jetafx 2025 Review: Everything You Need to Know

1. Summary

In this jetafx review, we analyze a forex broker that started in early 2024. The company quickly got attention from traders. Jetafx is registered in Saint Lucia and works without any regulatory oversight, which has led to mixed feedback from users. Many people praise how fast they process withdrawals, which usually takes 4 to 5 hours. They also like that the broker offers the advanced MT5 trading platform. However, some users have reported problems with getting their money out and worry about how transparent the company really is.

The broker lets you trade many different types of assets like forex, stocks, indices, commodities, and futures. But since they don't have regulation, this raises questions about legal protection and increases risk for traders. This review is meant for traders who want to trade different types of assets and are okay with taking higher risks. All our opinions and ratings come from public data and user feedback, so potential investors should do their own research before working with Jetafx.

2. Important Considerations

Jetafx is registered in Saint Lucia and has no regulation. This may put traders at risk because they don't have enough legal protection and could face fraud. Our review is based only on user feedback that's been published and information that's available to the public.

Different regions might have different experiences because laws vary from place to place. We created this review by carefully collecting user experiences and checking trusted online sources. You should treat our conclusions as helpful information, not as definitive investment advice. We encourage readers to look for more information before starting any business relationships.

3. Scoring Framework

4. Broker Overview

Jetafx was founded on January 3, 2024. It's a forex broker registered in Saint Lucia. Even though the company hasn't been around very long, it has gotten attention because of its modern approach to trading services.

Jetafx mainly offers trading in forex and other financial products like stocks, indices, commodities, and futures. However, the fact that it's not regulated is still a big concern. Since no reputable regulatory bodies watch over them, potential traders should be careful. The broker focuses on providing a simple trading environment, but they don't share enough details about how they operate, which has led to mixed reviews from traders.

Building on what it promised at the start, Jetafx says it provides complete trading services. The broker uses the MT5 platform, which is well-known for its advanced charts and strong order processing. You can trade forex pairs, various indices, some stocks, commodities, and futures contracts, which appeals to many different types of clients. But the fact that they don't have any formal regulatory approval is still a big problem.

As we noted in this jetafx review, this lack of oversight, plus some withdrawal problems that users have reported, might worry investors who don't like taking risks. Overall, while Jetafx offers innovative tools and processes withdrawals quickly, their way of operating means you need to be careful and make well-informed investment decisions.

Regulatory Region

Jetafx is registered in Saint Lucia and works without oversight from any recognized regulatory authority. This unregulated status creates potential legal risk for traders because there's limited investor protection in place.

Since no regulatory bodies watch them, the broker's internal policies and risk management practices stay mostly hidden.

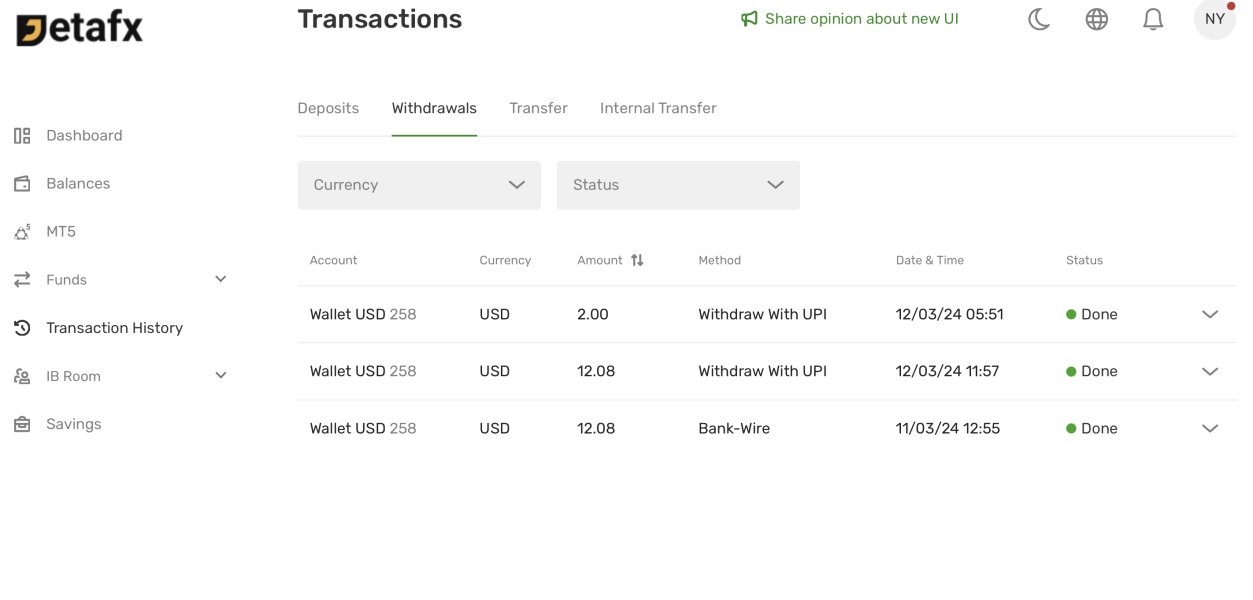

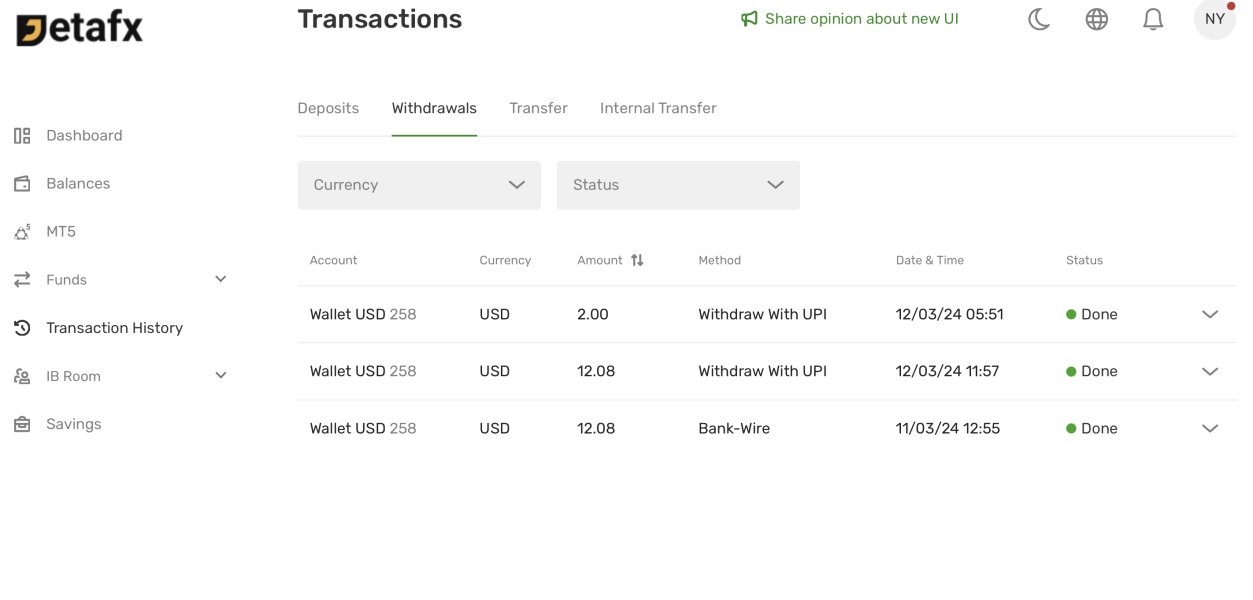

Deposit and Withdrawal Methods

The information we have doesn't explain the specific deposit and withdrawal methods that Jetafx offers. Details about how they process funds, what payment options they accept, or any fees they charge haven't been clearly provided in the materials we found.

Minimum Deposit Requirement

There's no clear information about the minimum deposit you need to open an account with Jetafx. Since they don't specify deposit thresholds, potential traders don't know how much money they need to start trading.

Bonus Promotions

Right now, there's no mention of any bonus or promotional offers from Jetafx. The broker's promotional strategies, if they have any, haven't been detailed in the information we found, making it hard to assess any extra benefits for new or existing traders.

Tradable Assets

Jetafx offers many different types of tradable assets including forex pairs, indices, stocks, commodities, and futures. This diverse range is designed to work with various trading strategies and risk levels.

However, while having variety in instruments is positive, they don't provide additional details on specific asset features and pairs. This means traders should check on their own to make sure the available markets match their trading goals.

Cost Structure

Jetafx hasn't provided clear details about its cost structure, including spreads and commission rates. This lack of clarity on trading costs may make it hard for traders to figure out the real expense of making trades.

Without clear information on the fee structure, traders have to rely on stories from other users, which suggests that costs might vary. Not being able to compare these costs with other brokers makes it even more important to be careful when considering this broker.

Leverage Ratio

No specific details about the leverage ratios that Jetafx offers are available. Not having this key information leaves traders without guidance on how the broker manages risk in volatile markets or how they might leverage their positions.

Platform Choices

Jetafx only offers the MT5 trading platform, which is known for its complete set of analytical tools, automated trading capabilities, and overall strong performance. While the MT5 platform is well-regarded in the industry, only having one platform may limit traders who want additional features or different user interfaces.

Regional Restrictions

There's no detailed information about any specific regional restrictions that Jetafx imposes. Since they don't clearly state geographic limitations, potential traders must contact the broker directly to find out if they can legally access the trading platform from their country.

Customer Service Languages

Details about the languages that Jetafx's customer service supports aren't provided in the available information. This lack of clarity may affect people who don't speak English as their first language or those from different linguistic backgrounds who need support in their preferred language.

6. Detailed Scoring Analysis

6.1 Account Conditions Analysis

The account conditions that Jetafx offers remain one of its least transparent aspects. In this jetafx review, the broker doesn't provide clear details about spreads, commissions, or the minimum deposit required to open an account.

There's no sign of different account types that might work for different trading needs. There's also no information on whether any specialized accounts are available. The account opening process details are also minimal, leaving traders to guess about things like verification procedures or processing times.

Users haven't reported any innovative features or competitive advantages when it comes to account management. Not having this information can discourage those who need detailed insights before opening an account. When compared with more established brokers, the lack of transparency in account conditions makes it hard for traders to fully assess the cost and risk implications of trading on Jetafx. Overall, the limited disclosure and absence of specific details on account conditions warrant a low score for this dimension.

Jetafx's main offering for tools and resources is its MT5 trading platform, which is a well-known and strong system in the industry. However, this jetafx review points out that they provide limited additional tools.

Although the MT5 platform includes advanced charting functions, technical analysis tools, and support for automated trading, the broker doesn't detail any extra research or educational resources that traders might find valuable. There's no mention of their own analytical tools, market news feeds, or educational content that could help less experienced traders. Furthermore, while the core functionality of MT5 meets the expectations of many active traders, not discussing mobile trading capabilities or integration of third-party tools leaves room for improvement.

Without a more diverse suite of resources, Jetafx depends only on the MT5 platform. Although it's reputable, it may not fully serve those who want a broader range of options or who need enhanced support resources. This limitation reduces the overall score in the tools and resources category.

6.3 Customer Service and Support Analysis

When assessing customer service and support, this jetafx review shows a mixed picture. Some users have noted that Jetafx processes withdrawals with reasonable speed, but there are also reports that customer support responses can be only average.

Not having clear contact details or specific support channels—whether through live chat, phone, or email—makes it hard to evaluate service quality. Traders looking for multi-language support or extended service hours may find the support infrastructure lacking, as there's little to no detailed information on operational hours or the depth of technical assistance available. Additionally, without precise case studies of problem resolution or testimonials highlighting exceptional support experiences, it's challenging to gauge the true responsiveness and reliability of the broker's customer service team.

Overall, while the promptness in processing withdrawals is a noted positive, the general service level doesn't make us feel confident that they provide strong support throughout the trading journey.

6.4 Trading Experience Analysis

The trading experience that Jetafx provides appears to be a mix of positives and negatives. Users have praised the broker for its fast withdrawal times, with funds typically processed within 4 to 5 hours—a significant advantage in the fast-paced trading environment.

Additionally, using the MT5 platform ensures that traders have access to a well-established, feature-rich interface known for high-performance order execution and advanced analytical capabilities. However, there are reports of occasional difficulties related to withdrawal procedures, which shows potential inconsistencies in the operational process. Issues such as varying transaction times or delays in specific scenarios have been noted, though less frequently than positive experiences.

The overall user interface and trading environment seem functional, but not having detailed information about order execution quality, platform stability, and mobile access leaves room for further scrutiny. Despite the efficient processing of withdrawals being a redeeming factor, these unresolved operational issues contribute to a trading experience that is moderately positive yet needs further improvements.

6.5 Trustworthiness Analysis

When considering trustworthiness, Jetafx faces significant challenges. This jetafx review emphasizes that the broker is unregulated and registered in Saint Lucia, a factor that naturally raises red flags for many in the trading community.

Not having oversight from known regulatory bodies means that there's limited external validation of the broker's operational integrity and adherence to industry standards. With no evidence of third-party audits or endorsements from trusted financial institutions, traders are left to rely only on stories from other users and unverifiable claims about the safety of their funds. Additionally, the lack of clear disclosures about fund security protocols, segregation of client funds, or proper risk management strategies further reduces confidence.

In an industry where regulation is the same as investor protection, this unregulated status coupled with reports of withdrawal difficulties results in a low score for trustworthiness. Prospective clients must therefore exercise heightened caution and consider these factors thoroughly before investing.

6.6 User Experience Analysis

The user experience at Jetafx is decidedly mixed based on this jetafx review. On one hand, positive user feedback highlights rapid withdrawal processing times as well as the intuitive nature of the MT5 platform.

These factors contribute to a generally satisfactory trading interface and operational efficiency for many users. On the other hand, some traders have reported challenges with withdrawal procedures, ranging from processing delays in certain instances to unclear operational instructions—which can be particularly frustrating for those used to high standards of efficiency. Additionally, there's little detailed feedback available about the overall account registration process, the clarity of fee disclosures, and the ease of navigation across the trading platform.

This combination of positive and negative features leads to an average user experience score. While many users appreciate the speed and functionality associated with key trading processes, the absence of consistency in all aspects of user interaction shows the need for improvements in overall service delivery.

7. Conclusion

In conclusion, Jetafx stands as a relatively new forex broker with both notable strengths and significant drawbacks. While the fast withdrawal speed and the reputable MT5 trading platform are commendable, the overall unregulated status and occasional withdrawal issues inject a high level of risk into the trading equation.

This jetafx review advises that traders with a higher risk tolerance and those already familiar with the intricacies of unregulated markets may find value in exploring this broker. More risk-averse investors might prefer alternatives with stronger regulatory backing. As always, thorough due diligence remains imperative before committing to any broker.