Is Onoka safe?

Business

License

Is Onoka Safe or Scam?

Introduction

Onoka is a forex broker that has emerged in the competitive landscape of online trading, catering to a diverse clientele looking to engage in foreign exchange markets. As trading platforms proliferate, it becomes increasingly vital for traders to assess the legitimacy and safety of brokers before committing their funds. The forex market is notorious for its risks, including potential scams and unregulated practices, making due diligence essential. This article will investigate whether Onoka is a safe trading platform or if it exhibits characteristics of a scam. Our assessment is based on a thorough analysis of regulatory compliance, company background, trading conditions, customer experiences, and risk factors.

Regulation and Legitimacy

The regulatory status of a forex broker is a crucial factor in determining its legitimacy. Brokers that operate under strict regulatory frameworks tend to offer more security to their clients. Unfortunately, the information regarding Onoka's regulatory status raises significant concerns.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | Seychelles | Not Verified |

As highlighted in various reviews, Onoka lacks valid regulatory information, which is a significant red flag for potential investors. Operating without oversight from recognized regulatory bodies such as the FCA (Financial Conduct Authority) or ASIC (Australian Securities and Investments Commission) suggests that Onoka may not adhere to the rigorous standards that protect traders' interests. The absence of regulation means that traders have limited recourse should disputes arise, making it imperative for potential users to consider the implications of trading with an unregulated broker.

Company Background Investigation

Onoka Capital Limited, the company behind the Onoka trading platform, has a relatively short history, having been established in 2020. The company is registered in Seychelles, a jurisdiction known for its lenient regulatory environment. The ownership structure and management team of Onoka remain opaque, with limited information available about their professional backgrounds and qualifications. This lack of transparency is concerning, as it raises questions about the competence and integrity of those managing the platform.

The company's operational history is also marked by reports of customer complaints regarding withdrawal issues and alleged fraudulent practices. Such accounts suggest that Onoka may not prioritize customer satisfaction or ethical trading practices. Given the importance of trust in financial services, the company's failure to provide clear information about its management and operations is a significant drawback in evaluating whether Onoka is safe.

Trading Conditions Analysis

When assessing a broker's reliability, the trading conditions they offer play a vital role. Onoka's fee structure, while not explicitly detailed, has raised eyebrows among traders. Reports indicate that users have encountered unexpected fees and difficulties in understanding the complete cost of trading on the platform.

| Fee Type | Onoka | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | High | Moderate |

| Commission Model | Unclear | Clear |

| Overnight Interest Range | High | Low |

The potential for high spreads and unclear commission structures can significantly impact a trader's profitability. Moreover, any unusual fees or policies can be indicative of a broker that may not have the trader's best interests at heart. Traders should remain vigilant when evaluating trading costs, as hidden fees can erode potential profits.

Client Fund Safety

The safety of client funds is paramount in forex trading. Onoka's measures for securing client funds are unclear, leading to concerns about fund segregation and investor protection policies. Without robust mechanisms to protect client deposits, traders face heightened risks of losing their investments.

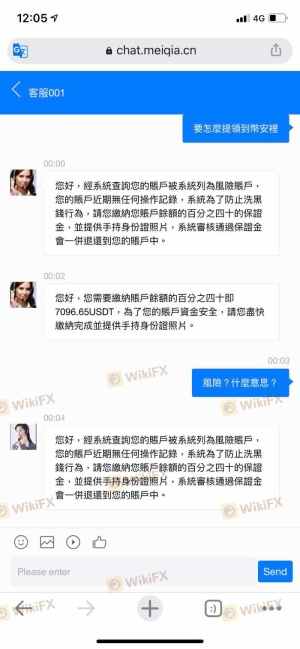

Historically, there have been reports of clients struggling to withdraw their funds from Onoka, raising alarms about the broker's reliability. Such instances of withdrawal issues are not only frustrating for clients but also serve as a warning sign for potential investors. It is essential for any broker to demonstrate a commitment to safeguarding client funds, and Onoka's track record in this regard is questionable.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability. Reviews of Onoka reveal a pattern of complaints primarily centered around withdrawal difficulties and perceived fraudulent practices. Many users have reported being unable to access their funds after making deposits, which is a significant concern for anyone considering trading with Onoka.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Complaints | Medium | Average |

The severity of complaints regarding withdrawal issues cannot be overstated. Traders expect to access their funds promptly and without hassle, and Onoka's failure to address these issues effectively indicates a lack of commitment to customer service. Additionally, the quality of the company's responses to complaints has been rated as poor, further eroding trust in the platform.

Platform and Execution

The performance and reliability of the trading platform are critical for a positive trading experience. Onoka offers a trading platform that is reportedly stable, but the execution quality has come under scrutiny. Traders have expressed concerns about slippage and order rejections, which can significantly impact trading outcomes.

The potential for platform manipulation is another area of concern. Traders should be cautious of brokers whose platforms exhibit signs of unfair practices, as this can lead to significant financial losses. Onoka's platform performance must be carefully evaluated to determine whether it meets the standards expected by traders.

Risk Assessment

Using Onoka comes with inherent risks that potential investors must consider. The lack of regulatory oversight, coupled with historical complaints about fund withdrawals and customer service, paints a concerning picture of the broker's reliability.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulation |

| Financial Risk | High | Withdrawal issues reported |

| Operational Risk | Medium | Platform performance concerns |

Traders should approach Onoka with caution, understanding that the risks associated with trading on this platform are elevated. It is advisable to conduct thorough research and consider alternative brokers with established reputations and regulatory oversight.

Conclusion and Recommendations

In conclusion, the evidence suggests that Onoka exhibits several characteristics commonly associated with scam brokers. The lack of regulatory oversight, combined with numerous customer complaints regarding fund withdrawals and poor customer service, raises significant red flags.

For traders considering their options, it is crucial to weigh the risks associated with Onoka carefully. If you are looking for a reliable trading experience, it may be wise to explore alternative brokers with strong regulatory frameworks and positive customer feedback. Some recommended alternatives include brokers with solid reputations and established regulatory compliance, ensuring a safer trading environment.

Ultimately, the question "Is Onoka safe?" leans towards a negative answer, and potential traders should exercise extreme caution before engaging with this broker.

Is Onoka a scam, or is it legit?

The latest exposure and evaluation content of Onoka brokers.

Onoka Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Onoka latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.