Is BetacryptoFx safe?

Business

License

Is Betacryptofx Safe or Scam?

Introduction

Betacryptofx is a relatively new player in the forex market, positioning itself as a broker that offers a range of trading opportunities, particularly in cryptocurrency and forex pairs. As the online trading landscape continues to grow, traders are increasingly aware of the potential risks associated with unregulated or poorly regulated brokers. Evaluating the legitimacy and safety of a broker like Betacryptofx is crucial for traders looking to protect their investments. This article aims to provide an objective analysis of Betacryptofx, utilizing a combination of narrative and structured information to assess its credibility.

To conduct this investigation, we have reviewed multiple sources, including user testimonials, expert reviews, and regulatory information. Our evaluation framework encompasses the broker's regulatory status, company background, trading conditions, customer fund security, client experiences, platform performance, and an overall risk assessment.

Regulation and Legitimacy

One of the most significant factors in determining whether Betacryptofx is safe is its regulatory status. Regulation serves as a critical safeguard for traders, ensuring that brokers adhere to specific standards and practices that protect clients' funds and interests. Unfortunately, Betacryptofx operates without any recognized regulatory oversight, which raises substantial concerns about its legitimacy.

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that traders have limited recourse in the event of disputes or issues with fund withdrawals. A broker lacking regulatory oversight can impose arbitrary terms and conditions, which may not be in the best interest of clients. Furthermore, unregulated brokers often operate in jurisdictions that do not have stringent financial laws, making it easier for them to engage in questionable practices without facing consequences.

The quality of regulation is paramount, as it not only provides a safety net for traders but also fosters trust. Given that Betacryptofx is unregulated, it is essential for potential clients to exercise caution. Historical compliance issues often accompany unregulated brokers, leading to a higher likelihood of fraud or mismanagement of funds. Therefore, the question remains: Is Betacryptofx safe? The evidence suggests otherwise.

Company Background Investigation

Understanding the background of Betacryptofx is essential for evaluating its reliability. The broker is operated by a company named Golden Vision Consult Ltd., which claims to have offices in London and Bulgaria. However, the lack of transparency regarding the ownership structure raises concerns. The absence of detailed information about the management team and their professional experience further complicates the assessment of the broker's credibility.

While Betacryptofx claims to offer educational resources and support, the quality of information provided is often superficial. Transparency is a crucial aspect of any financial service, and the inability to access comprehensive details about the companys operations may indicate a lack of accountability. Moreover, the limited availability of contact information and customer support can hinder effective communication, especially in times of crisis.

In a market where trust is paramount, the opacity surrounding Betacryptofx's operational history and ownership structure is a red flag. Traders must ask themselves whether they are willing to risk their capital with a broker that lacks a clear and transparent background. Ultimately, the evidence points to a concerning lack of credibility, leading us to question: Is Betacryptofx safe?

Trading Conditions Analysis

When evaluating a broker like Betacryptofx, understanding the trading conditions is crucial. The overall fee structure and trading conditions can significantly impact a trader's profitability. Betacryptofx offers various trading accounts with different minimum deposit requirements, which can be as high as $500. This initial investment is considerably above the industry average, which typically ranges from $100 to $250.

Moreover, the broker's fee structure appears to be opaque, with limited information available on spreads, commissions, and overnight interest rates. This lack of clarity can lead to unexpected costs for traders and may further complicate their trading strategies.

| Fee Type | Betacryptofx | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5-2% |

The absence of specified trading costs raises questions about the broker's practices. Traders may find themselves facing hidden fees that can erode their profits. Additionally, the lack of transparency around fees can be indicative of a broker that is not fully committed to fair trading practices. Therefore, the question arises: Is Betacryptofx safe? With the current evidence, potential traders should be wary of the hidden costs that may accompany their trading experience.

Customer Funds Security

The safety of customer funds is a paramount concern for any trader. In the case of Betacryptofx, the broker's lack of regulation significantly undermines its claims of providing secure trading conditions. Without regulatory oversight, there is no guarantee that client funds are held in segregated accounts, which is a standard practice among reputable brokers.

Additionally, Betacryptofx does not provide clear information regarding investor protection measures, such as negative balance protection. This means that traders could potentially lose more than their initial investment, depending on market conditions and the broker's practices. Historical issues surrounding fund security are also concerning, as many unregulated brokers have been known to misappropriate client funds or delay withdrawals.

Traders must consider whether they are comfortable entrusting their capital to a broker that lacks robust security measures. The absence of a solid framework for protecting customer funds raises significant doubts about the broker's reliability. Consequently, the question remains: Is Betacryptofx safe? The current analysis suggests that traders should be cautious when dealing with this broker.

Customer Experience and Complaints

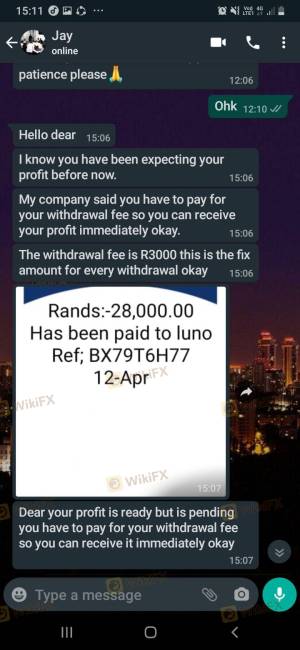

Customer feedback is a valuable indicator of a broker's reliability and service quality. In the case of Betacryptofx, numerous complaints have surfaced online, highlighting issues with fund withdrawals, lack of customer support, and aggressive sales tactics. Many users report difficulties in accessing their funds after making deposits, which is a common red flag for potential scams.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Inadequate |

| Misleading Promotions | High | Poor |

One notable complaint involved a trader who deposited funds but faced significant delays in processing withdrawal requests. After multiple attempts to contact customer support, the trader received vague responses and ultimately was unable to retrieve their funds. Such experiences highlight the potential risks associated with trading through Betacryptofx.

The lack of a timely and effective response to customer complaints raises serious concerns about the broker's commitment to client satisfaction. Therefore, it is crucial for potential clients to consider these experiences when evaluating whether Betacryptofx is safe for their trading activities.

Platform and Trade Execution

The trading platform offered by Betacryptofx is another area of concern. While the broker claims to provide an intuitive and user-friendly interface, many reviews indicate that the platform suffers from performance issues, including slow execution times and frequent downtime. These problems can severely impact traders' ability to execute trades effectively, especially in a volatile market.

Moreover, the quality of trade execution is critical for traders, as delays and slippage can lead to significant losses. If the platform is prone to issues such as high slippage or order rejections, traders may find it challenging to implement their strategies successfully. Additionally, any signs of potential market manipulation can further erode trust in the broker.

Given these factors, it is essential for traders to assess whether they can rely on Betacryptofx for consistent and reliable trade execution. The evidence suggests that the platform may not meet the standards expected by serious traders, raising further questions about whether Betacryptofx is safe for trading.

Risk Assessment

Engaging with Betacryptofx comes with inherent risks that potential clients must consider. The absence of regulation, coupled with a lack of transparency and numerous customer complaints, creates a high-risk environment for traders.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight, increasing potential for fraud. |

| Financial Risk | High | Lack of fund protection measures and transparency. |

| Operational Risk | Medium | Platform performance issues affecting trade execution. |

To mitigate these risks, traders should approach Betacryptofx with caution. It is advisable to start with a smaller investment and to conduct thorough research before committing significant capital. Additionally, seeking out alternative brokers with established regulatory oversight and positive customer reviews can provide a safer trading experience.

Conclusion and Recommendations

In conclusion, the investigation into Betacryptofx raises significant concerns about its safety and legitimacy. The broker's lack of regulation, combined with a troubling history of customer complaints and inadequate transparency, suggests that traders should exercise extreme caution. The question remains: Is Betacryptofx safe? The evidence indicates that it may not be.

For traders seeking a reliable and secure trading environment, it is advisable to consider alternative brokers that are well-regulated and have a proven track record of customer satisfaction. Some recommended alternatives include brokers that are regulated by reputable authorities like the FCA, ASIC, or CySEC, which offer robust protections for client funds and a transparent trading experience. Ultimately, the safety of your investments should be the top priority when choosing a trading platform.

Is BetacryptoFx a scam, or is it legit?

The latest exposure and evaluation content of BetacryptoFx brokers.

BetacryptoFx Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BetacryptoFx latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.