Grayscale Forex 2025 Review: Everything You Need to Know

Executive Summary

This grayscale forex review looks at a broker that worries many traders. Grayscale Forex is an unregulated forex broker that creates big risks for people who trade with them. The platform offers some good features like leverage up to 1:500 and spreads starting from 0.0 pips, but it works without proper rules watching over it. This should be a major warning sign for people thinking about investing.

The broker mainly targets traders who want high-leverage trading chances. They especially go after people who like competitive spreads and many different assets to trade. But the lack of protection from regulators and many reports calling Grayscale Forex a possible investment scam make it bad for serious traders who care about safety and following rules. BrokersView says the platform has been marked as an unregulated company with questionable business practices that could cause big financial losses for investors who don't know better.

Important Disclaimer

Warning: Grayscale Forex works as an unregulated forex broker, which means traders face big legal and financial risks when using this platform. The lack of regulatory oversight changes a lot across different countries, and investors should know that their money may not be protected under normal financial rules.

This review uses information that is available right now and may not cover all user experiences or market changes. The forex industry changes fast and regulations keep developing, so some information may become old. Traders should strongly consider doing their own research and talking with financial advisors before making any investment choices.

Rating Framework

Broker Overview

Grayscale Forex started working in the financial markets on January 3, 2024. The company set up its operations with a registration base in China. It presents itself as a provider of forex and other financial products, going after traders who want high-leverage opportunities in different market areas. Even though it started recently, the broker has quickly gotten attention, but sadly for worrying reasons rather than good market reputation.

The platform works under a business model that focuses on high-leverage forex trading without the safety net of proper regulatory oversight. This approach has created big concerns among industry watchdogs and trading communities, with many sources pointing out potential risks connected to the broker's operations.

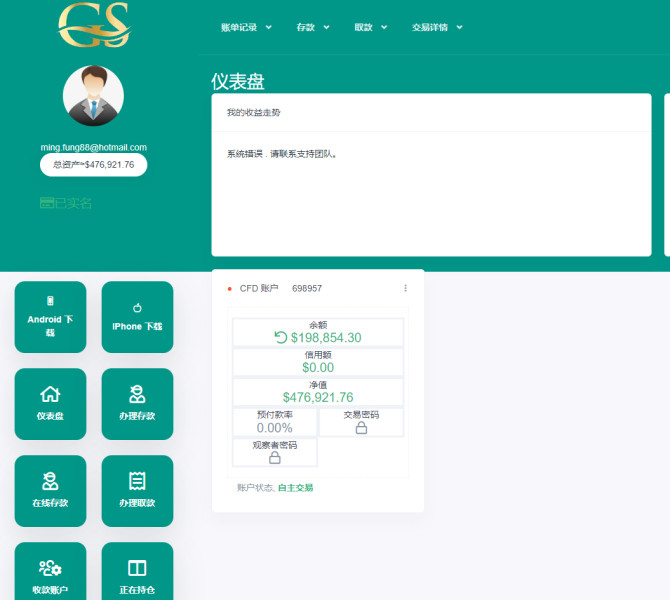

Available information shows that Grayscale Forex uses the MT5 trading platform to help with transactions across many asset classes including forex, commodities, indices, digital currencies, and futures. The broker's offering of diverse trading instruments seems designed to attract a wide range of traders, from currency specialists to those interested in cryptocurrency and commodity markets. But this grayscale forex review must stress that the lack of regulatory supervision greatly weakens the apparent benefits of their trading infrastructure.

The company's fast market entry and immediate availability of advanced trading tools suggests either big initial investment or possibly concerning business practices that need careful examination from potential clients.

Regulatory Status: Grayscale Forex works as an unregulated forex broker with registration in China. The lack of oversight from established financial regulatory bodies such as the FCA, CySEC, or ASIC means traders have no institutional protection for their investments.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods is not detailed in available sources. This itself creates concerns about transparency and operational clarity.

Minimum Deposit Requirements: The minimum deposit requirements are not specified in available documentation. This makes it hard for potential traders to assess entry barriers or account accessibility.

Bonus and Promotions: No information about bonus structures or promotional offerings has been found in current sources. This suggests either minimal marketing efforts or lack of competitive incentives.

Tradeable Assets: The platform offers access to forex pairs, commodities, indices, digital currencies, and futures contracts. It provides a diverse range of trading opportunities across multiple market sectors.

Cost Structure: Spreads begin from 0.0 pips according to available information, though commission structures remain unspecified. The lack of detailed fee information creates transparency concerns for cost-conscious traders.

Leverage Ratios: Maximum leverage reaches 1:500. This represents extremely high risk exposure that could result in rapid account depletion for inexperienced traders.

Platform Options: The broker uses the MT5 trading platform. This provides access to advanced trading tools, technical analysis capabilities, and automated trading functionality.

Geographic Restrictions: Specific regional limitations are not mentioned in available sources. However, regulatory restrictions may apply in various jurisdictions.

Customer Support Languages: Information regarding customer service language support is not available in current documentation. This potentially limits accessibility for international traders.

This grayscale forex review notes that the big gaps in publicly available information about basic operational details create serious concerns about the broker's transparency and commitment to client service.

Detailed Rating Analysis

Account Conditions Analysis (Score: 2/10)

The account conditions offered by Grayscale Forex present many concerns that greatly impact the overall trading experience. Available sources do not provide specific information about account types, their distinctive features, or the requirements for accessing different service levels. This lack of transparency makes it impossible for potential traders to make informed decisions about which account structure might suit their trading style and capital requirements.

The absence of clear minimum deposit requirements creates uncertainty for traders trying to budget their initial investment. Without this basic information, traders cannot properly assess whether the broker's services align with their financial capacity or trading objectives. Also, the account opening process details remain undisclosed, raising questions about verification requirements, documentation needs, and the time frame for account activation.

Specialized account features such as Islamic accounts for traders requiring Sharia-compliant trading conditions are not mentioned in available documentation. This omission suggests either limited service diversity or inadequate communication of available options to potential clients.

Most concerning is the identification of Grayscale Forex as a potential investment scam by industry monitoring services. This designation fundamentally undermines any potential benefits that might exist within their account structure, as the primary concern shifts from trading conditions to capital preservation and fraud prevention.

The combination of information gaps and negative industry assessments results in a severely compromised account conditions rating. This reflects the substantial risks associated with this grayscale forex review subject.

Grayscale Forex shows some skill in providing trading infrastructure through its adoption of the MT5 platform. This represents industry-standard technology for forex and multi-asset trading. The MT5 platform offers comprehensive charting capabilities, technical analysis tools, and support for automated trading strategies through Expert Advisors, providing traders with sophisticated execution capabilities.

The broker's asset diversity spanning forex, commodities, indices, digital currencies, and futures indicates an attempt to serve various trading preferences and portfolio diversification strategies. This multi-asset approach allows traders to capitalize on opportunities across different market sectors without requiring multiple brokerage relationships.

However, specific details about research and analysis resources remain absent from available documentation. Quality brokers typically provide market analysis, economic calendars, trading signals, and educational content to support trader decision-making. The lack of information about these value-added services suggests either minimal investment in client support resources or poor communication of available benefits.

Educational resources, which are crucial for trader development and platform familiarization, are not mentioned in current sources. This gap is particularly concerning for novice traders who require guidance on platform functionality, risk management, and trading strategy development.

While the MT5 platform inherently supports automated trading functionality, specific information about the broker's policies regarding algorithmic trading, VPS services, or API access is not available. This information vacuum prevents traders from fully assessing the platform's suitability for their specific trading methodologies.

The moderate rating reflects the positive aspects of MT5 platform adoption and multi-asset availability, balanced against significant concerns about resource depth and transparency.

Customer Service and Support Analysis (Score: 2/10)

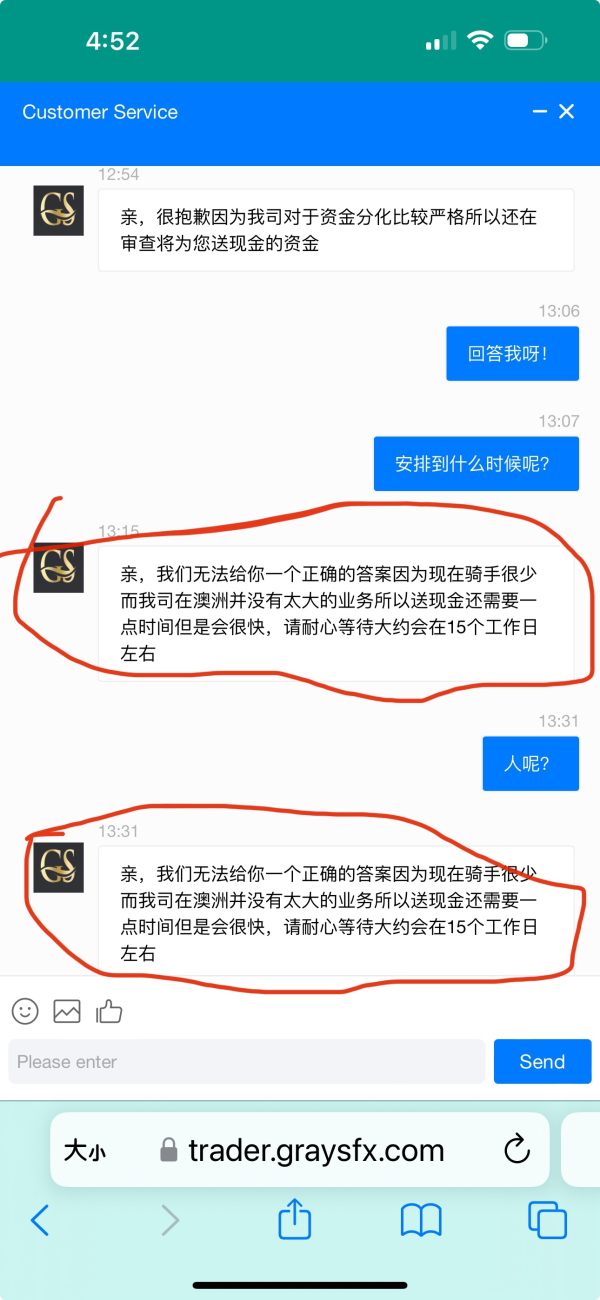

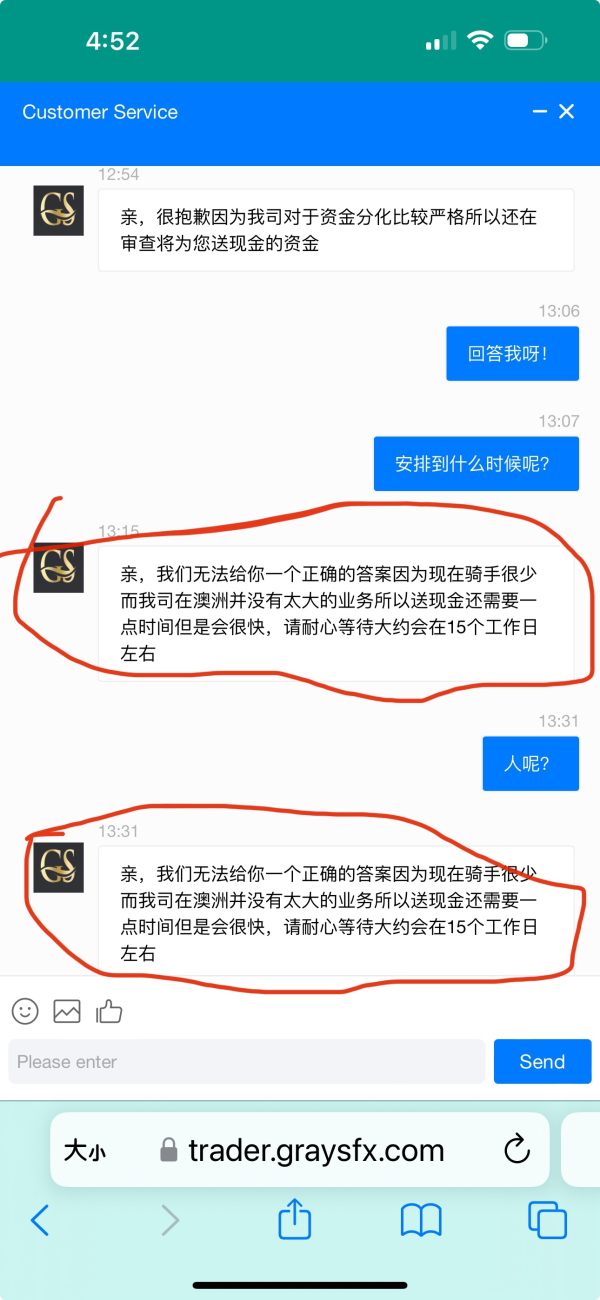

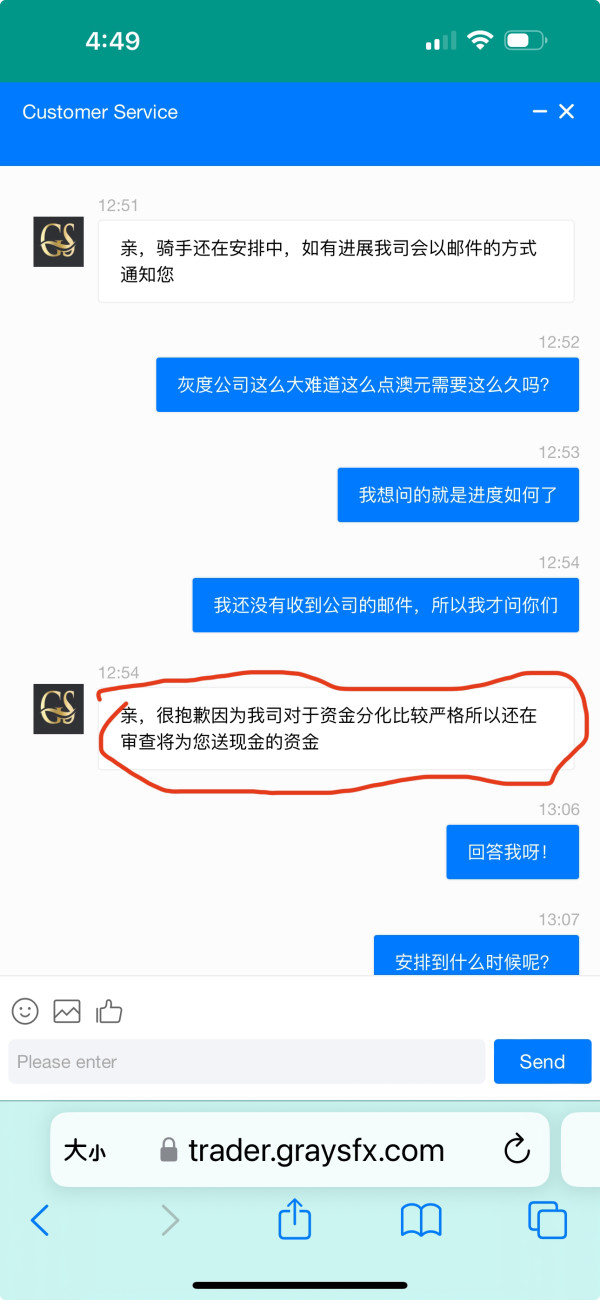

The customer service and support infrastructure of Grayscale Forex presents significant concerns due to the absence of detailed information about service availability, quality, and accessibility. Available sources do not specify the customer service channels offered, whether through live chat, email, telephone support, or other communication methods. This lack of clarity makes it impossible for traders to understand how they would receive assistance when needed.

Response time commitments, which are crucial indicators of service quality, remain unspecified in available documentation. Professional brokers typically guarantee response times for different inquiry types and provide service level agreements that establish clear expectations for client support. The absence of such commitments raises concerns about the broker's dedication to customer service excellence.

Service quality assessments from actual users are not available in current sources. This prevents objective evaluation of the customer experience. User testimonials, complaint resolution records, and satisfaction surveys would normally provide insights into real-world service performance, but this information appears to be either non-existent or not publicly accessible.

Multi-language support capabilities are not detailed in available information. This potentially limits accessibility for international traders who require assistance in their native languages. Given the global nature of forex trading, comprehensive language support is essential for effective customer service delivery.

The operational hours for customer service teams are not specified. This creates uncertainty about when traders can expect to receive assistance. This is particularly important for forex traders who may require support during various global market sessions.

The combination of information gaps and the broker's identification as a potential investment scam significantly undermines confidence in customer service capabilities and commitment to client welfare.

Trading Experience Analysis (Score: 5/10)

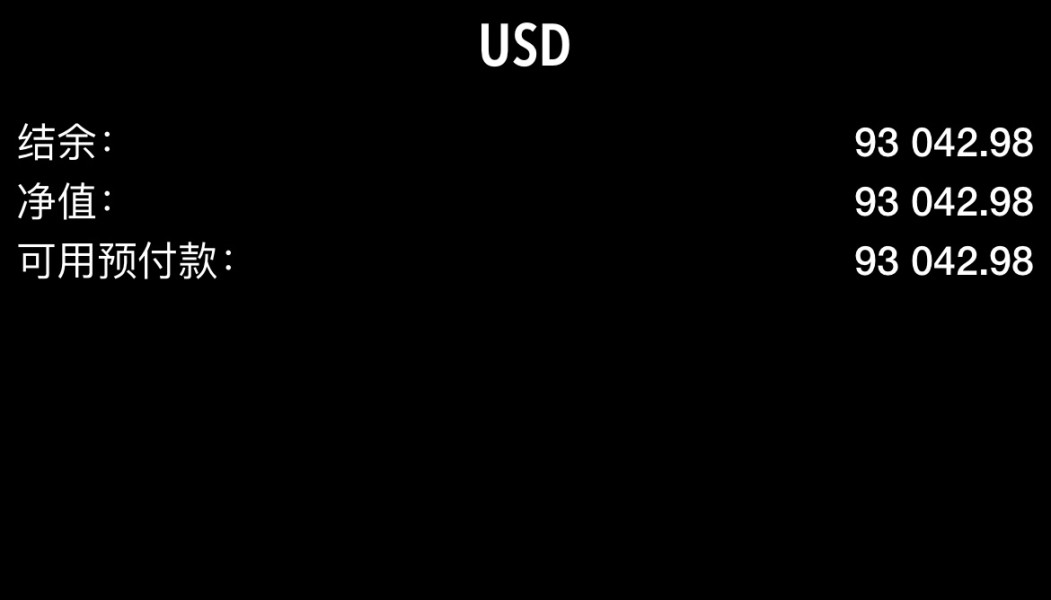

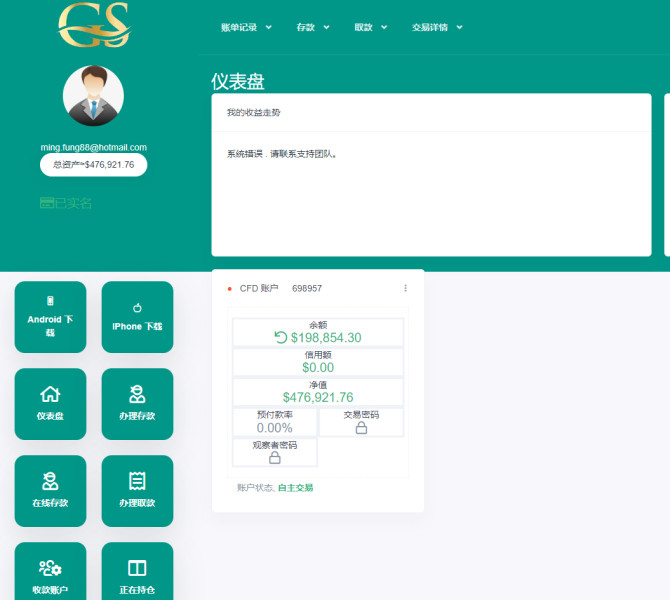

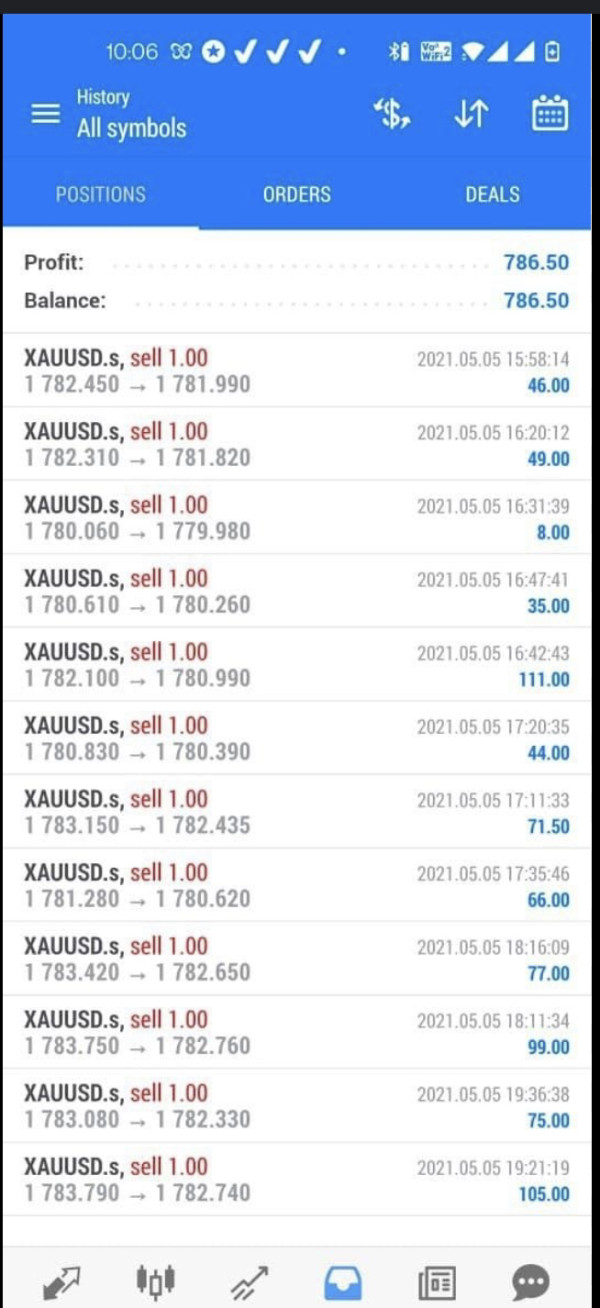

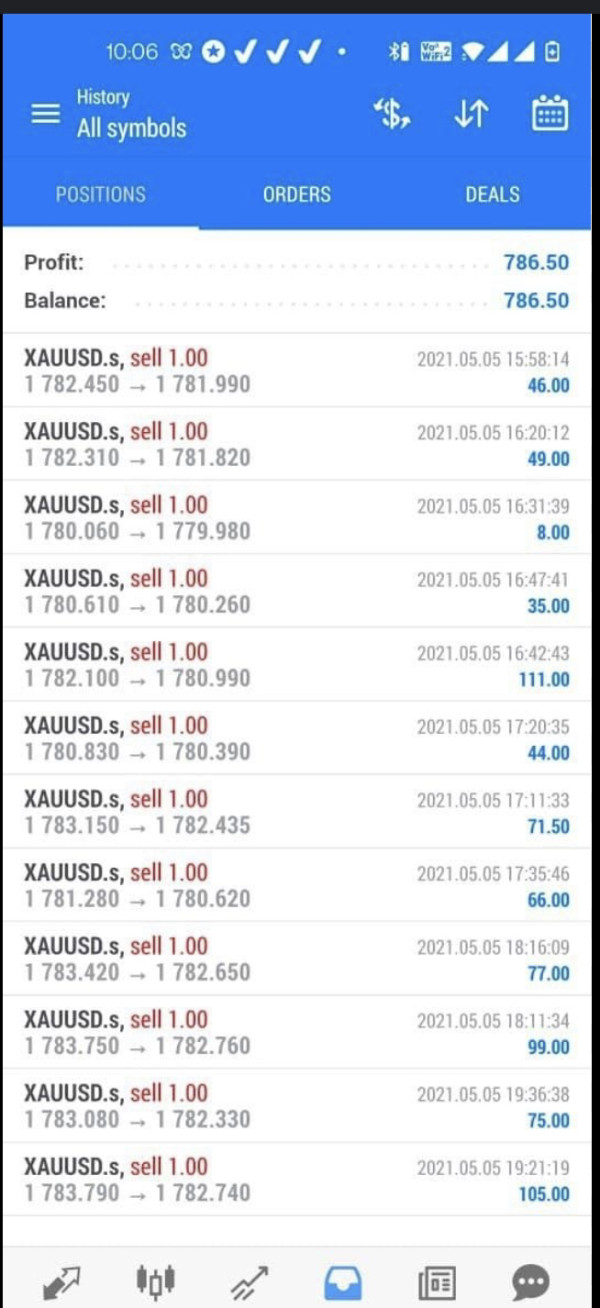

The trading experience offered by Grayscale Forex presents a mixed picture of competitive features overshadowed by significant reliability concerns. The platform's spreads starting from 0.0 pips represent attractive pricing that could appeal to cost-conscious traders, particularly those engaging in high-frequency trading strategies where transaction costs significantly impact profitability.

The maximum leverage of 1:500 provides substantial capital efficiency for experienced traders who understand the associated risks. However, this extreme leverage level also represents a double-edged sword that can rapidly amplify losses, making it potentially dangerous for inexperienced traders who may not fully comprehend the risk implications.

Platform stability and execution speed information is not available in current sources. This prevents assessment of crucial performance metrics that directly impact trading success. Reliable order execution without significant slippage or requotes is fundamental to positive trading experiences, yet no data exists to evaluate these critical factors.

The MT5 platform provides comprehensive functionality including advanced charting, technical analysis tools, and automated trading capabilities. However, specific details about the broker's implementation of these features, server performance, or additional platform customizations are not documented in available sources.

Mobile trading experience details are absent from current documentation. This is concerning despite the increasing importance of mobile accessibility for modern traders who require platform access across multiple devices and locations.

The moderate rating reflects the potentially attractive spread and leverage offerings balanced against significant concerns about platform reliability, execution quality, and the overall trustworthiness of the service provider. This grayscale forex review emphasizes that competitive trading conditions become meaningless if the broker cannot be trusted with client funds.

Trust and Reliability Analysis (Score: 1/10)

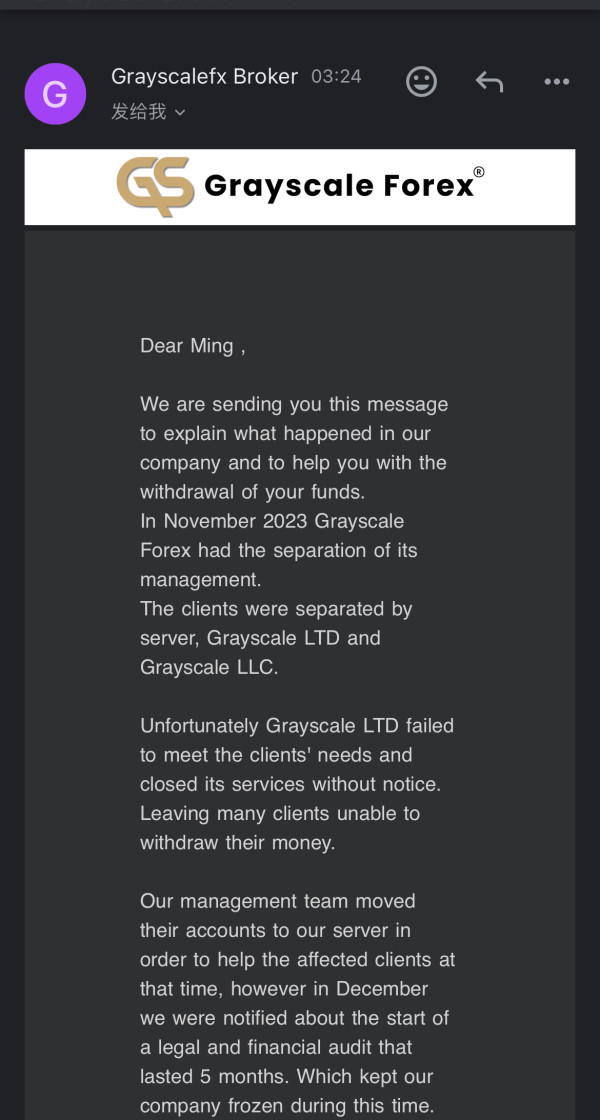

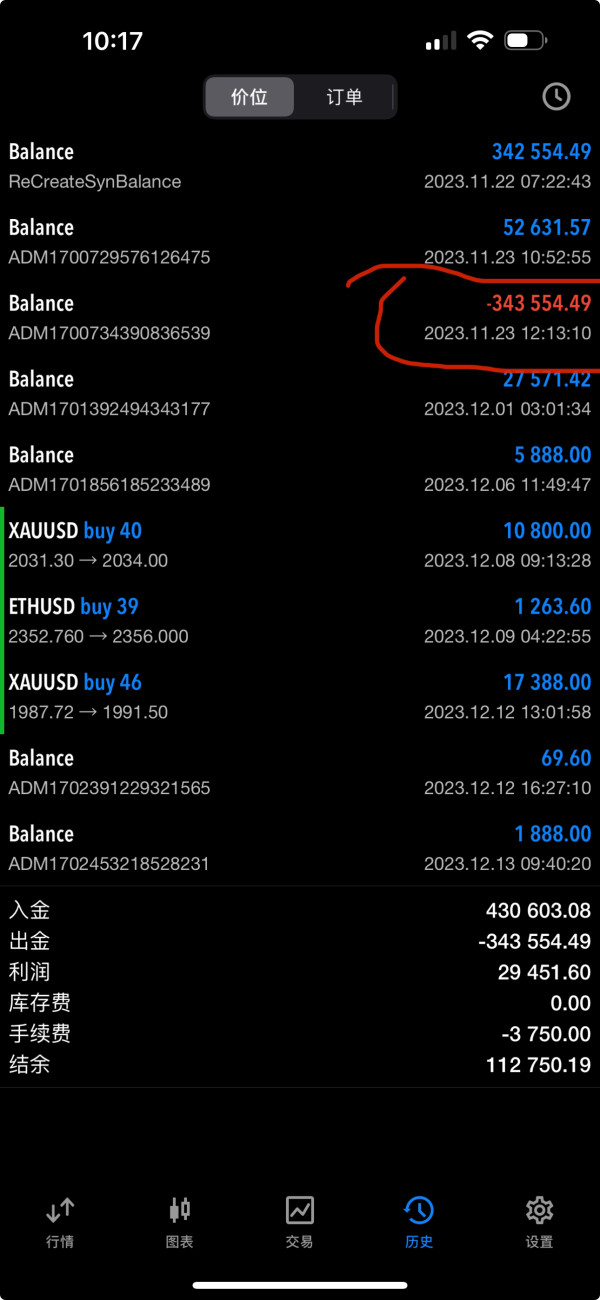

The trust and reliability assessment of Grayscale Forex reveals severe deficiencies that should concern any potential trader. The broker operates without regulation from established financial authorities, meaning client funds lack the protection typically provided by regulatory frameworks such as compensation schemes, segregated account requirements, or operational oversight.

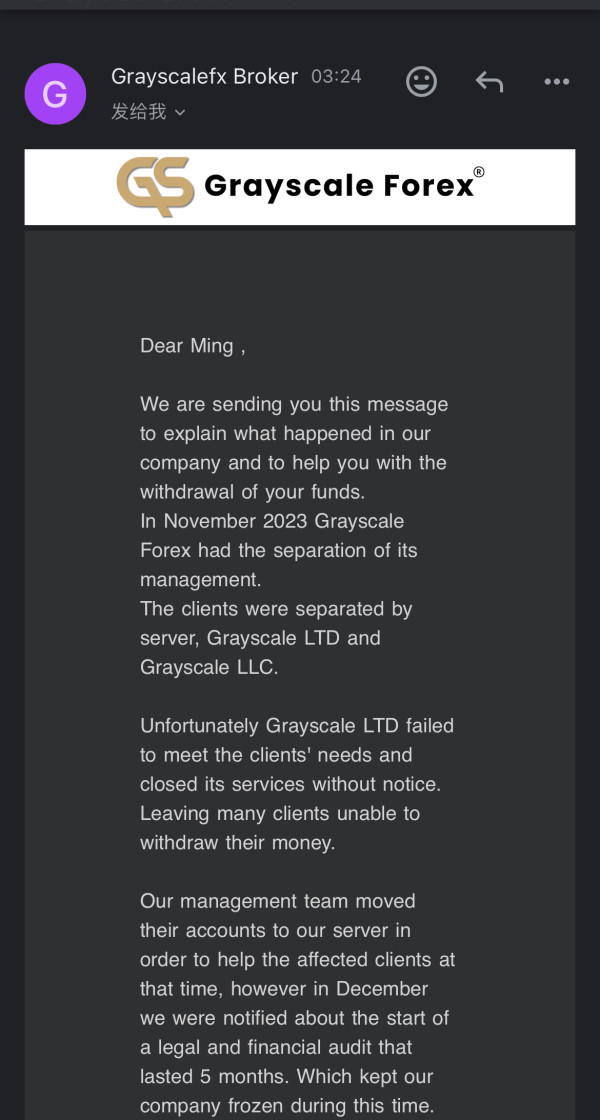

According to BrokersView, Grayscale Forex has been identified as an unregulated broker with characteristics consistent with investment scam operations. This designation represents the most serious concern possible in forex broker evaluation, as it suggests potential fraudulent intent rather than merely poor service delivery.

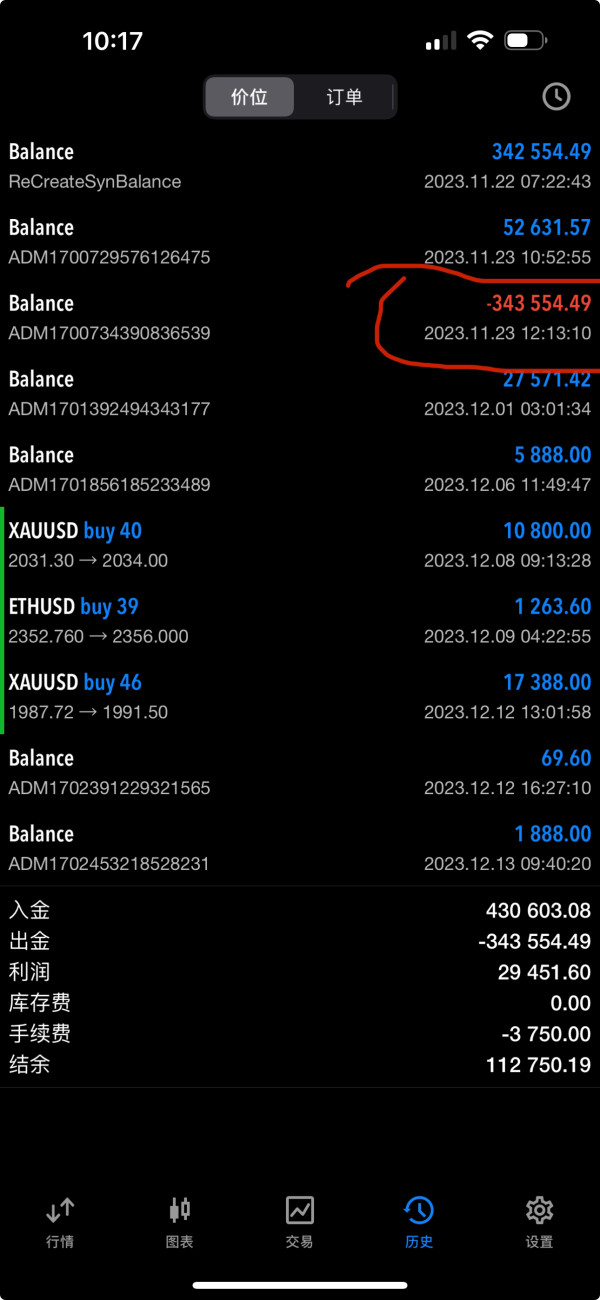

Fund safety measures, which should include segregated client accounts, insurance coverage, and transparent banking relationships, are not detailed in available documentation. The absence of such information, combined with the lack of regulatory oversight, creates an environment where client capital faces extreme risk of loss through operational failure or deliberate misappropriation.

Company transparency regarding ownership structure, financial statements, business operations, and regulatory compliance is notably absent. Legitimate brokers typically provide comprehensive information about their corporate structure, financial stability, and regulatory status to build client confidence.

The broker's industry reputation has been severely damaged by its identification as a potential investment scam. This negative assessment from industry monitoring services represents a critical warning that should deter serious traders from considering the platform regardless of any attractive trading conditions that may be advertised.

The combination of regulatory absence, scam allegations, and transparency deficiencies results in the lowest possible trust rating. This indicates extreme risk for potential clients.

User Experience Analysis (Score: 2/10)

The user experience evaluation of Grayscale Forex is severely hampered by the absence of comprehensive user feedback and the overwhelming concerns about the broker's legitimacy. Available sources do not provide information about overall user satisfaction levels, making it impossible to assess real-world client experiences with the platform.

Interface design and usability information is not available in current documentation. This prevents evaluation of the platform's accessibility and user-friendliness. While the MT5 platform provides a standardized interface, broker-specific customizations and additional tools can significantly impact the overall user experience.

Registration and verification process details remain undisclosed. This creates uncertainty about account opening complexity and time requirements. Streamlined onboarding processes are essential for positive initial user experiences, yet no information exists to evaluate this crucial aspect of service delivery.

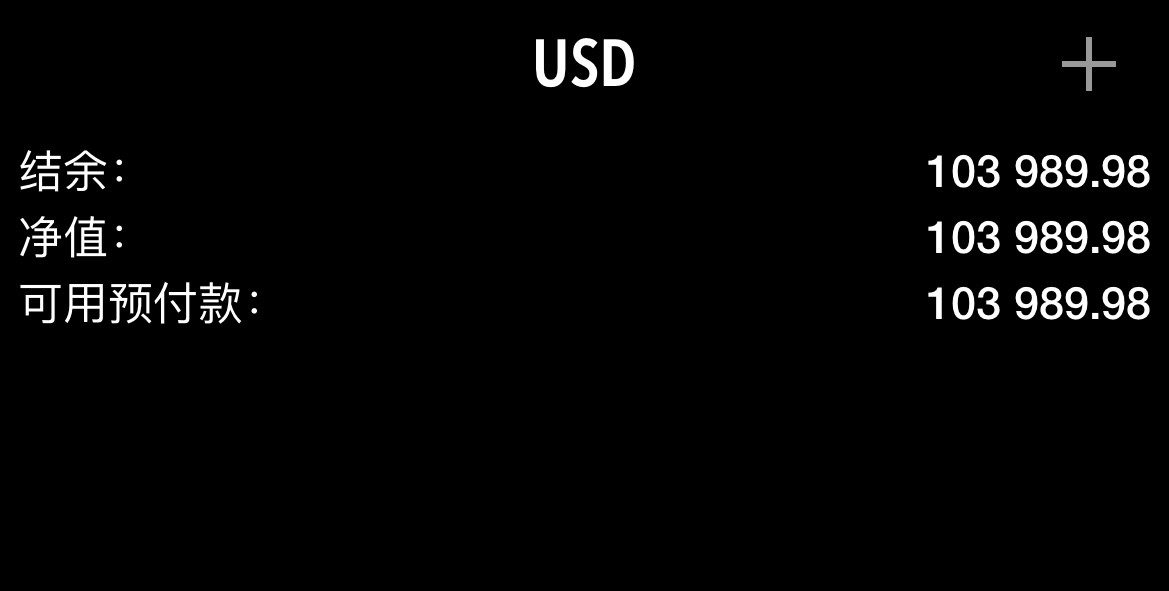

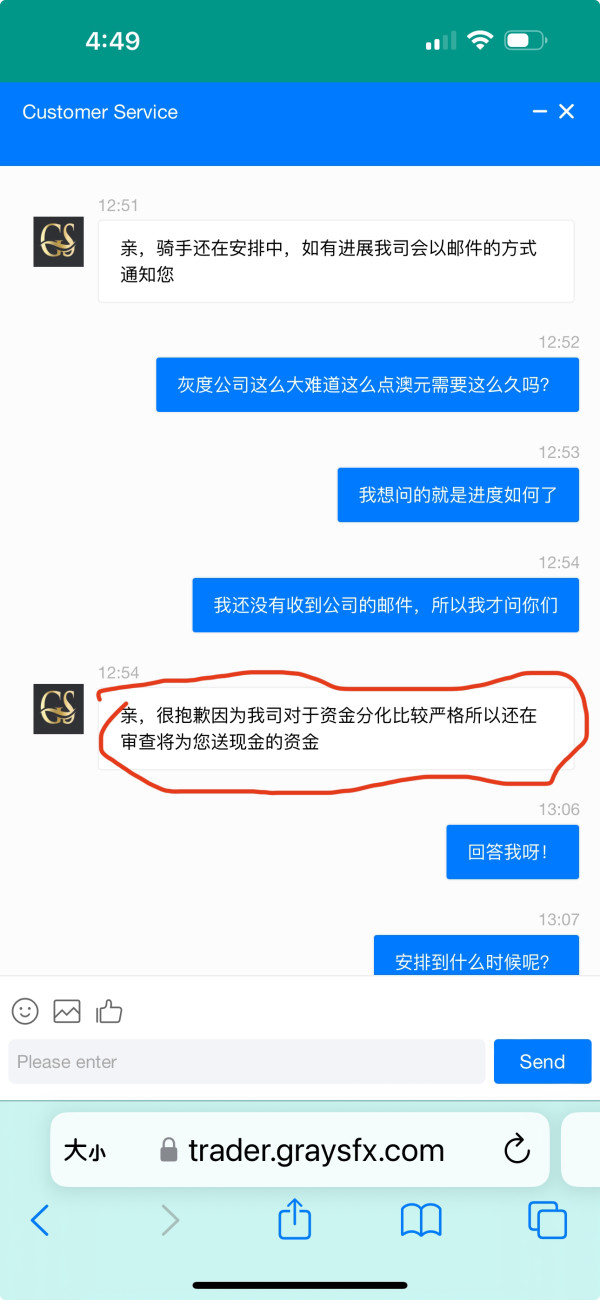

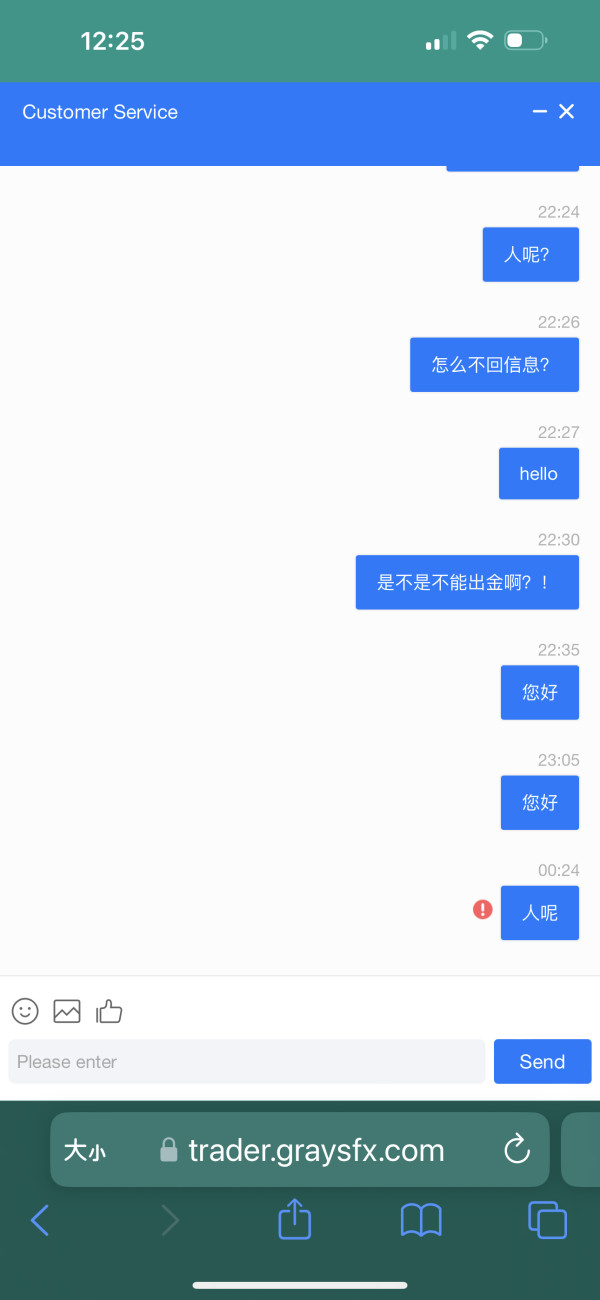

Fund operation experiences, including deposit and withdrawal processes, processing times, and associated fees, are not documented in available sources. These operational aspects directly impact user satisfaction and are critical considerations for traders evaluating broker selection.

The absence of documented user complaints or positive testimonials suggests either very limited user base or inadequate feedback collection mechanisms. Established brokers typically accumulate substantial user feedback that provides insights into service strengths and weaknesses.

Most significantly, the identification of Grayscale Forex as a potential investment scam fundamentally undermines any potential positive user experience elements. Regardless of platform functionality or service features, the risk of capital loss through fraudulent activity represents the ultimate negative user experience.

The low rating reflects these combined concerns and emphasizes that potential users face substantial risks. These risks far outweigh any possible benefits from platform engagement.

Conclusion

This comprehensive grayscale forex review reveals a broker that poses significant risks to potential traders despite offering some superficially attractive features. While Grayscale Forex provides high leverage up to 1:500, competitive spreads from 0.0 pips, and access to multiple asset classes through the MT5 platform, these benefits are fundamentally overshadowed by severe trust and regulatory concerns.

The broker's identification as an unregulated entity with characteristics consistent with investment scam operations represents a critical warning. This should deter traders seeking safe and compliant investment opportunities. The absence of regulatory protection means client funds lack essential safeguards that legitimate brokers provide through oversight compliance.

Grayscale Forex is not recommended for any trader category, particularly those prioritizing capital preservation and regulatory compliance. The combination of regulatory absence, transparency deficiencies, and negative industry assessments creates an unacceptable risk profile that outweighs any potential trading advantages the platform might offer.