Is C&C BROKER safe?

Business

License

Is CC Broker Safe or Scam?

Introduction

CC Broker is a forex brokerage that has garnered attention for its purported investment opportunities in the foreign exchange market. As traders navigate the complex landscape of forex trading, it becomes crucial to evaluate the legitimacy and safety of brokers like CC Broker. With the rise of online trading platforms, the potential for scams has also increased, making it essential for traders to conduct thorough due diligence before committing their funds. This article aims to investigate whether CC Broker is a safe option or a potential scam by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Our investigation is grounded in a comprehensive analysis of various reputable online sources, including regulatory databases, user reviews, and expert assessments. By employing a structured evaluation framework, we will provide an objective analysis of CC Broker's credibility and safety.

Regulation and Legitimacy

One of the primary indicators of a broker's reliability is its regulatory status. Regulatory bodies enforce rules and standards that brokers must adhere to, ensuring a level of protection for traders. Unfortunately, CC Broker does not appear to be regulated by any top-tier financial authority. This lack of oversight raises significant concerns regarding the safety of funds deposited with the broker.

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation means that CC Broker is not subject to the stringent requirements imposed by reputable regulatory authorities, such as the FCA in the UK or the ASIC in Australia. These regulators require brokers to maintain a minimum capital, segregate client funds, and provide transparency in their operations. Without such oversight, traders face increased risks, including potential loss of their investments without recourse.

The quality of regulation plays a crucial role in assessing a broker's legitimacy. Brokers regulated by high-tier authorities are subject to strict compliance checks, which significantly reduce the likelihood of fraudulent activities. In contrast, CC Broker's lack of regulation suggests a higher risk of encountering unethical practices, making it imperative for traders to exercise caution.

Company Background Investigation

Understanding a broker's history and ownership structure is vital in assessing its trustworthiness. CC Broker's company history lacks transparency, with limited information available regarding its founding, ownership, and operational practices. This opacity can be a red flag for potential investors.

The management team behind CC Broker is another critical aspect to consider. A broker's leadership should ideally consist of experienced professionals with a proven track record in the financial services industry. However, information regarding the qualifications and backgrounds of CC Broker's management team is scarce, leading to further questions about the broker's credibility.

Moreover, the level of transparency and information disclosure from CC Broker is concerning. A reputable broker typically provides comprehensive details about its services, fees, and operational practices. In contrast, the lack of accessible information about CC Broker raises doubts about its commitment to ethical business practices and customer service.

Trading Conditions Analysis

When evaluating a broker's trustworthiness, it's essential to scrutinize its trading conditions, including fees and spreads. CC Broker's fee structure has been a point of contention among users, with reports indicating that the broker may impose unusually high fees compared to industry standards. Such practices can significantly impact traders' profitability.

| Fee Type | CC Broker | Industry Average |

|---|---|---|

| Major Currency Pair Spread | High | Low |

| Commission Model | High | Low |

| Overnight Interest Range | Variable | Fixed |

The high spreads and commissions associated with CC Broker can deter traders from executing profitable trades, which is a significant concern for anyone considering this broker. Additionally, the variability in overnight interest rates can lead to unexpected costs, further complicating the trading experience.

Traders should be wary of any broker that does not provide clear and competitive pricing. High fees can be indicative of a broker that prioritizes profit over client success, which is a significant warning sign when assessing whether CC Broker is safe.

Client Fund Safety

The safety of client funds is paramount when choosing a forex broker. A trustworthy broker should implement robust measures to protect clients' investments, including fund segregation, investor protection schemes, and negative balance protection policies. Unfortunately, CC Broker's policies in these areas are not well-documented, raising concerns about the safety of deposited funds.

The absence of clear information regarding fund segregation practices means that clients may be at risk of losing their investments in the event of the broker's insolvency. Additionally, without investor protection schemes in place, traders may have no recourse for recovering lost funds.

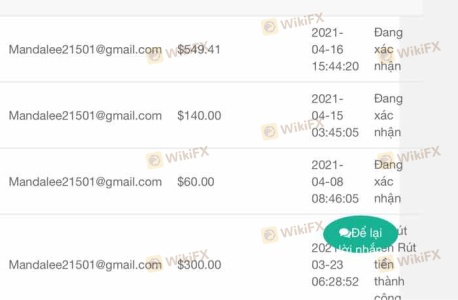

Historically, there have been reports of brokers without adequate fund safety measures engaging in questionable practices, including delaying withdrawals and freezing accounts. Such actions can leave traders vulnerable and without access to their money, further emphasizing the need for caution when considering CC Broker.

Customer Experience and Complaints

Customer feedback is a vital component in assessing a broker's reliability. Reviews of CC Broker reveal a mixed bag of experiences, with many users reporting dissatisfaction with the broker's services. Common complaints include high fees, poor customer support, and difficulties in withdrawing funds.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| High Fees | Medium | Unaddressed |

| Customer Support | High | Poor |

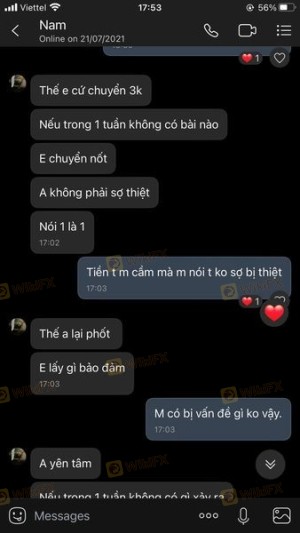

Several users have reported that their withdrawal requests were met with delays or were outright denied, which is a significant concern for anyone looking to trade with CC Broker. Additionally, the broker's customer support has been criticized for being unresponsive and unhelpful, further exacerbating user frustrations.

Two notable case studies highlight these issues. In the first instance, a trader reported waiting weeks for a withdrawal to be processed, only to receive minimal communication from the broker. In another case, a user expressed frustration over being charged unexpected fees without prior notification. These experiences paint a troubling picture of CC Broker's customer service and operational integrity.

Platform and Execution

The trading platform offered by a broker is a critical aspect of the trading experience. A reliable platform should provide stability, ease of use, and efficient trade execution. However, user reviews indicate that CC Broker's platform may not meet these expectations.

Traders have reported issues with platform stability, including frequent disconnections and slow execution speeds. Such problems can lead to missed trading opportunities and increased frustration for users. Furthermore, there have been allegations of slippage and order rejections, which can significantly impact trading outcomes.

The lack of transparency regarding the platform's performance and execution policies raises concerns about potential manipulation. Traders should be cautious of brokers that do not provide clear information about their trading environment and execution practices, as these can be indicative of deeper issues.

Risk Assessment

Using CC Broker presents several risks that traders should be aware of. The lack of regulation, high fees, and questionable customer service all contribute to an elevated risk profile.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight from reputable authorities |

| Financial Risk | High | High fees and poor fund safety measures |

| Operational Risk | Medium | Platform issues and execution problems |

To mitigate these risks, traders should consider conducting thorough research before engaging with CC Broker. This includes reading reviews, understanding the fee structure, and testing the platform with minimal funds. Additionally, traders may want to explore alternative brokers with better regulatory oversight and customer support.

Conclusion and Recommendations

Based on the evidence presented, it is clear that CC Broker raises several red flags that warrant caution. The lack of regulation, high fees, and poor customer service suggest that this broker may not be a safe option for traders. While there are no definitive signs of outright fraud, the combination of these factors indicates that traders should proceed with extreme caution.

For those considering forex trading, it may be wise to explore alternative brokers that offer better regulatory protection, transparent fees, and positive customer reviews. Some reputable alternatives include brokers regulated by top-tier authorities like the FCA or ASIC, which provide a safer trading environment.

In summary, while CC Broker may present appealing opportunities, the associated risks and concerns suggest that it is not a broker that can be recommended without reservations. Traders should prioritize their safety and consider all available options before making a decision.

Is C&C BROKER a scam, or is it legit?

The latest exposure and evaluation content of C&C BROKER brokers.

C&C BROKER Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

C&C BROKER latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.