Is RTOFX safe?

Business

License

Is RTOFX A Scam?

Introduction

RTOFX is a forex broker that has entered the competitive landscape of the foreign exchange market, positioning itself as a platform for traders seeking access to global currency trading. In an era where financial scams are prevalent, it is crucial for traders to carefully assess the legitimacy and safety of forex brokers before committing their funds. This article aims to provide a comprehensive evaluation of RTOFX, focusing on its regulatory status, company background, trading conditions, customer safety measures, user experiences, and associated risks. The investigation draws on various sources, including regulatory databases, customer reviews, and expert analyses, to present a well-rounded assessment of whether RTOFX is safe or a potential scam.

Regulation and Legitimacy

Understanding a broker's regulatory status is essential for assessing its legitimacy. RTOFX claims to operate under certain licenses; however, scrutiny reveals a lack of robust regulatory oversight. The following table summarizes the core regulatory information regarding RTOFX:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

The absence of a credible regulatory authority raises significant concerns about the safety of funds deposited with RTOFX. Regulatory bodies such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC) impose strict standards to protect traders. Without such oversight, there is an increased risk of fraud and malpractice. Historically, brokers without strong regulatory backing have faced issues with compliance and customer trust, leading to a higher likelihood of being labeled as scams. Therefore, the lack of regulation is a critical factor in determining whether RTOFX is safe for traders.

Company Background Investigation

RTOFXs history and ownership structure play a vital role in evaluating its credibility. The company appears to have a relatively short operational history, which can be a red flag in the forex industry, where established players usually have a proven track record. Information regarding the management team is sparse, making it difficult to assess their experience and qualifications. Transparency is a key component of trust in the financial sector; therefore, RTOFX's lack of publicly available information about its leadership and operational history raises concerns.

In terms of company transparency, RTOFX does not provide comprehensive details about its ownership structure, which is often a warning sign for potential investors. A broker that operates without clear information about its management and corporate governance may be hiding unsavory practices. As a result, traders should be cautious when considering RTOFX, as the combination of limited information and the absence of a strong regulatory framework contributes to the perception that RTOFX may not be safe for trading.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions offered is essential. RTOFX claims to provide competitive trading fees, but a deeper analysis reveals potential issues. The fee structure appears to be less transparent than that of many reputable brokers, which can lead to unexpected costs for traders. The following table compares core trading costs between RTOFX and industry averages:

| Fee Type | RTOFX | Industry Average |

|---|---|---|

| Major Currency Pairs Spread | High | Low |

| Commission Model | Unclear | Clear |

| Overnight Interest Range | N/A | Varies |

The high spreads on major currency pairs indicate that trading with RTOFX may not be cost-effective compared to its competitors. Additionally, the unclear commission structure raises concerns about hidden fees that could impact profitability. Traders should be aware that a broker with high trading costs can significantly affect their overall trading performance, which is another reason to question whether RTOFX is safe for trading activities.

Customer Funds Safety

The safety of customer funds is paramount in forex trading. RTOFX must have robust measures in place to protect client deposits. Unfortunately, the broker does not provide sufficient information regarding its fund security protocols. Key considerations include the segregation of client funds, investor protection schemes, and negative balance protection policies. Without these safeguards, traders may be at risk of losing their deposits in the event of company insolvency.

Moreover, historical data on RTOFX reveals no significant issues regarding fund security, but the lack of transparency in this area is concerning. Traders need to ensure that their funds are kept in secure accounts and that there are mechanisms in place to protect their investments. The absence of clear policies on fund safety raises the question of whether RTOFX is safe for traders looking to invest their money.

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing the reliability of a broker. RTOFX has received mixed reviews from users, with some praising its platform while others express dissatisfaction with customer service and withdrawal processes. The following table summarizes the primary complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Account Verification Delays | Medium | Average Response |

| Customer Service Availability | Low | Responsive |

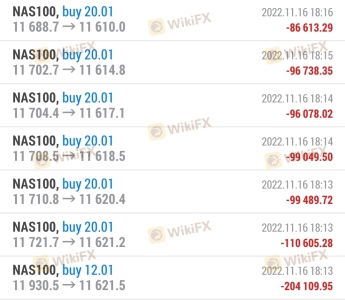

Common complaints include difficulties in withdrawing funds and delays in account verification, which can frustrate traders and lead to mistrust. The company's response to these complaints has been inconsistent, further impacting its reputation. Traders should be cautious when considering RTOFX, as unresolved complaints and poor customer service can indicate deeper issues within the broker. This raises the important question of whether RTOFX is safe for those looking to trade in a reliable environment.

Platform and Trade Execution

The trading platform is a critical aspect of the trading experience. RTOFX offers a platform that is described as user-friendly, but there are concerns regarding its execution quality. Issues such as slippage and order rejection can significantly affect trading outcomes. Traders have reported instances of delayed order execution, which can lead to missed opportunities and financial losses.

In addition, there are no substantial indications of platform manipulation, yet the lack of transparency about execution metrics is concerning. Traders should be aware that a broker's platform performance can directly impact their trading success, making it essential to ensure that the platform operates reliably. Consequently, traders must consider whether RTOFX is safe based on its platform's performance and execution quality.

Risk Assessment

Assessing the risks associated with trading through RTOFX is crucial for potential investors. The following risk scorecard summarizes key risk areas:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of regulation |

| Financial Risk | Medium | High trading costs |

| Operational Risk | Medium | Platform reliability |

| Customer Service Risk | High | Poor complaint resolution |

The high regulatory risk poses a significant concern for traders, as the absence of oversight can lead to potential fraud. Financial risks associated with high trading costs may deter traders from achieving profitability. Moreover, operational risks linked to platform reliability and customer service issues further exacerbate the overall risk profile of RTOFX.

To mitigate these risks, traders should conduct thorough research before engaging with RTOFX and consider starting with a small investment to gauge the broker's reliability. This approach can help determine whether RTOFX is safe for their trading needs.

Conclusion and Recommendations

In conclusion, the investigation into RTOFX raises several red flags regarding its safety and legitimacy. The lack of regulatory oversight, unclear trading conditions, and mixed customer feedback suggest that traders should exercise caution when considering this broker. While RTOFX may offer certain trading opportunities, the associated risks and concerns indicate that it may not be a safe choice for many traders.

For those seeking reliable alternatives, consider brokers that are well-regulated and have a proven track record of customer satisfaction. Examples include brokers regulated by the FCA, ASIC, or other reputable authorities, which provide a safer trading environment. In summary, traders should carefully weigh their options and consider whether RTOFX is safe before proceeding with any investment.

Is RTOFX a scam, or is it legit?

The latest exposure and evaluation content of RTOFX brokers.

RTOFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

RTOFX latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.