Is Pruton Capital safe?

Business

License

Is Pruton Capital Safe or Scam?

Introduction

Pruton Capital, an Indonesian-based forex broker, has been operating in the financial markets since 2006. It positions itself as a provider of online trading solutions, catering to both retail and institutional clients. However, in the volatile world of forex trading, it is crucial for traders to thoroughly evaluate the legitimacy and reliability of brokers before committing their funds. The potential for scams and fraudulent practices in the forex market necessitates a careful assessment of trading platforms. This article investigates whether Pruton Capital is safe or a scam by examining its regulatory status, company background, trading conditions, customer safety measures, client experiences, and overall risk factors.

Regulation and Legitimacy

Regulation plays a vital role in ensuring a broker's legitimacy and the safety of client funds. Pruton Capital claims to be regulated by the Indonesian Commodity Futures Trading Regulatory Agency (Bappebti) and is a member of the Jakarta Futures Exchange (JFX). However, the effectiveness of regulation in Indonesia has been questioned due to its relatively nascent regulatory framework.

| Regulatory Agency | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| Bappebti | N/A | Indonesia | Active |

Despite being registered under Bappebti, concerns arise regarding the quality of oversight and the historical compliance of Pruton Capital. Reports indicate that the regulatory system in Indonesia lacks stringent requirements, which may lead to inadequate protection for traders. Furthermore, Pruton Capital has faced scrutiny and negative feedback in various trading forums, raising alarms about its operational integrity. Hence, the question remains: Is Pruton Capital safe? The lack of robust regulatory measures and oversight raises significant concerns for potential investors.

Company Background Investigation

Pruton Capital, officially known as PT Pruton Mega Berjangka, has a history that spans over a decade. Founded in Jakarta, the company has expanded its operations across several Southeast Asian countries, including Malaysia, Singapore, and Vietnam. However, the ownership structure and management team of Pruton Capital lack transparency, which is a red flag for potential investors.

The company's leadership, including its CEO, has not been prominently featured in public disclosures. This opacity can lead to distrust among traders who rely on knowing the backgrounds of those managing their investments. Furthermore, the absence of detailed information regarding its operational history and corporate governance raises questions about Pruton Capital's commitment to transparency. In light of these factors, traders must ask themselves: Is Pruton Capital safe? The unclear ownership and management structure could pose risks to investors.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions and fee structures is essential. Pruton Capital offers a range of trading options, including forex, CFDs, and commodities, but the overall fees associated with trading can significantly impact profitability. Reports suggest that Pruton Capital has a minimum deposit requirement of approximately $10,000, which is considerably higher than the industry average.

| Fee Type | Pruton Capital | Industry Average |

|---|---|---|

| Spread on Major Pairs | 1.2 - 2.4 pips | 0.5 - 1.5 pips |

| Commission Model | None reported | Varies |

| Overnight Interest | N/A | 1-3% |

The spreads offered by Pruton Capital, particularly on major currency pairs, are notably higher than those of many competitors. Furthermore, the lack of clarity regarding commissions and overnight interest rates adds to the complexity of understanding the total cost of trading with this broker. This opacity in fee structures raises concerns about the potential for hidden fees, leading traders to question: Is Pruton Capital safe? The unfavorable trading conditions could diminish the overall trading experience and profitability for clients.

Customer Fund Safety

The safety of customer funds is paramount when choosing a forex broker. Pruton Capital claims to implement various measures to protect client funds, including fund segregation and adherence to local regulations. However, the effectiveness of these measures has been called into question.

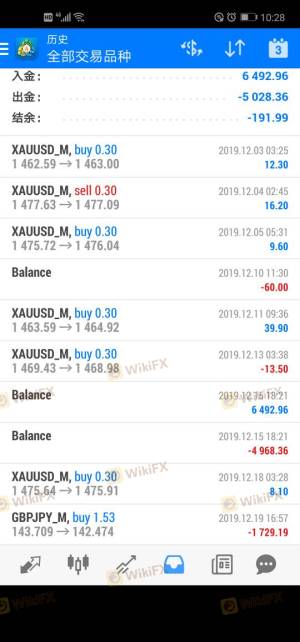

The lack of a clear investor protection scheme and the absence of negative balance protection policies are significant drawbacks. Additionally, historical reports of fund withdrawal issues have surfaced, with clients expressing frustration over delayed or denied withdrawal requests. These incidents raise alarms about the safety of funds held with Pruton Capital. Therefore, it is crucial to consider whether Is Pruton Capital safe for your investments, especially given the potential risks associated with fund security.

Customer Experience and Complaints

Customer feedback is an essential aspect of assessing a broker's reliability. Reviews of Pruton Capital reveal a mixed bag of experiences, with some clients praising the platform's trading capabilities while others report significant issues. Common complaints include difficulties in withdrawing funds, lack of communication from customer service, and concerns about the legitimacy of trading practices.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Fund Withdrawal Issues | High | Poor |

| Lack of Customer Support | Medium | Average |

| Trading Transparency Issues | High | Poor |

Several users have reported feeling misled by the company regarding their trading results, with claims of manipulated trading outcomes. These experiences lead to a critical evaluation of whether Is Pruton Capital safe for prospective traders. The prevalence of complaints and the company's inadequate response mechanisms indicate a need for caution.

Platform and Trade Execution

The trading platform offered by Pruton Capital is the widely-used MetaTrader 4 (MT4), known for its user-friendly interface and comprehensive trading tools. However, issues surrounding order execution quality have been reported, including instances of slippage and rejected orders.

Traders have expressed concerns about the platform's stability during high volatility periods, raising questions about potential platform manipulation. The overall user experience on the platform has been described as inconsistent, which could impact trading outcomes negatively. Thus, it is vital for traders to consider if Is Pruton Capital safe when relying on its trading platform for executing trades effectively.

Risk Assessment

Using Pruton Capital involves several risks that potential investors should carefully consider. The combination of regulatory uncertainties, opaque fee structures, and customer complaints contributes to a heightened risk profile for this broker.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Limited oversight and accountability. |

| Fund Safety Risk | High | History of withdrawal issues and lack of investor protection. |

| Trading Conditions Risk | Medium | High fees and unclear pricing structures. |

To mitigate these risks, traders are advised to conduct thorough research, consider using smaller amounts for initial trading, and remain vigilant regarding any changes in the company's operations.

Conclusion and Recommendations

In conclusion, the investigation into Pruton Capital raises significant concerns regarding its safety and legitimacy as a forex broker. While it operates under some regulatory oversight, the quality and effectiveness of that regulation are questionable. The company's lack of transparency, unfavorable trading conditions, and numerous customer complaints further compound these concerns. Therefore, traders should approach Pruton Capital with caution and consider alternative, more reputable brokers that offer better regulatory protections and customer support.

For those seeking reliable trading options, brokers like FXPro, XM, and eToro could provide safer alternatives with better trading conditions and customer service. Ultimately, it is essential for traders to prioritize the safety of their investments and conduct comprehensive due diligence before engaging with any broker, especially one with a history like Pruton Capital.

Is Pruton Capital a scam, or is it legit?

The latest exposure and evaluation content of Pruton Capital brokers.

Pruton Capital Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Pruton Capital latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.