Is Elio International safe?

Business

License

Is Elio International Safe or Scam?

Introduction

Elio International is a forex and CFD broker that claims to offer a wide range of trading instruments, including currencies, commodities, and cryptocurrencies. Established in Hong Kong, it positions itself as a competitive player in the online trading market, promising attractive trading conditions and a user-friendly platform. However, as the forex market continues to attract both seasoned traders and newcomers, it is crucial for investors to thoroughly evaluate brokers before committing their funds. This article aims to investigate whether Elio International is a trustworthy broker or a potential scam, utilizing a comprehensive framework that includes regulatory status, company background, trading conditions, and customer experiences.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy and safety. Elio International claims to be regulated, but multiple sources indicate that it operates without valid regulatory oversight. This lack of regulation is a significant red flag for potential investors.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of regulatory oversight means that Elio International is not bound by the stringent requirements that regulated brokers must adhere to, such as maintaining client funds in segregated accounts and providing transparent financial reporting. This lack of oversight raises concerns about the safety of client funds and the broker's overall reliability.

In summary, Elio International is not a regulated broker, which significantly increases the risk for potential investors. This unregulated status is a critical factor to consider when evaluating if Elio International is safe or a scam.

Company Background Investigation

Elio International's background is shrouded in ambiguity. Established in 2003, the broker claims to provide various trading services, but there is limited verifiable information regarding its ownership structure and management team. This lack of transparency can be alarming for traders who wish to know who is handling their investments.

The company's website provides minimal information about its founders or key management personnel, which raises questions about accountability and operational integrity. A transparent broker typically shares details about its leadership team, including their qualifications and experience in the financial industry. Unfortunately, Elio International fails to provide such information, making it challenging for potential investors to assess the broker's credibility.

Moreover, the absence of a clear company history and ownership details further complicates the assessment of whether Elio International is safe. Without a transparent structure, it becomes difficult for investors to trust that their funds are being managed responsibly.

Trading Conditions Analysis

When assessing the trading conditions offered by Elio International, it is essential to examine the overall fee structure and any unusual policies that may exist. While the broker advertises competitive spreads and leverage options, the lack of transparency surrounding its fees can be concerning.

| Fee Type | Elio International | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.0 pips | 1.2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

Elio International's marketing materials suggest that it offers spreads as low as 1.0 pip, which is competitive within the industry. However, many traders have reported hidden fees and unexpected charges that significantly increase the overall cost of trading. This lack of clarity regarding fees can lead to frustration and financial loss for traders who may not fully understand the costs associated with trading on the platform.

Furthermore, the absence of a well-defined commission structure raises questions about potential hidden costs. A reputable broker typically provides clear information about commissions and fees, allowing traders to make informed decisions. The lack of such transparency at Elio International adds to the skepticism surrounding its trading conditions.

Client Fund Safety

The safety of client funds is paramount when choosing a forex broker. Elio International's lack of regulation raises serious concerns about its ability to protect client funds. Regulated brokers are required to maintain client funds in segregated accounts, ensuring that client money is not misused for operational expenses. However, with Elio International operating without regulatory oversight, there is no guarantee that client funds are safe.

Additionally, there are no indications that Elio International offers investor protection measures, such as negative balance protection, which can safeguard traders from losing more than their initial investment. This absence of safety measures increases the risk for traders, particularly those who may be inexperienced or unfamiliar with the volatile nature of forex trading.

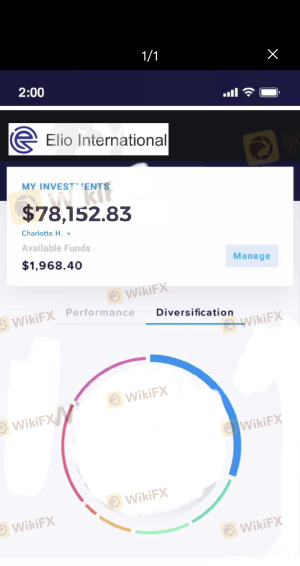

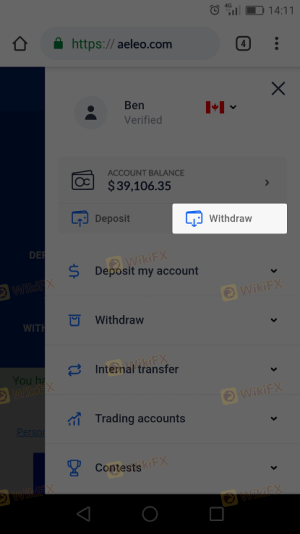

Historical complaints from users about difficulties in withdrawing funds further exacerbate concerns about the safety of client funds. Reports indicate that some clients have faced significant challenges when attempting to access their money, raising questions about the broker's financial practices and overall reliability.

Customer Experience and Complaints

Customer feedback is a vital aspect of evaluating a broker's reputation and reliability. In the case of Elio International, numerous complaints have surfaced regarding the broker's customer service and responsiveness. Many users have reported difficulties in reaching customer support and receiving timely assistance.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Communication | Medium | Poor |

| Hidden Fees | High | Poor |

Common complaints include issues related to withdrawal delays, lack of communication from customer support, and unexpected fees. These patterns of complaints indicate a troubling trend that potential investors should consider when determining if Elio International is safe or a scam.

For instance, one user reported being pressured to invest additional funds after initially making a deposit, only to face difficulties withdrawing their money later. This type of experience raises significant red flags and suggests that Elio International may not prioritize customer satisfaction or transparency.

Platform and Execution

The trading platform is another critical component of the trading experience. Elio International claims to offer a user-friendly platform, but reviews indicate mixed experiences concerning platform performance and execution quality. Many users have reported issues with order execution, including slippage and rejected orders, which can significantly impact trading outcomes.

Traders have expressed frustration over the platform's reliability, especially during volatile market conditions. A stable and efficient trading platform is essential for successful trading, and any signs of manipulation or poor execution can lead to significant losses for traders.

Risk Assessment

When evaluating the risks associated with using Elio International, several factors come into play. The overall lack of regulation, combined with negative customer experiences, presents a high-risk environment for traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Fund Safety Risk | High | No segregation of funds or investor protection. |

| Execution Risk | Medium | Reports of slippage and rejected orders. |

Given these risks, potential traders should exercise extreme caution when considering Elio International as a trading option. It is advisable to seek out regulated brokers that provide a safer trading environment and better customer support.

Conclusion and Recommendations

In conclusion, after thoroughly examining the various aspects of Elio International, it is evident that the broker exhibits several warning signs that suggest it may not be a safe option for traders. The lack of regulation, transparency issues, and numerous customer complaints raise serious concerns about the broker's legitimacy and reliability.

For traders seeking a trustworthy forex broker, it is highly recommended to consider alternatives that are regulated and have a proven track record of customer satisfaction. Brokers such as IG, OANDA, or Forex.com offer robust regulatory oversight and better client protection measures. In light of the findings, it is prudent to approach Elio International with caution and consider safer options for trading in the forex market.

In summary, is Elio International safe? The evidence suggests that it is not, and potential investors should be wary of the risks involved.

Is Elio International a scam, or is it legit?

The latest exposure and evaluation content of Elio International brokers.

Elio International Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Elio International latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.