Regarding the legitimacy of Eddid Bullion forex brokers, it provides HKGX and WikiBit, .

Is Eddid Bullion safe?

Business

License

Is Eddid Bullion markets regulated?

The regulatory license is the strongest proof.

HKGX Precious Metals Trading (AGN)

Hong Kong Gold Exchange

Hong Kong Gold Exchange

Current Status:

UnverifiedLicense Type:

Precious Metals Trading (AGN)

Licensed Entity:

金點貴金屬有限公司

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

香港灣仔駱克道54-62號博匯大廈14樓Phone Number of Licensed Institution:

21532645Licensed Institution Certified Documents:

Is Eddid Bullion Safe or Scam?

Introduction

Eddid Bullion is a forex broker that has positioned itself within the competitive landscape of the foreign exchange market, primarily focusing on trading precious metals such as gold and silver. As the forex market continues to attract numerous traders, both experienced and novice, it becomes increasingly crucial for traders to assess the credibility and safety of their chosen brokers. This evaluation is not merely about the potential for profit; it also encompasses the safety of funds, the integrity of trading practices, and the overall reliability of the broker. In this article, we will conduct a thorough investigation into Eddid Bullion's legitimacy, examining its regulatory status, company background, trading conditions, customer experiences, and risk factors. Our analysis is based on a comprehensive review of various online resources, including user reviews, regulatory databases, and financial news articles.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors in determining its safety. Eddid Bullion claims to operate under a regulatory framework, but there are significant concerns regarding the validity of its licenses. The broker is reportedly registered in Hong Kong and holds a Class AA market trading business license. However, investigations reveal that its regulatory score is alarmingly low, raising red flags about its operational legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Hong Kong Gold and Silver Exchange Fair | 156 | Hong Kong | Suspicious Clone |

The low verification status indicates that Eddid Bullion may not adhere to the stringent regulatory standards expected of legitimate brokers. Additionally, the lack of a robust regulatory framework raises questions about the protection of client funds and the enforcement of trading practices. Without proper oversight, traders may find themselves vulnerable to potential fraud or mismanagement of their investments. Thus, it is vital for traders to approach Eddid Bullion with caution and to consider the implications of trading with a broker that operates under such dubious regulatory conditions.

Company Background Investigation

Eddid Bullion Limited was established in Hong Kong in 2017, and its ownership structure remains somewhat opaque. The broker has undergone several changes in management and has shifted its focus over the years. While the company claims to have a solid track record in the precious metals market, the lack of transparency regarding its ownership and management team raises concerns about its operational integrity.

The management teams background is crucial in assessing the broker's credibility. Unfortunately, there is limited publicly available information about the qualifications and experience of the individuals behind Eddid Bullion. This lack of disclosure can lead to mistrust among potential clients, as traders typically prefer brokers with well-known and reputable management teams. Furthermore, the company's transparency regarding its operational practices and financial disclosures appears to be lacking, which is another indicator that traders should be wary of.

Trading Conditions Analysis

When evaluating whether Eddid Bullion is safe, it is essential to consider its trading conditions, including fees, spreads, and commissions. The broker offers trading in precious metals with varying spreads and leverage options. However, there are reports of unusual fees that could potentially trap traders in unfavorable financial situations.

| Fee Type | Eddid Bullion | Industry Average |

|---|---|---|

| Major Currency Pair Spread | $0.5 (Gold) | $1.0 (Gold) |

| Commission Structure | Varies | Typically 0.1% |

| Overnight Interest Range | 0.5% | 1.0% |

While Eddid Bullion's spreads for gold appear competitive, the overall fee structure remains ambiguous. Traders have reported issues with unexpected fees during withdrawals, which can significantly impact profitability. Such practices are often indicative of less-than-transparent operations, leading traders to question whether Eddid Bullion is safe for their investment.

Client Fund Security

The safety of client funds is paramount when assessing a forex broker's legitimacy. Eddid Bullion claims to implement various security measures to protect client funds, including the segregation of accounts and risk management protocols. However, the effectiveness of these measures is questionable, given the broker's low regulatory standing.

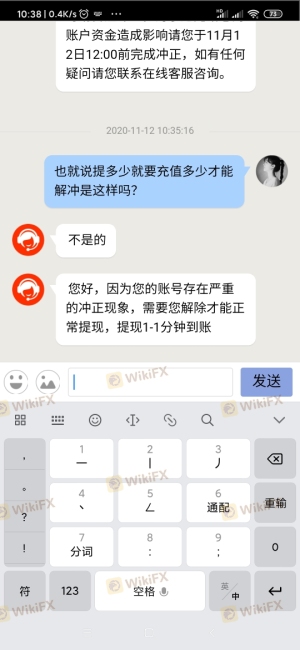

Many users have reported difficulties in withdrawing funds, with some alleging that their accounts were frozen after multiple withdrawal requests. These incidents raise serious concerns about the broker's commitment to client fund security. Without robust investor protection policies and a reliable withdrawal process, traders may find themselves at risk of losing their investments.

Customer Experience and Complaints

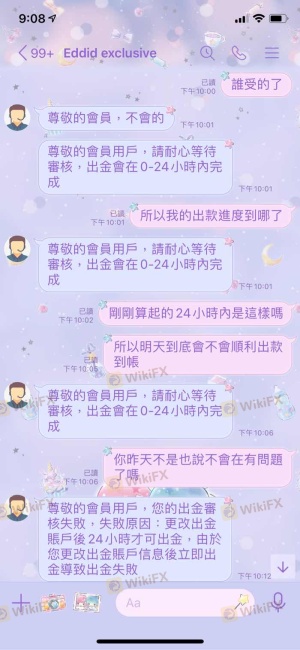

Customer feedback is a vital component in determining whether Eddid Bullion is safe. A review of user experiences reveals a pattern of complaints regarding withdrawal issues and unresponsive customer service. Many users have expressed frustration over their inability to access their funds, with some claiming that their accounts were frozen without explanation.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| Customer Service | Medium | Inadequate |

One notable case involved a trader who was unable to withdraw funds after multiple attempts, only to be told that additional deposits were required to process the withdrawal. Such experiences contribute to the perception that Eddid Bullion may not prioritize customer satisfaction or fund security, further casting doubt on its legitimacy.

Platform and Trade Execution

Evaluating the trading platform and execution quality is essential for determining the overall user experience with Eddid Bullion. The broker offers a proprietary trading platform that is said to be user-friendly; however, reports of technical issues and execution delays have surfaced. Traders have noted instances of slippage and rejections during high volatility periods, which can significantly affect trading outcomes.

The platform's stability is crucial for traders, especially in a fast-paced market like forex. Any signs of manipulation or consistent execution failures can lead to substantial losses, reinforcing the need for thorough scrutiny of Eddid Bullion's platform performance.

Risk Assessment

The comprehensive risk landscape associated with trading with Eddid Bullion must be analyzed carefully. The combination of regulatory uncertainty, withdrawal issues, and negative customer feedback presents a high-risk scenario for potential traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Low verification status raises concerns. |

| Withdrawal Risk | High | Reports of frozen accounts and delayed withdrawals. |

| Platform Risk | Medium | Technical issues and execution delays observed. |

To mitigate these risks, it is advisable for traders to conduct thorough due diligence before engaging with Eddid Bullion. Considering alternative brokers with better regulatory standing and customer reviews may provide a safer trading environment.

Conclusion and Recommendations

In conclusion, the investigation into Eddid Bullion raises several red flags regarding its safety and legitimacy. The broker's low regulatory standing, combined with numerous complaints about withdrawal issues and customer service, suggests that traders should exercise extreme caution.

While Eddid Bullion may offer competitive trading conditions, the overall risk associated with trading with this broker appears high. For traders seeking a safe trading environment, it may be prudent to explore other options with better regulatory oversight and customer satisfaction ratings. Some recommended alternatives include brokers regulated by top-tier authorities, which provide more robust protections for client funds and a more transparent trading experience. Ultimately, the question "Is Eddid Bullion safe?" leans towards a negative response, and potential traders should weigh their options carefully before proceeding.

Is Eddid Bullion a scam, or is it legit?

The latest exposure and evaluation content of Eddid Bullion brokers.

Eddid Bullion Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Eddid Bullion latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.