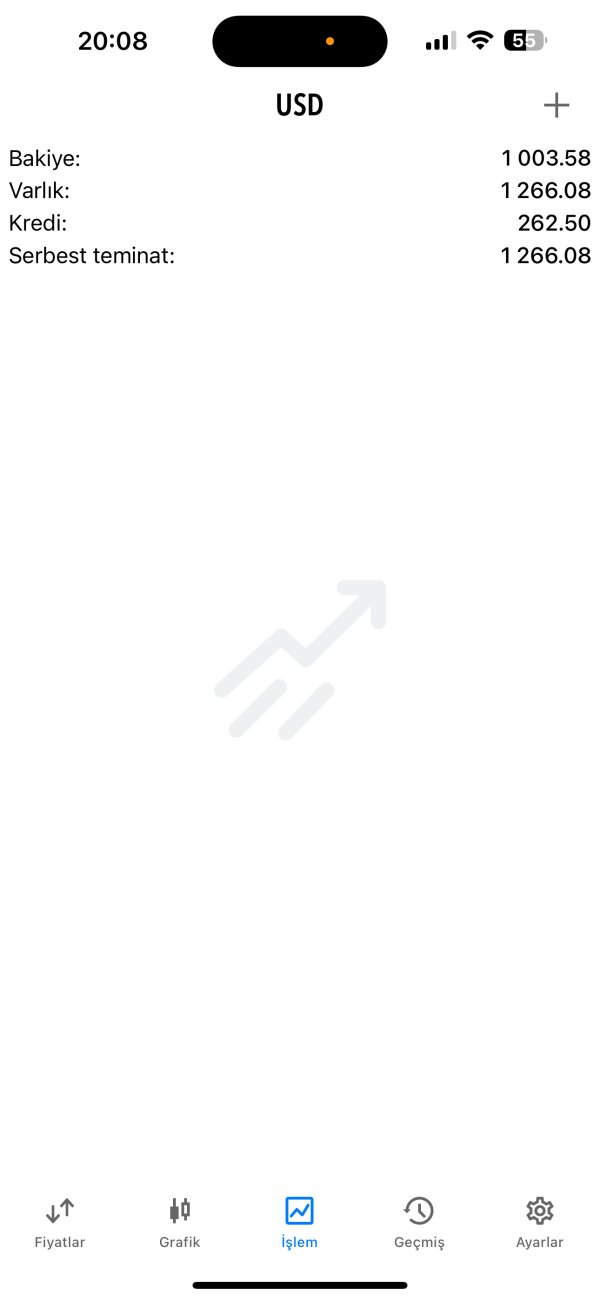

Hello, you cannot withdraw money from the institution, their directions are completely negative.

ORJIN CAPITAL Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Business

License

Hello, you cannot withdraw money from the institution, their directions are completely negative.

This orjin capital review gives you a fair look at a new online Forex and CFD broker that started in 2023. Orjin Capital works from Comoros and lets you trade many different types of investments like forex, commodities, indices, stocks, and cryptocurrencies. The broker attracts traders with tight spreads that start at 0.1 pips and charges no commissions. They use the popular MT5 platform and offer leverage up to 1:500.

But we found some big problems with how they handle rules and share information about their business. The broker doesn't have clear permission from well-known financial authorities, which makes us wonder about how safe your money is and whether they follow proper rules. Also, no one has written reviews about them yet, so we can't tell you what real traders think about using their platform. You can start trading with just 0.01 micro lots, which helps new traders get started without much money. The high leverage appeals to traders who know what they're doing and want to make bigger trades with less money. You should think carefully about these issues, especially the rule problems, before you put your money with this broker.

This review uses information that anyone can find online, but there aren't many user reviews because the broker is so new. You should know that rules and services can be very different depending on where you live. The information we share here is what we found as of 2024, and you should check everything yourself before you decide to invest your money.

Since we don't have complete information about their rules and what users say about them, you should think of this review as just a starting point. You need to do extra research before you choose this broker for your trading.

| Evaluation Criteria | Score | Rating Justification |

|---|---|---|

| Account Conditions | 8/10 | Great access with 0.01 micro lot minimum deposit and competitive 1:500 leverage that works for many trading styles |

| Tools and Resources | 7/10 | Good foundation with MT5 platform and multiple asset classes, but we need more details about educational resources and analysis tools |

| Customer Service | 5/10 | Not enough information about how to get help, how fast they respond, and how good their service is |

| Trading Experience | 8/10 | Excellent trading conditions with 0.1 pip minimum spreads and the strong MT5 platform |

| Trust and Safety | 3/10 | Big concerns because we can't verify that recognized financial authorities have approved them |

| User Experience | 4/10 | Limited user feedback and no user ratings make it hard to judge how well the platform really works |

Orjin Capital started in the busy forex broker market in 2023 and calls itself an online Forex and CFD broker based in Comoros. Information from WikiBit and other industry sources shows that the company wants to provide complete trading services to customers around the world, but we don't know much about who started it or how the company is set up.

The broker works by making trading easy to access and offering good trading conditions. They want both new traders who don't have much money to start with and experienced traders who want high leverage. Orjin Capital offers many different financial instruments, which follows the trend of trading platforms that give you lots of choices for different investment styles and risk levels.

The company's platform is built around the MetaTrader 5 (MT5) system and supports trading in five main types of investments: foreign exchange pairs, commodities, stock indices, individual stocks, and cryptocurrencies. This orjin capital review shows that while the broker looks good on paper, the lack of clear rule information and limited transparency are important things to think about if you're considering using their platform.

Regulatory Landscape: The information we have doesn't show that recognized financial authorities have given them permission to operate, which is a big concern for traders who care about rules and protection.

Deposit and Withdrawal Methods: We don't have specific information about how you pay, how long withdrawals take, and what fees you'll pay, so you'll need to ask the broker directly to understand these things completely.

Minimum Deposit Requirements: The platform lets you trade micro-lots with a minimum position size of 0.01 lots, which makes it easy for traders who don't have much money to start while still letting you control your position sizes precisely.

Promotional Offerings: The information we found doesn't talk about current bonuses or special offers, which suggests they either don't have these programs or don't share much about their marketing.

Tradeable Assets: The broker gives you access to five main types of investments - forex currency pairs, commodity futures, stock market indices, individual company shares, and cryptocurrency instruments, so you can spread your investments across traditional and digital markets.

Cost Structure: Trading costs include competitive spreads that start at 0.1 pips with no commissions, which could cost you less overall compared to brokers that charge commissions, though we need more details about spread ranges for different instruments.

Leverage Provisions: Maximum leverage goes up to 1:500, which gives you big opportunities to amplify your capital but requires careful risk management because of the increased exposure.

Platform Technology: MT5 serves as the main trading system and offers advanced charting, algorithmic trading support, and comprehensive market analysis tools that are standard in the MetaTrader system.

Geographic Restrictions: We don't have specific information about which countries can't use their services or regional limitations.

Customer Support Languages: The sources we found don't say which languages customer service supports.

This orjin capital review shows that potential traders need to check these details directly with the broker because there isn't much complete public information available.

Orjin Capital does really well with account access and trading settings, earning high scores for its trader-friendly approach to account minimums and leverage options. The broker's choice to use a 0.01 micro lot minimum position size removes traditional barriers that often stop new traders from entering the forex market, while also letting experienced traders use precise position sizing strategies.

The 1:500 maximum leverage ratio puts the broker in a good competitive position within the high-leverage part of the retail forex market, especially appealing to traders who want amplified market exposure. This leverage level requires careful risk management but gives you flexibility for various trading strategies from scalping to swing trading.

However, this orjin capital review notes that available information lacks detailed descriptions of specific account types, Islamic account availability, or tiered account structures that might offer better features for traders who trade more. The absence of complete account opening process information and verification requirements also limits our ability to fully judge the user onboarding experience.

Additional account features like negative balance protection, margin call levels, and stop-out percentages need direct verification with the broker, representing areas where transparency could be better to help potential clients understand risk management settings.

The broker's technology setup centers around the MetaTrader 5 platform, which provides a solid foundation for professional trading activities. MT5's complete feature set includes advanced charting capabilities, multiple timeframe analysis, custom indicator support, and automated trading functionality through Expert Advisors, meeting the technical needs of both manual and algorithmic traders.

The platform's multi-asset capability works well with Orjin Capital's diverse instrument offerings across forex, commodities, indices, stocks, and cryptocurrencies, giving traders a unified interface for portfolio diversification strategies. MT5's mobile application support ensures trading access across devices, though specific customization or proprietary tools offered by Orjin Capital remain undocumented.

However, available information lacks detail about additional research resources, market analysis provision, economic calendar integration, or educational materials that could make the trading experience better. The absence of documented trading signals, expert commentary, or fundamental analysis resources represents a potential limitation compared to full-service brokers.

Third-party integration capabilities, VPS services, and API access for institutional traders also need clarification, as these features increasingly influence broker selection among sophisticated market participants seeking comprehensive trading ecosystems.

Customer service evaluation presents big challenges because of limited available information about Orjin Capital's support infrastructure and service delivery standards. The absence of detailed information about contact methods, operating hours, and response time commitments prevents comprehensive assessment of the broker's client service capabilities.

Industry standards typically include multiple communication channels such as live chat, email support, telephone assistance, and potentially social media engagement, but specific availability of these options remains unclear. The lack of documented support hours is particularly concerning for traders operating across different time zones who need assistance during their active trading periods.

Multi-language support capabilities, which are crucial for international brokers serving diverse client bases, also lack clear documentation. This absence of transparency about communication options and language availability may indicate limited support infrastructure or insufficient marketing disclosure of existing services.

The broker's approach to handling client complaints, dispute resolution procedures, and escalation processes remains undocumented, representing important considerations for traders evaluating long-term platform relationships and potential issue resolution scenarios.

Orjin Capital's trading environment shows strong technical fundamentals through its MT5 platform implementation and competitive cost structure. The minimum spread of 0.1 pips represents an attractive offer for cost-conscious traders, particularly when combined with the zero-commission model that eliminates per-trade fees common among many competitors.

The MT5 platform's reputation for stability, execution speed, and comprehensive functionality provides confidence in the technical trading experience, though specific performance metrics such as average execution speeds, slippage statistics, and uptime percentages require verification through actual trading or broker disclosure. Order execution quality, while dependent on MT5's infrastructure capabilities, benefits from the platform's advanced order management features including pending orders, stop losses, and take profit functionality.

The platform's support for multiple order types and partial fills accommodates various trading strategies from scalping to position trading. However, this orjin capital review notes that real-world performance verification remains limited due to insufficient user feedback and trading experience reports.

Mobile trading capabilities through MT5's mobile application should provide adequate functionality, though any broker-specific customizations or proprietary mobile features remain undocumented.

The trust and safety evaluation reveals the most significant concerns in our orjin capital review, primarily stemming from the absence of clear regulatory authorization from recognized financial supervisory authorities. This regulatory uncertainty creates substantial questions about client fund protection, operational oversight, and recourse mechanisms in case of disputes or platform issues.

Established financial centers typically require brokers to maintain segregated client accounts, participate in compensation schemes, and submit to regular auditing processes that protect trader interests. The lack of verified regulatory status raises questions about whether such protective measures are in place at Orjin Capital.

Fund security measures, including client money segregation, bank partnerships, and insurance coverage, require clarification to assess the safety of deposited funds. The absence of documented relationships with tier-one banks or established payment processors may indicate limited institutional backing or insufficient operational maturity.

Company transparency metrics such as published financial statements, regulatory filings, or third-party audits that could provide insight into operational stability and financial health remain unavailable in public documentation. This opacity contrasts unfavorably with regulated brokers that maintain transparent reporting standards and public accountability measures.

User experience assessment faces significant limitations due to the absence of substantial user feedback and the broker's recent market entry. The zero user rating mentioned in available sources prevents meaningful analysis of real-world platform performance, customer satisfaction levels, and common user experiences or complaints.

The account registration and verification processes, which significantly impact initial user experience, lack detailed documentation regarding required documentation, processing timeframes, and potential complications. Streamlined onboarding procedures are crucial for user satisfaction, particularly among new traders who may be unfamiliar with forex industry standards.

Platform usability beyond MT5's standard interface requires evaluation of any broker-specific modifications, custom tools, or enhanced features that might differentiate the user experience. The absence of documented proprietary tools or platform enhancements suggests a standard MT5 implementation without significant customization.

Fund management experiences, including deposit processing times, withdrawal procedures, and associated fees, remain undocumented and require direct verification. These operational aspects significantly influence user satisfaction and platform viability for active traders who require efficient capital management capabilities.

This comprehensive orjin capital review reveals a broker with attractive trading conditions but significant transparency and regulatory concerns. While Orjin Capital offers competitive spreads starting at 0.1 pips, zero-commission trading, and high leverage up to 1:500 through the reliable MT5 platform, the absence of clear regulatory oversight and limited user feedback present substantial considerations for potential clients.

The broker appears most suitable for experienced traders who prioritize trading conditions over regulatory assurance, and new traders attracted by low minimum deposits who understand the associated risks. However, traders prioritizing regulatory protection, comprehensive support services, and established track records may find better alternatives among more established, regulated brokers.

Key advantages include competitive cost structures and accessible account requirements, while primary disadvantages center on regulatory uncertainty and limited operational transparency. Prospective clients should carefully weigh these factors against their individual risk tolerance and trading requirements before proceeding.

FX Broker Capital Trading Markets Review