FGS MARKETS Review 1

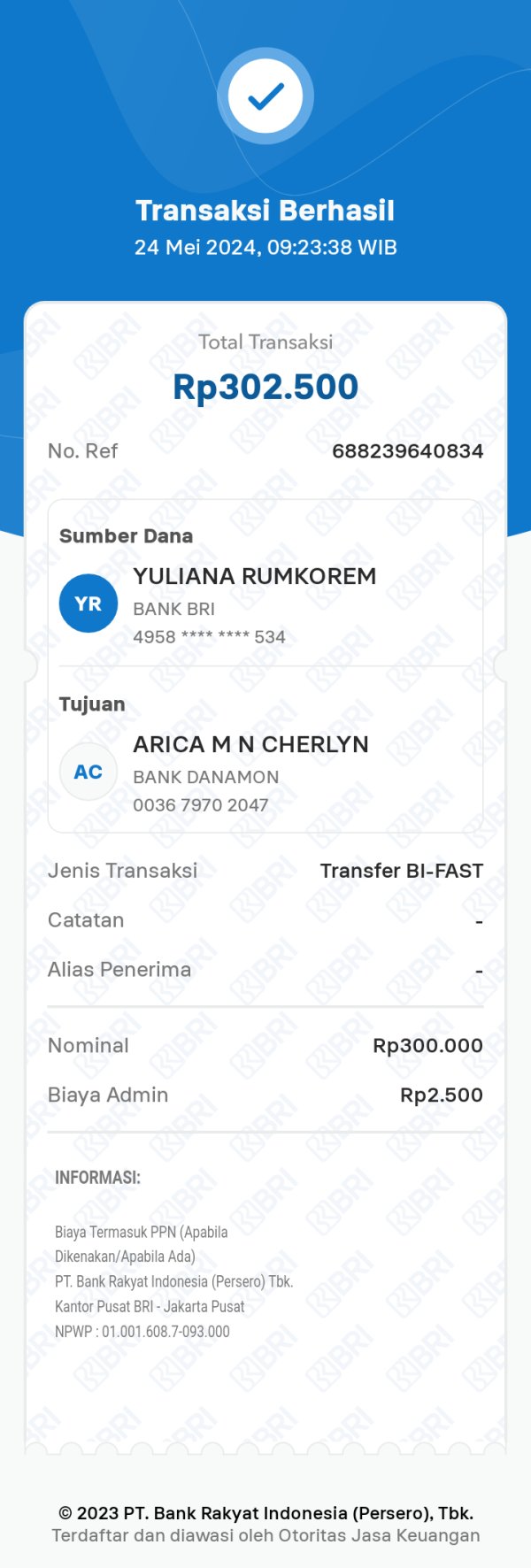

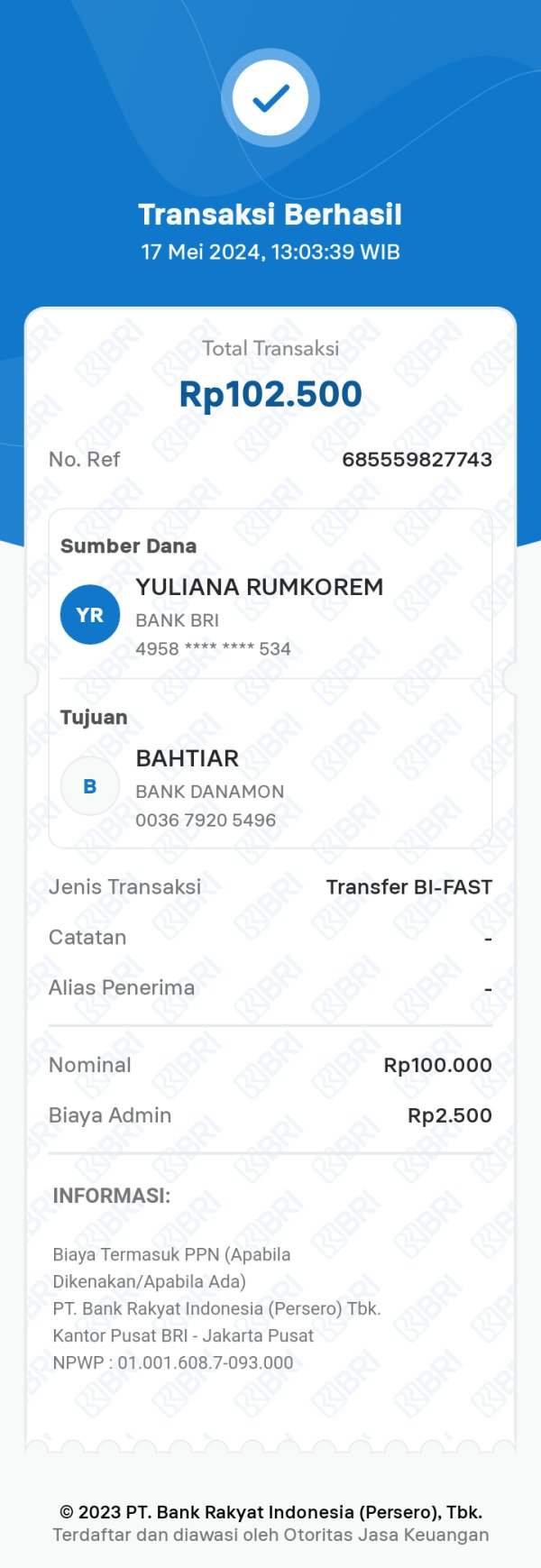

I was told to complete the task but can't withdraw the top-up.

FGS MARKETS Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Business

License

I was told to complete the task but can't withdraw the top-up.

FGS Markets shows concerning problems in the forex brokerage world. This fgs markets review finds major red flags about following rules and keeping users happy. The broker has mostly bad user reviews across many platforms, which shows serious fraud and rule-breaking risks.

The company does offer a low minimum deposit of just 1 USD and uses the popular MetaTrader 4 platform. But these good points can't make up for the lack of proper oversight and many user complaints about withdrawal problems. The broker targets traders who don't have much money and want basic access to forex markets.

However, the major rule-breaking concerns and poor user ratings mean traders should be very careful. Users keep reporting withdrawal problems and bad customer service. Information about regulations is missing from available documents, which is a big warning sign.

The low entry cost might attract new traders. But the risks are much bigger than any possible benefits for most trading situations.

FGS Markets works without clear oversight from recognized financial authorities. This creates different compliance rules depending on where you live. The lack of specific regulatory mentions in available documents suggests traders may face different protection levels based on their location.

Since regulatory transparency is limited, traders should do extra research before using this broker. This review uses user feedback and public market information, but it can't cover all possible risks. The evaluation here shows information available when this was written and may not include all changing risk factors or recent changes.

| Evaluation Category | Score | Rating Basis |

|---|---|---|

| Account Conditions | 3/10 | Minimal 1 USD deposit requirement, but lacks comprehensive account type information |

| Tools and Resources | 4/10 | MT4 platform availability, though specific trading tools and resources remain unspecified |

| Customer Service | 2/10 | Multiple user reports of withdrawal difficulties and poor customer support experiences |

| Trading Experience | 3/10 | Negative user feedback regarding slippage issues and platform performance |

| Trust and Safety | 2/10 | Absence of regulatory oversight, multiple user complaints, and fraud risk indicators |

| User Experience | 3/10 | Low user ratings and frequent withdrawal-related complaints affecting overall satisfaction |

FGS Markets started in the forex market in 2014. The company has its headquarters in Cyprus and uses an STP/ECN business model for trade execution. It positions itself as a provider of forex and CFD trading services for retail traders who want access to international currency markets.

Despite almost ten years of operation, the broker keeps a low profile in the forex community. There is limited public information about its management structure or how the company is run. The broker's main focus is providing forex and contract for difference trading through established trading infrastructure.

However, information about the company's specific rule compliance, licensing, and oversight remains very limited. This fgs markets review finds that while the company claims to use STP/ECN execution models, checking these claims is hard due to limited transparency in reporting and documentation.

Regulatory Jurisdiction: Available documents do not specify which regulatory authorities oversee FGS Markets operations. This raises major compliance concerns for potential traders.

Deposit and Withdrawal Methods: Specific information about available funding methods and withdrawal procedures was not detailed in accessible materials. User feedback suggests processing difficulties though.

Minimum Deposit Requirements: The broker offers a very low minimum deposit of 1 USD. This makes it accessible to traders with limited starting capital.

Bonus and Promotional Offers: Current promotional activities and bonus structures are not specified in available documentation. This suggests limited marketing incentives.

Tradeable Assets: The platform provides access to foreign exchange pairs and contracts for difference across various market categories. Specific instrument counts remain unspecified though.

Cost Structure: Detailed information about spreads, commissions, and additional trading fees was not provided in accessible broker documentation. This creates transparency concerns.

Leverage Ratios: FGS Markets offers leverage up to 1:200. This provides significant position sizing flexibility for qualified traders within this multiple.

Platform Options: Trading operations use the MetaTrader 4 platform. This provides access to established charting tools and automated trading capabilities through this industry-standard software.

Geographic Restrictions: Specific regional limitations and restricted territories are not detailed in available materials. Prospective traders need individual verification.

Customer Service Languages: Available customer support languages and communication options are not specified in accessible broker information.

This fgs markets review emphasizes the concerning lack of detailed operational information. This significantly impacts trader confidence and regulatory transparency expectations.

FGS Markets' account structure shows both accessibility and transparency concerns. The broker's most notable feature is its very low minimum deposit requirement of just 1 USD. This positions it among the most accessible options for traders with limited starting capital.

However, this apparent advantage is significantly hurt by the absence of detailed information about account types, their specific features, and associated trading conditions. The lack of comprehensive account documentation raises questions about tier structures, premium account benefits, and progression pathways for growing traders. Available information does not specify whether the broker offers specialized account types such as Islamic accounts for Shariah-compliant trading, professional trader classifications, or institutional-grade services.

This information gap creates uncertainty for traders seeking to understand their long-term relationship potential with the platform. User feedback about account experiences reveals concerning patterns, particularly around fund withdrawal processes that directly impact account management satisfaction. Multiple reports suggest difficulties in accessing deposited funds, which fundamentally undermines the value proposition of low entry requirements.

When compared to established brokers offering similar minimum deposits, FGS Markets falls short in providing the transparency and reliability that traders expect. The fgs markets review assessment of account conditions reflects these transparency and operational concerns. While the low barrier to entry may attract initial interest, the lack of detailed account information and withdrawal difficulties significantly limit the practical value for serious trading activities.

The trading tools and resources offered by FGS Markets center mainly around the MetaTrader 4 platform. This represents a standard but limited approach to trader support infrastructure. While MT4 provides established functionality for chart analysis, automated trading through Expert Advisors, and basic market research capabilities, the broker appears to offer minimal additional proprietary tools or enhanced analytical resources beyond this platform's default features.

Available information does not indicate specialized research departments, dedicated market analysis teams, or proprietary trading tools that would differentiate FGS Markets from competitors. The absence of detailed educational resource descriptions suggests limited investment in trader development programs, webinar series, or comprehensive learning materials that many established brokers provide to support client success. Economic calendar integration, advanced charting tools, and specialized market analysis features remain unspecified in accessible documentation.

This lack of detailed tool descriptions creates uncertainty about the depth of analytical support available to traders seeking comprehensive market research capabilities. Additionally, automated trading support appears limited to standard MT4 Expert Advisor functionality without enhanced algorithmic trading features or advanced automation tools. The overall tools and resources evaluation reveals a basic service offering that meets minimal platform requirements without providing the enhanced analytical capabilities or educational support that serious traders typically require.

This basic approach fails to provide the comprehensive support needed for informed decision-making and skill development in competitive forex markets.

Customer service represents one of FGS Markets' most significant operational weaknesses. User feedback consistently highlights inadequate support quality and responsiveness. Available customer feedback indicates prolonged response times to critical issues, particularly those involving fund withdrawals and account access problems.

The support team's apparent inability to effectively resolve withdrawal difficulties has generated substantial negative feedback across multiple review platforms. Communication channel availability and multilingual support capabilities remain unspecified in accessible documentation. This creates additional uncertainty about service accessibility for international traders.

The absence of detailed customer service hour information suggests potential limitations in round-the-clock support availability. This is particularly concerning for traders operating across different time zones in global forex markets. Professional competency concerns emerge from user reports indicating that support staff may lack sufficient technical knowledge to address complex trading platform issues or account-related problems effectively.

This professional capability gap becomes especially problematic when traders encounter urgent trading-related difficulties requiring immediate expert assistance. The pattern of unresolved user complaints suggests systemic customer service deficiencies rather than isolated incidents. Case resolution effectiveness appears particularly poor regarding withdrawal processing issues, with multiple users reporting prolonged delays and inadequate explanations for fund access restrictions.

These customer service shortcomings significantly impact trader confidence and operational reliability. They contribute to the broker's poor overall reputation in user satisfaction metrics.

The trading experience with FGS Markets reveals significant concerns about platform stability, execution quality, and overall operational reliability based on available user feedback. Traders report inconsistent platform performance with stability issues that can disrupt trading activities during critical market periods. These technical difficulties appear to extend beyond typical market volatility impacts, suggesting underlying infrastructure limitations.

Order execution quality presents notable problems according to user experiences. Reports include slippage issues and requoting incidents that negatively impact trading outcomes. These execution problems are particularly concerning for traders employing strategies requiring precise entry and exit timing, as execution delays or price discrepancies can significantly affect trading profitability.

The frequency of these execution issues suggests systematic problems rather than isolated technical incidents. Platform functionality completeness through the MT4 interface appears standard, though user feedback indicates that the overall trading environment suffers from spread instability and inconsistent pricing feeds. Mobile trading experience details remain unspecified in available documentation, creating uncertainty about trading accessibility across different devices and platforms.

The fgs markets review of trading experience reflects these operational concerns. User dissatisfaction stems primarily from execution reliability issues and platform performance problems. The combination of technical difficulties and execution quality concerns creates a challenging trading environment that may significantly impact trader success rates and overall satisfaction with the platform.

Trust and safety concerns represent the most critical issues surrounding FGS Markets operations. The absence of clear regulatory oversight creates substantial risk factors for potential traders. The lack of specific regulatory authority mentions in available documentation suggests the broker may be operating without proper licensing from recognized financial regulators.

This fundamentally undermines trader protection and fund security. Fund safety measures and segregation protocols remain unspecified in accessible broker information, creating uncertainty about client money protection standards. Established brokers typically provide detailed information about client fund segregation, insurance coverage, and regulatory compliance measures, while FGS Markets appears to lack this transparency.

This information gap raises serious questions about fund security and recovery options in case of operational difficulties. Corporate transparency presents additional concerns, with limited public information about management structure, corporate governance practices, and operational oversight mechanisms. The broker's industry reputation has been significantly damaged by multiple red flag warnings from industry monitoring services and negative user experiences that remain largely unaddressed through proper complaint resolution procedures.

Third-party evaluation sources consistently highlight compliance concerns and operational red flags. User trust feedback remains predominantly negative. The pattern of unresolved user complaints, combined with regulatory uncertainty and limited corporate transparency, creates a concerning trust profile that suggests significant risk for trader fund security and operational reliability.

Overall user satisfaction with FGS Markets remains extremely low. User ratings average approximately 2 out of 10 across review platforms, indicating widespread dissatisfaction with broker services. This poor satisfaction rating reflects systemic issues across multiple operational areas rather than isolated service problems.

The low ratings suggest fundamental deficiencies in the broker's approach to client service and platform management. Interface design and platform usability appear to rely primarily on standard MT4 functionality without significant customization or enhancement for improved user experience. While MT4 provides familiar navigation for experienced traders, the lack of proprietary interface improvements or user experience enhancements suggests minimal investment in client satisfaction optimization.

Registration and verification process details remain unspecified in available documentation. This creates uncertainty about account opening efficiency and requirements. Fund management experience represents the most significant source of user dissatisfaction, with frequent complaints about withdrawal processing delays and access restrictions.

These operational difficulties fundamentally undermine user confidence and create practical barriers to effective account management. Common user complaints consistently focus on withdrawal difficulties and slow customer service response times, indicating systemic operational problems. User demographic analysis suggests the broker may attract traders with limited capital due to low minimum deposit requirements, but the high-risk profile makes it unsuitable for cautious investors.

Improvement recommendations would necessarily focus on establishing proper regulatory compliance, improving withdrawal processing efficiency, and enhancing customer service quality. These changes are needed to address the fundamental operational deficiencies affecting user experience.

This comprehensive fgs markets review reveals a broker presenting significant risks that substantially outweigh potential benefits for most trading scenarios. While the exceptionally low 1 USD minimum deposit requirement may initially attract traders with limited capital, the absence of proper regulatory oversight, frequent withdrawal difficulties, and consistently poor user feedback create an unsuitable environment for serious forex trading activities. The broker's operational deficiencies span multiple critical areas including customer service quality, platform reliability, and most importantly, regulatory compliance and fund security.

These systematic problems suggest fundamental business practice issues that pose substantial risks to trader capital and operational success. For traders considering FGS Markets, the risk-reward analysis strongly favors seeking alternative brokers with established regulatory compliance and positive user satisfaction records.

FX Broker Capital Trading Markets Review