Is Locus Market safe?

Business

License

Is Locus Market Safe or Scam?

Introduction

Locus Market is a forex broker that has recently gained attention in the trading community, primarily for its promises of high returns and a user-friendly trading platform. As traders navigate the complex landscape of forex trading, it becomes crucial to evaluate the legitimacy and safety of brokers like Locus Market. The forex market is rife with opportunities but also fraught with risks, including potential scams that can lead to significant financial losses. This article aims to provide a comprehensive analysis of Locus Market, examining its regulatory status, company background, trading conditions, customer safety measures, user experiences, and overall risk profile. The information is gathered from multiple sources, including user reviews and regulatory databases, to present a balanced view of whether Locus Market is indeed safe or a potential scam.

Regulation and Legitimacy

When assessing the safety of any forex broker, regulation is a critical factor. Regulated brokers are subject to oversight by financial authorities, which helps protect traders funds and ensures fair trading practices. Unfortunately, Locus Market operates without any regulatory oversight, which raises significant red flags.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that Locus Market is not held accountable to any governing body, allowing it to operate in a grey area. This lack of oversight can expose traders to various risks, including the potential for fraud and mismanagement of funds. Moreover, the broker's website has faced accessibility issues, further complicating the ability to verify its claims. The Financial Conduct Authority (FCA) in the UK and other regulatory bodies have issued warnings against unregulated brokers like Locus Market, advising traders to exercise extreme caution when engaging with them.

Company Background Investigation

Locus Market is operated by Locus Market Int Ltd, a company that lacks transparency regarding its ownership structure and operational history. The broker claims to provide a diverse range of financial instruments, including forex pairs, commodities, and indices, but fails to offer substantial information about its establishment or management team. This obscurity can be concerning for potential investors, as a lack of transparency often correlates with higher risks.

The management teams background is also unclear, raising questions about their qualifications and experience in the financial industry. A reputable broker typically provides detailed information about its leadership and operational processes, which is crucial for building trust with clients. The absence of such information further compounds the skepticism surrounding Locus Market, leading many to question whether it is safe to invest with them.

Trading Conditions Analysis

Understanding the trading conditions offered by Locus Market is essential for evaluating its overall value proposition. The broker advertises low spreads and high leverage, which can be attractive to traders looking for cost-effective trading options. However, the lack of transparency regarding fees and commissions is a significant concern.

| Fee Type | Locus Market | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0 pips | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

While Locus Market claims to offer spreads as low as 0 pips, the absence of detailed information about commissions and overnight interest raises questions about potential hidden fees. Traders should be wary of brokers that do not clearly disclose their fee structures, as this can lead to unexpected costs that diminish profitability. Additionally, the high leverage ratios offered by Locus Market, while appealing, can also amplify risks, exposing traders to significant losses.

Customer Funds Safety

The safety of customer funds is paramount when evaluating a broker's credibility. Locus Market has not provided adequate information regarding its fund safety measures, such as whether it uses segregated accounts to protect clients' deposits. Regulated brokers typically implement strict protocols to ensure that client funds are kept separate from the company's operational funds, providing an additional layer of security.

Moreover, there is no indication that Locus Market offers any investor protection schemes or negative balance protection policies. These measures are essential in safeguarding traders from losing more than their initial investment, especially in volatile market conditions. The absence of such protections raises concerns about the safety of funds deposited with Locus Market, making it imperative for traders to consider the risks involved.

Customer Experience and Complaints

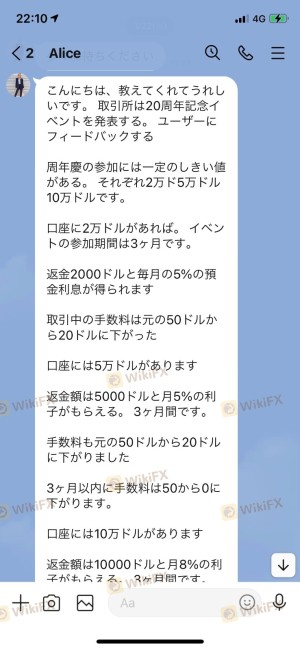

User feedback is a valuable indicator of a broker's reliability and service quality. Unfortunately, Locus Market has garnered numerous negative reviews from traders who have reported issues with fund withdrawals and customer support. Many users have claimed that they encountered difficulties when trying to withdraw their funds, with some alleging that the broker imposed excessive withdrawal fees or introduced new rules that hindered their ability to access their money.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delays | Medium | Poor |

Typical complaints include unresponsive customer service and a lack of clear communication regarding account management. These issues can be particularly alarming for traders who may need timely assistance during critical trading moments. The overall negative sentiment surrounding Locus Market suggests that it may not provide the level of support and reliability that traders expect from a reputable broker.

Platform and Trade Execution

Evaluating the trading platform's performance is crucial for any forex trader. Locus Market claims to offer access to the popular MetaTrader 5 platform, known for its advanced trading features and user-friendly interface. However, the platform's actual performance and reliability remain questionable due to the lack of user testimonials and reviews that highlight the execution quality and stability.

Traders have reported concerns regarding order execution, including slippage and rejected orders, which can significantly impact trading results. The absence of transparency about these issues raises further doubts about whether Locus Market is a safe trading environment. A reliable broker should provide a seamless trading experience, ensuring that orders are executed promptly and accurately.

Risk Assessment

Trading with Locus Market presents a myriad of risks, primarily due to its unregulated status and lack of transparency. The following risk assessment highlights key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No oversight from financial authorities. |

| Fund Safety Risk | High | Lack of information on fund protection measures. |

| Trading Condition Risk | Medium | Unclear fee structure and potential hidden costs. |

| Customer Support Risk | High | Numerous complaints regarding unresponsive service. |

To mitigate these risks, traders should conduct thorough research and consider alternatives to Locus Market, opting for regulated brokers that offer greater transparency and safety.

Conclusion and Recommendations

In conclusion, the evidence suggests that Locus Market raises several red flags that warrant caution. The broker operates without regulatory oversight, lacks transparency regarding its operations and fees, and has received numerous complaints from users about withdrawal issues and poor customer support. Given these factors, it is prudent for traders to approach Locus Market with skepticism.

For those considering forex trading, it is advisable to seek out regulated brokers with a proven track record of reliability and customer satisfaction. Alternatives such as brokers regulated by the FCA or ASIC can provide a safer trading environment and better protection for your investments. Ultimately, ensuring that your chosen broker is safe is paramount to achieving success in the forex market.

Is Locus Market a scam, or is it legit?

The latest exposure and evaluation content of Locus Market brokers.

Locus Market Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Locus Market latest industry rating score is 1.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.