Is BAQuote safe?

Business

License

Is BAQuote Safe or Scam?

Introduction

BAQuote is a forex broker that claims to offer a wide range of trading services to retail and institutional clients. Operating from the Marshall Islands, it presents itself as a platform for trading various assets, including currencies, commodities, and indices. However, the forex market is rife with scams and unregulated brokers, making it crucial for traders to thoroughly assess any broker before committing their funds. This article aims to evaluate the legitimacy of BAQuote by examining its regulatory status, company background, trading conditions, customer safety measures, user experiences, and overall risk profile. The investigation is based on a comprehensive analysis of online reviews and data from various financial regulatory bodies.

Regulation and Legitimacy

Regulation is a critical factor in determining the safety and reliability of a forex broker. A regulated broker is subject to strict oversight, ensuring that it adheres to specific operational standards designed to protect traders. Unfortunately, BAQuote operates without proper regulation. The broker claims to be registered in the Marshall Islands, a well-known offshore jurisdiction that lacks a robust regulatory framework for forex trading.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Marshall Islands | Unregulated |

The absence of a legitimate regulatory authority raises significant concerns about BAQuote's operations. The Marshall Islands does not have a dedicated forex regulatory body, which means that brokers registered there are not held accountable to any financial standards or consumer protection laws. This lack of oversight can lead to various issues, including potential fraud and mismanagement of client funds. Furthermore, the historical compliance of offshore brokers is generally questionable, often resulting in numerous complaints from traders who have fallen victim to scams.

Company Background Investigation

Understanding the history and ownership structure of BAQuote is essential in assessing its credibility. The broker claims to be a trading name of BAQuote Ltd., but details about its establishment, ownership, and operational history are scarce. There is no concrete information available regarding the management team, which raises further doubts about the broker's transparency.

The lack of information about the company's management and its operational history can be a red flag for potential investors. A legitimate broker typically provides details about its founders, management team, and operational milestones. The absence of such transparency could indicate that BAQuote is not committed to building trust with its clients. Moreover, the information provided on its website is vague and does not offer insights into its business practices or financial stability.

Trading Conditions Analysis

When evaluating a forex broker, it is essential to consider the trading conditions they offer, including fees, spreads, and commissions. BAQuote presents itself as a competitive broker, but a closer examination reveals some concerning aspects of its fee structure.

| Fee Type | BAQuote | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 3 pips (EUR/USD) | 1-2 pips |

| Commission Model | None specified | Varies |

| Overnight Interest Range | Not disclosed | Varies |

The spread for major currency pairs, such as EUR/USD, is notably high at 3 pips, which is significantly above the industry average. Such inflated spreads can increase trading costs, making it challenging for traders to achieve profitability. Additionally, the lack of clarity regarding commissions and overnight interest rates further complicates the evaluation of BAQuote's trading conditions. Traders should be wary of brokers that do not provide transparent fee structures, as this can lead to unexpected costs and lower overall returns.

Customer Funds Security

The security of customer funds is paramount when considering a forex broker. BAQuote's approach to fund security is concerning, as it does not provide clear information about its measures for protecting client deposits. There is no indication that the broker offers segregated accounts, which are essential for ensuring that client funds are kept separate from the broker's operational funds.

Furthermore, there is no mention of investor protection schemes, such as negative balance protection, which can safeguard traders from incurring debts exceeding their account balances. The lack of transparency regarding these safety measures raises questions about the security of funds held with BAQuote. Historical issues related to fund security and withdrawal problems have been reported with unregulated brokers, highlighting the risks associated with trading with such entities.

Customer Experience and Complaints

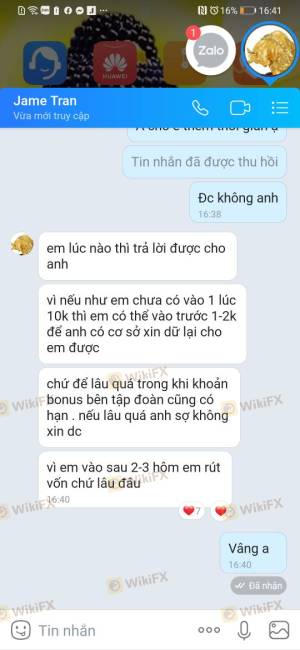

Analyzing customer feedback is vital in assessing the reliability of a broker. Reviews of BAQuote reveal a pattern of complaints from users, particularly concerning withdrawal issues and poor customer support. Many users have reported difficulties in accessing their funds, with claims that withdrawal requests are often delayed or denied without adequate explanations.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Inconsistent |

The severity of these complaints cannot be overlooked, as they indicate systemic issues within the broker's operations. A lack of responsive customer support can exacerbate frustrations, leaving traders feeling abandoned when they encounter problems. One typical case involved a trader who experienced a lengthy delay in withdrawing funds, only to receive vague responses from customer service. Such experiences can significantly impact a trader's perception of the broker's reliability.

Platform and Trade Execution

The trading platform is another critical aspect of evaluating a forex broker. BAQuote claims to offer the widely recognized MT5 trading platform, which is known for its robust features and user-friendly interface. However, the performance of the platform is crucial in determining whether it meets traders' needs.

Users have reported mixed experiences with the platform's stability and order execution quality. Issues such as slippage and order rejections have been noted, which can adversely affect trading outcomes. Any signs of platform manipulation or technical deficiencies could indicate deeper problems within the broker's operations.

Risk Assessment

Engaging with BAQuote carries inherent risks that potential clients should be aware of. The lack of regulation, high trading costs, and poor customer feedback contribute to a high-risk profile for this broker.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker operating offshore |

| Financial Risk | Medium | High spreads increase trading costs |

| Operational Risk | High | Poor customer service and withdrawal issues |

To mitigate these risks, traders should consider using risk management strategies, such as setting stop-loss orders and limiting their exposure to any single trade. Additionally, it may be prudent to seek out regulated brokers with established reputations.

Conclusion and Recommendations

In conclusion, the evidence suggests that BAQuote exhibits several characteristics commonly associated with scam brokers. The lack of regulation, high trading costs, and numerous customer complaints raise significant concerns about the safety and reliability of this broker. While BAQuote may present itself as a legitimate trading platform, the underlying issues indicate that traders should exercise extreme caution.

For traders seeking safer alternatives, it is advisable to consider brokers that are regulated by reputable authorities, such as the FCA in the UK or ASIC in Australia. These brokers offer greater security and transparency, ensuring a more reliable trading experience. Ultimately, the question of "Is BAQuote safe?" leans heavily towards "No," making it essential for traders to explore other options before committing their funds.

Is BAQuote a scam, or is it legit?

The latest exposure and evaluation content of BAQuote brokers.

BAQuote Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BAQuote latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.