Is WTi safe?

Business

License

Is WTI Safe or Scam?

Introduction

WTI, a broker that has emerged in the forex market, positions itself as a platform for trading various financial instruments. Established in 2020, WTI claims to offer a user-friendly trading experience, leveraging the popular MetaTrader 4 platform. However, the forex market is rife with potential pitfalls, making it crucial for traders to conduct thorough evaluations of brokers before committing their funds. This article aims to provide an objective analysis of WTI, exploring its regulatory status, company background, trading conditions, customer experiences, and overall safety. The investigation is based on a review of multiple sources, including regulatory databases and user feedback, to ascertain whether WTI is a safe trading option or a potential scam.

Regulation and Legality

Understanding the regulatory environment is paramount for assessing the credibility of any forex broker. Regulation serves as a safety net for traders, ensuring that brokers adhere to specific standards and practices designed to protect clients. Unfortunately, WTI is not regulated by any recognized financial authority, which raises significant concerns regarding its legitimacy.

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The lack of regulation means that WTI operates without the oversight that typically accompanies licensed brokers. Regulatory bodies such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC) enforce strict guidelines to protect investors. WTI's absence from these lists indicates a higher risk for traders, as they may not have recourse in the event of disputes or financial mismanagement. Furthermore, the Financial Markets Authority (FMA) in New Zealand has issued warnings against WTI, labeling it as a fraudulent entity due to its non-compliance with regulatory standards. This history of negative disclosures adds to the skepticism surrounding WTI's operations.

Company Background Investigation

WTI's history is relatively short, having been established in 2020. While it claims to be based in New Zealand, numerous reviews suggest that this information may be misleading. The company's ownership structure remains opaque, with little information available regarding its founders or management team. This lack of transparency raises red flags for potential investors.

The absence of a verifiable corporate history and ownership details makes it challenging to assess the credibility of WTI. A reputable broker typically provides clear information about its management and operational history, allowing traders to evaluate their expertise and reliability. In WTI's case, the lack of information only fuels concerns regarding its legitimacy. Moreover, customer reviews often highlight issues related to insufficient communication and unresponsiveness from the company's support team, further eroding trust.

Trading Conditions Analysis

Examining the trading conditions offered by WTI reveals a complex picture. While the broker provides access to the MetaTrader 4 platform, which is widely recognized for its robust features, the overall cost structure raises concerns. WTI does not clearly outline its fees, and many user reviews report unexpected charges that deviate from industry norms.

| Fee Type | WTI | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.0 pips | 1.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | High | Moderate |

The spread for major currency pairs is significantly higher than the industry average, indicating that traders may face increased costs when trading through WTI. Additionally, the lack of a transparent commission structure raises concerns about hidden fees that could erode profits. Traders should be wary of brokers that do not provide clear and upfront information regarding their fees, as this can be a tactic used by less reputable firms to exploit unsuspecting clients.

Client Fund Safety

The safety of client funds is a critical aspect of any broker's operations. WTI's lack of regulatory oversight means that there are no mandated requirements for fund segregation or investor protection. This poses a substantial risk to traders, as their funds may not be safeguarded in the event of the broker's insolvency or fraudulent activities.

Historically, WTI has faced allegations regarding the mishandling of client funds, with reports of delayed withdrawals and unresponsive customer service. The absence of negative balance protection further exacerbates these concerns, as traders could potentially lose more than their initial investment. In a market where financial security is paramount, WTI's practices raise significant alarms about the safety of client assets.

Customer Experience and Complaints

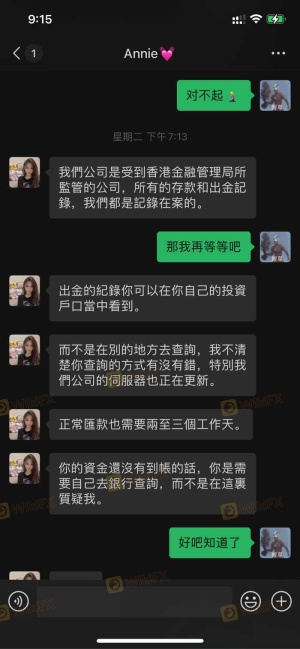

Customer feedback is an invaluable resource for assessing the reliability of a broker. In WTI's case, numerous complaints have surfaced, primarily focusing on withdrawal issues and unresponsive customer support. Many users report difficulties in accessing their funds, with some claiming that their accounts were suspended without clear explanations.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Support | High | Poor |

For instance, one user reported that after making a profitable trade, they were unable to withdraw their funds, citing vague explanations from WTI's support team. Another trader expressed frustration over the lack of communication when attempting to resolve issues related to their account. These patterns of complaints suggest a troubling trend that potential investors should carefully consider before engaging with WTI.

Platform and Execution

The trading platform's performance is a crucial factor in the overall trading experience. WTI utilizes the MetaTrader 4 platform, which is known for its reliability and user-friendly interface. However, user reviews indicate that the platform often suffers from execution delays and slippage, which can significantly impact trading outcomes.

Traders have reported instances of orders being executed at unfavorable prices, leading to unexpected losses. This raises concerns about the integrity of WTI's trading infrastructure and whether it can provide a fair and transparent trading environment. Furthermore, the absence of evidence supporting the platform's reliability only adds to the skepticism surrounding WTI's operations.

Risk Assessment

Using WTI as a trading platform presents several risks that potential investors should be aware of. The lack of regulation, coupled with numerous complaints regarding fund safety and execution issues, creates a precarious trading environment.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight or protection. |

| Financial Risk | High | Allegations of fund mismanagement. |

| Execution Risk | Medium | Reports of slippage and delayed orders. |

To mitigate these risks, traders should consider the following recommendations:

- Conduct Thorough Research: Always verify a broker's regulatory status and read user reviews before investing.

- Start Small: If you choose to trade with WTI, consider starting with a small investment to limit potential losses.

- Utilize Risk Management Tools: Implement stop-loss orders and other risk management strategies to protect your capital.

Conclusion and Recommendations

In conclusion, the evidence suggests that WTI exhibits several characteristics commonly associated with scam brokers. The lack of regulation, negative customer feedback, and issues with fund safety raise significant concerns about the broker's legitimacy.

Traders are advised to exercise extreme caution when considering WTI as a trading option. For those seeking a safe and reliable trading environment, it may be prudent to explore alternatives that are regulated by reputable authorities. Brokers such as IG, OANDA, and Forex.com offer robust regulatory oversight and positive user experiences, making them more trustworthy options for forex trading. Always prioritize safety and transparency when selecting a broker to protect your investments.

In summary, is WTI safe? The overwhelming consensus from reviews and reports indicates that it is not, and traders should be wary of engaging with this broker.

Is WTi a scam, or is it legit?

The latest exposure and evaluation content of WTi brokers.

WTi Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

WTi latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.