LEIWOW FX 2025 Review: Everything You Need to Know

Executive Summary

LEIWOW FX is a controversial forex broker that presents traders with a mixed bag of opportunities and concerns. This leiwow fx review reveals a brokerage that offers MetaTrader 4 and MetaTrader 5 trading platforms alongside CFD and forex trading capabilities, yet faces significant scrutiny regarding its regulatory status and business practices.

The broker primarily targets traders seeking diversified trading instruments, including forex, CFDs, indices, and commodities. However, according to multiple industry reports, LEIWOW FX has been flagged for falsely claiming to possess legitimate regulatory licenses. This raises serious questions about its credibility and operational transparency.

User feedback presents a polarized picture, with some traders appreciating the platform's technical offerings while others express concerns about high-risk investment practices and questionable business conduct. The regulatory information available suggests that LEIWOW FX operates without proper licensing. This makes it a potentially risky choice for serious traders.

Given the mixed reviews and regulatory concerns, potential clients should exercise extreme caution when considering LEIWOW FX as their trading partner. While the broker offers familiar trading platforms and various asset classes, the lack of proper regulatory oversight and negative user experiences significantly impact its overall reliability rating.

Important Disclaimers

This leiwow fx review is based on publicly available information and user feedback collected from various industry sources. Cross-regional entity differences may apply, as LEIWOW FX may operate under different regulatory frameworks or restrictions depending on the trader's location.

The evaluation methodology relies on user testimonials, regulatory reports, and publicly accessible broker information rather than direct testing or on-site investigation. Traders should conduct their own due diligence and consider current regulatory status before making any investment decisions with this broker.

Rating Overview

Broker Overview

LEIWOW FX operates as a forex and CFD trading broker, positioning itself as a provider of diverse trading opportunities for retail investors. While specific information about the company's establishment date and founding background remains unclear in available documentation, the broker has developed a presence in the online trading space by offering access to popular trading platforms and various financial instruments.

The company's primary business model revolves around providing access to forex markets, CFDs, indices, and commodities trading through established platforms like MetaTrader 4 and MetaTrader 5. According to various industry sources, LEIWOW FX markets itself as offering "safe and secure" trading environments. However, this claim has been disputed by regulatory watchdogs and user review platforms.

This leiwow fx review must note that the broker's operational transparency remains limited, with crucial details about company registration, management team, and financial backing not readily available through official channels. The lack of comprehensive corporate information raises questions about the broker's commitment to transparency and regulatory compliance. These are essential factors for trader confidence in today's regulated forex market environment.

Regulatory Status: Available information indicates that LEIWOW FX faces significant regulatory challenges, with reports suggesting the broker falsely claims to possess legitimate licenses from recognized financial authorities.

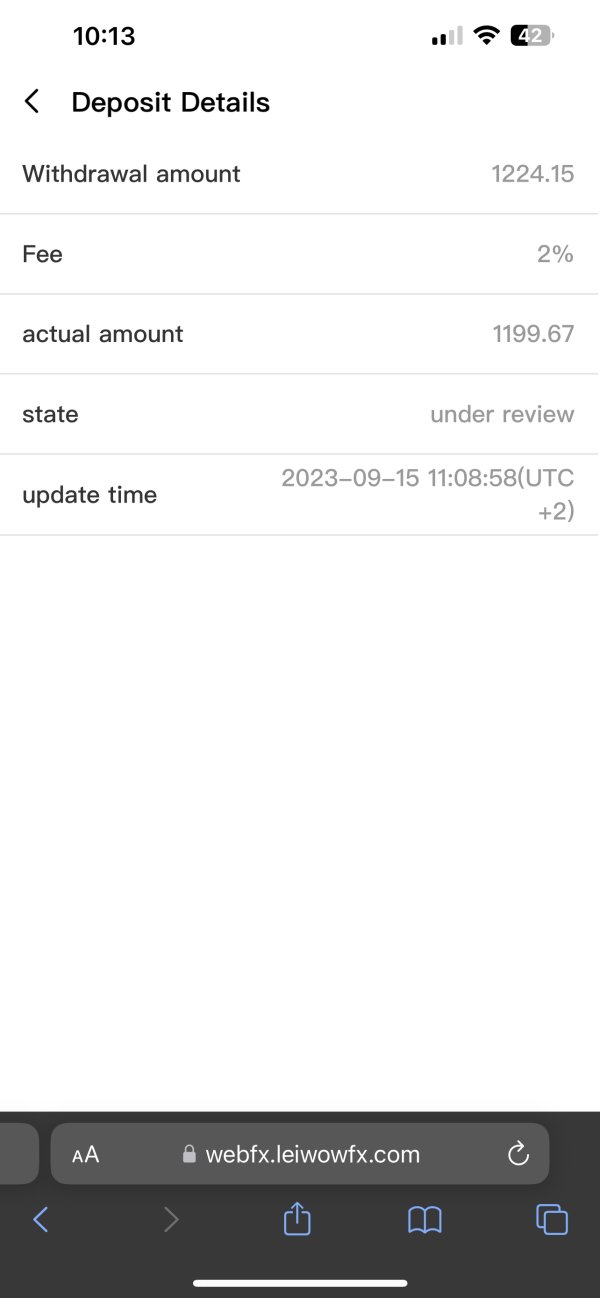

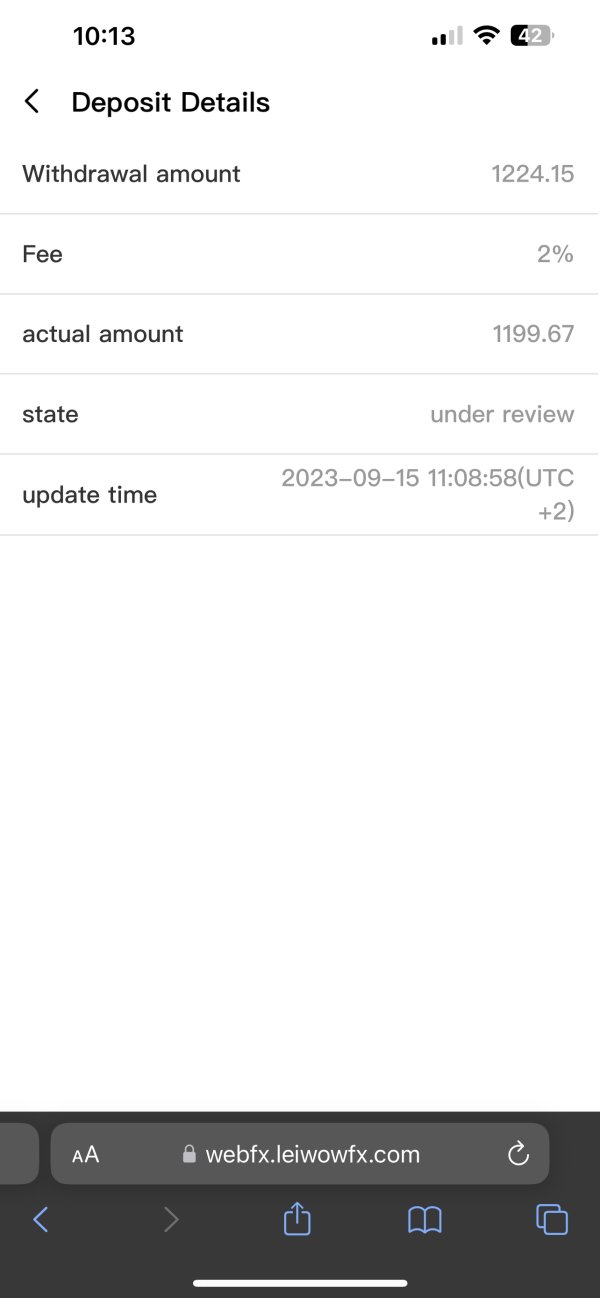

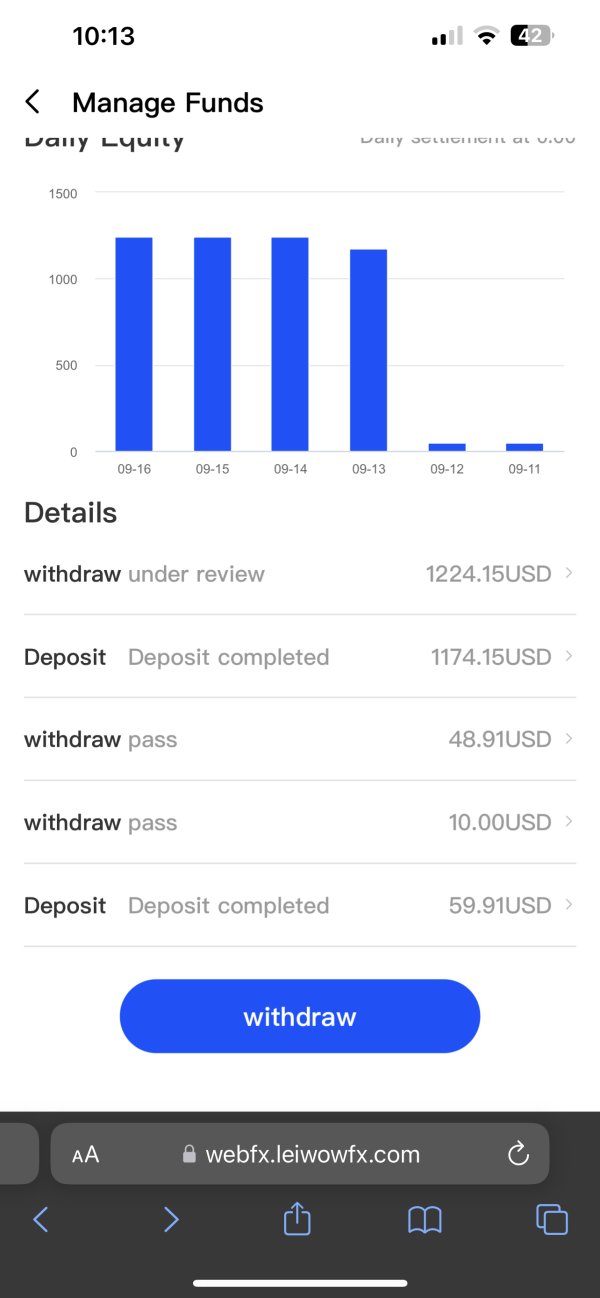

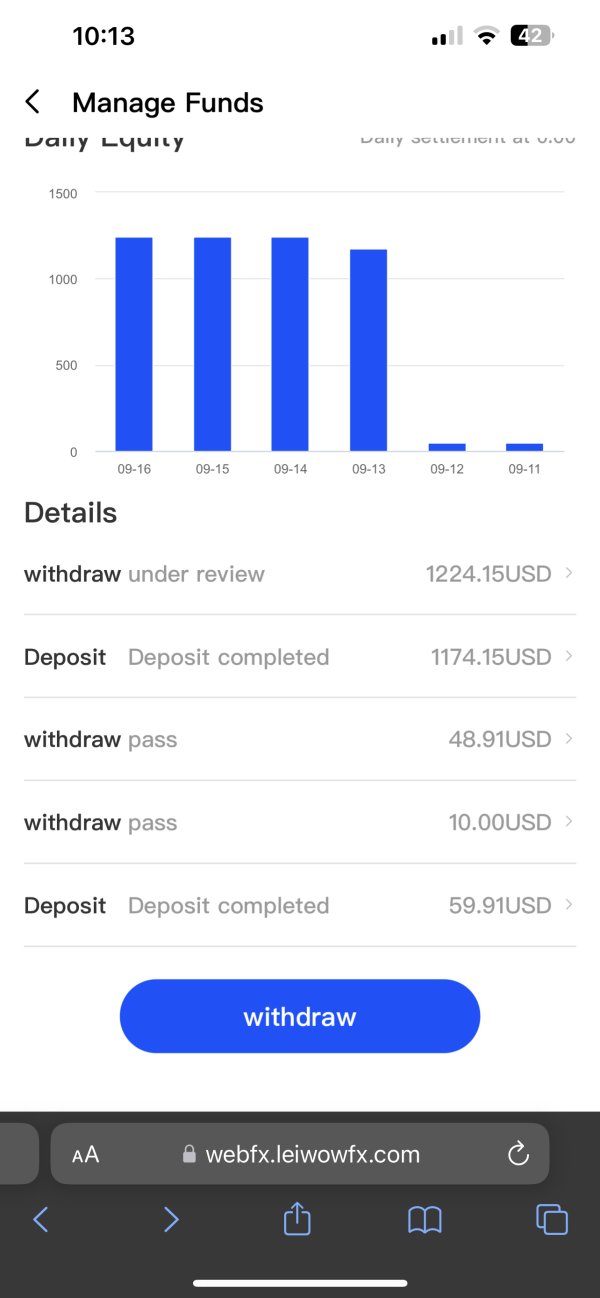

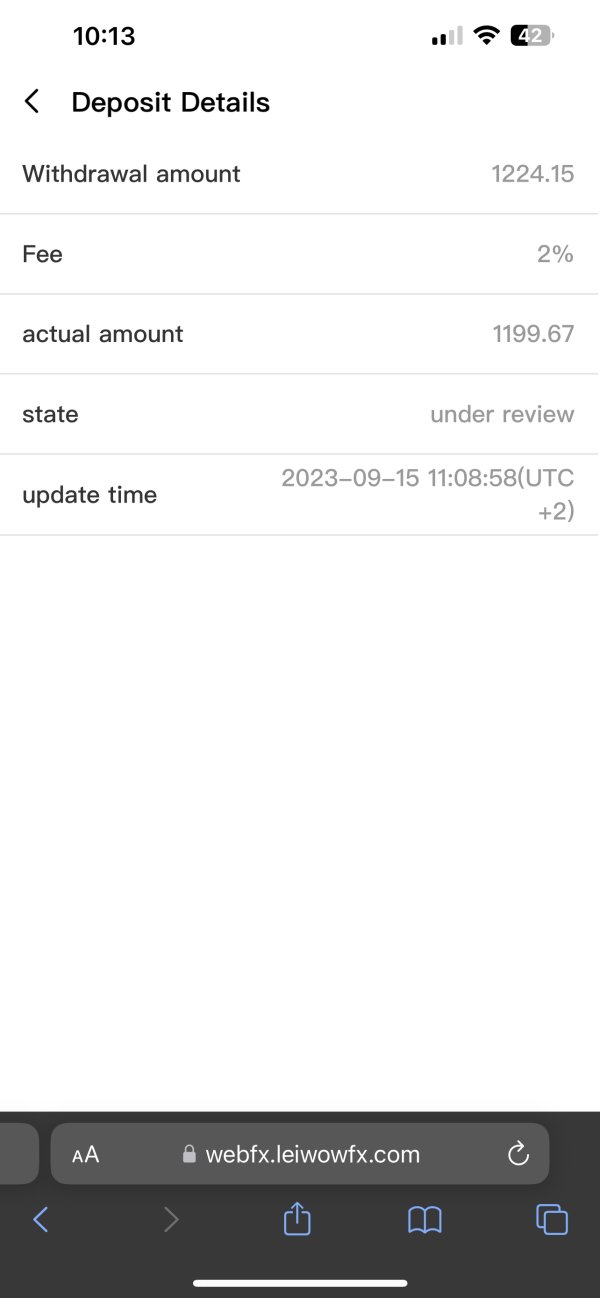

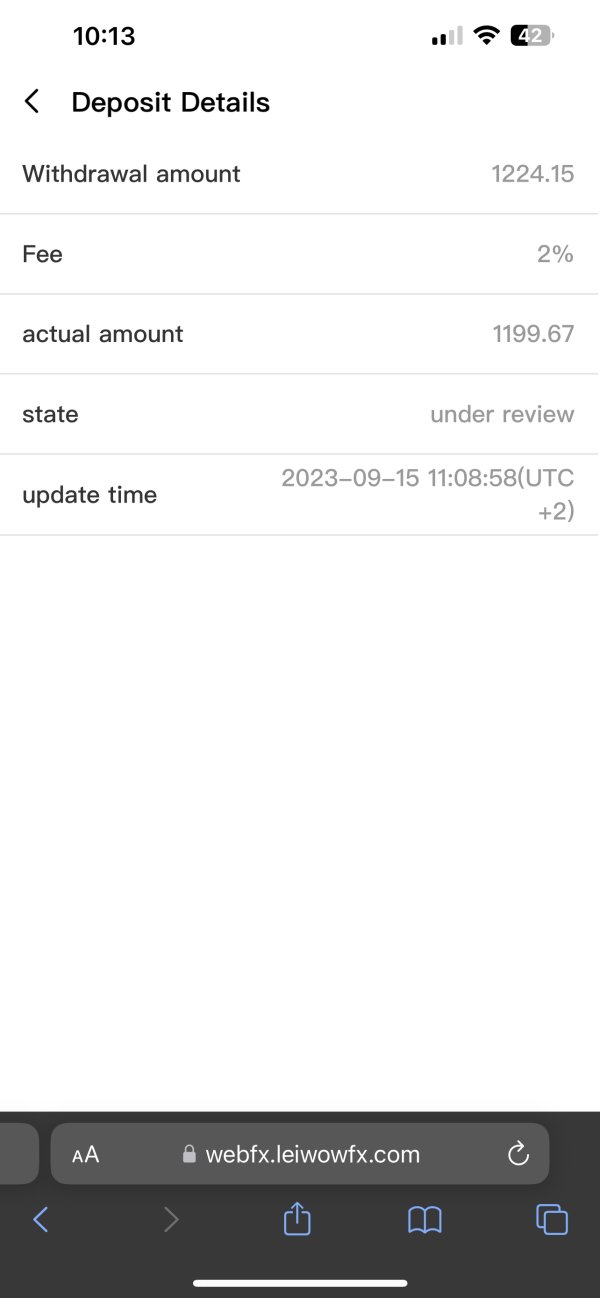

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and associated fees is not detailed in available documentation. This creates uncertainty for potential clients regarding fund management.

Minimum Deposit Requirements: The exact minimum deposit amount required to open an account with LEIWOW FX is not specified in current available materials. This makes it difficult for traders to assess accessibility.

Promotional Offers: Details about bonuses, promotional campaigns, or special trading incentives are not clearly outlined in the broker's publicly available information.

Tradeable Assets: LEIWOW FX offers access to forex pairs, CFDs, indices, and commodities. This provides traders with a relatively diverse selection of financial instruments across different market sectors.

Cost Structure: Specific information about spreads, commissions, overnight fees, and other trading costs is not comprehensively detailed in available sources. This limits transparency regarding the true cost of trading.

Leverage Options: Maximum leverage ratios and margin requirements are not specifically mentioned in current documentation. This is concerning for risk management purposes.

Platform Options: The broker supports MetaTrader 4 and MetaTrader 5 platforms. This offers traders access to industry-standard trading software with technical analysis tools and automated trading capabilities.

Geographic Restrictions: Information about restricted countries or regional limitations is not clearly specified in available materials.

Customer Support Languages: The range of supported languages for customer service is not detailed in current documentation. This leiwow fx review notes this as a transparency gap.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

LEIWOW FX's account conditions present several concerns that contribute to its below-average rating in this category. The broker's lack of transparency regarding account types, minimum deposit requirements, and specific terms and conditions creates uncertainty for potential traders seeking clear information about what to expect when opening an account.

Available information does not detail the variety of account types offered. This makes it impossible to assess whether the broker caters to different trader experience levels or investment capacities. The absence of clear minimum deposit information further complicates the evaluation process, as traders cannot determine accessibility thresholds.

User feedback suggests that the account opening process may involve complications, with some traders reporting difficulties in understanding the full scope of terms and conditions. The lack of detailed fee structures and account maintenance costs in publicly available information indicates poor transparency standards compared to reputable brokers in the industry.

The overall account conditions appear to lack the comprehensive documentation and clear communication that experienced traders expect from professional forex brokers. This leiwow fx review finds that the broker's approach to account management information falls short of industry standards. This contributes to user uncertainty and potential dissatisfaction with the onboarding experience.

LEIWOW FX receives an average rating for tools and resources, primarily due to its provision of MetaTrader 4 and MetaTrader 5 platforms, which are industry-standard trading software solutions. These platforms offer traders access to comprehensive charting tools, technical indicators, and automated trading capabilities through Expert Advisors.

The availability of both MT4 and MT5 platforms provides traders with flexibility in choosing their preferred trading environment, as each platform offers distinct advantages for different trading styles. MT4 remains popular for its simplicity and extensive community support, while MT5 offers more advanced features and improved performance capabilities.

However, the broker appears to lack comprehensive educational resources, market analysis tools, and research materials that many reputable brokers provide to support trader development. The absence of detailed information about additional trading tools, market commentary, or educational content suggests limited commitment to trader education and support beyond basic platform access.

User feedback indicates that while the core trading platforms function adequately, the overall package of tools and resources feels incomplete compared to more established brokers. The lack of proprietary tools, advanced analytics, or comprehensive market research capabilities limits the broker's appeal to serious traders seeking a complete trading environment.

Customer Service and Support Analysis (Score: 5/10)

Customer service and support at LEIWOW FX receives an average rating based on mixed user feedback and limited transparency about support capabilities. Available information does not clearly outline the specific customer service channels, operating hours, or response time commitments that traders can expect when seeking assistance.

User reviews present varied experiences with customer support, with some traders reporting adequate assistance while others express frustration with response times and problem resolution effectiveness. The lack of detailed information about support languages, availability schedules, and escalation procedures suggests potential gaps in service delivery standards.

The broker's approach to customer communication appears inconsistent, with some users noting difficulties in reaching support representatives during critical trading periods. This inconsistency in service delivery can be particularly problematic for traders who require immediate assistance with technical issues or account-related concerns.

Without comprehensive information about support infrastructure, training programs for support staff, or service level agreements, it becomes challenging to assess the true quality and reliability of customer service. The overall customer support experience appears to meet basic requirements but falls short of the comprehensive, professional support standards that serious traders expect from their chosen broker.

Trading Experience Analysis (Score: 5/10)

The trading experience with LEIWOW FX presents a mixed picture that earns an average rating due to platform availability balanced against concerns about execution quality and overall reliability. The broker's use of MetaTrader platforms provides traders with familiar, tested trading environments that support various trading strategies and styles.

User feedback regarding platform stability and execution speed shows varied experiences, with some traders reporting satisfactory performance while others note concerns about order execution quality during volatile market conditions. The lack of specific data about average execution speeds, slippage rates, or fill ratios makes it difficult to assess the broker's technical performance objectively.

The trading environment appears to support basic trading needs through the MT4 and MT5 platforms, offering access to standard order types, charting capabilities, and automated trading features. However, users report inconsistent experiences with spread stability and pricing transparency, which can impact overall trading satisfaction.

This leiwow fx review notes that while the core trading functionality meets basic requirements, the overall trading experience lacks the polish and reliability that serious traders seek. The absence of detailed performance metrics and mixed user feedback suggests that trading conditions may not consistently meet professional standards. This is particularly true during high-impact market events.

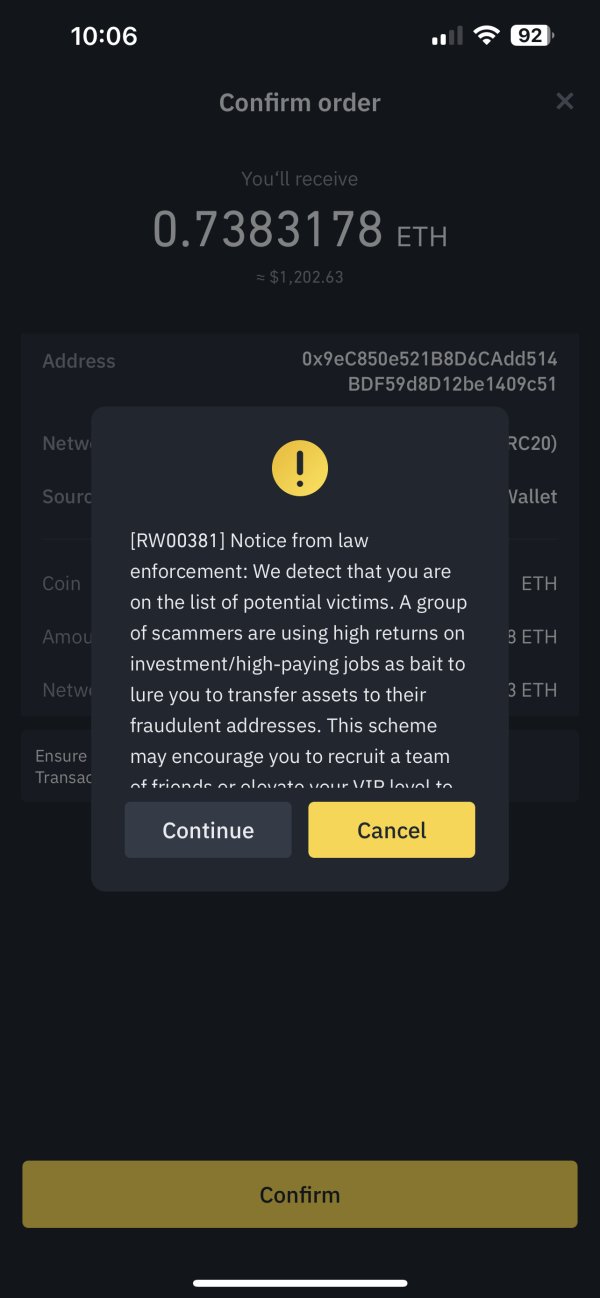

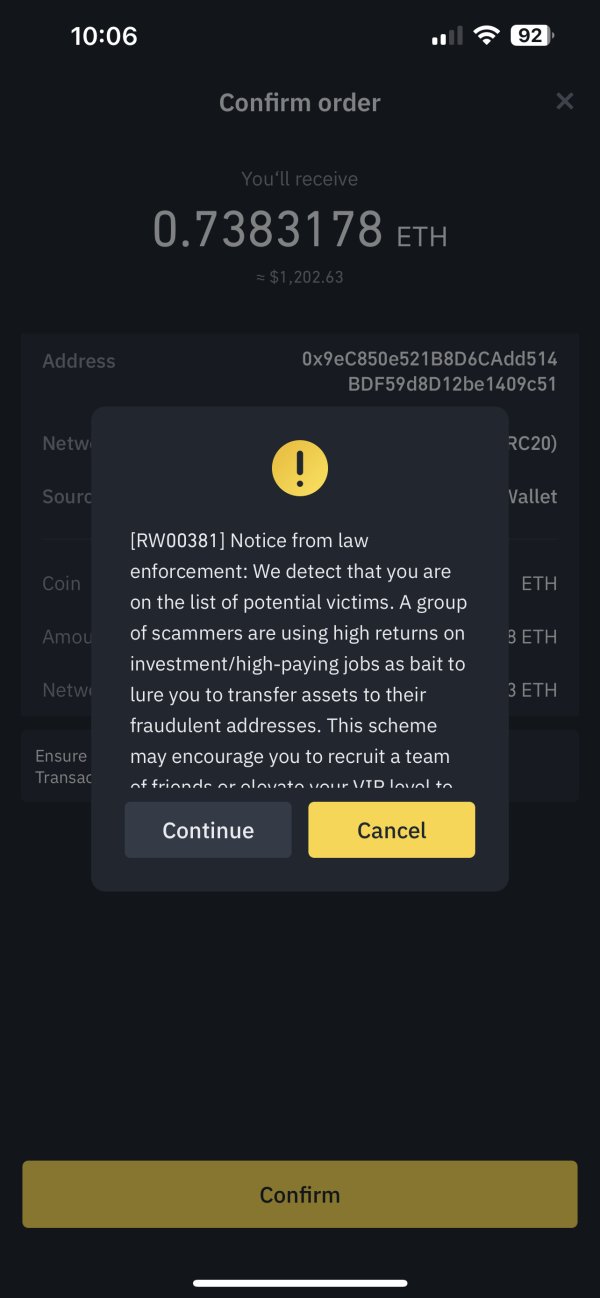

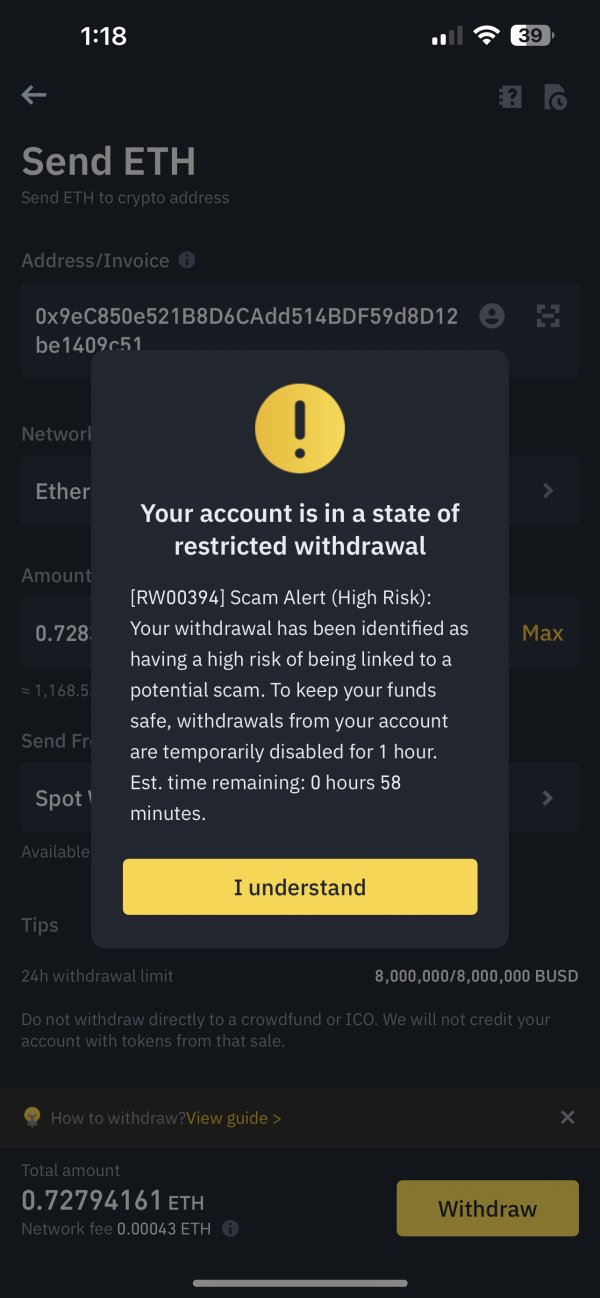

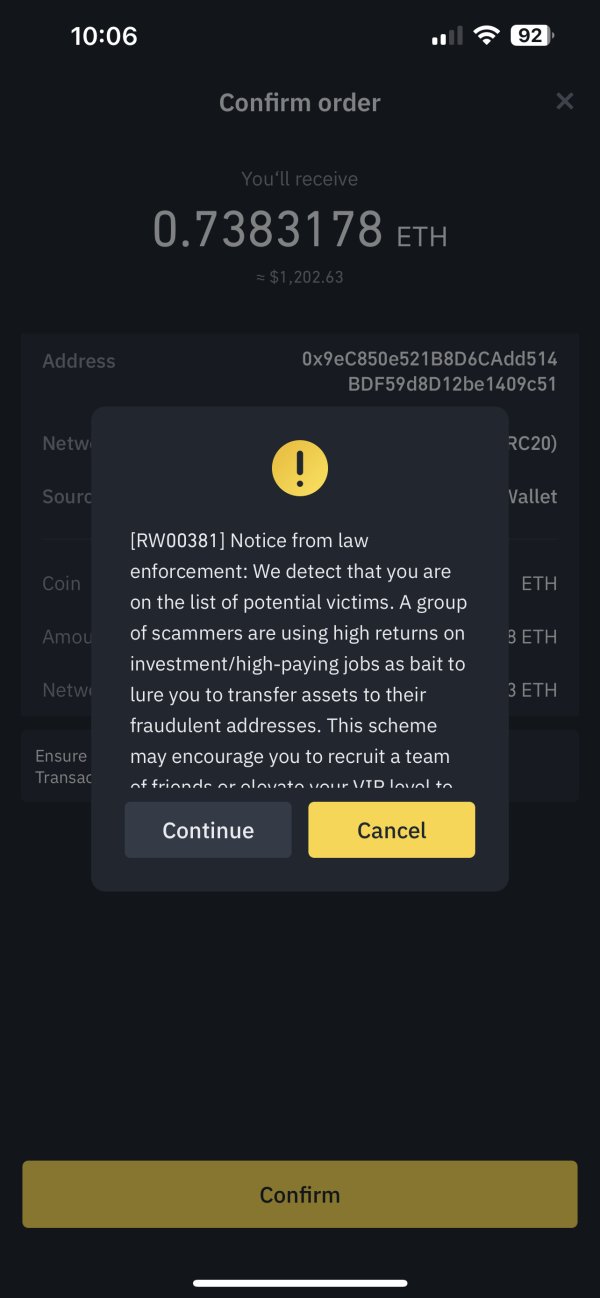

Trust and Reliability Analysis (Score: 3/10)

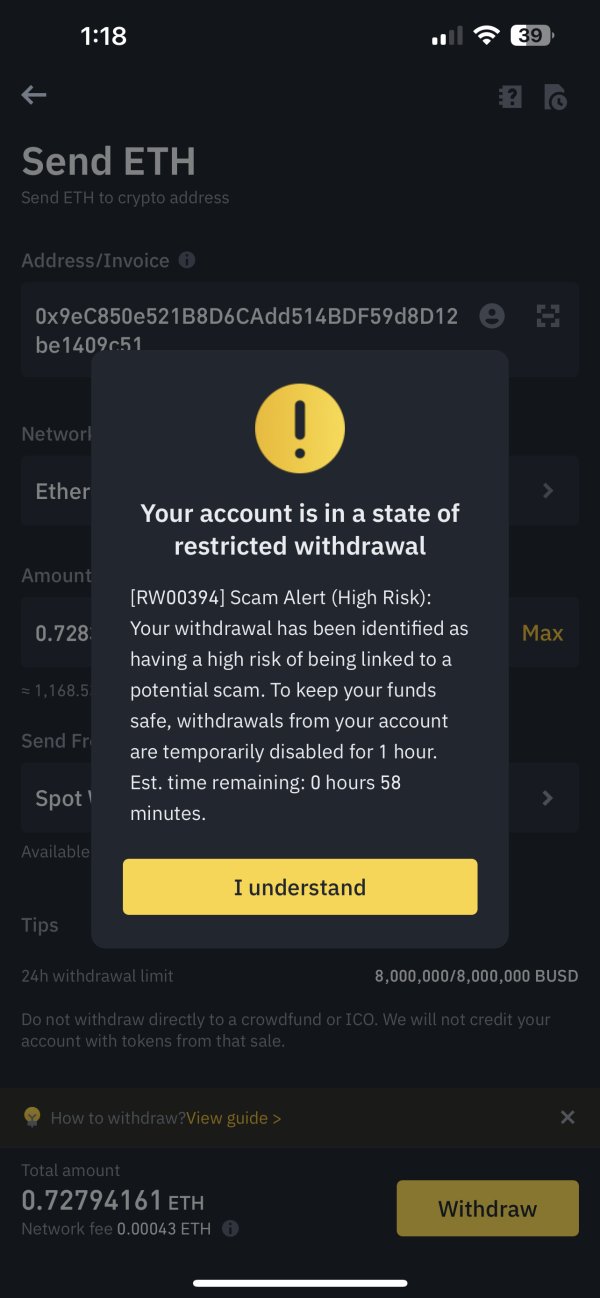

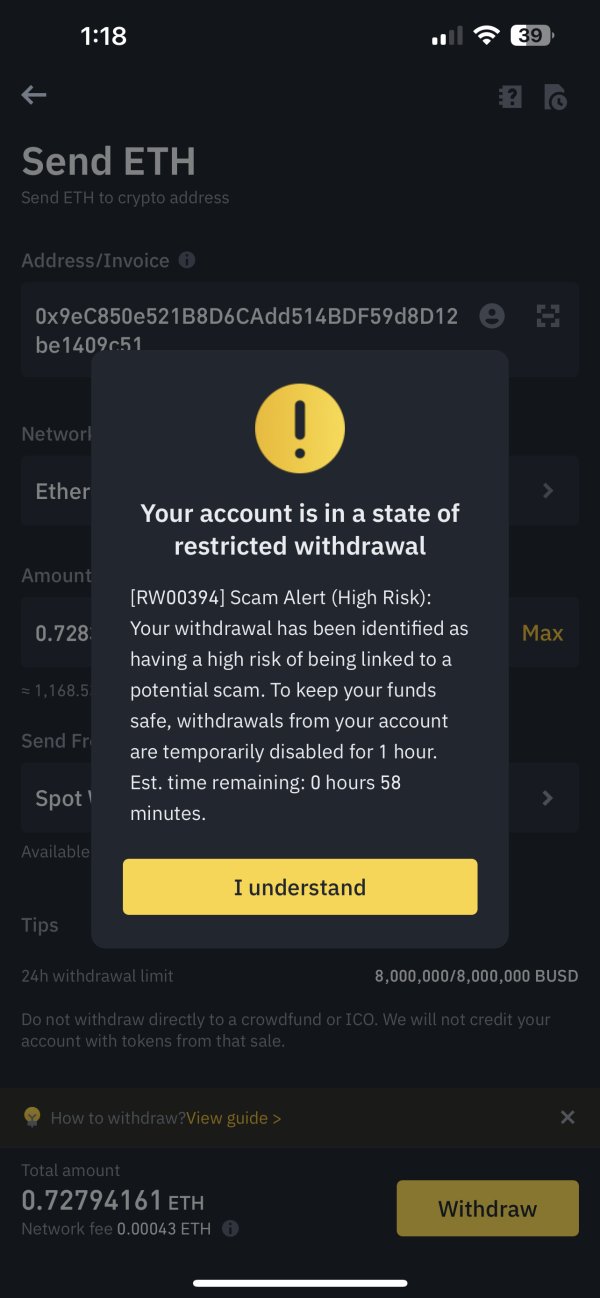

Trust and reliability represent LEIWOW FX's weakest areas, earning a poor rating due to significant regulatory concerns and questionable business practices. Multiple industry sources report that LEIWOW FX has been accused of falsely claiming to possess legitimate regulatory licenses, which represents a fundamental breach of industry trust standards.

The regulatory status concerns are particularly troubling, as proper licensing and oversight are essential components of a trustworthy forex broker. Reports suggesting that the broker operates without appropriate regulatory authorization raise serious questions about client fund safety, operational oversight, and legal recourse options for traders.

Available information does not detail specific fund protection measures, segregated account policies, or insurance coverage that would typically provide trader protection. The absence of clear regulatory oversight means traders lack the standard protections that licensed brokers must provide under established financial regulations.

Industry reputation appears significantly damaged by negative reviews and regulatory warnings, with multiple sources flagging the broker as potentially problematic. The combination of regulatory concerns, limited transparency, and negative industry feedback creates a trust profile that falls well below acceptable standards for serious forex trading activities.

User Experience Analysis (Score: 4/10)

User experience with LEIWOW FX receives a below-average rating due to mixed feedback that reveals significant concerns alongside some positive aspects. The overall user satisfaction appears compromised by issues related to transparency, communication, and service delivery consistency.

Trader feedback presents a polarized picture, with experiences ranging from acceptable platform functionality to serious concerns about business practices and customer treatment. The lack of clear information about user interface design, account management features, and overall service quality contributes to uncertainty about what new users can expect.

Common user complaints focus on high-risk investment practices, inadequate customer support responsiveness, and concerns about the broker's legitimacy and regulatory status. These fundamental issues significantly impact user confidence and satisfaction with the overall service experience.

The registration and verification process appears to lack the streamlined efficiency that modern traders expect, with some users reporting complications in account setup and documentation requirements. Fund management experiences show mixed results, with varying reports about deposit and withdrawal processes that suggest inconsistent service delivery standards.

Conclusion

This comprehensive leiwow fx review reveals a broker that presents significant risks alongside limited benefits for potential traders. LEIWOW FX offers access to industry-standard MetaTrader platforms and a range of trading instruments, but these advantages are overshadowed by serious regulatory concerns and trust issues that make it unsuitable for most serious traders.

The broker's main strengths include platform diversity and asset variety, but these are insufficient to overcome fundamental weaknesses in regulatory compliance, transparency, and customer protection. The poor trust rating and below-average user experience indicate systemic issues that extend beyond minor service shortcomings.

For traders seeking reliable, regulated, and transparent forex trading services, LEIWOW FX does not meet professional standards. The regulatory concerns and mixed user feedback suggest that traders would be better served by choosing established, properly licensed brokers that prioritize client protection and regulatory compliance.