LMG 2025 Review: Everything You Need to Know

Executive Summary

LMG stands as Australia and New Zealand's largest and most progressive aggregator group. The company supports a community of over 6,000 brokers and advisers across both countries. This lmg review examines a company that has operated for over 30 years, helping brokers and business owners deliver enhanced services to their clients. As a proudly family-owned and led organization, LMG offers flexible services and cutting-edge software solutions designed to help brokers focus on what matters most: their clients.

The company operates under a unique business model. This model allows businesses to function under their own brand or the Loan Market brand, partnering with over 70 banks and lenders. LMG's approach emphasizes flexibility through services, technology solutions, and specialist expertise. However, this review must note that specific information regarding trading conditions, regulatory frameworks, and detailed operational metrics remains limited in available documentation. The primary user base consists of brokers and business owners seeking aggregation services rather than direct trading capabilities.

Important Notice

This evaluation is based on available information regarding LMG's business operations. The review may not encompass comprehensive user feedback or market analysis. Users considering LMG's services should independently verify regulatory compliance and operational details relevant to their specific jurisdictions. Different regional entities may operate under varying regulatory frameworks, and potential clients should confirm applicable regulations before engaging with LMG services.

The assessment methodology relies on publicly available information and company documentation. This information may not reflect the complete operational picture or recent developments in the company's service offerings.

Rating Framework

Broker Overview

LMG has established itself as a significant player in the Australian and New Zealand financial services landscape. The company operates from its Sydney, New South Wales headquarters. The company employs between 501-1,000 staff members and maintains a substantial social media presence with over 34,334 followers. As the largest aggregator group in the region, LMG has built its reputation on supporting brokers and advisers through comprehensive business solutions.

The organization's business model centers on providing aggregation services that allow brokers to operate under flexible arrangements. This lmg review reveals that the company supports businesses operating under their own brand identity or under the established Loan Market brand. LMG's partnership network spans over 70 banks and lenders, creating extensive opportunities for brokers to access diverse lending solutions for their clients.

LMG's approach emphasizes modernizing how aggregators partner with their businesses. This approach reflects the various operational preferences of different brokerages. The company's cutting-edge software solutions and specialist expertise are designed to help brokers concentrate on client relationships and service delivery. However, specific details regarding trading platforms, asset classes, and regulatory oversight are not detailed in available source materials.

Regulatory Regions: Available documentation does not specify particular regulatory authorities overseeing LMG's operations. The company operates primarily in Australia and New Zealand markets.

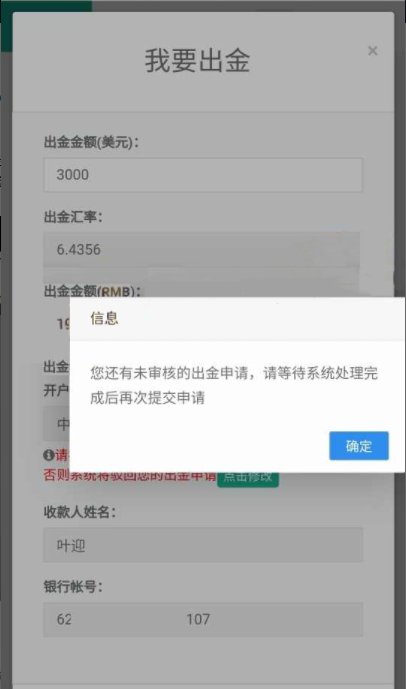

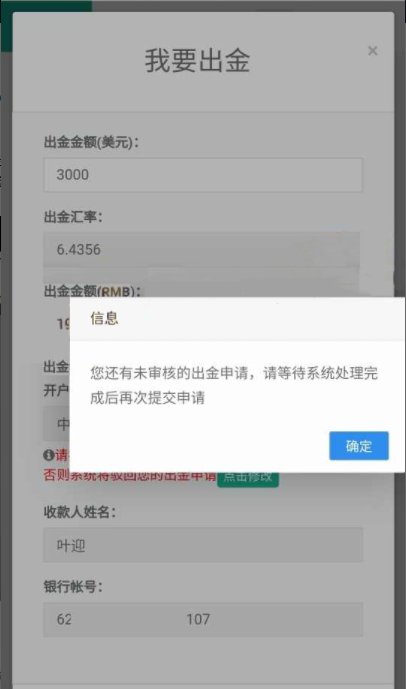

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal processes is not detailed in available source materials.

Minimum Deposit Requirements: Minimum deposit thresholds are not specified in the available documentation.

Bonuses and Promotions: Details regarding promotional offers or bonus structures are not mentioned in source materials.

Tradeable Assets: The range of tradeable assets is not specifically outlined in available documentation. The company facilitates access to lending products through its partner network.

Cost Structure: Detailed fee structures and trading costs are not specified in the available information. Users require direct inquiry with the company.

Leverage Ratios: Leverage specifications are not mentioned in the source materials reviewed for this lmg review.

Platform Options: Specific trading platform details are not provided in available documentation.

Regional Restrictions: Geographic limitations are not explicitly detailed in source materials.

Customer Service Languages: Language support options are not specified in available documentation.

Detailed Rating Analysis

Account Conditions Analysis

The available information does not provide comprehensive details regarding LMG's account structure, minimum deposit requirements, or account opening procedures. This lmg review cannot assess the variety of account types or their specific features based on current documentation. The company's focus appears to be on supporting brokers and advisers rather than offering traditional trading accounts to individual investors.

Without specific information about account tiers, minimum balance requirements, or special account features such as Islamic accounts, it's challenging to evaluate the competitiveness of LMG's account conditions. Potential clients would need to engage directly with LMG representatives to understand the specific terms and conditions applicable to their business requirements.

The lack of detailed account information in public documentation suggests that LMG may operate on a more consultative basis. Account conditions are potentially customized based on individual broker needs and business models. This approach might offer flexibility but makes standardized comparison difficult.

Available documentation does not detail the specific trading tools, research resources, or educational materials provided by LMG. The company mentions cutting-edge software solutions and specialist expertise, but the exact nature and scope of these tools remain unspecified in source materials.

The emphasis on supporting brokers suggests that LMG's tools and resources are likely oriented toward business management, client relationship management, and lending facilitation rather than traditional trading analysis tools. However, without detailed specifications, it's challenging to assess the quality and comprehensiveness of available resources.

The company's mention of flexibility in service delivery implies that tools and resources may be adaptable to different business models and client needs. This could represent a strength in terms of customization but makes evaluation difficult without specific feature lists or user testimonials.

Customer Service and Support Analysis

While LMG emphasizes supporting over 6,000 brokers and advisers, specific details regarding customer service channels, response times, and support quality are not provided in available documentation. The company's 30-year operational history suggests established support systems, but quantitative metrics are not available.

The family-owned and led structure mentioned in company materials might suggest a more personalized approach to customer service. This cannot be confirmed without specific service level agreements or user feedback data. Support availability hours, communication channels, and escalation procedures are not detailed in source materials.

Given LMG's focus on broker support rather than direct consumer services, the customer service model likely differs from traditional retail trading platforms. The nature of support may be more consultative and relationship-based, but specific service standards require direct verification with the company.

Trading Experience Analysis

Available information does not provide details about trading platform stability, execution speeds, or order processing quality. This lmg review cannot assess the technical performance of LMG's systems based on current documentation. The company's role as an aggregator suggests that trading experience may be mediated through partner institutions rather than direct platform provision.

Without specific information about platform functionality, mobile applications, or trading environment features, it's challenging to evaluate the user experience for active traders. The company's focus appears to be on facilitating broker operations rather than providing direct trading access to end users.

The mention of cutting-edge software solutions suggests technological capability. Without detailed specifications or performance metrics, the actual trading experience remains unclear. Users would need to request demonstrations or trial access to properly evaluate platform capabilities.

Trust and Reliability Analysis

LMG's 30-year operational history and position as the largest aggregator group in Australia and New Zealand suggests established market credibility. The family-owned structure and substantial employee base indicate organizational stability, though specific regulatory credentials are not detailed in available documentation.

The company's partnership with over 70 banks and lenders implies industry recognition and established relationships within the financial services sector. However, without specific regulatory approval numbers or third-party audits, quantitative trust metrics cannot be established.

The substantial social media following and extensive broker network suggest market acceptance. Formal trust indicators such as regulatory ratings, financial strength assessments, or independent audits are not referenced in available materials.

User Experience Analysis

Available documentation does not provide comprehensive information about user interface design, registration processes, or overall user satisfaction metrics. The company's emphasis on flexibility and client focus suggests attention to user experience, but specific usability features are not detailed.

Without information about onboarding procedures, platform navigation, or common user complaints, this evaluation cannot assess the practical user experience. The business-to-business nature of LMG's operations may result in more complex onboarding processes compared to retail trading platforms.

The company's focus on supporting diverse business models suggests adaptability in user experience design. Specific interface features, mobile accessibility, and user feedback mechanisms require direct investigation with the company.

Conclusion

This lmg review reveals a well-established aggregator group with significant market presence in Australia and New Zealand. LMG's 30-year operational history and support for over 6,000 brokers and advisers demonstrates substantial industry experience. The company's strength lies in its flexible service model and extensive partnership network with over 70 banks and lenders.

However, the lack of detailed information regarding regulatory oversight, specific service terms, and user experience metrics limits comprehensive evaluation. LMG appears most suitable for brokers and business owners seeking aggregation services rather than individual traders requiring direct market access. Potential clients should conduct direct consultations to understand specific service offerings and regulatory compliance relevant to their needs.