Is PrimeTrade safe?

Business

License

Is Primetrade Safe or a Scam?

Introduction

Primetrade is a relatively new player in the forex market, having been established in 2022. It claims to offer a range of trading services, including forex, cryptocurrencies, and CFDs. However, with the increasing prevalence of scams in the financial sector, it is crucial for traders to conduct thorough due diligence before engaging with any broker. The potential for loss is significant, especially when dealing with unregulated entities. This article aims to objectively evaluate the safety and legitimacy of Primetrade by examining its regulatory status, company background, trading conditions, customer experience, and overall risk profile.

To conduct this assessment, we analyzed various online sources, including reviews and regulatory databases, focusing on key indicators of broker reliability. Our evaluation framework includes factors such as regulatory compliance, company transparency, user feedback, and the overall trading environment offered by Primetrade.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy. A regulated broker is subject to strict oversight by financial authorities, which helps protect traders' interests and funds. Unfortunately, Primetrade does not hold any licenses from recognized financial regulators. This lack of regulation is a significant red flag, as it exposes traders to higher risks.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulatory oversight means that Primetrade is not bound by any legal requirements to ensure fair trading practices or to safeguard client funds. Furthermore, the company has been flagged by various regulatory bodies, including the UK's Financial Conduct Authority (FCA), which has issued warnings against its operations. This lack of regulatory compliance raises serious concerns about the safety of funds deposited with Primetrade.

Company Background Investigation

Primetrade's company history is relatively sparse, with limited information available regarding its ownership and management structure. The broker claims to be registered in the United Kingdom, but multiple sources indicate that its operational legitimacy is questionable. The company does not provide detailed information about its founders or the management team, which is a common practice among reputable brokers.

The lack of transparency surrounding Primetrade's operations is concerning. A reliable broker typically discloses its corporate history, ownership details, and the qualifications of its management team. In this case, the absence of such information makes it difficult for potential clients to assess the broker's credibility. Moreover, the companys website lacks essential contact information, such as a phone number, which further diminishes its transparency and trustworthiness.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall value proposition. Primetrade advertises a variety of trading instruments, including forex pairs, cryptocurrencies, and CFDs. However, the overall cost structure appears to be unfavorable compared to industry standards.

| Cost Type | Primetrade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | High | Low |

| Commission Model | High | Low |

| Overnight Interest Range | Unclear | Clear |

The spreads offered by Primetrade are reported to be significantly higher than those of regulated brokers, which can eat into traders' profits. Additionally, the lack of clarity regarding commission structures and overnight interest rates raises concerns about hidden fees. Such unfavorable trading conditions may indicate that Primetrade prioritizes its profits over the interests of its clients.

Client Fund Security

The security of client funds is paramount in the trading industry. Regulated brokers are required to implement measures such as segregated accounts and investor protection schemes to safeguard client deposits. However, Primetrade does not offer any such assurances. The absence of regulatory oversight means that there are no legal requirements for the broker to maintain client funds in segregated accounts, exposing traders to the risk of losing their investments.

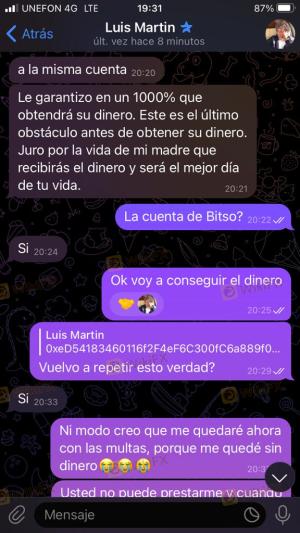

Moreover, there have been reports of clients experiencing difficulties when attempting to withdraw their funds. Such issues are often indicative of a broker's operational integrity. Without a solid framework for fund security and transparency, traders are left vulnerable to potential fraud.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability. In the case of Primetrade, the general sentiment among users is overwhelmingly negative. Many traders have reported being unable to withdraw their funds, while others have expressed dissatisfaction with the quality of customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

| Misleading Information | High | Poor |

Common complaints include high fees, poor customer service, and issues with fund withdrawals. These complaints highlight a concerning trend where clients feel misled and unsupported. In one notable case, a trader reported being promised high returns but ended up losing their entire investment without any recourse from the broker. Such experiences reinforce the notion that Primetrade may not be a trustworthy platform.

Platform and Trade Execution

The trading platform is a crucial component of the trading experience. Primetrade claims to offer a user-friendly interface, but user reviews suggest that the platform may not perform as advertised. Issues such as slippage, order rejections, and overall instability have been reported by users.

Traders have noted that the execution quality is subpar, with many experiencing significant delays during high volatility periods. This raises concerns about whether Primetrade is manipulating prices or engaging in practices that could harm traders. A reliable broker should provide a stable and efficient trading environment, which appears to be lacking with Primetrade.

Risk Assessment

Engaging with Primetrade presents several risks that potential traders should consider carefully. The lack of regulation, poor customer feedback, and unfavorable trading conditions contribute to a high-risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Unregulated broker |

| Fund Security | High | No protection measures |

| Customer Support | Medium | Poor response rates |

To mitigate these risks, it is advisable for traders to seek alternative brokers that are well-regulated and have a proven track record of reliability. Conducting thorough research and reading user reviews can also help traders make informed decisions.

Conclusion and Recommendations

In conclusion, the evidence suggests that Primetrade is not a safe broker and may exhibit characteristics of a scam. The lack of regulation, negative customer feedback, and unfavorable trading conditions all point to a high-risk environment for traders.

For those considering engaging with Primetrade, it is crucial to exercise extreme caution. We recommend exploring alternative brokers that are regulated by reputable authorities, such as the Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC). These brokers offer a safer trading environment, providing better protection for client funds and more favorable trading conditions.

In summary, if you are asking yourself, "Is Primetrade safe?" the answer is likely no. It is essential to prioritize safety and transparency in forex trading to protect your investments.

Is PrimeTrade a scam, or is it legit?

The latest exposure and evaluation content of PrimeTrade brokers.

PrimeTrade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

PrimeTrade latest industry rating score is 1.45, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.45 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.